What State Taxes Are Deductible On Federal Return The deduction for state and local taxes is no longer unlimited At one time you could deduct as much as you paid in taxes but the Tax Cuts and Jobs Act TCJA limits the SALT deduction to 10 000 or just 5 000 if you re

Taxpayers who itemize deductions on their federal income tax returns can deduct state and local taxes specifically property taxes plus either income taxes or general sales taxes However the Tax Cuts and Jobs Act limits the total state State local and foreign income taxes Real estate taxes Personal property taxes Ad Valorem tax and State and local sales taxes NOTE Your deduction of state and local income sales

What State Taxes Are Deductible On Federal Return

What State Taxes Are Deductible On Federal Return

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

Investment Expenses What s Tax Deductible Charles Schwab

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/Example-2.png

DEDUCTIBLE TAXES WASHINGTON Did you know that you may be able to deduct certain taxes on your federal income tax return You can if you file IRS Form 1040 and itemize You might be able to get a federal deduction for state or local income taxes you paid in 2024 even if they were for an earlier tax year To get this deduction you ll need to itemize There s a

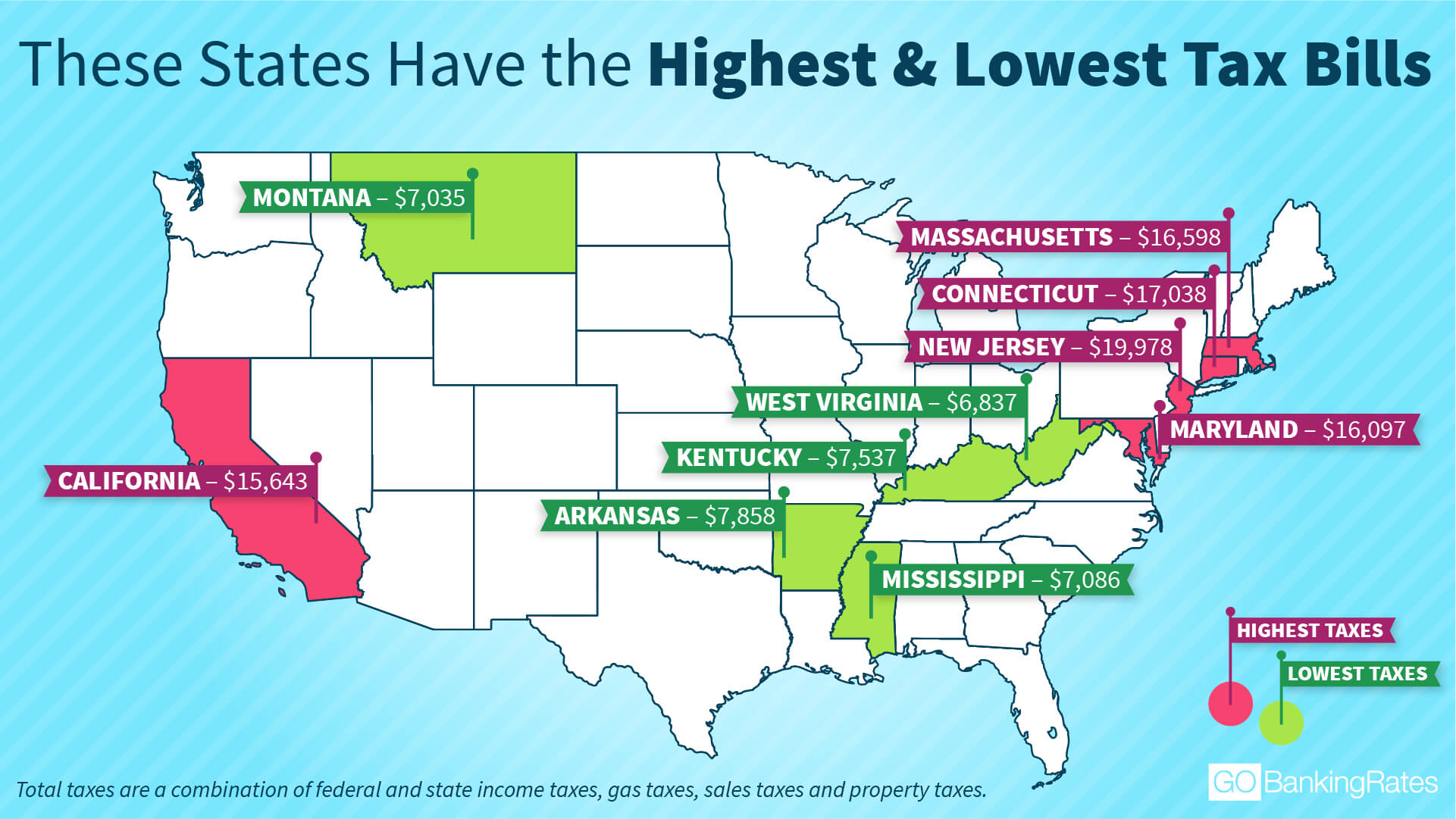

Only five of the 41 states that impose a tax on income allow taxpayers to claim a deduction for their federal income taxes These states are Alabama Iowa Missouri Montana and Oregon Louisiana removed the Taxpayers who itemize deductions on their federal income tax returns can deduct state and local real estate and personal property taxes as well as either income taxes or general sales taxes

