What Is The Fuel Tax Credit Rate Fuel tax credit rates change regularly Using the fuel tax credit calculator is the easiest way to work out what you can claim in your business activity statement BAS or

The Inflation Reduction Act of 2022 retroactively extended several fuel tax credits Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their business activities You can claim for taxable

What Is The Fuel Tax Credit Rate

What Is The Fuel Tax Credit Rate

https://telematics-australia.com/wp-content/uploads/2020/06/Fuel-Tax-Credits.png

Never Mine The Budget Here s The Fuel Tax Credit Scheme The

https://australiainstitute.org.au/wp-content/uploads/2022/03/table2.png

Fuel Tax Credit Rate History

https://support.practicalsystems.com.au/Content/Images/Uploads/z5g4xh4g.mnf.jpg

The latest tax rates and information on eligibility to claim Fuel Tax Credits following February 2023 CPI index increases The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar based on specific types of fuel costs The

Fuel Tax Credits also known as fuel tax rebates can represent a very significant value to businesses The highest rates are available for eligible fuels used to power heavy machinery plant light vehicles and other How much is the fuel tax credit The value of the fuel tax credit is the difference between the diesel fuel excise rate and the Road User Charge The current rate of the fuel tax

Download What Is The Fuel Tax Credit Rate

More picture related to What Is The Fuel Tax Credit Rate

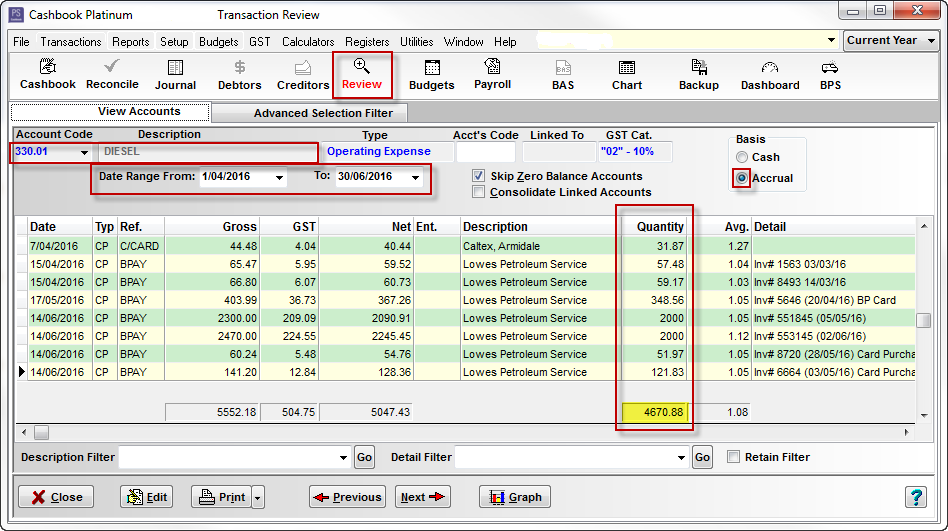

Calculating Fuel Tax Credit Manually PS Support

https://support.practicalsystems.com.au/Content/Images/Uploads/4yoruzmx.g3k.png

:max_bytes(150000):strip_icc()/FuelTaxCredit4-3V1-3b25b99dc86b458a877911fb8fea6c80.png)

Fuel Tax Credit Definition

https://www.investopedia.com/thmb/ONXdzz3EyMksb8oXKWEpjH3T8Jk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/FuelTaxCredit4-3V1-3b25b99dc86b458a877911fb8fea6c80.png

Fuel Tax Credit Rate Changes Affecting Your March 22 BAS Beam Bookkeeping

https://beambk.com.au/wp-content/uploads/2022/04/Image-Truck.png

Tax credits are available based on the fuel tax credit rate when you bought the fuel the business activities you are using the fuel for Check if you can The fuel tax credit is a calculation of No of eligible litres x cents per litre rate The cents per litre rate is generally the rate applicable on the date of purchase however there are a number of

The amount of fuel tax credit you can claim per litre of eligible fuel will depend on how that fuel is used ie on road or off road in what type of vehicle it is used ie truck excavator generator chainsaw etc and A Fuel Tax Credit is a type of tax credit available to business owners who have purchased fuel for their business be it petrol diesel or other kinds of eligible fuel

2021 Fuel Tax Credit Rate Changes 542 Partners

https://542partners.com.au/wp-content/uploads/2021/02/542-Blog-Image.png

Fuel Tax Credit Rate Changes For The 2020 Financial Year Aston

https://s.astonaccountants.com.au/wp-content/uploads/photo-of-gasoline-dispenser-in-station-1051397.jpg

https://www.ato.gov.au/.../rates-business

Fuel tax credit rates change regularly Using the fuel tax credit calculator is the easiest way to work out what you can claim in your business activity statement BAS or

https://www.irs.gov/.../fuel-tax-credits

The Inflation Reduction Act of 2022 retroactively extended several fuel tax credits

Fuel Tax Credits CIB Accountants Advisers

2021 Fuel Tax Credit Rate Changes 542 Partners

And The Award For Biggest Fossil Fuel Subsidy Goes To The Fuel Tax

How To Claim Your Full Fuel Tax Credit Entitlement NatRoad

Leverage Asset Tracking To Increase Your Fuel Tax Credit Rebate

Fuel Tax Credit Rate History

Fuel Tax Credit Rate History

Fuel Tax Credit Changes Acumon Accountants And Business Advisors

Fuel Tax Credit Changes

Fuel Tax Credit Changes Element Accountants Advisors

What Is The Fuel Tax Credit Rate - In Australia fuel tax is collected as a tax on the production or importation of fuel offset by a system of fuel tax credits for business users of fuel This explainer sets out the key