What Is The Homestead Exemption In Colorado Web 20 Okt 2023 nbsp 0183 32 Every homestead in the state is exempt from execution and attachment arising from any debt contract or civil obligation not exceeding in actual cash value in excess of any liens or encumbrances on the homesteaded property in existence at the time of any levy of execution thereon a

Web 16 Mai 2022 nbsp 0183 32 The homestead exemption is a legal statute that shields a certain amount of equity in the case of Colorado s new law between 250 000 and 350 000 from certain creditors following the death of a homeowner s spouse or a declaration of bankruptcy by the homeowner Web The senior property tax exemption is available to senior citizens and the surviving spouses of senior citizens The state reimburses the local governments for the loss in revenue When the State of Colorado s budget allows 50 percent of the first 200 000 of actual value of the qualified applicant s primary residence is exempted

What Is The Homestead Exemption In Colorado

What Is The Homestead Exemption In Colorado

https://lakelandfloridaliving.com/wp-content/uploads/2021/09/Things-To-Know-About-Florida-Homestead-Exemption-663x1024.png

Texas Homestead Exemption Explained How To Fill Out Texas Homestead

https://i.ytimg.com/vi/1EcmMvUwEp8/maxresdefault.jpg

What Is The Homestead Exemption In Arizona My AZ Legal Team PLLC

https://www.phoenixbankruptcy.co/wp-content/uploads/2021/01/what-is-the-homestead-exemption-in-arizona.jpg

Web 18 Dez 2023 nbsp 0183 32 The homestead exemption is 350 000 if the homeowner spouse or dependent is disabled or 60 or older In Colorado spouses cannot double the homestead exemption Example 1 If you own a house worth 370 000 and have a mortgage balance of 330 000 you have 40 000 of equity in the property Web Local Government Bill Summary There is currently a property tax exemption for an owner occupied residence of a qualifying senior or veteran with a disability homestead exemption that is equal to 50 of the first 200 000 of the actual value of the property

Web 10 Okt 2022 nbsp 0183 32 Colorado s homestead exemption which reduces the amount of property tax a homeowner owes currently is available to people 65 years and older who have lived in their home for 10 years or longer It is also available to veterans with a service related permanent disability Web Colorado s statutory homestead exemption exempts a portion of a homestead from seizure to satisfy a debt contract or civil obligation Section 2 increases the amount of the homestead exemption From 75 000 to 250 000 if the homestead is occupied as a home by an owner of the home or an owner s family and

Download What Is The Homestead Exemption In Colorado

More picture related to What Is The Homestead Exemption In Colorado

Filing For Homestead Exemption In Georgia

https://www.heathermurphygroup.com/wp-content/uploads/2023/03/HMG-Filing-for-Homestead-Exemption-in-Georgia.png

How To Fill Out Texas Homestead Exemption Form 50 114 The Complete

https://res.cloudinary.com/agiliti/image/upload/v1669098889/late-homested-exemption-illustration.webp

How To Fill Out Texas Homestead Exemption Form 50 114 The Complete

https://res.cloudinary.com/agiliti/image/upload/v1669104038/texas-homestead-exemption-form-section-1.webp

Web Section 3 5 of Article X of the Colorado Constitution grants a property tax exemption to qualifying senior citizens and disabled veterans commonly referred to as the Homestead Exemption To qualify a property owner occupier must be at least 65 years of age on the assessment date and must have occupied the property for at least ten years Web 21 Sept 2010 nbsp 0183 32 The basic purpose of the Colorado homestead exemption not to be confused with the federal Homestead Acts which pertain to land patents is to help a person protect his home against creditors A

Web 17 Nov 2023 nbsp 0183 32 Bill Summary For the 2023 property tax year the bill increases the maximum amount of actual value of the owner occupied residence of a qualifying senior veteran with a disability or surviving spouse of a veteran with a disability that is exempt from property taxation from 200 000 to 325 000 Web 20 Juni 2016 nbsp 0183 32 Homeowners who are disabled or over the age of 60 may claim an exemption of up to 90 000 this also applies if the homeowner s spouse or a dependent is disabled or over 60 For example a couple has 50 000 of equity on a home worth 150 000 with a mortgage on the remaining 100 000

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

What Is The Homestead Exemption In Bankruptcy In Colorado

http://coloradobankruptcyguide.com/wp-content/uploads/2010/11/colorado-homestead-exemption.jpg

https://colorado.public.law/statutes/crs_38-41-201

Web 20 Okt 2023 nbsp 0183 32 Every homestead in the state is exempt from execution and attachment arising from any debt contract or civil obligation not exceeding in actual cash value in excess of any liens or encumbrances on the homesteaded property in existence at the time of any levy of execution thereon a

https://www.lyonsgaddis.com/blog/what-does-colorado-s-new-homestead...

