What Qualifies As Hsa Purchase Your HSA can help you cover qualified emergency dental vision and family medical expenses The CARES Act has expanded the list of HSA eligible items to include over

You must be enrolled in a high deductible health insurance plan to qualify for an HSA What expenses are eligible for an HSA The government only allows these tax HSA contribution limits View contribution limits for 2024 and historical limits back to 2004 Includes contribution limits for both single and married people as well as catch up

What Qualifies As Hsa Purchase

What Qualifies As Hsa Purchase

https://i.ytimg.com/vi/hV_7dSeujhE/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYZSBJKEUwDw==&rs=AOn4CLCID7Bq1sCJNfFFr6xOR-UHCp_Eog

HSA Investment Strategies MyHealthMath

https://myhealthmath.com/wp-content/uploads/2022/08/HSA-Investments-Blog.png

Learn More About Our HSA Plan Pediatric Dental Associates

https://pediatricdentalassociatesal.com/wp-content/uploads/2017/07/shutterstock_461780311.jpg

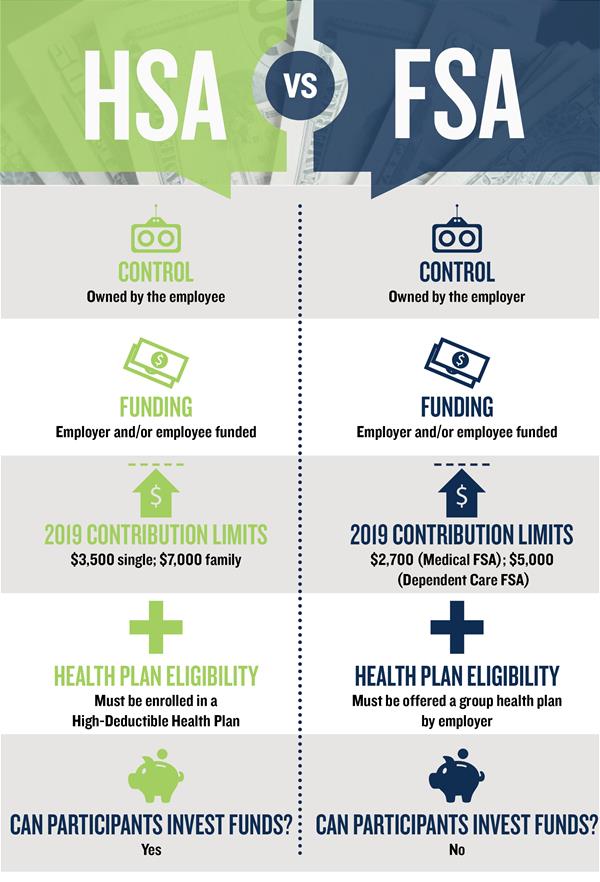

From A to Z items and services deemed eligible for tax free spending with your Flexible Spending Account FSA Health Savings Account HSA Health Reimbursement A type of savings account that lets you set aside money on a pre tax basis to pay for qualified medical expenses By using untaxed dollars in a Health Savings Account

HSA eligible expenses are ones the IRS has deemed as qualified That means you can use money in your HSA to pay for those expenses without it being considered a taxable distribution Expenses related to medical You can open an HSA if you have a qualifying high deductible health plan For the 2022 tax year the maximum contribution amounts are 3 650 for individuals and 7 300 for family coverage

Download What Qualifies As Hsa Purchase

More picture related to What Qualifies As Hsa Purchase

Health Savings Account HSA Cigna Healthcare

https://www.cigna.com/static/www-cigna-com/images/individuals-families/shop-plans/plans-through-employer/hsa/preview-0KR.1024x576.jpeg

