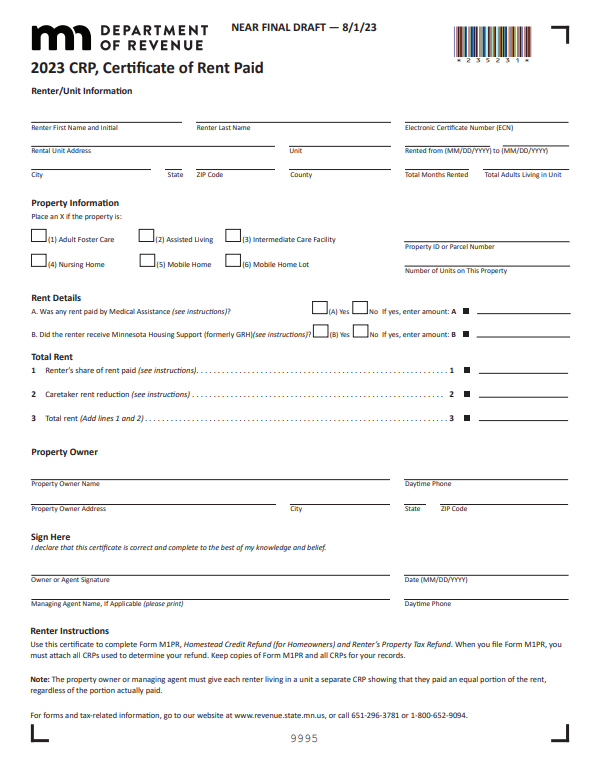

When Do You Get Renters Rebate Mn 2024 You must be a Minnesota resident or part year resident to qualify for a property tax refund 2024 or you believe the rent amount or any other amounts entered on your CRP are incorrect contact call us at 651 296 3781 or 1 800 652 9094 Your refund is based on rent you paid and not on rent paid by government programs or emergency

Renters will need the CRP to apply for the Renter s Property Tax Refund The Minnesota Department of Revenue has expanded access to their CRP system in e Services and you will be able to create CRPs using e Services by January 1 2024 all residential property owners and managing agents will be able to use e Services Minnesota Department of 1 Can I get a property tax refund if I own my own house Do I have to file my renter s refund with my regular taxes on April 15 Can I file my renter s refund after August 15 LawHelpMN does not collect any personal information when you take this quiz For more information see our privacy policy

When Do You Get Renters Rebate Mn 2024

When Do You Get Renters Rebate Mn 2024

https://printablerebateform.net/wp-content/uploads/2023/02/Minnesota-Renters-Rebate-2023.jpg

Pa Renters Rebate Status RentersRebate RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2023/05/pa-renters-rebate-status-rentersrebate-20.png

Kentucky Renters Rebate 2023 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/01/Kentucky-Renters-Rebate-2023.png

The renter s property tax refund program sometimes called the renters credit is a state paid refund that provides tax relief to renters whose rent and implicit property taxes are high relative to their incomes Rent constituting property taxes is assumed to equal 17 percent of rent paid If rent constituting property Minnesota allows a property tax credit to renters and homeowners who were residents or part year residents of Minnesota during the tax year Who can claim the credit Homeowners with household income less than 135 410 can claim a refund up to 3 310 Homeowners and mobile home owners must have owned and lived in your home on January 2 2024

