What Is The Federal Residential Renewable Energy Tax Credit You will need to file Form 5695 Residential Energy Credits when you file your tax return for year in which your residential energy property was put in service Learn the steps for claiming a residential clean energy tax credit

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 You may qualify for energy tax credits if you made renewable energy upgrades or energy efficient improvements to your home like solar or geothermal equipment Learn more about the Energy Efficient Home Improvement Credit and the Residential Clean Energy Credit and find out whether you re eligible to claim these write offs to save on your taxes

What Is The Federal Residential Renewable Energy Tax Credit

What Is The Federal Residential Renewable Energy Tax Credit

https://www.nortonrosefulbright.com/-/media/images/nrf/thought-leadership/us/us_43201_social-media-capital-account-implications-for-renewable-energy-tax-credits_1200.jpeg?revision=a5e6caf0-1dea-4076-9c5e-6774a98047b7&revision=5249587443937387904

Equipment Tax Credits For Primary Residences About ENERGY STAR

https://www.energystar.gov/sites/default/files/TaxCredit_Residential.png

2023 Residential Clean Energy Credit Guide ReVision Energy

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer 2 Other types of renewable energy are If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified newly installed property from 2022 through 2032

Officially named the Residential Clean Energy Credit allows solar system owners to receive a tax credit worth up to 30 of the eligible cost basis of a solar installation A project with an eligible cost basis of 30 000 would entitle the owner to receive a 9 000 tax credit in the year the project was placed in service What is the Residential Clean Energy Credit The Federal Solar Tax Credit or Residential Clean Energy Credit is a federal tax incentive implemented by the United States government It allows a taxpayer in the U S with a private residence to claim 30 of the cost of installing new qualified clean energy systems for their home such as solar

Download What Is The Federal Residential Renewable Energy Tax Credit

More picture related to What Is The Federal Residential Renewable Energy Tax Credit

New Residential Energy Tax Credit Estimates Eye On Housing

https://i0.wp.com/eyeonhousing.org/wp-content/uploads/2017/04/image001.png?fit=1200%2C783

A Little known Government Program Called The Residential Renewable

https://i.pinimg.com/originals/8c/77/f5/8c77f505d5209bd2edaf8a0ff16fb1fb.jpg

Thinking About Going Solar A Little known Government Program Called

https://i.pinimg.com/originals/ee/9a/6f/ee9a6f0c7d96a0e77bcbbfb5c24b40a5.jpg

Homeowners looking to improve energy efficiency can benefit from several federal tax credits These incentives aim to encourage the adoption of renewable energy sources and enhance home efficiency The Investment Tax Credit ITC is significant for those installing solar energy systems What are the residential solar tax credit amounts Installing renewable energy equipment on your home can qualify you for Residential Clean Energy credit of up to 30 of your total qualifying cost depending on the year the equipment is installed and placed in service 30 for equipment placed in service in tax years 2017 through 2019

[desc-10] [desc-11]

The Residential Renewable Energy Tax Credit Is A Little known

https://i.pinimg.com/originals/1b/98/80/1b9880ef9f4ad1c19ae2a03a0711bb6e.png

Tax Credits Extended For Renewable Energy Urban Solar

https://urbansolar.com/wp-content/uploads/2015/12/tax-credits-extended-for-renewable-energy.jpg

https://www.irs.gov › credits-deductions › how-to...

You will need to file Form 5695 Residential Energy Credits when you file your tax return for year in which your residential energy property was put in service Learn the steps for claiming a residential clean energy tax credit

https://www.irs.gov › credits-deductions › home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Federal Solar Tax Credit What It Is How To Claim It For 2023

