What Is The Federal Energy Tax Credit For 2021 The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades

Key Takeaways An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

What Is The Federal Energy Tax Credit For 2021

What Is The Federal Energy Tax Credit For 2021

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2021-01.jpg?itok=SJbBX9lJ

Replacement Windows Rebates Window Replacement

https://windowreplacementsandiego.com/wp-content/uploads/2022/07/What-is-the-Federal-energy-tax-credit-for-2021.jpeg

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

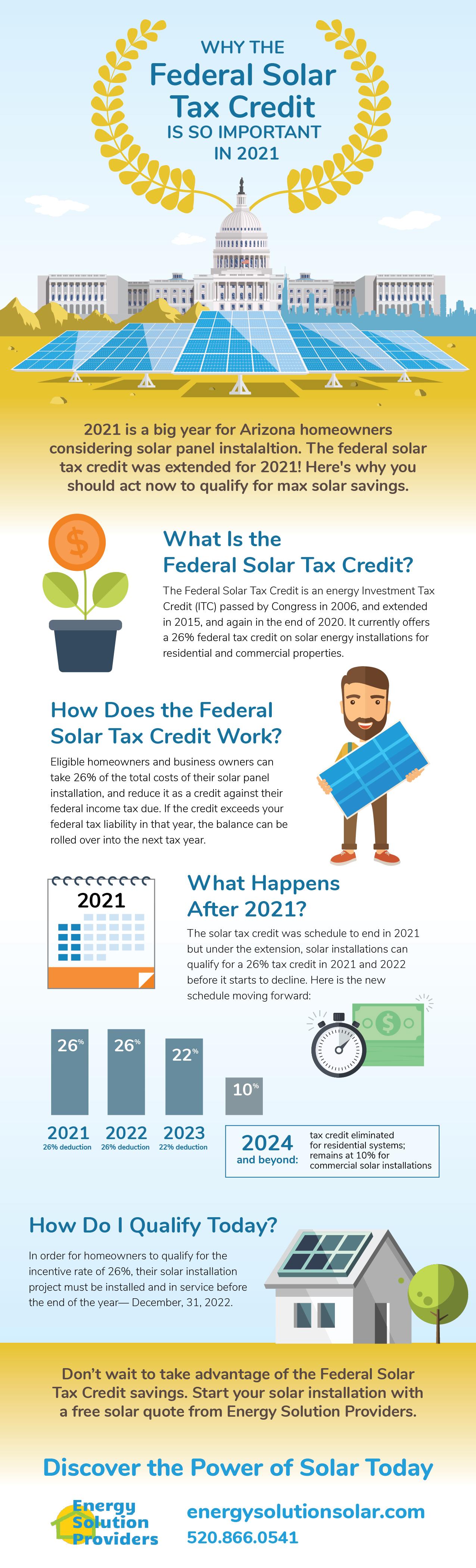

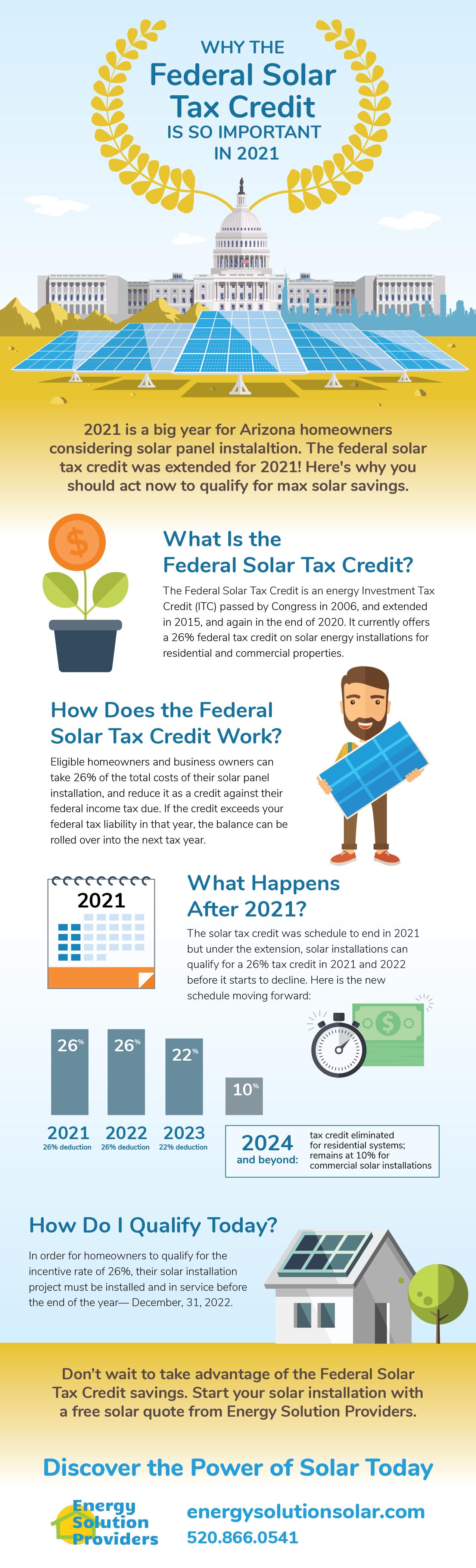

Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also Tax Credits for Home Builders The tax credits for builders of new energy efficient homes has been retroactively extended to homes built after December 31 2017 through December 31 2021 2022 Tax Credit Information

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to claim them on your taxes when you file for 2022 Energy Efficient Upgrades That Qualify for Federal Tax Credits The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

Download What Is The Federal Energy Tax Credit For 2021

More picture related to What Is The Federal Energy Tax Credit For 2021

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

The Inflation Reduction Act amended the credit to be worth up to 1 200 per year for qualifying property placed in service on or after January 1 2023 and before January 1 2033 and gave it a new name the Energy Efficient Home Improvement Credit The residential solar energy credit is worth 30 of the installed system costs through 2032 26 in 2033 22 in 2034 and expires after that What is the Residential Clean Energy Credit In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems

How Does The Tax Credit System Work Leia Aqui How Do Tax Credits

https://www.greenmountainenergy.com/Images/GME-Blog-SolarIncentives-Infographic-2x_tcm465-57648.png

Solar Information Blog Solar Pros Inc

https://www.solarprosinc.com/wp-content/uploads/2018/06/solar-tax-credit.jpg

https://www.energystar.gov/about/federal-tax-credits

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades

https://www.investopedia.com/terms/e/energy-tax-credit.asp

Key Takeaways An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount

Invictus Solar Power

How Does The Tax Credit System Work Leia Aqui How Do Tax Credits

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

Federal Energy Tax Credits For Nonprofits A Guide Simple Solar

Make Sure You Get These Federal Energy Tax Credits Consumer Reports

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

2023 Residential Clean Energy Credit Guide ReVision Energy

What Is The Federal Energy Tax Credit For 2021 - The renewed Energy Efficient Home Improvement Tax Credit 25C program increases the HVAC tax credit limit for installing CEE Top Tier high efficiency equipment it is retroactive to January 1 2022 and approved until 2032 Eligible equipment includes Heat pumps and heat pump water heaters