What Is The Senior Tax Credit For 2023 To qualify for the Senior Tax Credit you must be 65 years of age or older by the end of the tax year If they are younger you must Be a retiree on permanent and total disability Have taxable disability income Not yet reached

A credit for taxpayers aged 65 or older OR retired on permanent and total disability and received taxable disability income for the tax year AND with an adjusted gross income OR the total of For tax year 2023 the additional standard deduction amounts for taxpayers who are 65 and older or blind are 1 850 for single or head of household

What Is The Senior Tax Credit For 2023

What Is The Senior Tax Credit For 2023

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

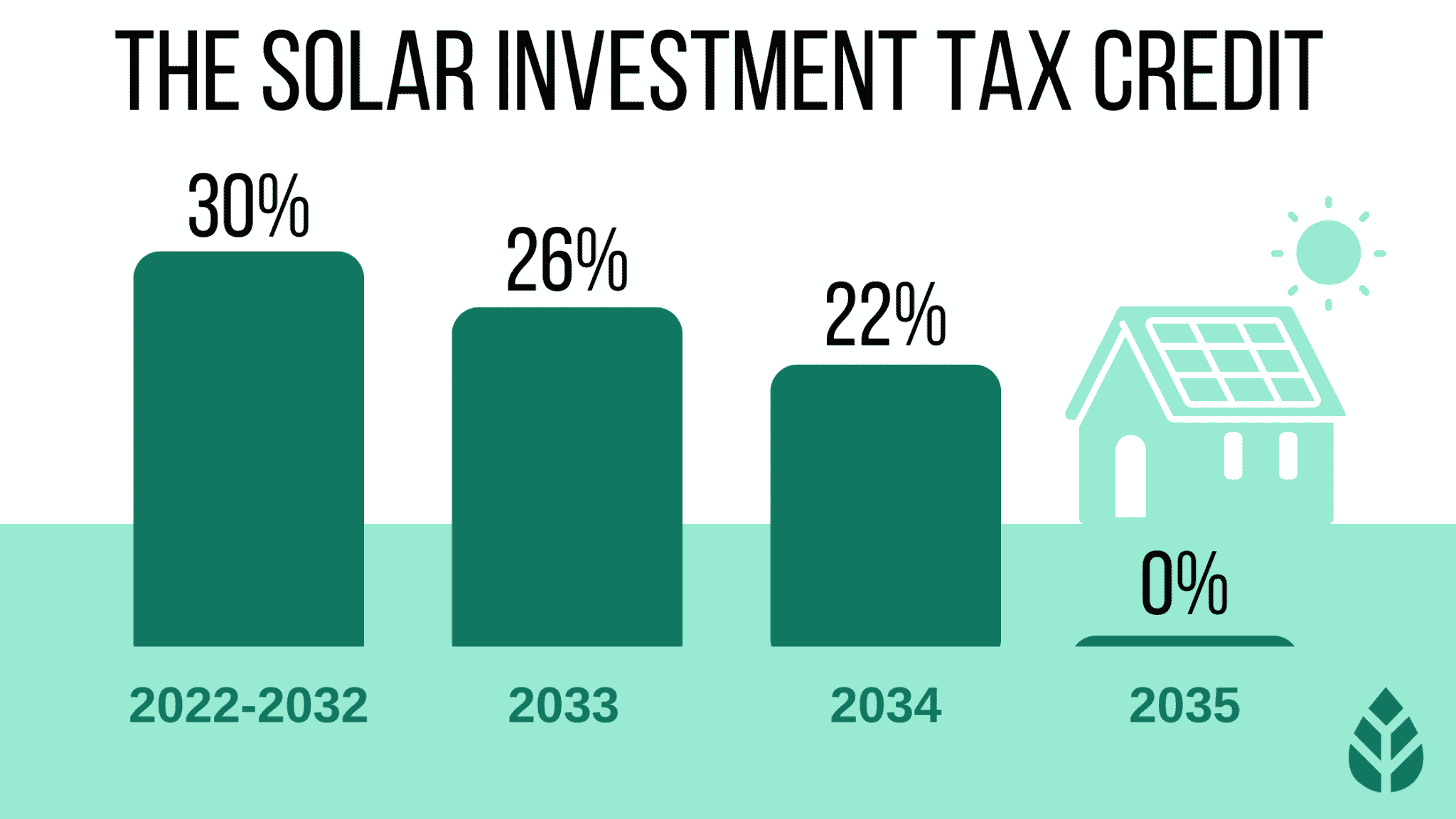

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

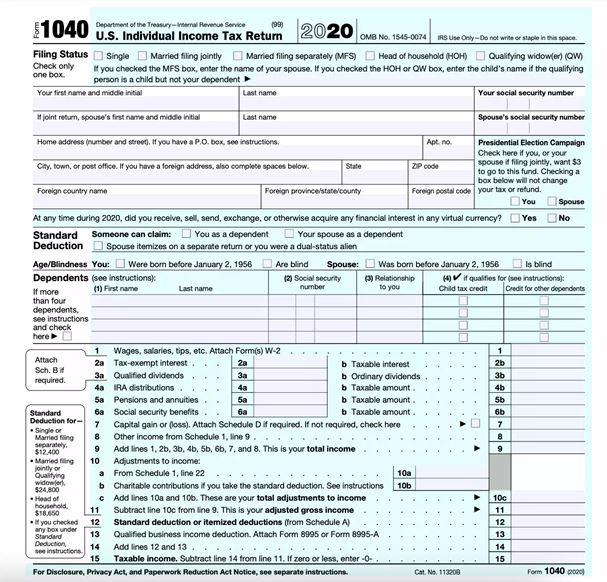

For 2023 e g if you haven t filed yet due to a tax deadline extension the standard deduction amounts were 13 850 for single and for those who are married filing The Internal Revenue Service extends a special credit to older taxpayers called the Credit for the Elderly or the Disabled This tax break allows individuals and couples to reduce the amount of

The Credit for the Elderly and Disabled ranges from 3 750 to 7 500 depending on your income and filing status If you owe 4 000 in taxes before the credit and you get a The maximum Earned Income Tax Credit in 2023 for single and joint filers is 560 if the filer has no children Table 5 The maximum credit is 3 995 for one child 6 604 for

Download What Is The Senior Tax Credit For 2023

More picture related to What Is The Senior Tax Credit For 2023

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/e23b505f-ffa6-4e69-9c23-dde3138f86cc_2100x1500.png

FinancialFridays Seniors Tax Credits Part 1 United Way Of Bruce Grey

https://unitedwayofbrucegrey.com/wp-content/uploads/2022/03/275750249_10159719719897970_6754699348310005992_n-1024x1024.jpg

An Up To 7 500 Tax Credit For The Elderly And Disabled Grady H

https://www.floridaelder.com/wp-content/uploads/2019/04/Tax-credit-1.jpg

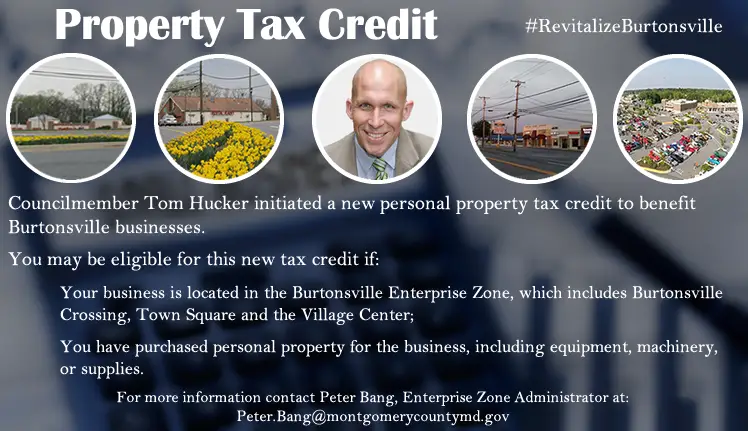

