What Percentage Of Paycheck Goes To Taxes In Colorado The combined federal and state taxes can take up about 15 to 30 of your gross income Updated on Jul 06 2024 Free paycheck calculator to calculate your hourly and salary income after income taxes in Colorado

Use ADP s Colorado Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest Your average tax rate is 10 94 and your marginal tax rate is 22 This marginal tax rate means that your immediate additional income will be taxed at this rate Use our income tax calculator

What Percentage Of Paycheck Goes To Taxes In Colorado

What Percentage Of Paycheck Goes To Taxes In Colorado

https://i.insider.com/5aa8049d3be59f23008b46ac?width=1000&format=jpeg&auto=webp

What Percentage Of Paycheck Goes To Taxes Everything You Need To Know

https://wealthnation.io/wp-content/uploads/2023/04/image-40.png

What Percentage Of Paycheck Goes To Taxes Everything You Need To Know

https://wealthnation.io/wp-content/uploads/2023/04/image-39.png

Colorado Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck Use our paycheck tax calculator If You are able to use our Colorado State Tax Calculator to calculate your total tax costs in the tax year 2024 25 Our calculator has recently been updated to include both the latest Federal Tax

Calculate your Colorado net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local W4 information into this free Colorado The Colorado Paycheck Calculator is a powerful tool designed to help employees and employers in Colorado accurately calculate the net take home pay after deductions such as federal and state taxes Social Security