The Residential Renewable Energy Tax Credit Is A Little known

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

A Little known Government Program Called The Residential Renewable

The Residential Renewable Energy Tax Credit Is A Little known

House Passes Historic Inflation Reduction Act V E Energy Update

House Passes Historic Inflation Reduction Act V E Energy Update

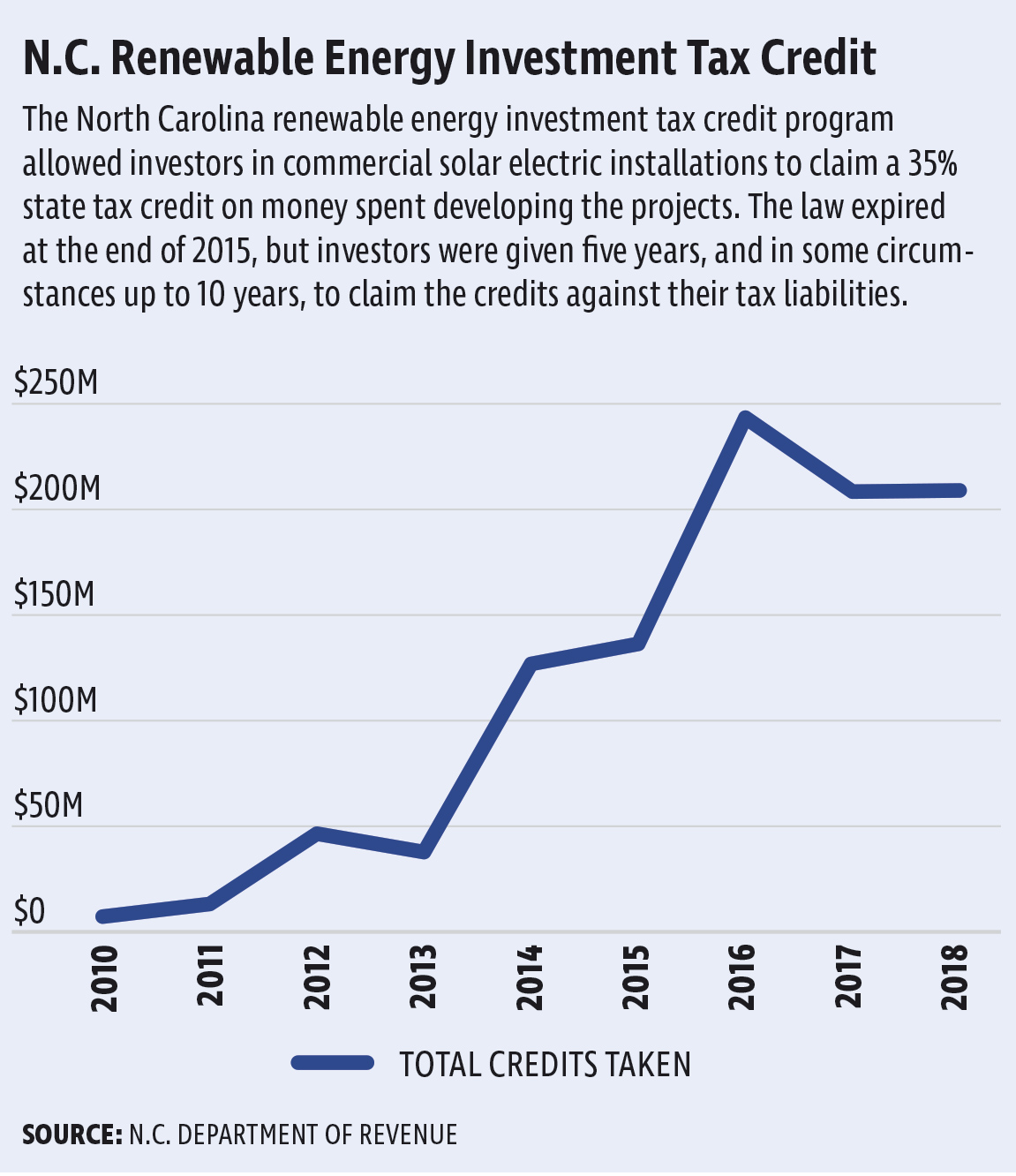

N C Has Issued More Than 1 Billion In Renewable Energy Tax Credits

Homeowners Love Their Solar Company Solar Renewable Energy Energy

A Little known Government Program Called The Residential Renewable

What Is The Federal Residential Renewable Energy Tax Credit - Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer 2 Other types of renewable energy are