When To File For Income Tax Return Online returns is 12 months from the accounting date paper returns is 9 months from the accounting date 2022 to 2023 tax year and earlier The Self Assessment deadline for

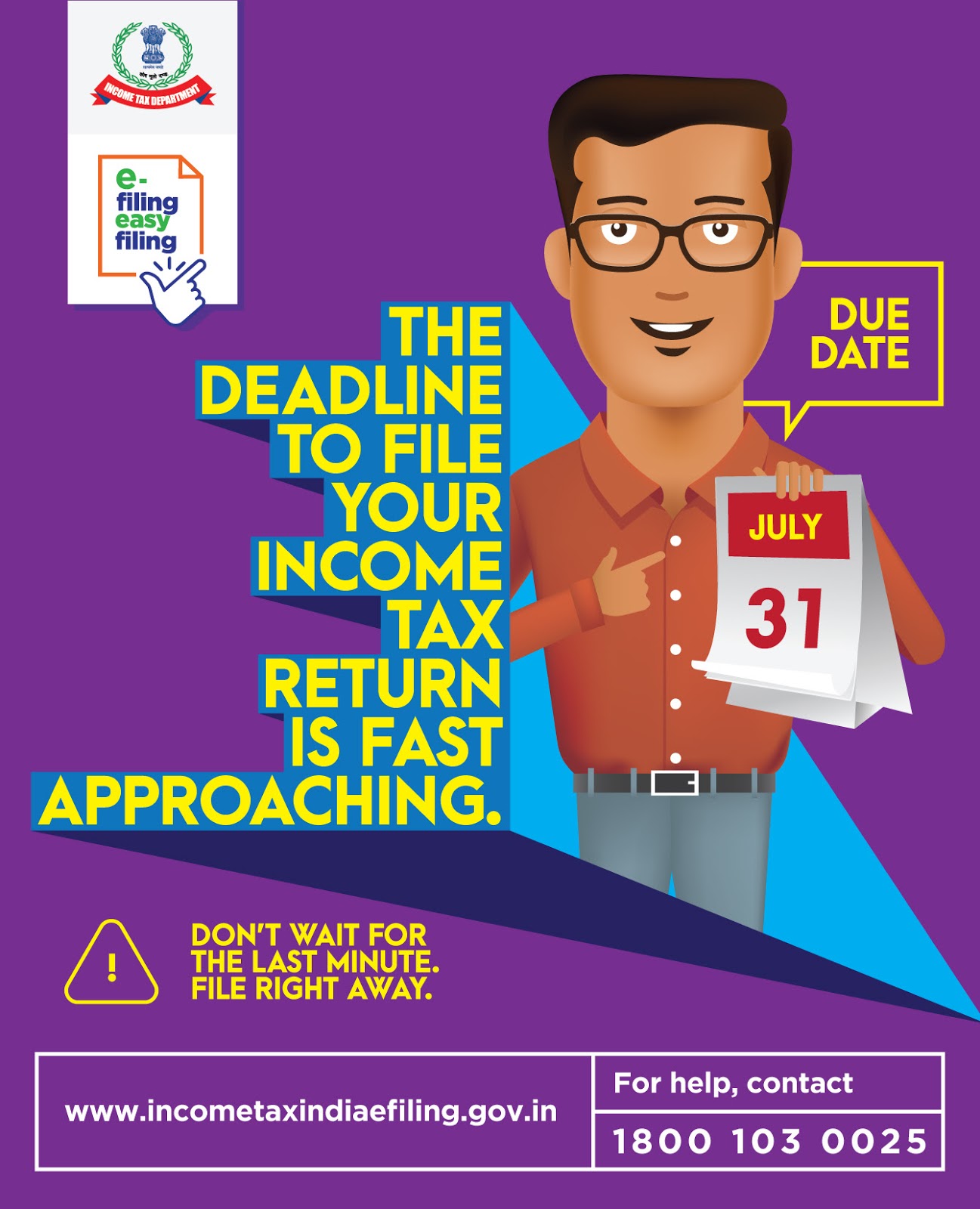

Usually the due date to file an income tax return is 31st July for individuals and non audit cases and 31st October for audit cases of the relevant assessment year Sending your return File your tax return online or call HMRC and request form SA100 Deadlines Send your tax return by the deadline

When To File For Income Tax Return

When To File For Income Tax Return

https://texasredzonereport.com/wp-content/uploads/2023/10/IMG_20231003_175803-1024x576.jpg