Download What Percentage Of Paycheck Goes To Taxes In Colorado

More picture related to What Percentage Of Paycheck Goes To Taxes In Colorado

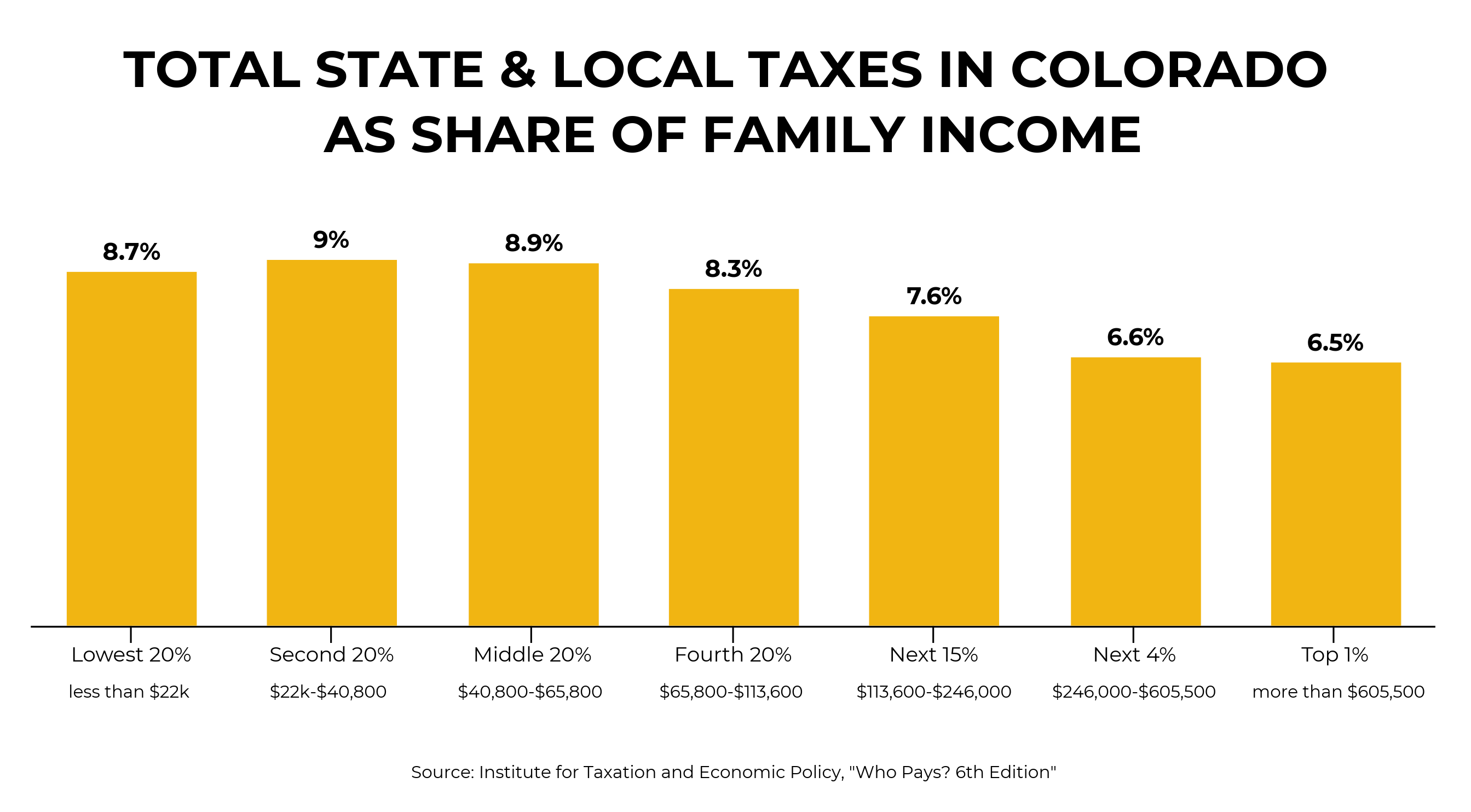

Learn More Quick Facts On A Fair Tax For Colorado

https://www.bellpolicy.org/wp-content/uploads/2020/02/total-statelocal-taxes-in-Colorado-share-of-family-income.png

Visualizing Taxes Deducted From Your Paycheck In Every State

https://cdn.howmuch.net/articles/how-much-money-gets-taken-out-paychecks-1542.jpg

How Much Of My Paycheck Goes To Taxes In Colorado Ethelyn Cantu

https://i.pinimg.com/originals/b8/5b/c7/b85bc7747d440793d09384417b56dda9.png

SmartAsset s Colorado paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay Colorado has a flat tax rate of 4 4 for 2023 This means that everyone pays the same percentage of their taxable income regardless of how much they earn Colorado has an

Each employee s gross pay deductions and net pay for both Federal and Colorado state taxes will be calculated for you Or use our Colorado paycheck calculator for If you make 55 000 a year living in the region of Colorado USA you will be taxed 11 397 That means that your net pay will be 43 604 per year or 3 634 per month Your average tax rate

