What Is The Seniors Home Safety Tax Credit 2023 Ontario The Ontario Seniors Care at Home Tax Credit is a refundable personal income tax credit to help low to moderate income seniors with eligible medical expenses including expenses that

Ontario Senior Home Safety Tax Credit If you paid for renovations to improve the safety and accessibility of your home for a senior who lives there you might be able to claim the new Ontario Seniors Care at Home Tax Credit This is also refundable The credit provides up to 25 of claimable medical expenses up to 6 000 Who is Eligible You are eligible to claim the credit if you turned 70 years of age or older in the

What Is The Seniors Home Safety Tax Credit 2023 Ontario

What Is The Seniors Home Safety Tax Credit 2023 Ontario

https://stillcpa.ca/wp-content/uploads/2022/01/emotional-ge5179d0d6_1280-1-1024x640.jpg

The Benefits Of ERC Tax Credit For Nonprofit Organizations Corensic

https://www.mdaprograms.com/wp-content/uploads/O_-Employee-Retention-Credit-ERC-ad_FP_Sept-2022_8-scaled.jpg

Understanding Seniors Home Safety Tax Credit ConsidraCare

https://www.considracare.com/wp-content/uploads/2022/07/tax-credit-.png

Tax credit for seniors or people who live with senior relatives to help make the home safer and more accessible Maximum credit is 2 500 25 of up to 10 000 in eligible expenses for a Seniors Home Safety Tax Credit The objective is to allow Ontario older adults to adapt their homes to accommodate new challenges that may arise over time Ontario Seniors Public Transit Tax Credit This is for seniors choosing to

25 of up to maximum 10 000 in eligible expenses for a senior s principal residence in Ontario resulting in maximum 2 500 credit Maximum can be shared by the people who share a home including spouses and common law The Ontario Seniors Home Safety Tax Credit is a provincial initiative designed to help seniors make their homes safer and more accessible This tax credit introduced to

Download What Is The Seniors Home Safety Tax Credit 2023 Ontario

More picture related to What Is The Seniors Home Safety Tax Credit 2023 Ontario

Seniors Home Safety Tax Credit YouTube

https://i.ytimg.com/vi/zpt1m4bWkzQ/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgYShRMA8=&rs=AOn4CLCMnPlync0zl2cKvDQtCSxKvMXAgg

Home Safety Checklist For Seniors Optalis

https://www.optalishealthcare.com/wp-content/uploads/2022/09/Blog-Photo-729.png

Home Safety Solutions Helps Seniors Age In Their Own Homes Health

https://healthnewshub.org/wp-content/uploads/2022/08/CHA-1-e1661960720325-768x445.jpg

For this 2023 edition here is an overview of the actual main tax credits available to Ontario seniors and their families 1 Ontario Seniors Home Care Tax Credit The Ontario Care at The Seniors Home Safety Tax Credit is a refundable credit worth 25 per cent of up to 10 000 per household in eligible expenses to a maximum credit of 2 500 It can be

Ontario Seniors Home Safety Tax Credit If you are 65 by the end of the tax year or older you may be eligible for a temporary refundable Home Safety Tax Credit towards your It is available to eligible senior homeowners and renters in Ontario for the 2021 and 2022 tax years The tax credit covers 25 of up to 10 000 in eligible expenses per year

Warn Seniors About Social Security Scams Health Concepts

https://healthconceptsltd.com/wp-content/uploads/2019/09/GettyImages-75288084-768x512.jpg

Ontario s New Seniors Tax Credit Is Really A Gift To Real Estate Lobby

https://img.huffingtonpost.com/asset/5fa5b5c8240000b33761f3f4.jpeg?cache=BNTqg5563P&ops=1778_1000

https://www.ontario.ca › page › ontario-seniors-care-home-tax-credit

The Ontario Seniors Care at Home Tax Credit is a refundable personal income tax credit to help low to moderate income seniors with eligible medical expenses including expenses that

https://support.hrblock.ca › en-ca › Content › Other...

Ontario Senior Home Safety Tax Credit If you paid for renovations to improve the safety and accessibility of your home for a senior who lives there you might be able to claim the new