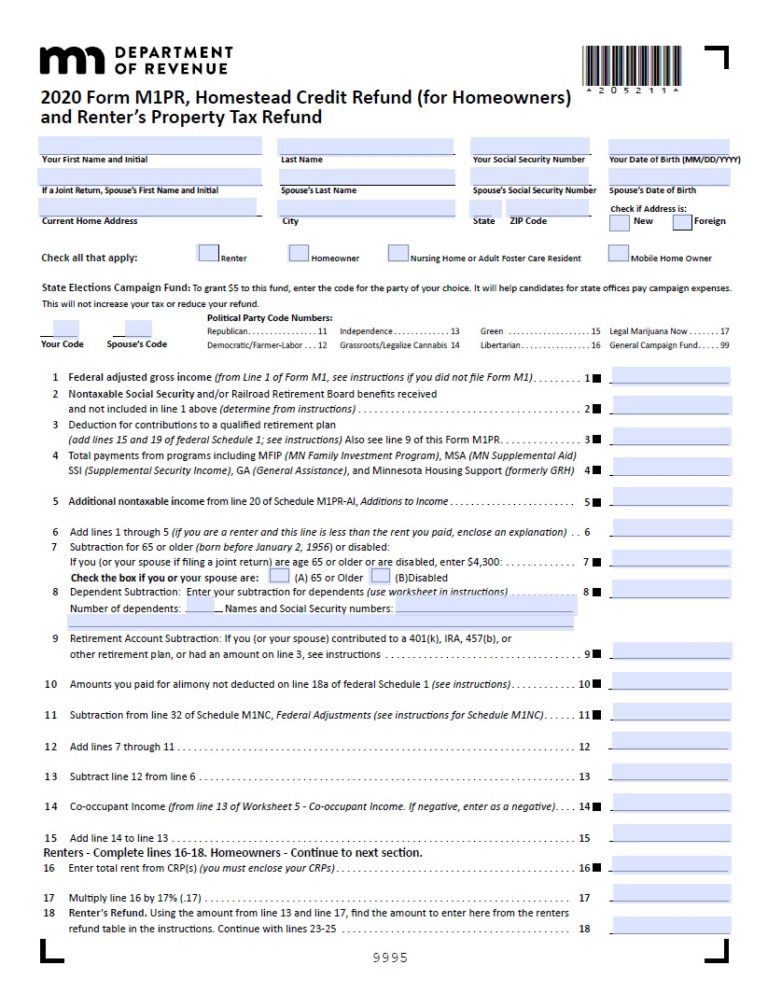

If you own use your Property Tax Statement Get the tax form called the 2023 Form M 1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund You can call 651 296 3781 to get a form or write to Minnesota Tax Forms Mail Station 1421 600 N Robert St St Paul MN 55146 1421 You can also get all forms and Claims filed before August 15 2021 will be paid beginning in August 2021 The deadline for filing claims based on rent paid in 2020 is August 15 2022 taxpayers filing claims after that date will not receive a refund How many renters receive refunds and what is the total amount paid

Download When Do You Get Renters Rebate Mn 2024

More picture related to When Do You Get Renters Rebate Mn 2024

Renter s Insurance Why Your Tenant Needs It ProRealty HOA Condo And Co op Building

https://www.prorealtyusa.com/wp-content/uploads/2021/07/Renters-Insurance.jpeg

New Hampshire Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-Hampshire-Renters-Rebate-2023-768x684.jpg

2023 Renters Rebate Easthartfordct

https://www.easthartfordct.gov/sites/g/files/vyhlif9241/f/bulletins/2023_renters_rebate_10.67_x_5.33_in.png

Office apply online at MNBenefits mn gov or call the United Way toll free information line by dialing 2 1 1 or 800 543 7709 and 6 the following statement Your landlord can file an eviction case if you do not pay the total amount due or move out within 14 days from the date of this notice Some local governments may have an eviction If you own use your Property Tax Statement Get the tax form called the 2021 Form M 1PR Homestead Credit Refund for Homeowners and Renter Property Tax Refund You can get it from a library call 651 296 3781 or write to MN Tax Forms Mail Station 1421 St Paul MN 55146 1421 H 21 pg 1

Important If you ve changed their address or banking information since their 2021 tax return you can go to the Department of Revenue s new portal taxrebate mn gov submit to update your information Deadline July 28 2023 at 5 p m CT Minnesotans who died before Jan 1 2023 are not eligible for the rebate check Is there anything else Date of Release July 10 2023 ST PAUL Minn The Minnesota Department of Revenue announced today the process to send 2 4 million one time tax rebate payments to Minnesotans This rebate was part of the historic 2023 One Minnesota Budget signed into law by Governor Tim Walz on May 24 2023

Colorado Renters Rights 2023 Printable Rebate Form RentersRebate

https://www.rentersrebate.net/wp-content/uploads/2023/05/colorado-renters-rights-2023-printable-rebate-form.png

Ohio Renters Rebate 2023 Printable Rebate Form RentersRebate

https://www.rentersrebate.net/wp-content/uploads/2023/05/ohio-renters-rebate-2023-printable-rebate-form-28.jpg

https://www.revenue.state.mn.us/sites/default/files/2023-12/m1pr-inst-23.pdf

You must be a Minnesota resident or part year resident to qualify for a property tax refund 2024 or you believe the rent amount or any other amounts entered on your CRP are incorrect contact call us at 651 296 3781 or 1 800 652 9094 Your refund is based on rent you paid and not on rent paid by government programs or emergency

https://www.careproviders.org/CPM/ACTION/Vol39/Ed03/ZP05.aspx

Renters will need the CRP to apply for the Renter s Property Tax Refund The Minnesota Department of Revenue has expanded access to their CRP system in e Services and you will be able to create CRPs using e Services by January 1 2024 all residential property owners and managing agents will be able to use e Services Minnesota Department of