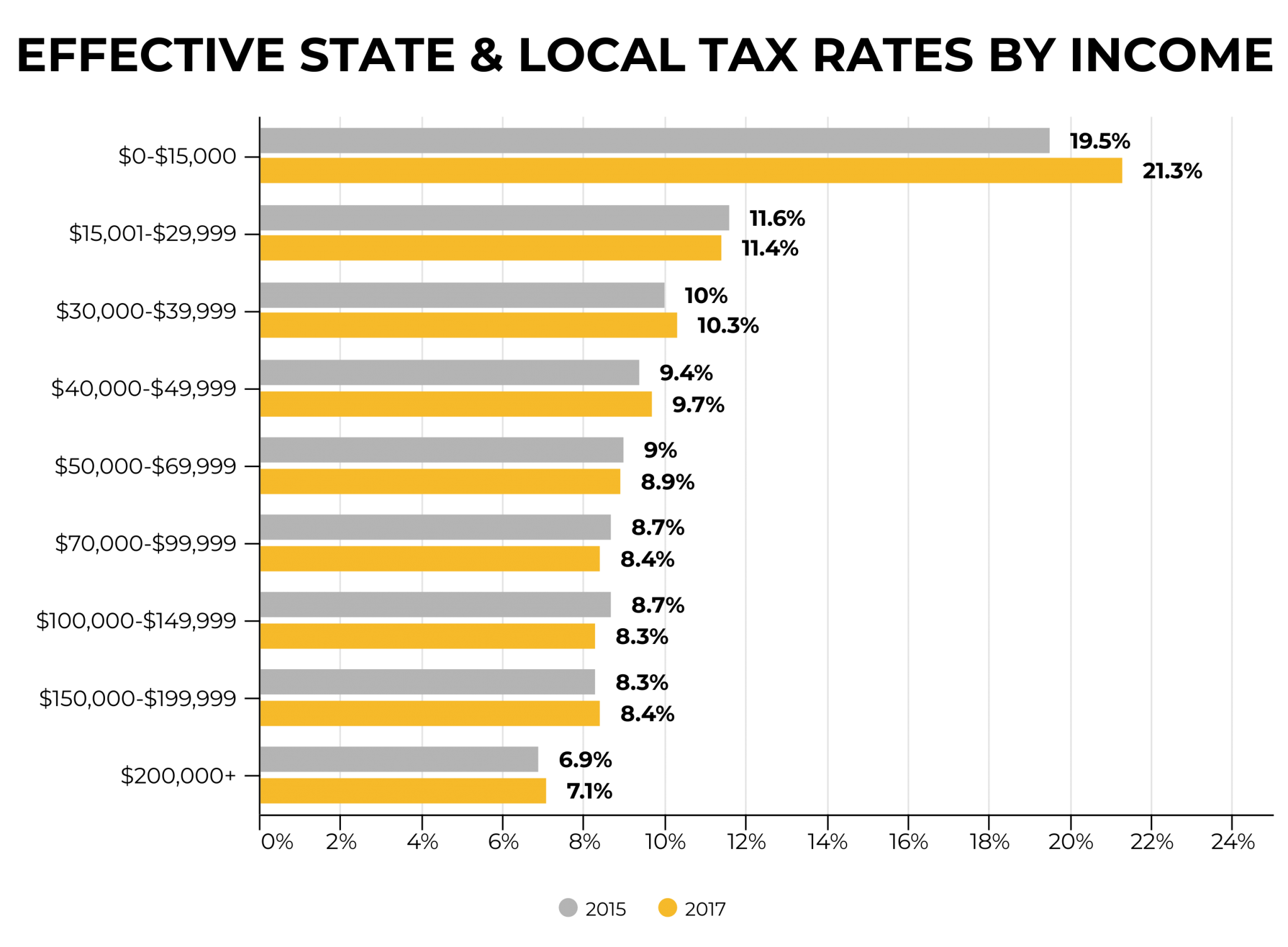

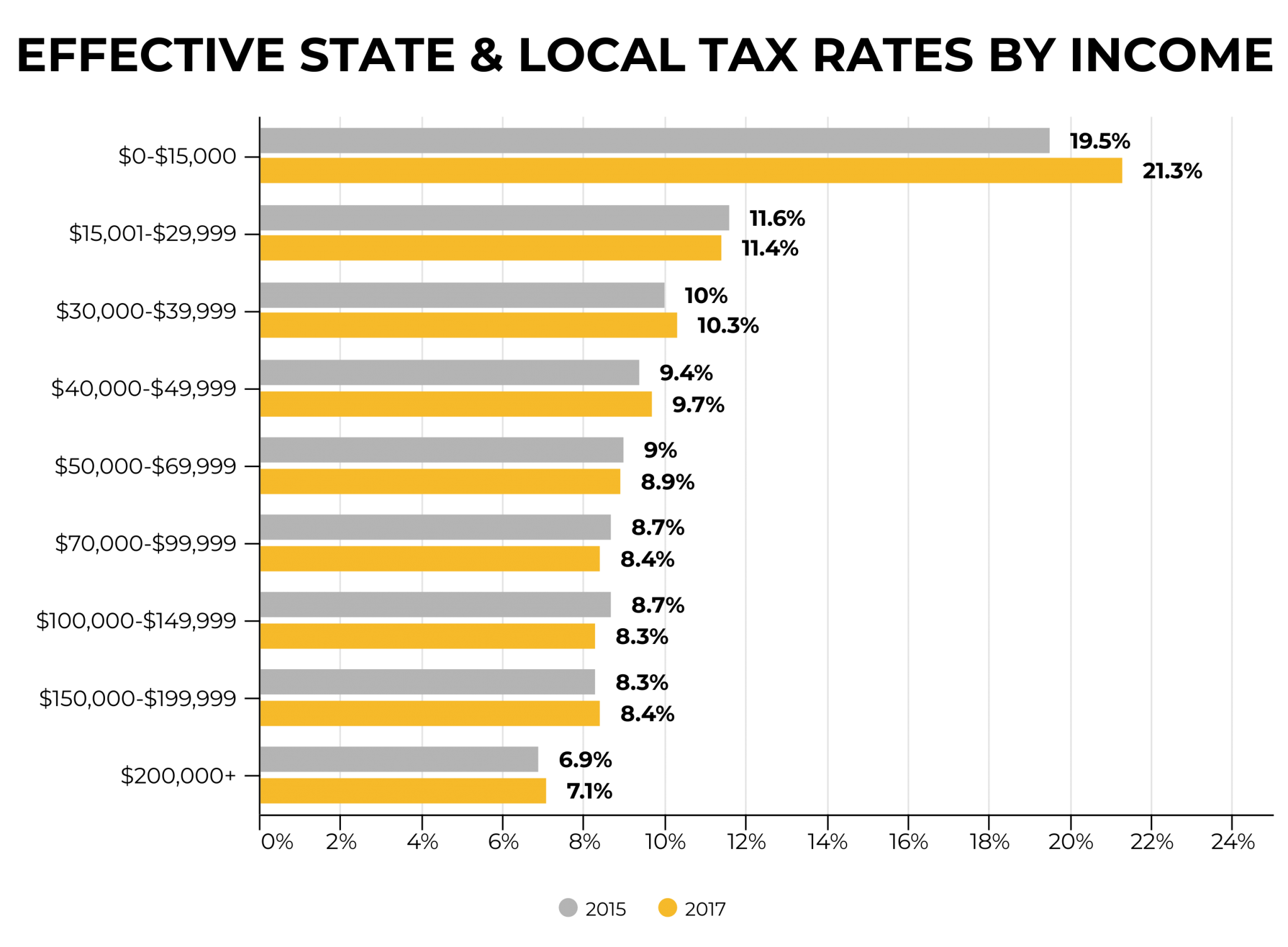

Headlines From The Colorado Tax Report The Bell Policy Center

https://www.bellpolicy.org/wp-content/uploads/1-1-2048x1506.png

In The US What Percentage Of Your Paycheck Goes To Taxes Quora

https://qph.cf2.quoracdn.net/main-qimg-a99db52bd15e4fe18b179646c70157c7-pjlq

https://www.mypaycalculator.net/.../colorado

The combined federal and state taxes can take up about 15 to 30 of your gross income Updated on Jul 06 2024 Free paycheck calculator to calculate your hourly and salary income after income taxes in Colorado

