What Qualifies For Energy Tax Credit 2022 OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home 2022 Tax Credit Information ENERGY STAR Home About ENERGY STAR Federal Tax Credits For Energy Efficiency Tax Credit Information 2022 Tax

What Qualifies For Energy Tax Credit 2022

What Qualifies For Energy Tax Credit 2022

https://s3media.angieslist.com/s3fs-public/HOUSE-~1.jpeg

2022 Standard Deduction Amounts Are Now Available Bankruptcy L Lawyers

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636590821/Tax_Form_And_Calculator.jpg

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax December 21 2022 Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub to learn more about saving

Claiming energy tax credits for 2022 and 2023 4 min read Share Making energy efficient updates to your home is a great move for our environment But you might feel the pinch in your household budget The good news The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to

Download What Qualifies For Energy Tax Credit 2022

More picture related to What Qualifies For Energy Tax Credit 2022

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

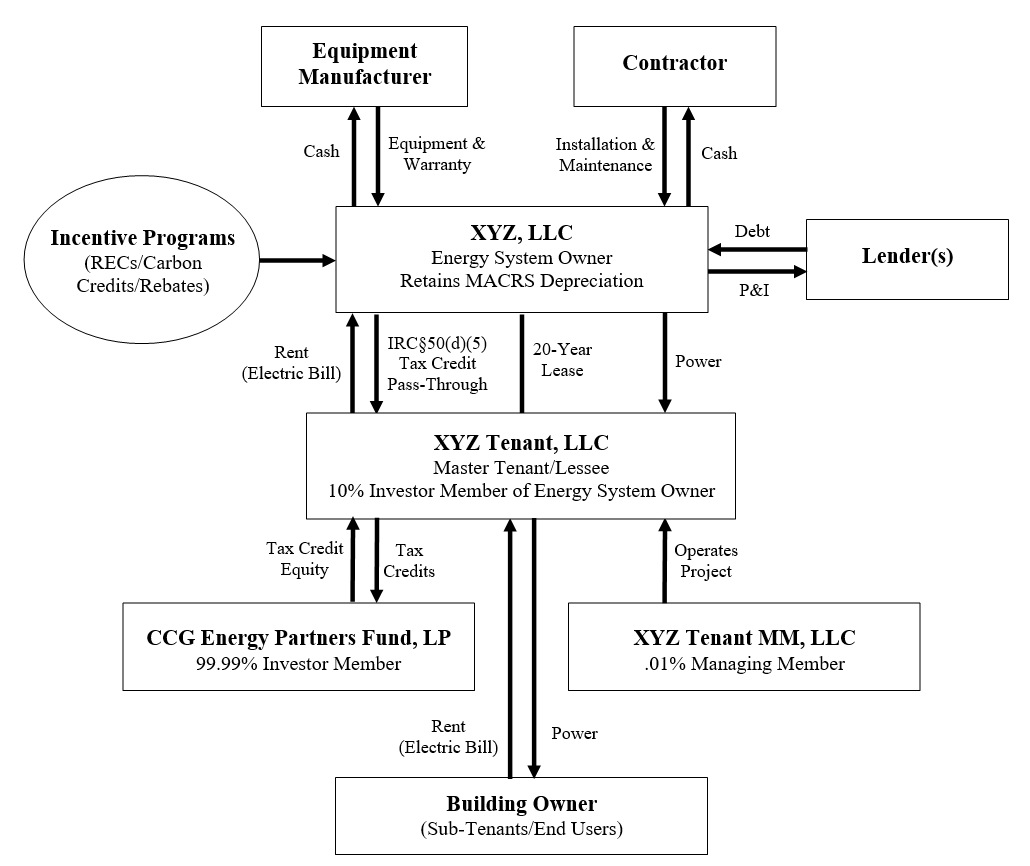

Solar Energy Transactional Structures CityScape Capital Group The

https://images.squarespace-cdn.com/content/v1/5b072f6789c172576d276207/1527364069036-7KEFSJLYUBE4USCMBKKY/setc_multitier_lease.png

Are You Eligible For R D Tax Credit Find Out Using This Infographic

https://www.thinkastute.com/wp-content/uploads/2020/02/RD-Credits-Infographic-969x2048.jpg

Section 45L energy efficient residential housing credit Solar investment tax credit ITC Renewable energy tax credits for fuel cells small wind turbines and Highlights Qualifying energy efficient products are eligible for a 26 tax credit in 2022 The tax credit drops to 22 in 2023 and ends in 2024 There are five different types of equipment that qualify for

However the Inflation Reduction Act extends it through 2034 rebrands it as the Residential Clean Energy Credit and boosts the credit amounts to 30 for 2022 to Roofing and air circulating fans will no longer qualify for the credit Some energy efficiency standards are updated as well In addition the 500 lifetime limit is

How Does The Tax Credit System Work Leia Aqui How Do Tax Credits

https://www.greenmountainenergy.com/Images/GME-Blog-SolarIncentives-Infographic-2x_tcm465-57648.png

2022 Tax Brackets Delma Stock

https://www.taxjar.com/wp-content/uploads/[email protected]

https://turbotax.intuit.com/tax-tips/home...

OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023

https://www.irs.gov/credits-deductions/frequently...

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home

What Is The ERC Tax Credit 2022 Updated For 2023 Qualifications For

How Does The Tax Credit System Work Leia Aqui How Do Tax Credits

TaxTips ca Business 2022 Corporate Income Tax Rates

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

2022 Education Tax Credits Are You Eligible

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

2023 Residential Clean Energy Credit Guide ReVision Energy

Tourshabana Green Energy Tax Credits For Home Improvement

Tax Credit ClimaCool

What Qualifies For Energy Tax Credit 2022 - The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to