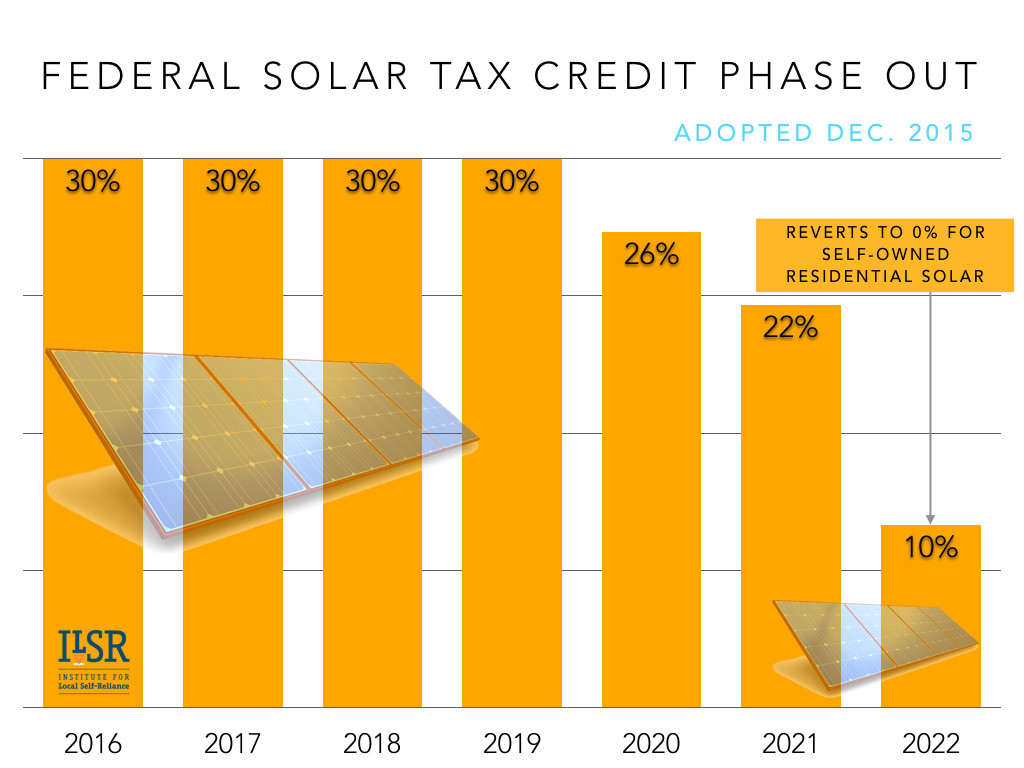

What Is The Tax Credit For Solar Panels Verkko Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Verkko 28 elok 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit Verkko 13 jouluk 2023 nbsp 0183 32 The Federal Solar Tax Credit for 2023 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as

What Is The Tax Credit For Solar Panels

What Is The Tax Credit For Solar Panels

http://www.skippingstonesdesign.com/wp-content/uploads/2022/03/load-image-2022-03-29T235018.174.jpg

Does A New Roof Qualify For The Solar Investment Tax Credit Florida

https://djh4x3uvkdok.cloudfront.net/resources/20210618205145/Solar-Panels-On-A-Roof-Get-A-Tax-Credit.jpg

Is There A Tax Credit For Solar Panels 2023 Rules Reward

https://www.missionnewenergy.com/wp-content/uploads/2022/01/solar-tax-credits-1-768x402.png

Verkko The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but Verkko 21 jouluk 2023 nbsp 0183 32 Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of

Verkko For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 18 000 0 30 5 400 State Tax Credit Verkko 8 syysk 2022 nbsp 0183 32 Solar Energy Technologies Office Solar Investment Tax Credit What Changed President Biden signed the Inflation Reduction Act into law on Tuesday August 16 2022 One of the many things this act accomplishes is the expansion of the Federal Tax Credit for Solar Photovoltaics also known as the Investment Tax Credit

Download What Is The Tax Credit For Solar Panels

More picture related to What Is The Tax Credit For Solar Panels

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

https://tampabaysolar.com/wp-content/uploads/2022/04/AdobeStock_201159810-2048x1365.jpeg

How Does The Federal Solar Tax Credit Work Nicki Karen

https://nickiandkaren.com/wp-content/uploads/2019/12/photo-1566093097221-ac2335b09e70.jpeg

California Solar Tax Credit LA Solar Group

https://la-solargroup.com/wp-content/uploads/2020/10/Calculating-Solar-Tax-Credit.jpg

Verkko In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems The Inflation Reduction Act renamed and extended the existing solar tax credit through 2034 for solar system installations on residential property It also increased the credit s value Verkko The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill

Verkko 6 kes 228 k 2023 nbsp 0183 32 The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar Verkko 3 marrask 2023 nbsp 0183 32 Either way the process of claiming the 30 solar tax credit is painless If you re claiming a tax credit for a solar power system installed after 2022 you ll need to complete IRS form 5695 Insert the total installation purchase and sales tax costs of your residential power system on line 1 of form 5695

Solar Tax Credit 2022 Incentives For Solar Panel Installations

https://quickelectricity.com/wp-content/uploads/2020/12/Federal-Solar-Tax-Credit-Extension-2022.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Verkko Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Verkko 28 elok 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Federal Tax Credit For Solar Panels In 2023