https://www.adp.com/resources/tools/c…

Use ADP s Colorado Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest

Colorado s Low Property Taxes Colorado Fiscal Institute

Headlines From The Colorado Tax Report The Bell Policy Center

US States Where The Most Taxes Are Taken Out Of Every Paycheck

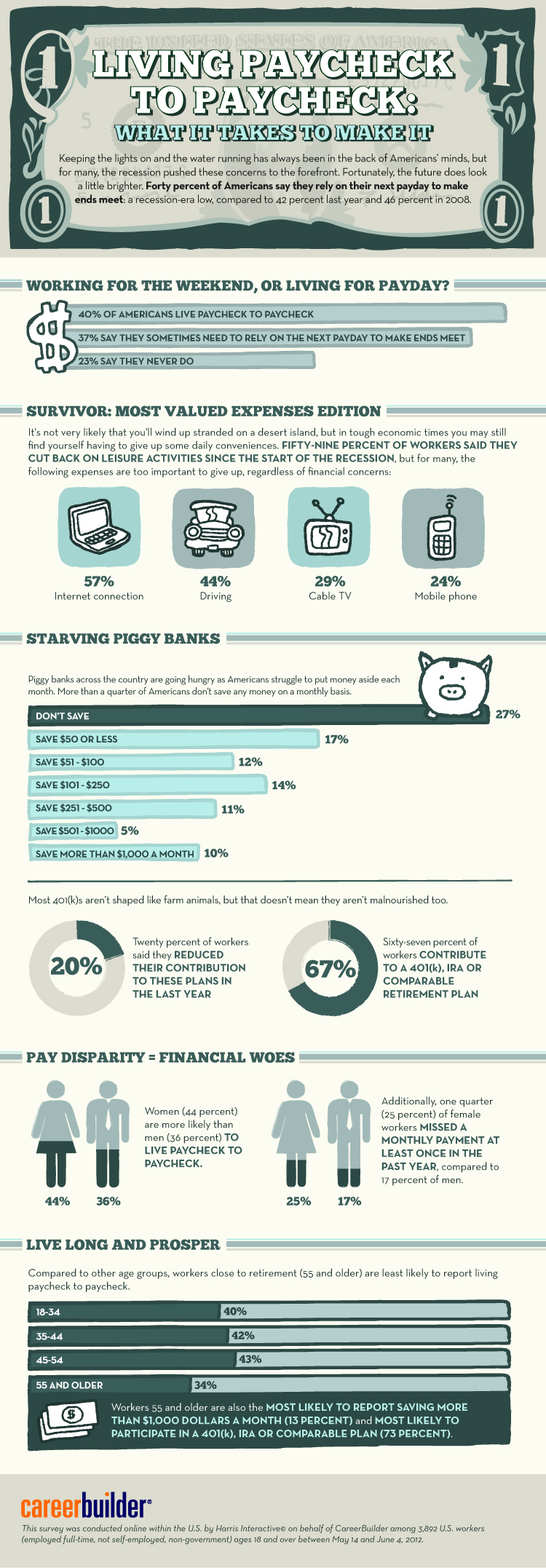

Infographic 40 Percent Of Americans Live Paycheck To Paycheck

How Much GST HST Do I Pay And Charge Per Province

How To Read Your Paycheck Everything You Need To Know Chime