Download What State Taxes Are Deductible On Federal Return

More picture related to What State Taxes Are Deductible On Federal Return

School Supplies Are Tax Deductible Wfmynews2

https://media.wfmynews2.com/assets/WFMY/images/181276e9-96af-4e3f-b43a-1cdd1d198fdc/181276e9-96af-4e3f-b43a-1cdd1d198fdc_1920x1080.jpg

Average Tax Refund In Every U S State Vivid Maps

https://vividmaps.com/wp-content/uploads/2019/02/Taxes.jpg

Credit Cards And Itemized Deductions What To Know Before Filing Your

https://www.creditonebank.com/content/dam/creditonebank/articles/2023/02/230043-CM-ItemizedDeductionsRefresh-SEOA-FINAL.jpg

If you itemize deductions you can deduct state and local taxes you paid during the year These taxes can include state and local income taxes or state and local sales taxes but not both Taxpayers can take advantage of numerous deductions and credits on their taxes each year that can help them pay a lower amount of taxes or receive a refund from the IRS You may be able to claim

If you want to deduct your state taxes on your federal return consider the following You ll have to itemize your deductions using a Form 1040 Any state and local taxes you paid are subtracted The state and local tax deduction SALT allows you to deduct up to 10 000 of your state and local property taxes Is it right for you Let s find out

Are Mortgage Payments Still Deductible On Federal Income Tax Return

https://www.heraldtribune.com/gcdn/presto/2020/10/27/NSHT/d0211e6b-6afc-4d8d-816b-70ccfa74f023-glink-tax-20201015.jpg?width=1320&height=880&fit=crop&format=pjpg&auto=webp

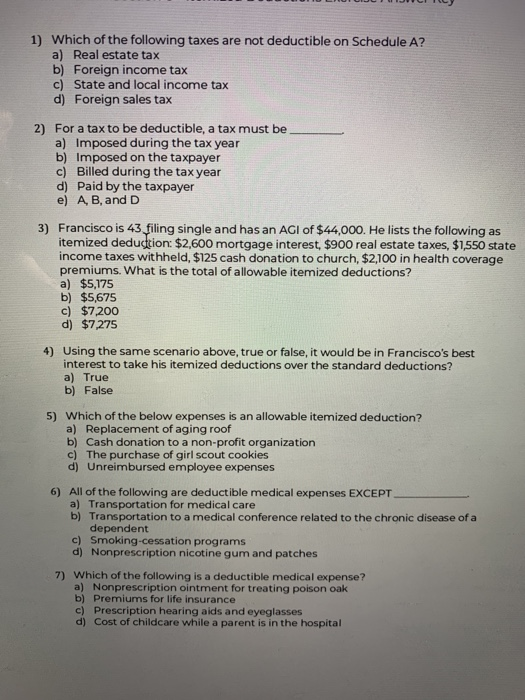

Solved 1 Which Of The Following Taxes Are Not Deductible On Chegg

https://media.cheggcdn.com/study/d05/d05f82e0-744a-4c13-b4eb-ee6121915b77/image.png

https://www.thebalancemoney.com

The deduction for state and local taxes is no longer unlimited At one time you could deduct as much as you paid in taxes but the Tax Cuts and Jobs Act TCJA limits the SALT deduction to 10 000 or just 5 000 if you re

https://taxpolicycenter.org › briefing-book › …

Taxpayers who itemize deductions on their federal income tax returns can deduct state and local taxes specifically property taxes plus either income taxes or general sales taxes However the Tax Cuts and Jobs Act limits the total state

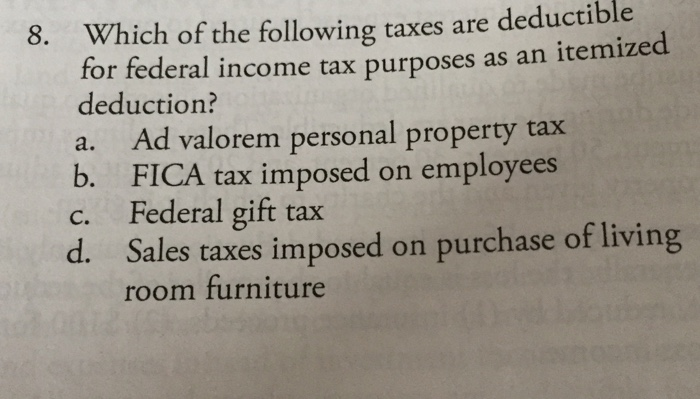

Solved 8 Which Of The Following Taxes Are Deductible For Chegg

Are Mortgage Payments Still Deductible On Federal Income Tax Return

Income Tax Worksheet Pdf

Infographic Is My Move Tax Deductible Wheaton

T21 0294 Repeal 10 000 Limit On Deductible State And Local Taxes

Tax Deductions You Can Deduct What Napkin Finance

Tax Deductions You Can Deduct What Napkin Finance

Americans In These 5 States Have The Lowest Tax Bills Study Finds

Property Taxes Are 6 9 Of Alabama s Tax Revenue Lowest In U S

Standard Deduction 2020 Self Employed Standard Deduction 2021

What State Taxes Are Deductible On Federal Return - You might be able to get a federal deduction for state or local income taxes you paid in 2024 even if they were for an earlier tax year To get this deduction you ll need to itemize There s a