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

The Federal Solar Tax Credit What You Need To Know 2022

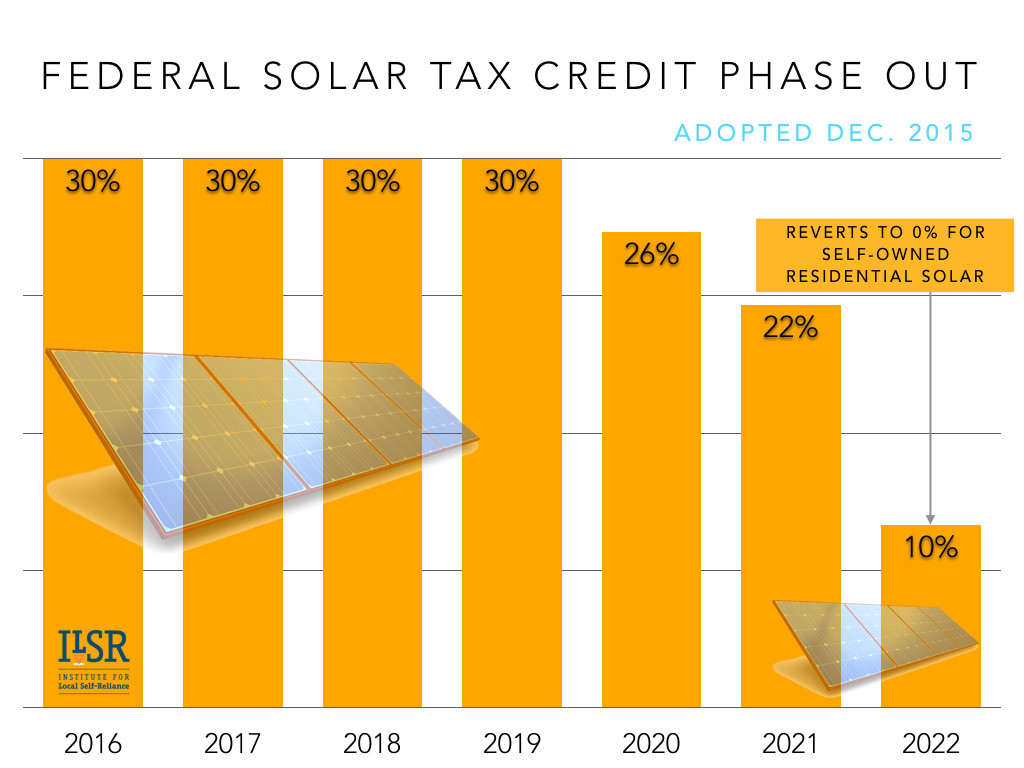

Congress Gets Renewable Tax Credit Extension Right Institute For

Congress Gets Renewable Tax Credit Extension Right Institute For

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

Understanding The Federal Tax Credit For Solar Panels

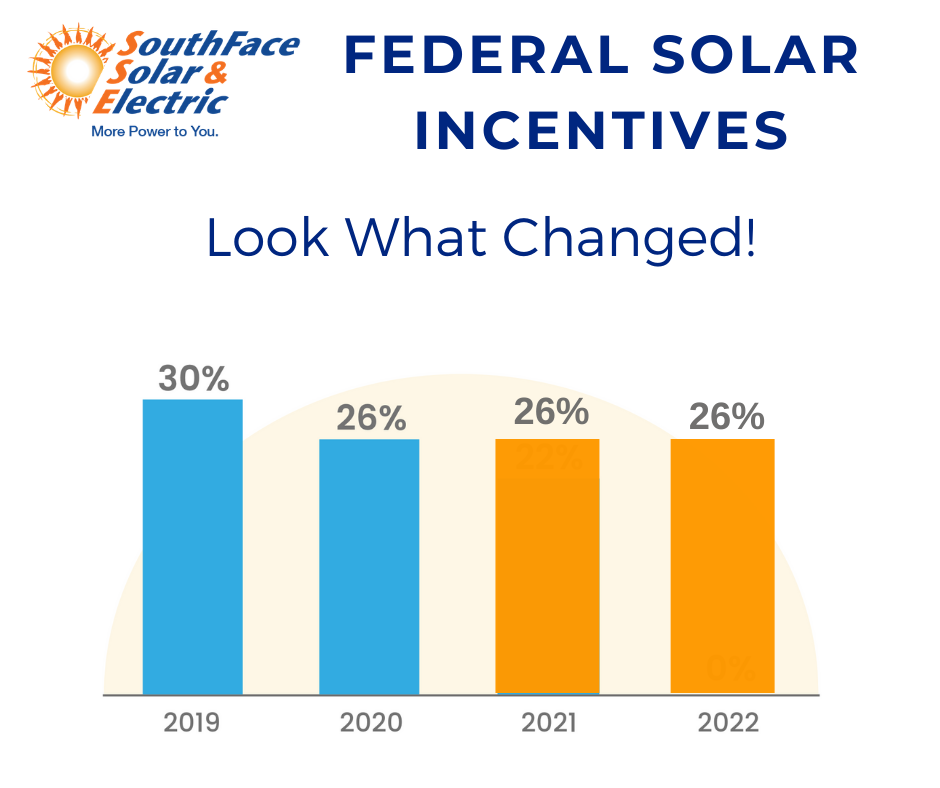

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

What Is The Tax Credit For Solar Panels - Verkko Updated 2 weeks ago A Solar Energy Tax credit is a nonrefundable credit Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were