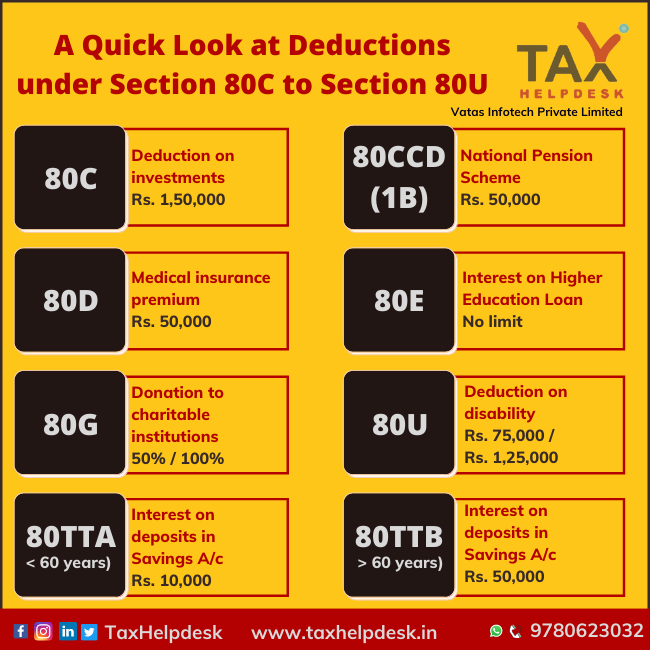

What Is The Maximum Limit In 80c The limit of Rs 1 5 lakh deduction of Section 80C includes 80CCC contribution towards pension plan and 80CCD 1 80CCD 1b and 80CCD 2 Section 80CCCD 1 is a contribution towards the

Any contribution towards the Public Provident Fund PPF can be filed for tax deduction under Section 80C Public Provident Funds come with a maximum deposit limit of If we Claim 1 5Lakh under Sec 80C with Insurance PF and Mutual Fund and 50k under 80CCD 1B then where can we claim the amount contributed towards 80CCD 2 And what is the limit of

What Is The Maximum Limit In 80c

What Is The Maximum Limit In 80c

https://us-static.z-dn.net/files/d9d/9ae913ce05d0ad072899d6f02236c4d6.png

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

What Is The Maximum Limit Of GST Rate IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2023/03/What-is-the-maximum-limit-of-GST-rate.jpg

The maximum deduction under Section 80C is capped at INR 1 50 000 which also includes contributions under Sections 80CCC and 80CCD 1 However The maximum limit on investment to claim a tax break under Section 80C remains Rs 1 5 lakh as it is now i e for current FY 2023 24 This limit will continue to

Maximum Limit Rs 1 50 lakh every financial year Please note that the aggregate deduction amount under Sections 80C 80CCC and 80CCD is restricted to Rs What is the maximum deduction can be claimed under Section 80C and its sub section The maximum deduction can be claimed upto INR 2 lakhs under Section 80C 80CCC 80CCD 1 Section

Download What Is The Maximum Limit In 80c

More picture related to What Is The Maximum Limit In 80c

What I Learned From No Limit Records Stundar Website For Aspiring

http://blog.stundar.co.za/wp-content/uploads/2020/08/no-limit-records.jpg

Which Speed Limit Sign Drives Home The Strongest Message

https://www.throughlinegroup.com/wp-content/uploads/2016/02/Speed-Limit-Sign-5-iStockPhoto.jpg

How Much Over The Speed Limit Is A Felony Abusiness Homes

https://d3n8a8pro7vhmx.cloudfront.net/walkbikenashville/pages/483/attachments/original/1572625521/speed-limit-1.jpg?1572625521

Section 80C of the Income Tax Act is the most popular income tax deduction for tax saving 80C deduction limit for the current FY 2023 24 AY 2024 25 is Rs 1 50 000 However ITR filing is mandatory in order The maximum limit for claiming tax benefits under Section 80C remains at Rs 1 5 lakh for the current fiscal year 2023 24 and will stay the same for individuals looking