These tips will help you complete your income tax and benefit return and avoid interruptions to your benefit and credit payments Filing and payment deadline You will be The types of tax credits available for seniors include the Retirement Savings Contributions Credit Elderly and Disabled Tax Credit and Property Tax Credit To claim these credits seniors must meet eligibility

Tax season can be overwhelming especially for seniors However the Elderly Tax Credit for 2023 offers a silver lining This article will guide you through the types of credits Tax Credit for the Elderly or Disabled This tax credit directly lowers the tax bill by between 3 750 and 7 500 for those who qualify People 65 and over can be eligible if they

W4 Printable Forms 2022 Printable Explained 2022 W 4 Form

https://2022w-4form.com/wp-content/uploads/2022/09/top-10-us-tax-forms-in-2022-explained-pdf-co-20.png

A Day In The Life Of Clarence Churn Senior Tax Accountant From OTA Tax

https://myotaenlightstorage.blob.core.windows.net/culture/content/images/4cf05543-b7c5-44c7-8b1e-0508327d88c6.jpg

https://www.findlaw.com/elder/elder-care-law/t…

To qualify for the Senior Tax Credit you must be 65 years of age or older by the end of the tax year If they are younger you must Be a retiree on permanent and total disability Have taxable disability income Not yet reached

https://www.irs.gov/credits-deductions/individuals/...

A credit for taxpayers aged 65 or older OR retired on permanent and total disability and received taxable disability income for the tax year AND with an adjusted gross income OR the total of

Earned Income Tax Credit For Households With One Child 2023 Center

W4 Printable Forms 2022 Printable Explained 2022 W 4 Form

2022 Education Tax Credits Are You Eligible

Tax Return Printable Form

FAQ WA Tax Credit

Do Seniors Get A Property Tax Break In Maryland Greatsenioryears

Do Seniors Get A Property Tax Break In Maryland Greatsenioryears

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

What Is The Senior Tax Credit For 2023 - The Internal Revenue Service extends a special credit to older taxpayers called the Credit for the Elderly or the Disabled This tax break allows individuals and couples to reduce the amount of