What Retirement Income Is Not Taxable In Illinois Illinois does not tax the amount of any federally taxed portion not the gross amount included in your Form IL 1040 Line 1 that you received from qualified employee benefit plans including

You may subtract the amount of federally taxed Social Security and retirement income included in your adjusted gross income on Form IL 1040 Line 1 that you received from qualified Pensions Illinois is one of the states that won t tax your retirement income including income from private pensions as long as it s from a qualified employee benefit plan You won t pay tax

What Retirement Income Is Not Taxable In Illinois

What Retirement Income Is Not Taxable In Illinois

http://blog.hubcfo.com/wp-content/uploads/2015/04/What-Income-is-Taxable.png

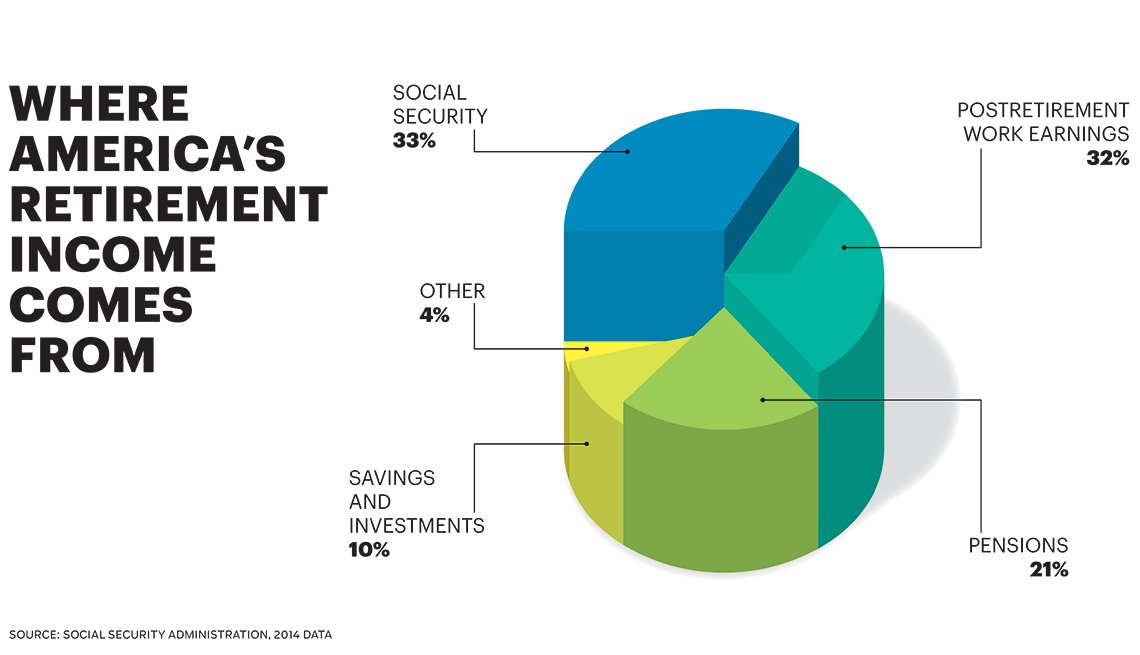

What Retirement Income Is Taxed Retirement Income Planning Taxes

https://i.ytimg.com/vi/oMNZIN2zkJI/maxresdefault.jpg

The Importance Of Retirement Plan Consulting BenefitCorp

https://benefitcorp.com/wp-content/uploads/2020/09/A-man-wearing-black-suit-holding-a-paper-that-read-Whats-Your-Plan-for-Retirement.Consider-Retirement-Plan-Consulting.jpg

Illinois which has a 4 95 percent flat income tax won t tax distributions from most pensions and 401 k plans or from IRAs and Social Security payouts Earnings from investments are taxable however Retirees often ask does Illinois tax retirement income For the state s residents the good news is that there is no state tax on pension income as well as other types of retirement

Illinois doesn t tax Social Security or any other type of retirement income Social Security benefits pensions IRA and 401 k distributions are tax exempt However Illinois has a flat Here again there are many states 14 to be precise that do not tax pension income at all Alaska Florida Nevada South Dakota Tennessee Texas Washington Wyoming New Hampshire Alabama