Web 16 Mai 2022 nbsp 0183 32 The homestead exemption is a legal statute that shields a certain amount of equity in the case of Colorado s new law between 250 000 and 350 000 from certain creditors following the death of a homeowner s spouse or a declaration of bankruptcy by the homeowner

Homestead Exemption Application For 65 Cedar County Iowa

Harris County Homestead Exemption Form ExemptForm

What Is The Homestead Exemption In Texas Would You Like T Flickr

Bought A Home In Florida In 2021 File For Your Homestead Exemption By

What Is The Illinois Homestead Exemption DebtStoppers

Homestead Exemption In CA Bankruptcy Finkel Law Group

Homestead Exemption In CA Bankruptcy Finkel Law Group

What Is The Homestead Exemption

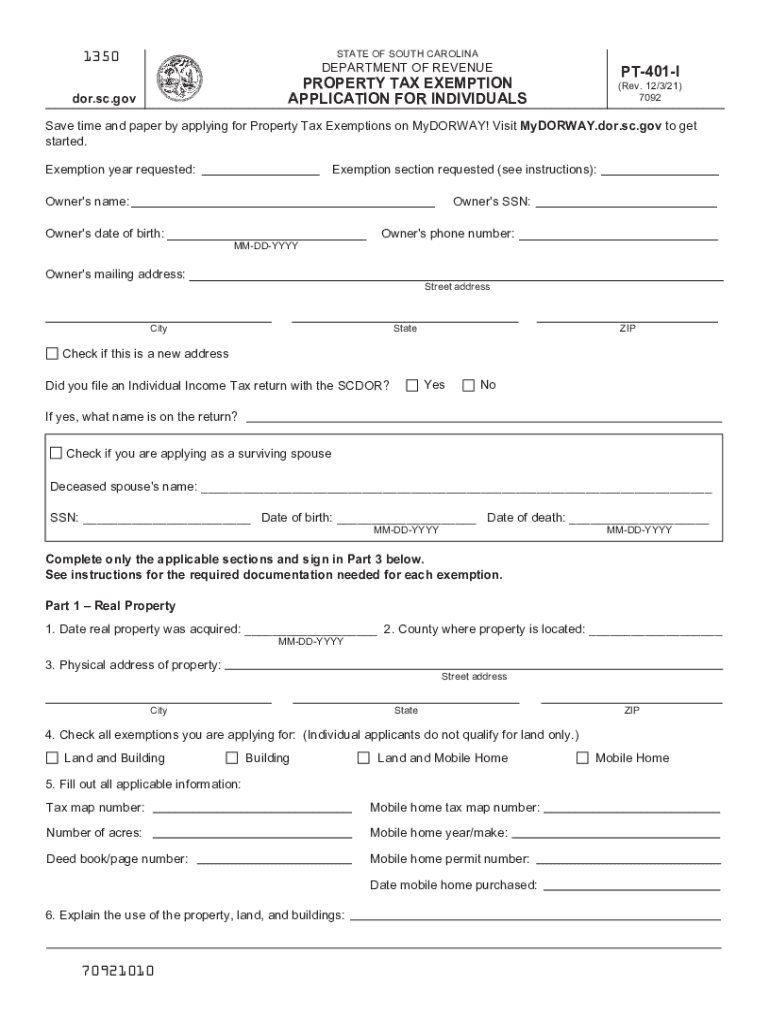

York County Sc Residential Tax Forms Homestead Exemption CountyForms

2021 Form SC PT 401 I Fill Online Printable Fillable Blank PdfFiller

What Is The Homestead Exemption In Colorado - Web 10 Okt 2022 nbsp 0183 32 Colorado s homestead exemption which reduces the amount of property tax a homeowner owes currently is available to people 65 years and older who have lived in their home for 10 years or longer It is also available to veterans with a service related permanent disability