How To File Income Tax Return Online In Hindi YouTube

https://i.ytimg.com/vi/KG6fme5psps/maxresdefault.jpg

Income Tax Return Filing Requirements Explained How To Know When To

https://i.ytimg.com/vi/f99735nYVm0/maxresdefault.jpg

You can file your Self Assessment tax return online if you are self employed are not self employed but you still send a tax return for example because you receive income from When is the best time to file your tax return The answer may depend on what you re trying to accomplish and whether you ve got a refund coming

See graphic for more on who will be able to use IRS Direct File in 2025 In the 2024 tax season more than 140 000 taxpayers in 12 states filed their federal tax The due date for filing your tax return is typically April 15 if you re a calendar year filer Generally most individuals are calendar year filers For individuals the last day to file your 2023 taxes without an

Download When To File For Income Tax Return

More picture related to When To File For Income Tax Return

File Your ITR And Earn Up To Rs 10 000 Check This Reward Scheme Here

https://www.indiafilings.com/learn/wp-content/uploads/2017/11/Types-of-Income-Tax-Return.jpg

FBR Income Tax Calculator 2023 24

https://bslearning.com/fbr-income-tax-return/images/income-tax-return.webp

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/03/income-tax-filing-form-number.jpg

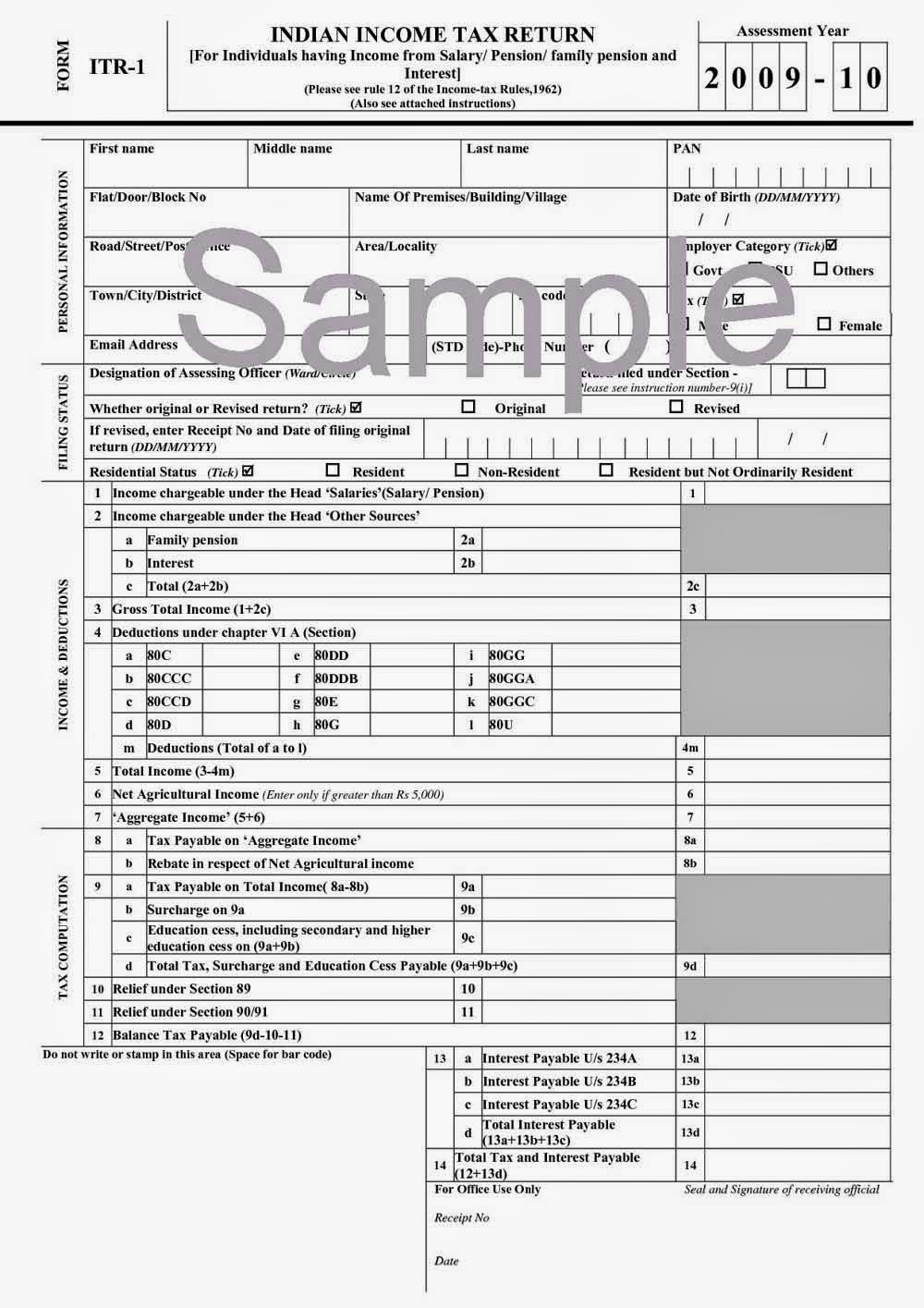

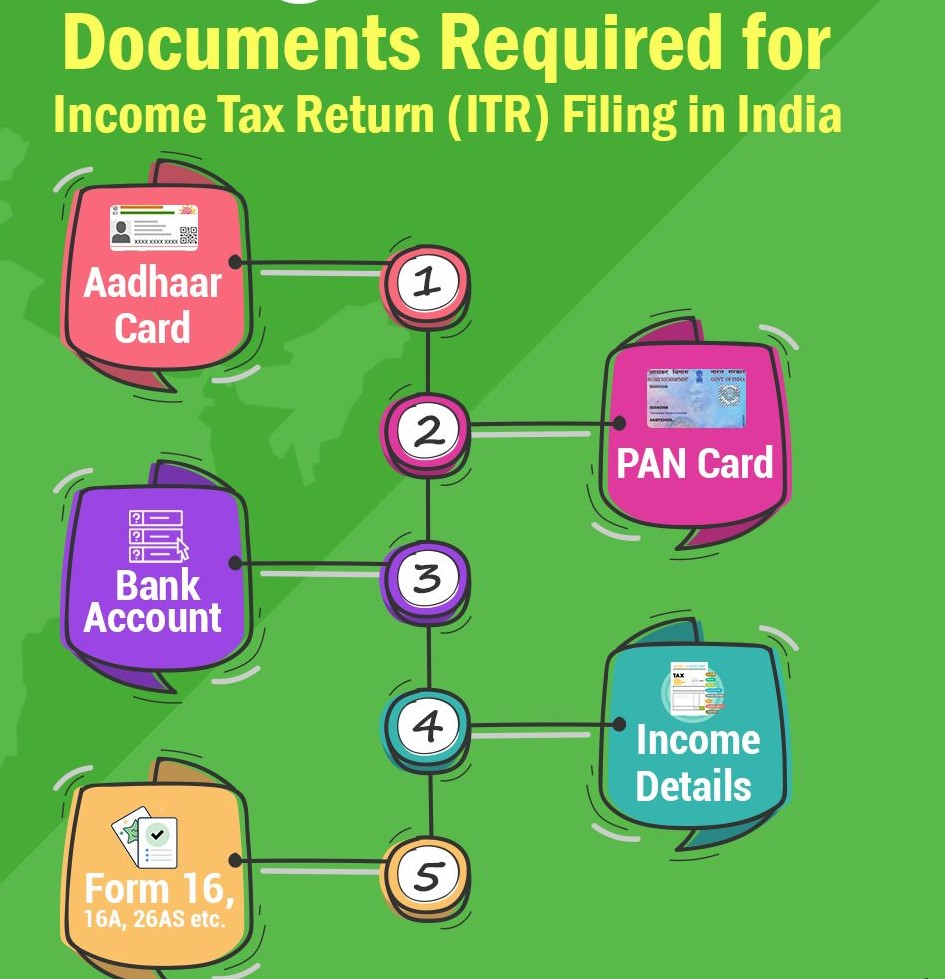

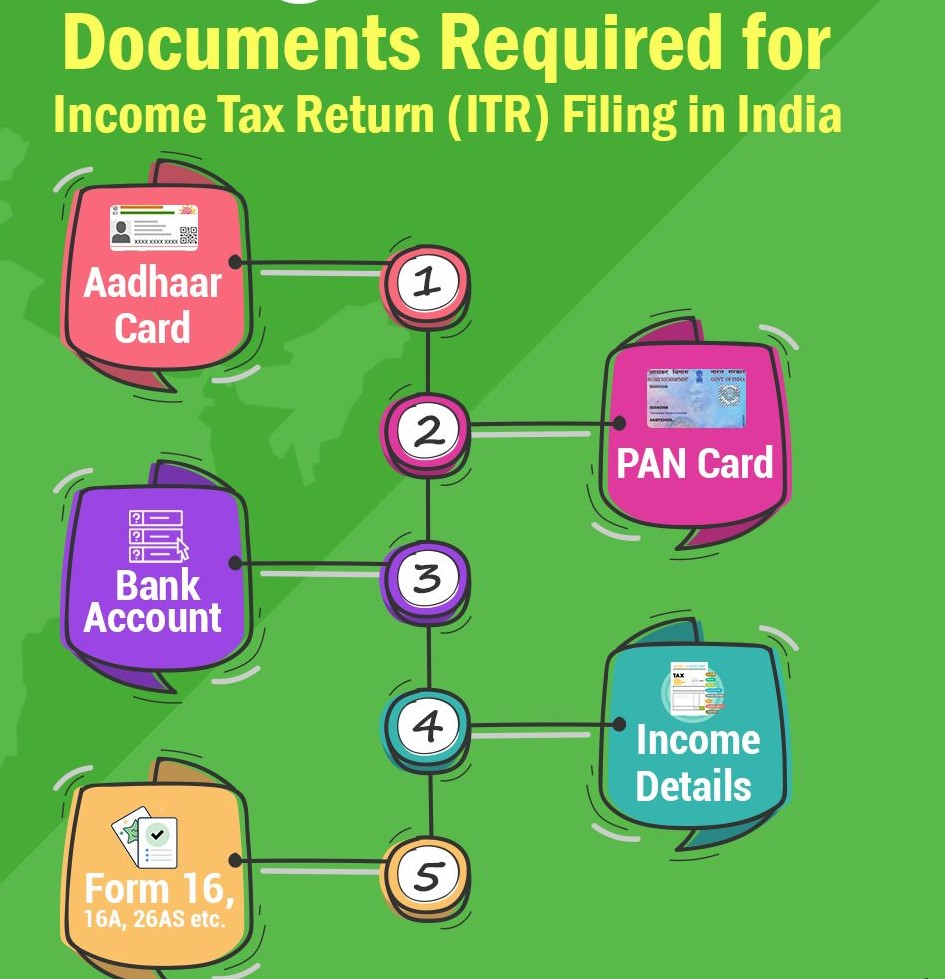

Efiling Income Tax Returns ITR is made easy with Clear platform Just upload your form 16 claim your deductions and get your acknowledgment number online You can efile income tax return on your income from ITR refers to Income Tax Return forms specified by the Income tax Act 1961 Seven types of ITR forms are available for different taxpayers based on income sources Filing ITR is mandatory if income

File your tax return by the deadline For most filers the deadline for 2023 tax returns is Monday April 15 2024 April 17 2024 if you live in Maine or Massachusetts Find E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries

6 Benefits Of Tax Return Services Melbourne Registered Tax Agent

https://rsgaccountants.com.au/wp-content/uploads/2020/06/Filing-Income-Tax-Returns-RSGAccountants.jpg

ITR Income Tax Return E verification To Complete Filing Process All

https://static.tnn.in/thumb/msid-93580108,imgsize-100,width-1280,height-720,resizemode-75/93580108.jpg

https://www.gov.uk/self-assessment-tax-returns/deadlines

Online returns is 12 months from the accounting date paper returns is 9 months from the accounting date 2022 to 2023 tax year and earlier The Self Assessment deadline for

https://cleartax.in/s/due-date-tax-filing

Usually the due date to file an income tax return is 31st July for individuals and non audit cases and 31st October for audit cases of the relevant assessment year

ITR Filing Due Dates For Financial Year 2022 23

6 Benefits Of Tax Return Services Melbourne Registered Tax Agent

File Income Tax Return How To E File Your Income Tax Return Online

Boost Efficiency With Our Editable Form For Tax Declaration Form

How To EFile Your Income Tax Return And Wealth Statement Online With

Online File Income Tax Returns Rajput Jain Associates

Online File Income Tax Returns Rajput Jain Associates

ABC Of Tax Lets Learn The Basics Everything About E filing Made Easier

Steps For Filing Your Income Tax Return Online Mint

Last Date For File Your Income Tax Return 31 July 2019 SA POST

When To File For Income Tax Return - See graphic for more on who will be able to use IRS Direct File in 2025 In the 2024 tax season more than 140 000 taxpayers in 12 states filed their federal tax