How To Read Your Paycheck Everything You Need To Know Chime

Taxes And Your Paycheck

How Much Do The Top 1 Percent Pay Of All Taxes

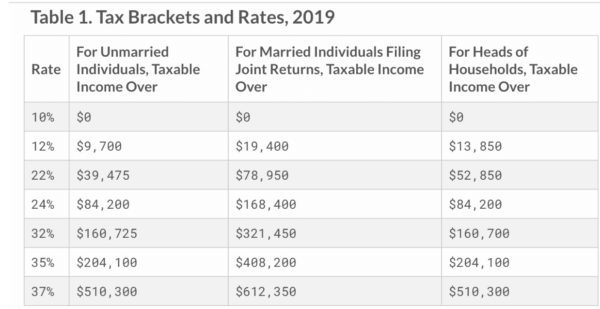

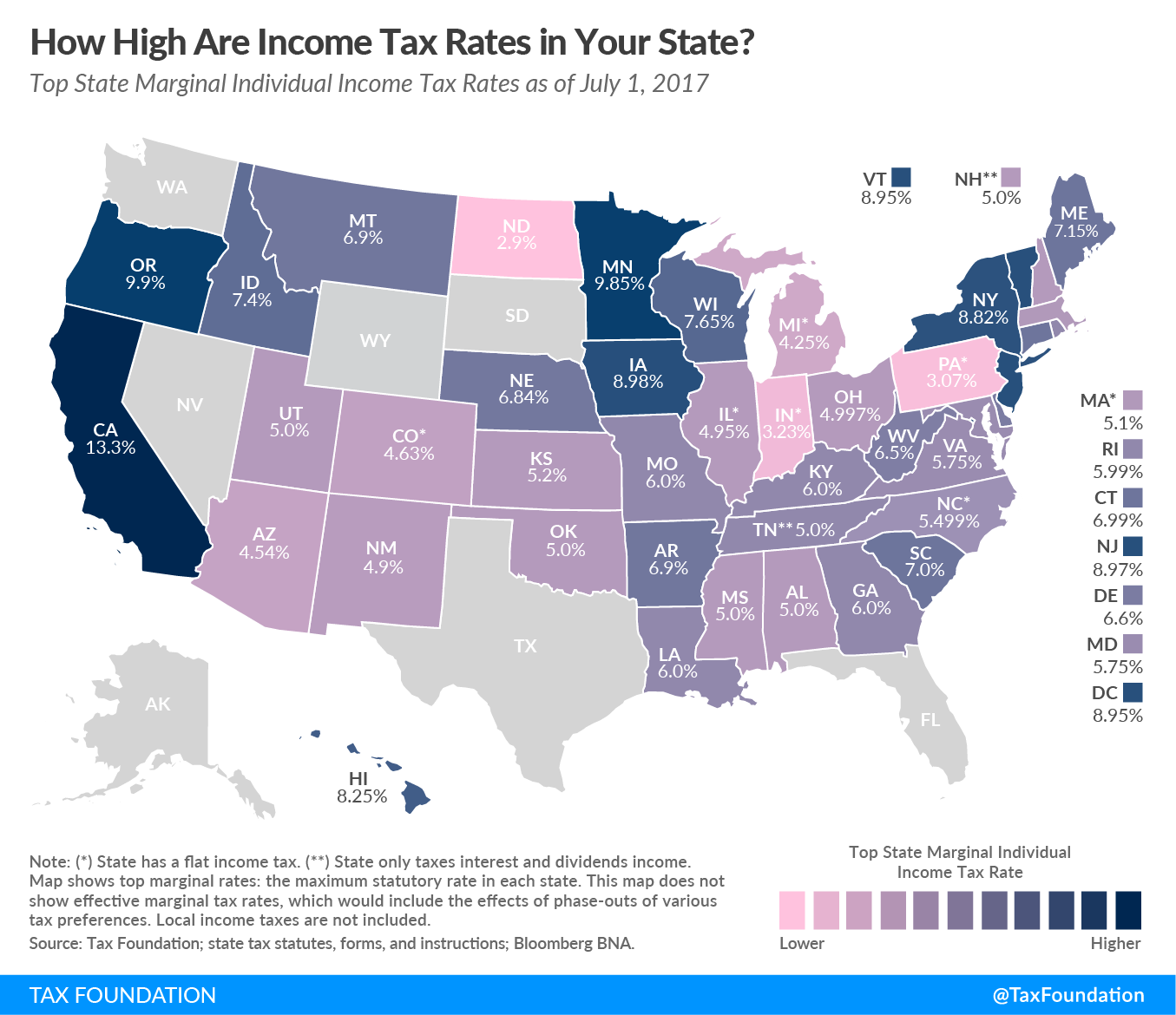

State Individual Income Tax Rates And Brackets 2017 Tax Foundation

What Percentage Of Paycheck Goes To Taxes In Colorado - You are able to use our Colorado State Tax Calculator to calculate your total tax costs in the tax year 2024 25 Our calculator has recently been updated to include both the latest Federal Tax