Download What Retirement Income Is Not Taxable In Illinois

More picture related to What Retirement Income Is Not Taxable In Illinois

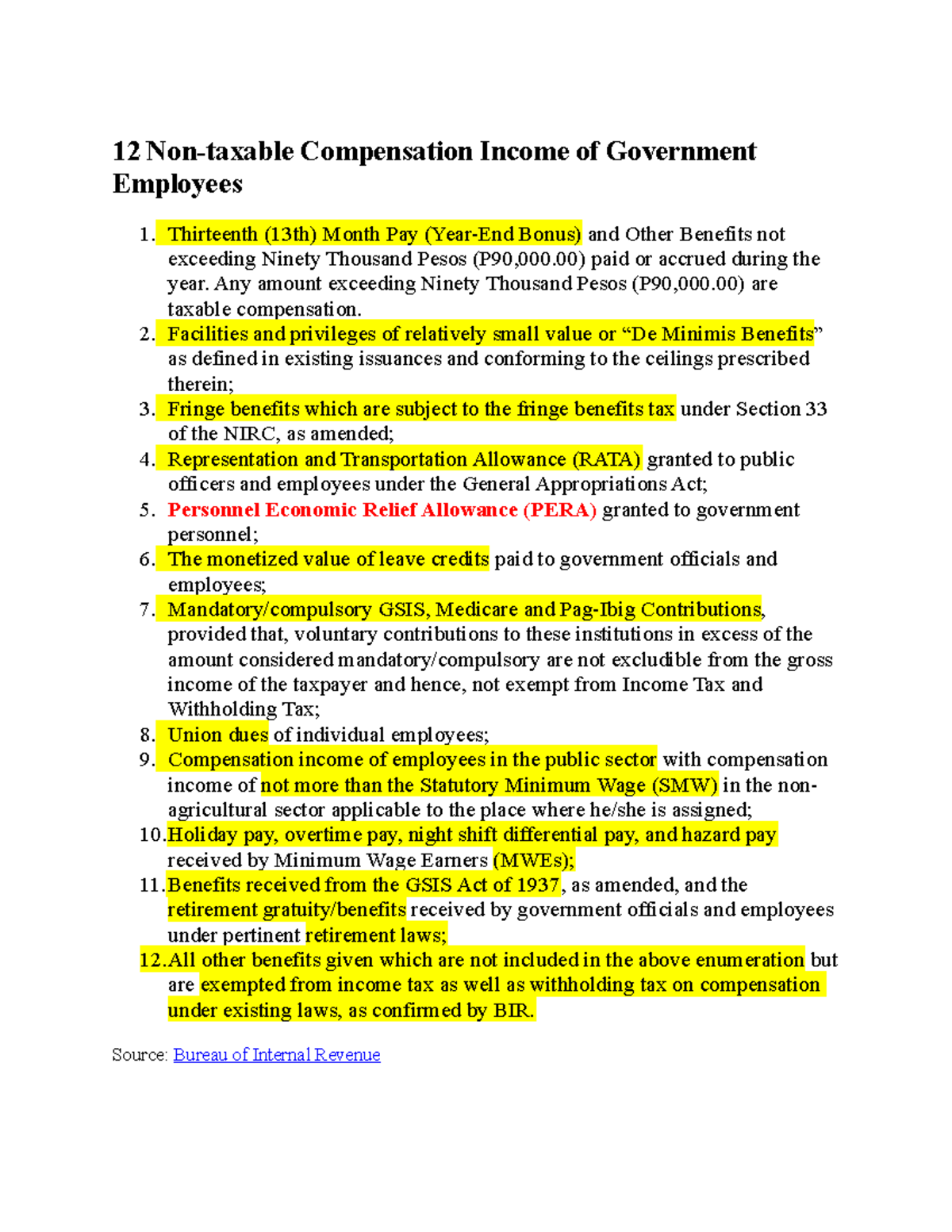

12 Non Taxable Compensation Of Government Employees 12 Non taxable

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8def460a118dbf58656d6da484651792/thumb_1200_1553.png

States That Won t Tax Your Retirement Distributions In 2021

https://i.pinimg.com/originals/dc/a0/56/dca056eaee2dec98ced133abee117640.png

Whether Gratuity Taxable Or Not Income Tax Calculation On Gratuity

https://i.ytimg.com/vi/KvJ8p70qv7U/maxresdefault.jpg

States that don t tax retirement income Four more states that do levy an income tax make an exception for retirement income Illinois Iowa must be 55 or older Most retirement income in Illinois is not subject to the state income tax This includes IRAs 401ks the federally taxed portion of Social Security and almost all pensions Benefits and pay

Many states do not tax certain sources of retirement income Here s a guide to what does and doesn t get taxed in each state Publication 120 Retirement Income gives retirees detailed information about what retirement income they may subtract from their federal adjusted gross income when completing Form IL

Is Military Retirement Pay Taxable In Delaware JacAnswers

https://jacanswers.com/wp-content/uploads/2021/12/canva-retirement-MAEJIiQw8FI.jpg