Spahealthy

Warn Seniors About Social Security Scams Health Concepts

Seniors Home Safety Tax Credit Being Extended Burlington Gazette

Home Safety Measures For Seniors HomeSafety Seniors Home Safety

Why You Should Join A Senior Dance Class The Senior Magazine

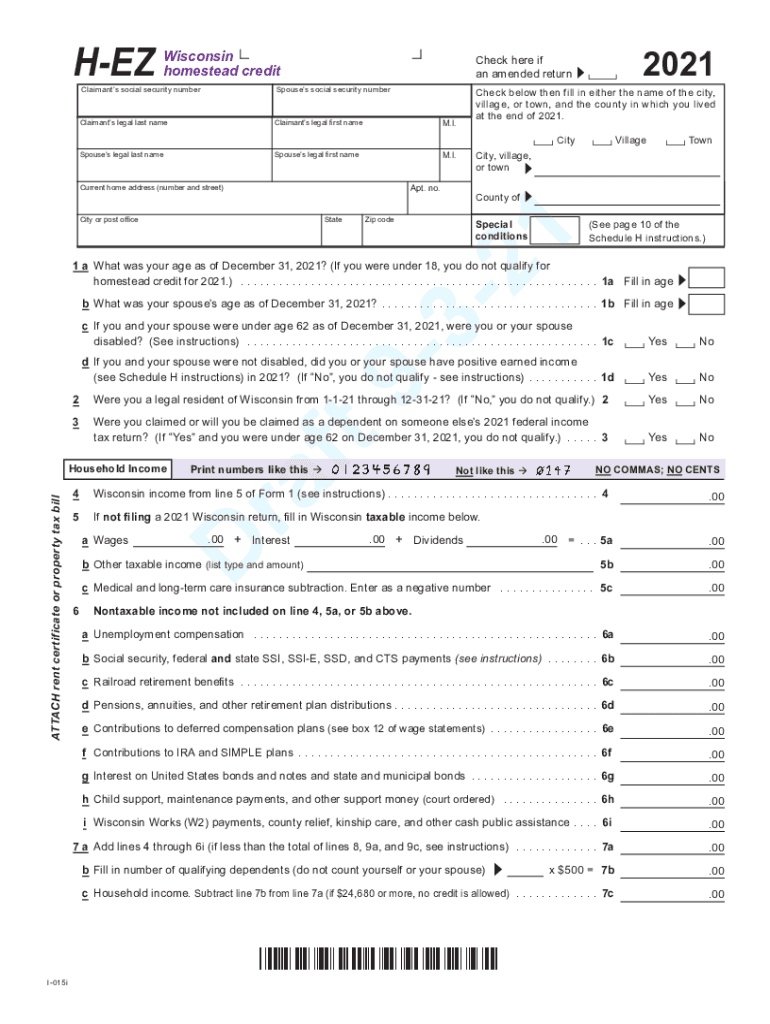

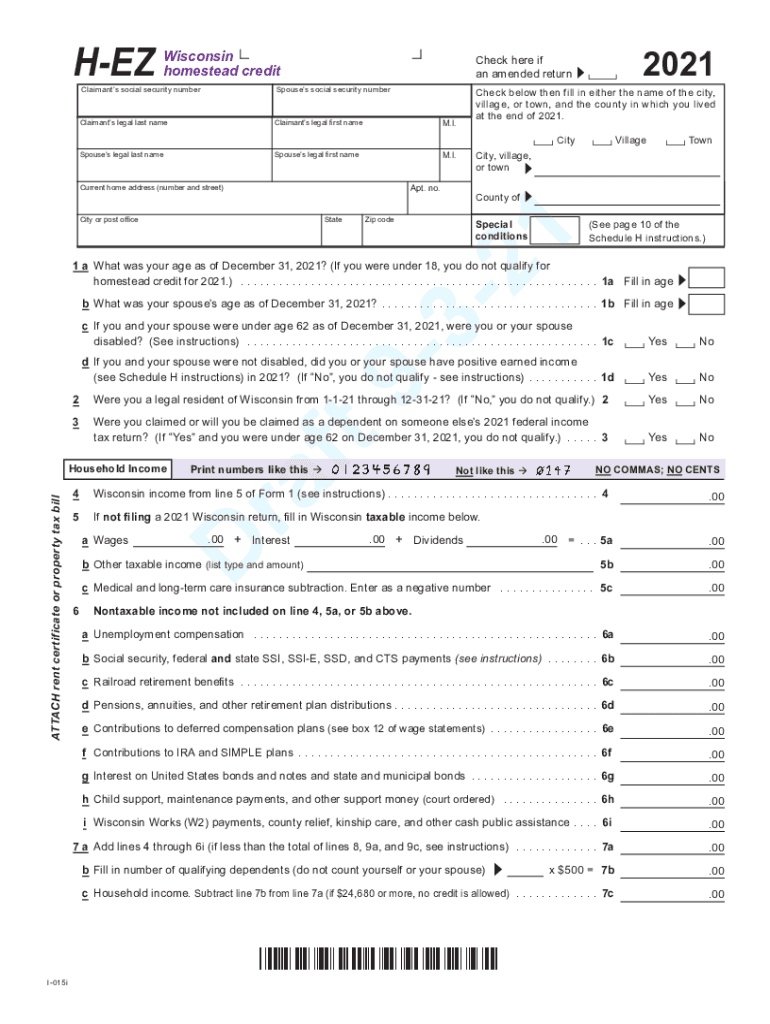

Wisconsin Homestead Credit 2021 2024 Form Fill Out And Sign Printable

Wisconsin Homestead Credit 2021 2024 Form Fill Out And Sign Printable

Home Safety For Seniors Security City

Home Safety Checklist For Seniors Scripps Affiliated Medical Groups

Understanding Seniors Home Safety Tax Credit Home Safety Tax

What Is The Seniors Home Safety Tax Credit 2023 Ontario - Tax credit for seniors or people who live with senior relatives to help make the home safer and more accessible Maximum credit is 2 500 25 of up to 10 000 in eligible expenses for a