What Is The Maximum Limit Under Section 80c Verkko Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax It allows for a maximum

Verkko 13 kes 228 k 2019 nbsp 0183 32 Amount you can invest There is no such limit for making investments in the ULIP but the premium should not be more Verkko 28 jouluk 2023 nbsp 0183 32 Explore the comprehensive list of Income Tax Deductions for FY 2022 23 AY 2023 24 under Sections 80C

What Is The Maximum Limit Under Section 80c

What Is The Maximum Limit Under Section 80c

https://i.ytimg.com/vi/L1AUhzT9w0Y/maxresdefault.jpg

Income Tax Deduction Under Section 80C AY 2022 23 2023

https://i0.wp.com/cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/01/section-80c.jpg

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Verkko 13 hein 228 k 2023 nbsp 0183 32 What is the maximum deduction limit under Section 80C As per Section 80C you can claim a deduction of up to 1 5 lakh per financial year 2 Verkko 22 syysk 2022 nbsp 0183 32 Section 80CCD 1B deduction of up to 50 000 is over and above this limit Therefore under Sections 80C 80CCC 80CCD 1 and 80CCD 1B a

Verkko 21 hein 228 k 2020 nbsp 0183 32 Deduction under Section 80C Section 80CCC Section 80CCD Maximum amount of Income Tax deduction Rs 1 50 000 Rs 50 000 Deduction under Section 80C In order to Verkko 4 p 228 iv 228 228 sitten nbsp 0183 32 Income Tax Deduction Limits Under Section 80C 80CCC 80CCD 1 The limit of Rs 1 5 lakh means that after taking into account all the investments

Download What Is The Maximum Limit Under Section 80c

More picture related to What Is The Maximum Limit Under Section 80c

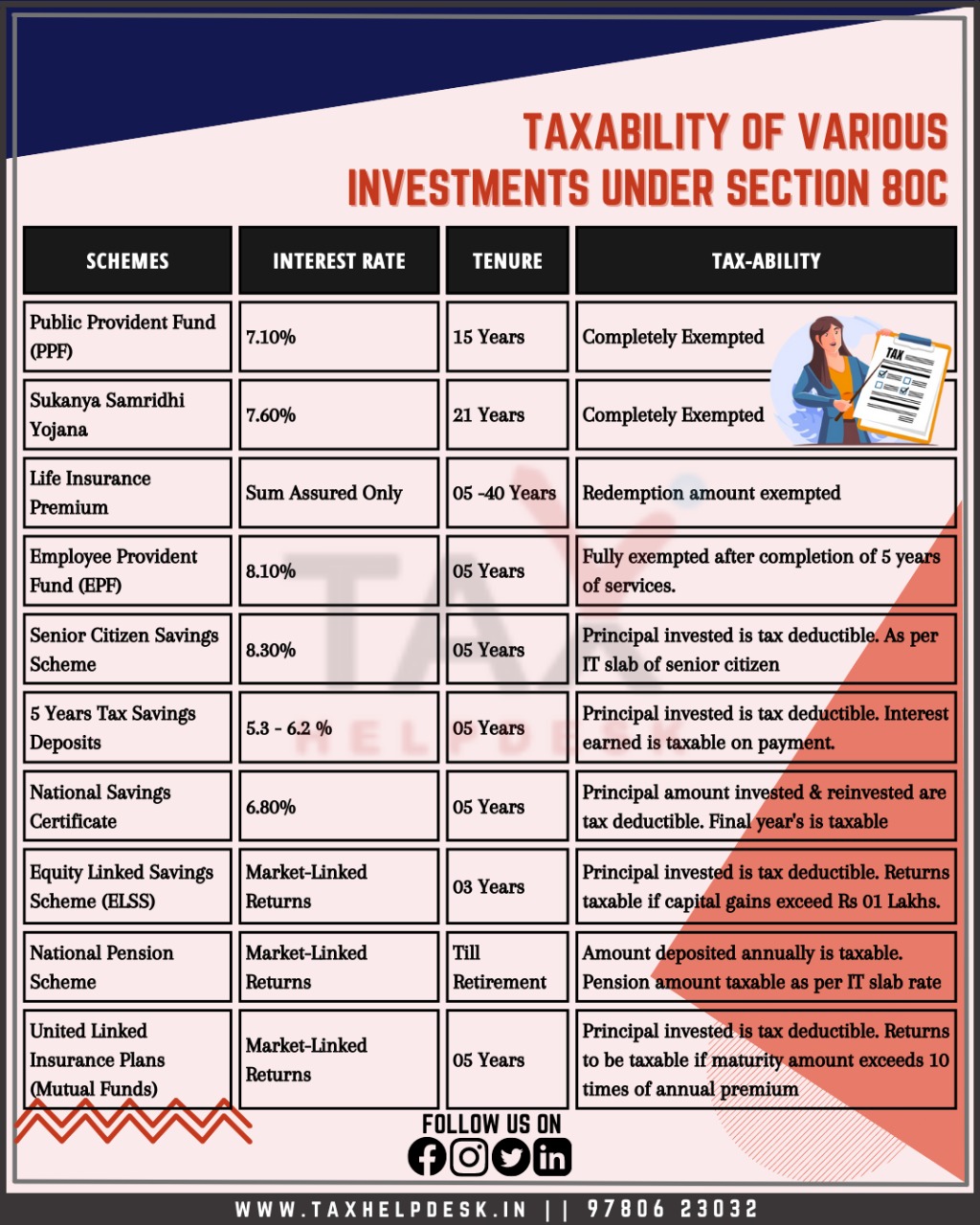

Understand About Taxability Of Various Investments Under Section 80C

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Investments-under-Section-80C.jpeg