What Retirement Income Is Taxable In Illinois Read Book Money

https://readbookmoney.com/wp-content/uploads/2023/03/What-Retirement-Income-Is-Taxable-In-Illinois.jpg

https://tax.illinois.gov › questionsandanswers

Illinois does not tax the amount of any federally taxed portion not the gross amount included in your Form IL 1040 Line 1 that you received from qualified employee benefit plans including

https://tax.illinois.gov › individuals › pension.html

You may subtract the amount of federally taxed Social Security and retirement income included in your adjusted gross income on Form IL 1040 Line 1 that you received from qualified

Can We Also Exempt Teacher Retirement From Tax And Other Questions

Is Military Retirement Pay Taxable In Delaware JacAnswers

Taxable Vs Nontaxable Income Dalby Wendland Co P C

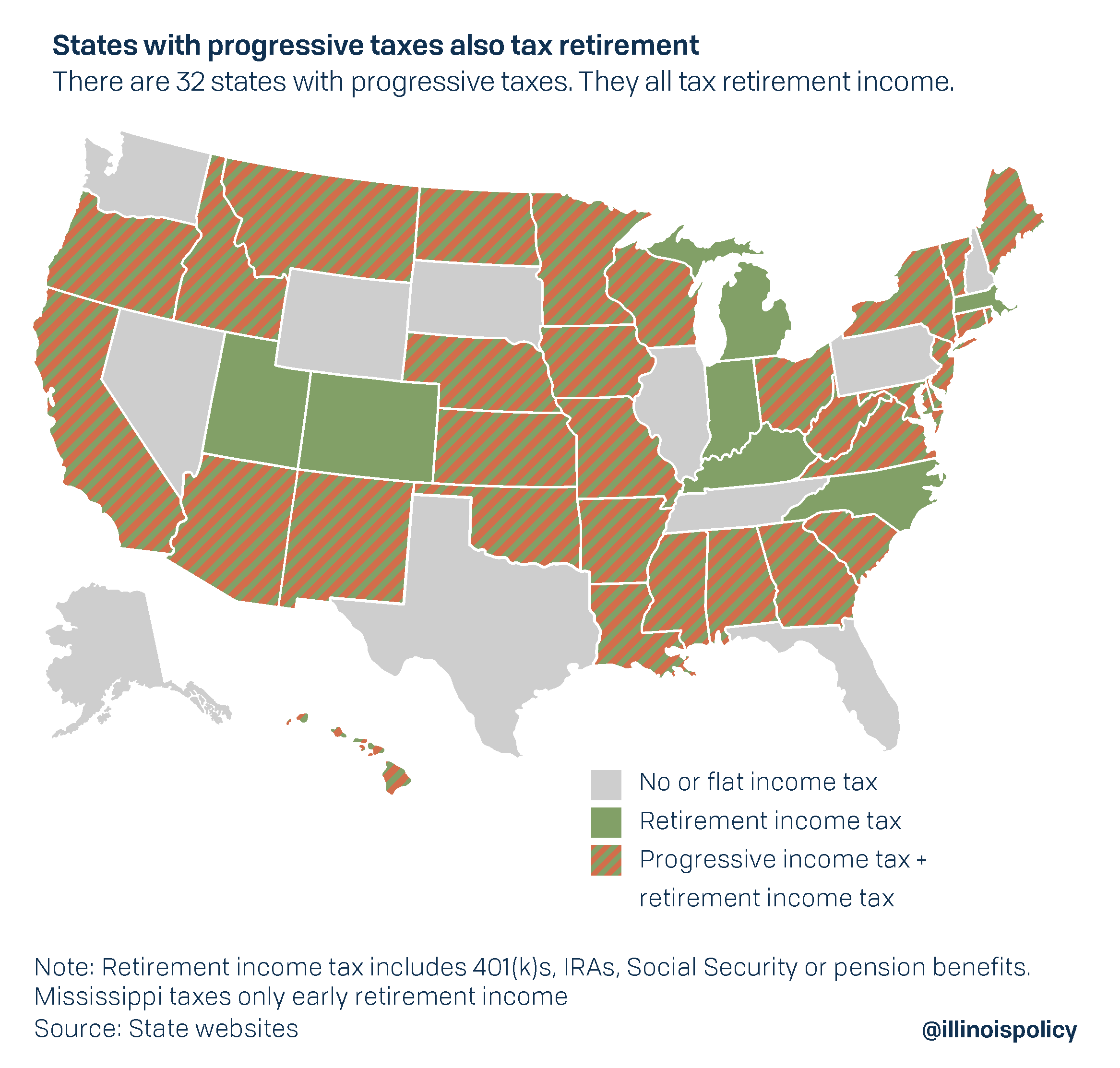

Every State With A Progressive Tax Also Taxes Retirement Income

Taxable And Nontaxable Income Lefstein Suchoff CPA Associates

This Map Shows The Best And Worst States For Retirement In 2019 Www

This Map Shows The Best And Worst States For Retirement In 2019 Www

Pay Less Retirement Taxes

What Retirement Income Is Taxable In Nj Retire Gen Z

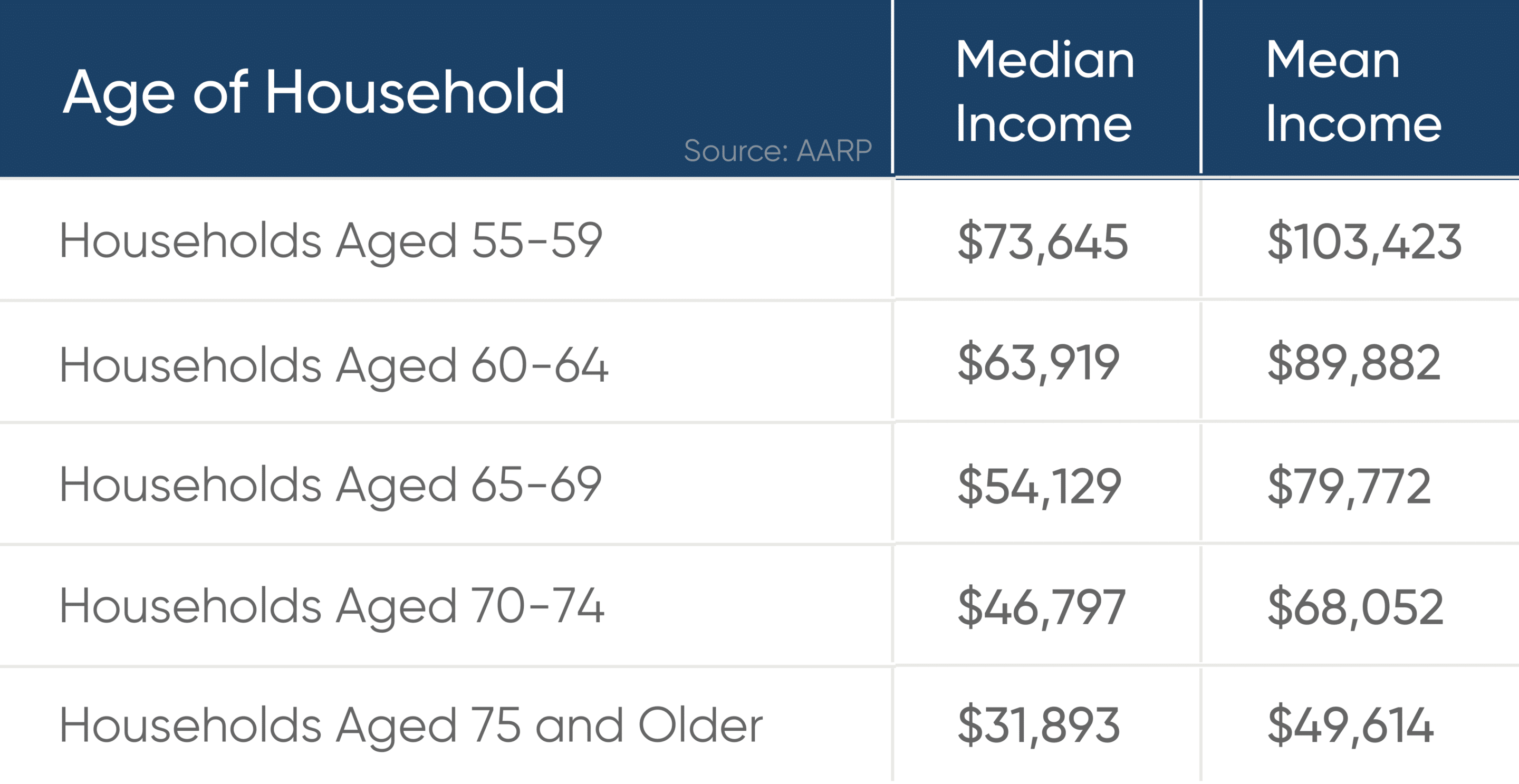

What Is A Good Monthly Retirement Income How Much Money Do

What Retirement Income Is Not Taxable In Illinois - Here again there are many states 14 to be precise that do not tax pension income at all Alaska Florida Nevada South Dakota Tennessee Texas Washington Wyoming New Hampshire Alabama