What Is The Tax Credit For Seniors The Tax Counseling for the Elderly TCE program offers free tax help for all taxpayers particularly those who are 60 years of age and older TCE volunteers specialize in

The Credit for the Elderly and Disabled ranges from 3 750 to 7 500 depending on your income and filing status If you owe 4 000 in taxes before the credit and you get a The credit for the elderly and disabled provides a 3 750 7 000 tax credit for those who can meet specific age or disability requirements Taxpayers aged 65 or older and those who retired permanently and totally disabled

What Is The Tax Credit For Seniors

What Is The Tax Credit For Seniors

https://cambridgeelevating.com/wp-content/uploads/2020/12/Tax-Credits-scaled-1-scaled-1.jpeg

Tax Credit For Seniors In Canada Making The Most Of Your Tax Return

https://turbotax.intuit.ca/tips/images/AdobeStock_436608996-1.jpeg

1502 EARNED INCOME TAX CREDIT FOR SENIORS 3000 3600 CHILD TAX

https://i.ytimg.com/vi/PyGg0oWBiwU/maxresdefault.jpg

Tax information for seniors and retirees including typical sources of income in retirement and special tax rules Older adults have special tax situations and benefits Understand Tax Credits for Seniors Thousands of Canadian seniors save money each year by claiming one or more of the following income tax credits Take a close look at the list to

If you re 65 years or older at the end of the tax year you can claim a non refundable tax credit towards your federal taxes To qualify your net income must be less than The Internal Revenue Service extends a special credit to older taxpayers called the Credit for the Elderly or the Disabled This tax break allows individuals and couples to reduce

Download What Is The Tax Credit For Seniors

More picture related to What Is The Tax Credit For Seniors

Spahealthy

https://d2hg8ctx8thzji.cloudfront.net/spahealthy.net/wp-content/uploads/2020/04/TaxCreditForSeniors-975x650.jpg

Earned Income Tax Credit Now Available To Seniors Without Dependents

https://assets-global.website-files.com/5daf3d101c624dc1e85b5fe3/6228af6ab920ee0cd578c4f1_Earnedincometaxcredit_88eba54ea7cede988522b3ba130d480e_2000.png

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

https://adalawcompliance.com/wp-content/uploads/2021/08/TAX-CREDIT-AND-DEDUCTIONS.png

The senior tax credit is open to people age 65 and older who want to lower their tax bill and certain adults under age 65 on permanent and total disability Your tax filing status Older adults and people who are retired can take advantage of additional tax breaks and savings when it comes time to file their taxes For starters there is a larger standard

Thankfully there s a tax credit for seniors that can help offset the taxes you owe on your retirement income One of the biggest is known as the Tax Credit for Elderly or Disabled When older adults were eligible for the tax year 2021 they could receive roughly 1 500 in tax relief helping many offset housing costs and other bills including food health care

Are Seniors Eligible For Earned Income Tax Credit Blog

https://www.hudacklaw.com/wp-content/uploads/2022/05/Are-Seniors-Eligible-for-Earned-Income-Tax-Credit.jpg

Tax Credit For Seniors Who Volunteer YouTube

https://i.ytimg.com/vi/-xJ9iXR-klU/maxresdefault.jpg

https://www.irs.gov/publications/p524

The Tax Counseling for the Elderly TCE program offers free tax help for all taxpayers particularly those who are 60 years of age and older TCE volunteers specialize in

https://www.aarp.org/.../tax-credits-eligibility.html

The Credit for the Elderly and Disabled ranges from 3 750 to 7 500 depending on your income and filing status If you owe 4 000 in taxes before the credit and you get a

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

Are Seniors Eligible For Earned Income Tax Credit Blog

Costs Inheritance tax co uk

Fast Tax Bookkeeping Estate And Tax Planning CA NV Beyond

How To Get Your Credit Score And Credit Reports For FREE In Canada

What Is Deferred Tax Liability DTL Formula Calculator

What Is Deferred Tax Liability DTL Formula Calculator

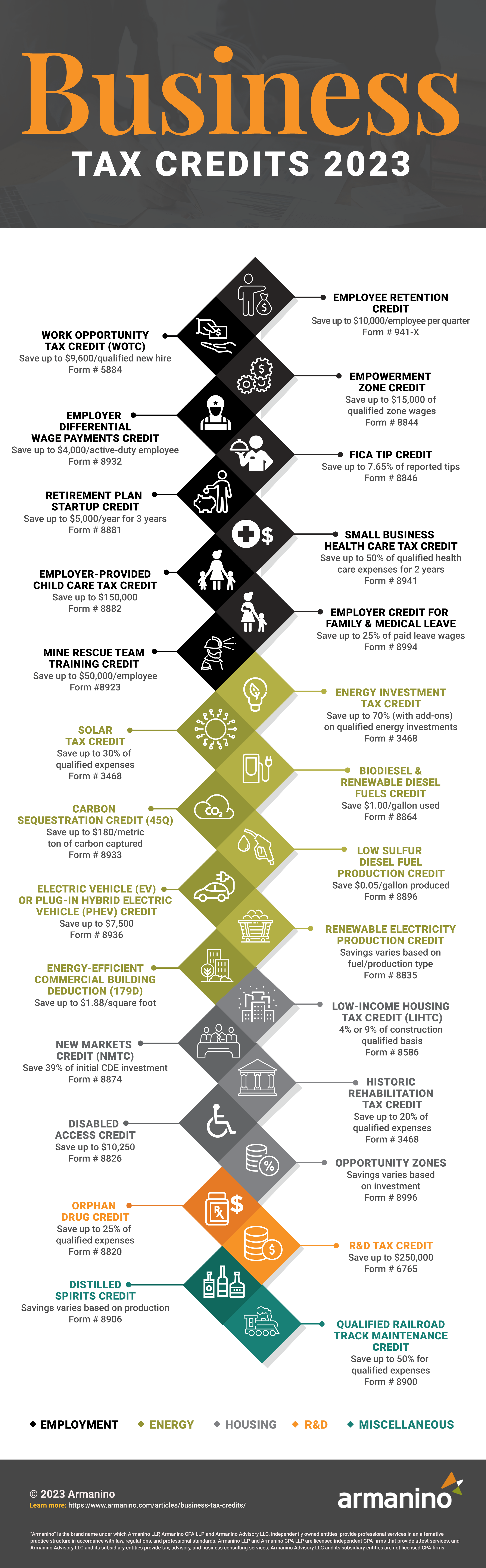

Business Tax Credits 2023 Armanino

How Can Small Business Owners Lower Taxes For 2022

Federal Budget 2023 Tax Credit For Seniors Could Ease Labour Shortage

What Is The Tax Credit For Seniors - The types of tax credits available for seniors include the Retirement Savings Contributions Credit Elderly and Disabled Tax Credit and Property Tax Credit To