Section 80C of the IT Act provides a deduction of up to INR 1 5 lakh from the total taxable income of individuals and HUFs Here s all you need to know The least that you can contribute towards PPF is Rs 500 and the maximum contribution allowed is Rs 1 5 lakh The amount you contribute towards PPF is eligible

![]()

Section 80C Deduction Under Section 80C In India Paisabazaar

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_800/https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

80c Deductions

https://www.taxhelpdesk.in/wp-content/uploads/2022/04/Deductions-under-Section-80C-to-80U.png

https://cleartax.in

The limit of Rs 1 5 lakh deduction of Section 80C includes 80CCC contribution towards pension plan and 80CCD 1 80CCD 1b and 80CCD 2 Section 80CCCD 1 is a contribution towards the

https://groww.in › tax

Any contribution towards the Public Provident Fund PPF can be filed for tax deduction under Section 80C Public Provident Funds come with a maximum deposit limit of

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Section 80C Deduction Under Section 80C In India Paisabazaar

What Is The Maximum Social Security Benefit In 2023 YouTube

Deductions Under Section 80C Its Allied Sections

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Speed Limit Sign What Does It Mean

Speed Limit Sign What Does It Mean

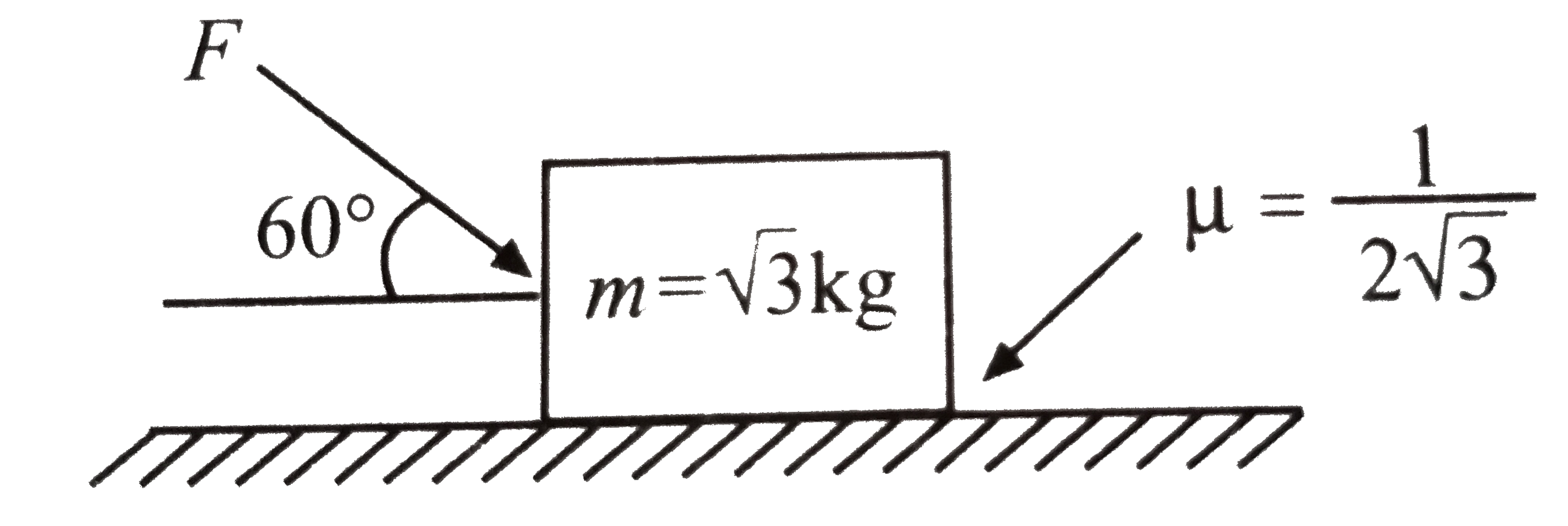

What Is The Maximum Value Of The Force F Such That The Block Shown In

20km Speed Limit Road Sign R201 20 Safety Sign Online

Stop Limit Order In Options Examples W Visuals Projectfinance

What Is The Maximum Limit In 80c - You can claim a maximum deduction of up to 1 5 lakh from your total income under Section 80C Who is eligible for an 80C deduction It is available for individuals and