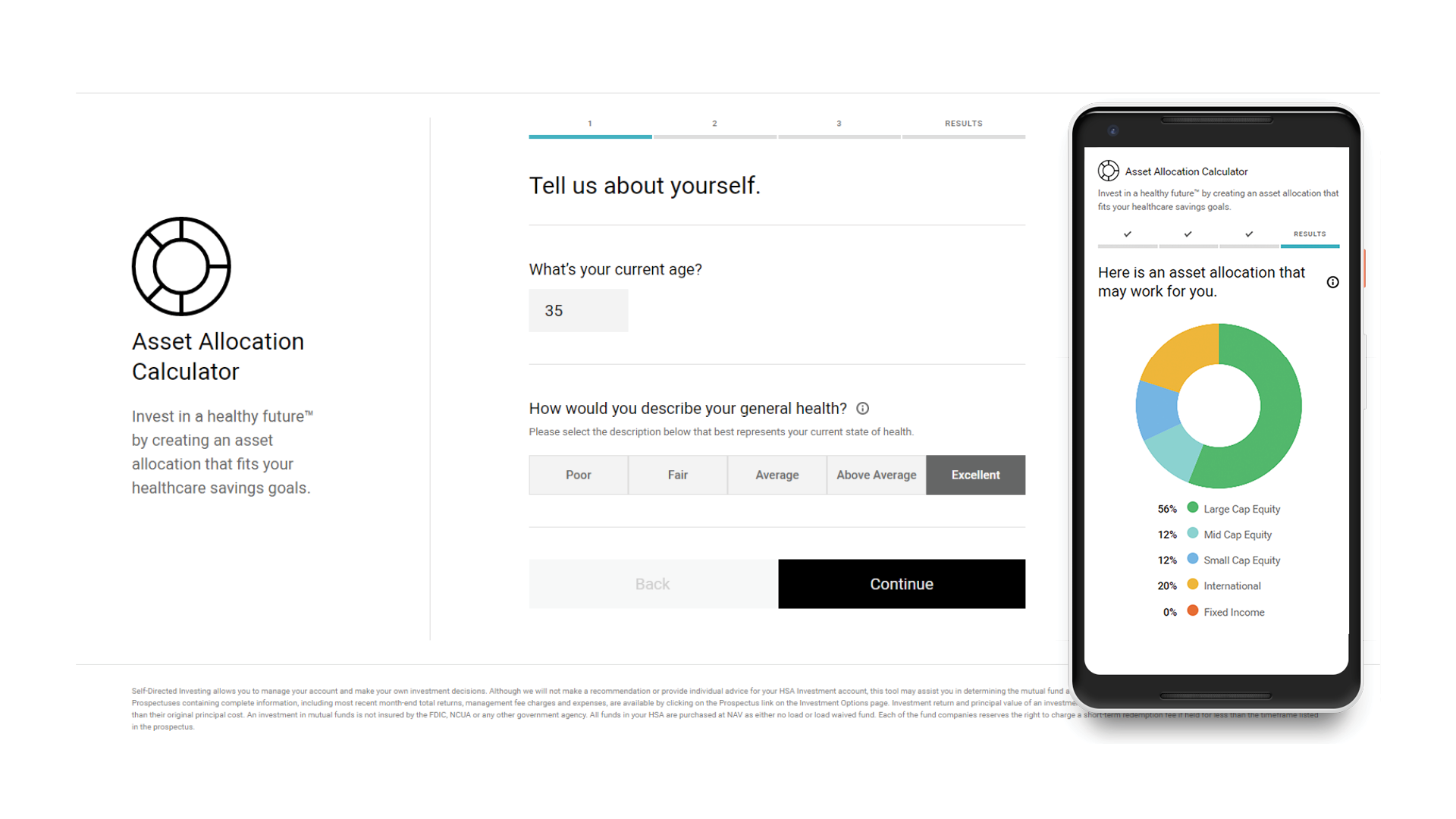

New HSA Asset Allocation Calculator Devenir

https://www.devenir.com/wp-content/uploads/AssetAllocation_Screenshots.png

What Is A Health Savings Account HSA Jefferson Bank

https://www.jefferson-bank.com/uploadedfiles/images/articles/anatomy-of-an-hsa-infographic.jpg?v=1D6981783634880

Understanding which expenses qualify for your HSA funds shouldn t be complicated Here we list every qualified medical expense defined by the IRS Want to know whether something else is eligible to be covered by HSA or FSA dollars If you have a Fidelity HSA you can use the Fidelity Health App to find out fast Just scan

HSA HRA healthcare FSA and dependent care eligibility list The following is a summary of common expenses claimed against Health Savings Accounts HSAs Health We rounded up everything we ve written about that you can use your remaining HSA dollars on including a 23andMe DNA Test Elvie Breast Pump Nanit Pro Camera Supergoop

Hsa YouTube

https://yt3.googleusercontent.com/5iZcwXCF-sm-t3QduQ20MOTeGvUSAM8lfDb57y_qPPCQDhfiucHCmx_kaBMaGRbVM1j1WGo3V_c=s900-c-k-c0x00ffffff-no-rj

HSA transfer Award

https://www.tha.de/Binaries/Binary42807/y-160830-hsa-transfer-award-1000x1000px-01.png

https://www.goodrx.com › insurance › fsa-hsa › hsa-eligible-expenses

Your HSA can help you cover qualified emergency dental vision and family medical expenses The CARES Act has expanded the list of HSA eligible items to include over

https://www.nerdwallet.com › article › health › hsa-qualified-expenses

You must be enrolled in a high deductible health insurance plan to qualify for an HSA What expenses are eligible for an HSA The government only allows these tax

Hsa Plumbing Merchants Middlesbrough

Hsa YouTube

HSA Bank To Present At Baird Global Healthcare Conference

Does FSA Cover Incontinence Products Adult Diapers Tranquility

HSA Logo LogoDix

What Qualifies As An HSA Eligible Expense Explaining Finance

What Qualifies As An HSA Eligible Expense Explaining Finance

Software Development Pathway HSA Columbus High Career Tech

HSA Repair Centre LTD

HSA Day Observed Hmar Students Association Churachandpur Joint

What Qualifies As Hsa Purchase - Anyone with a qualified high deductible health insurance plan can contribute and deduct the following amounts in 2021 3 600 for self only coverage or 7 200 for family coverage