Renters Rebate Form MN 2022 Class Profile Printable Rebate Form

Colorado Renters Rights 2023 Printable Rebate Form RentersRebate

Pa Renters Rebate Form 2022 RentersRebate RentersRebate

Renters Rebate Form Printable Rebate Form

How To Fill Out Renters Rebate Mn RentersRebate

Montana Renters Rebate 2023 Printable Rebate Form

Montana Renters Rebate 2023 Printable Rebate Form

MN Renters Rebate Form Printable Rebate Form

Missouri Renters Rebate 2024 PrintableRebateForm

Mn Renters Rebate Refund Table RentersRebate

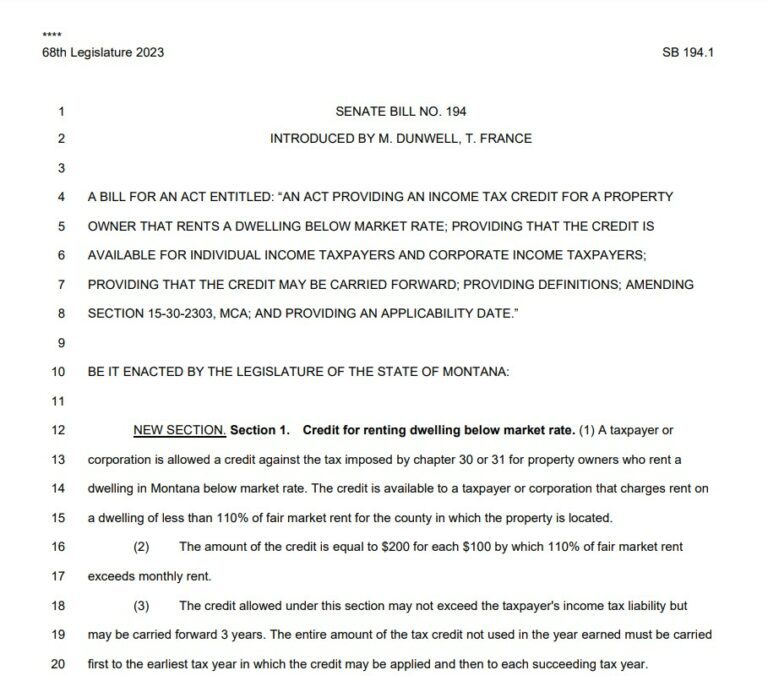

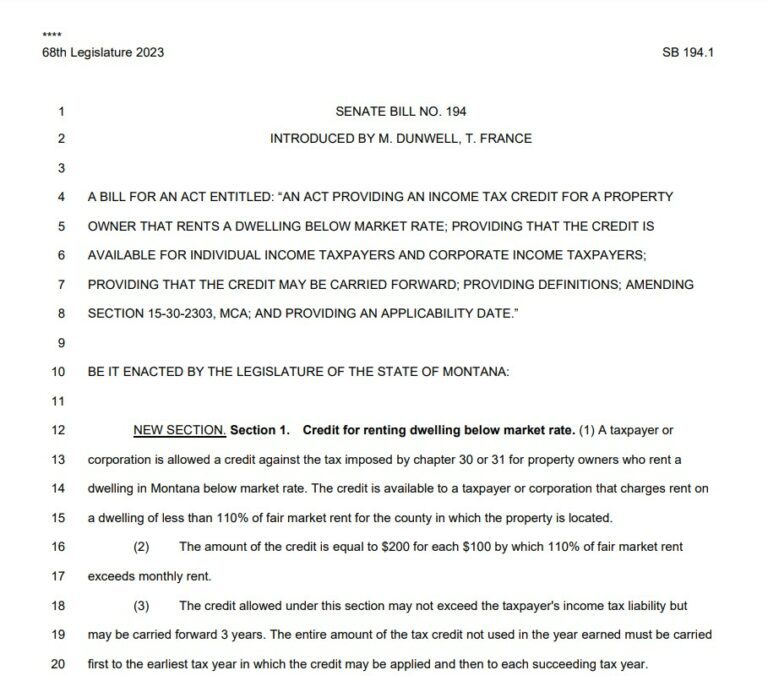

When Do You Get Renters Rebate Mn 2024 - Rep Nathan Coulter The bill s provisions would be effective for tax year 2023 or for refunds based on rent paid in 2023 meaning the first credits calculated as part of the income tax return would be claimed during the 2024 filing period