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

Section 80C Deduction Under Section 80C In India Paisabazaar

https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

Verkko 8 tammik 2018 nbsp 0183 32 The maximum limit of deduction under section 80C is Rs 150000 For some Rs 150000 per annum is a minuscule amount which gets covered in their EPF Verkko The maximum amount of deduction you can claim under this section per financial year is Rs 1 50 000 a combined limit that includes sections 80CCC and 80CCD 1 The

Verkko 10 elok 2022 nbsp 0183 32 The maximum quantum of deduction available under this section along with Section 80C and Section 80CCD 1 is subject to the threshold limit of Rs 1 5 Verkko Check deductions under section 80C 80CCD 1 80CCD 1B 80CCD 2 and 80CCC Term Insurance Term Plan Calculator Calculate necessary coverage amount as per

Deductions Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

https://life.futuregenerali.in/media/2zjhyg5j/section-80c-deductions.jpg

https://groww.in/p/tax/section-80c

Verkko Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax It allows for a maximum

https://tax2win.in/guide/income-tax-deduction …

Verkko 13 kes 228 k 2019 nbsp 0183 32 Amount you can invest There is no such limit for making investments in the ULIP but the premium should not be more

Deductions Under Section 80C Benefits Works Myfinopedia

Deductions Under Section 80C Its Allied Sections

Deduction From Gross Total Income Section 80C To 80U Graphical Table

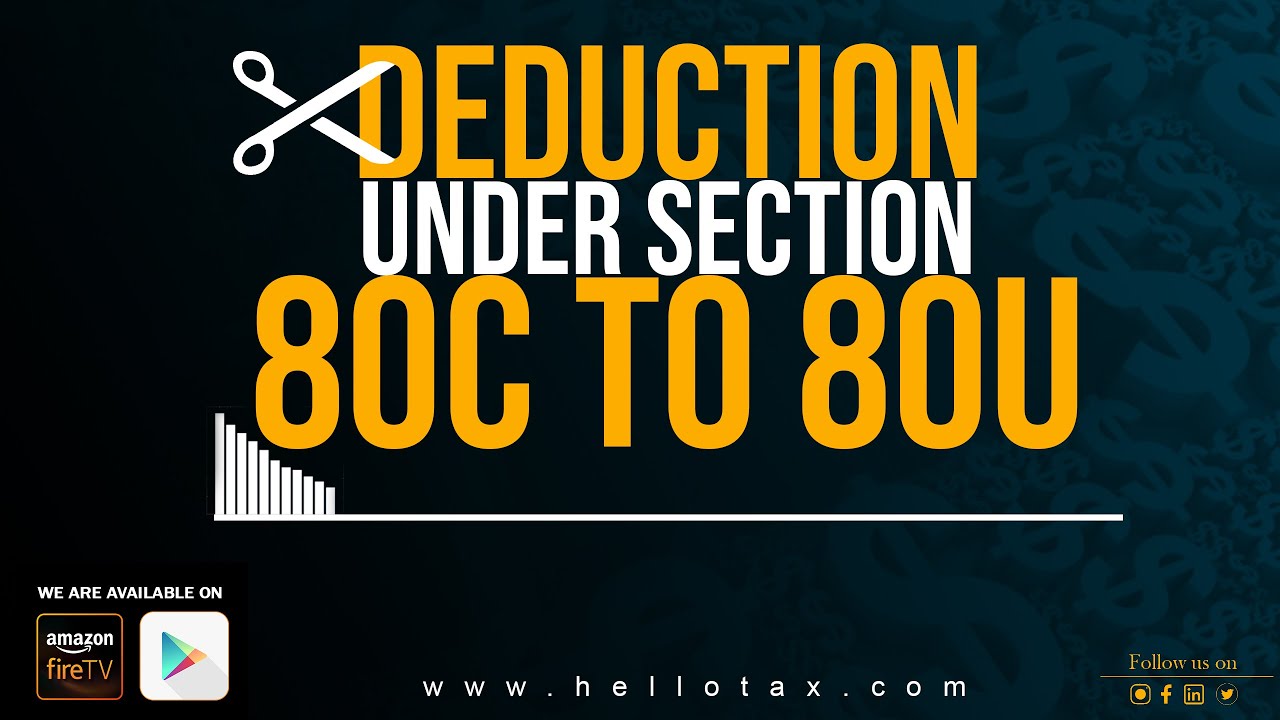

Module 05 Deduction Under Section 80C TO 80U Theory Studocu

Reintroducing Medical Reimbursement And Transport Allowance What

Exhausted Section 80C Limit Here Are 10 Other Tax Saving Investment

Exhausted Section 80C Limit Here Are 10 Other Tax Saving Investment

Deduction Under Section 80C To 80U YouTube

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Tax Deductions For Financial Year 2018 19 WealthTech Speaks

What Is The Maximum Limit Under Section 80c - Verkko 1 maalisk 2023 nbsp 0183 32 Rs 1 50 000 Step 1 Step 2 Step 3 Step 4 Step 5 Amount remaining under Section 80C Step 7 You might find yourself with very little of the