Who Is Eligible For Carbon Tax Rebate In Bc Web 5 Okt 2023 nbsp 0183 32 Quarterly carbon tax rebates start going out to eligible British Columbians About 2 million families and individuals will receive the credit this year according to the

Web Approach to carbon pricing On April 1 2023 B C s carbon tax rate rose from 50 to 65 per tCO2e To protect affordability revenues generated by the new carbon tax Web Vor 5 Tagen nbsp 0183 32 Money from Climate Action Tax Credit helps people after the holidays This week more than two million families and individuals will receive their third quarterly

Who Is Eligible For Carbon Tax Rebate In Bc

Who Is Eligible For Carbon Tax Rebate In Bc

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Carbon Tax Canada 2019

https://i.cbc.ca/1.4875360.1540329689!/fileImage/httpImage/federal-government-s-carbon-tax-and-rebate-plan.png

Frequently Asked Questions On The CARES Act Spartan Echo

https://nsuspartanecho.files.wordpress.com/2020/04/rcs_official_photo_2016_optimized-1.jpg

Web 1 M 228 rz 2023 nbsp 0183 32 The B C climate action tax credit is a quarterly payment from the province to residents to help offset carbon taxes paid by individuals and families 4 2 billion deficit Web 5 Juli 2023 nbsp 0183 32 Single people in B C who make under a net income of 61 465 annually are eligible for up to 447 this year an increase of 250 from 2022 And a family of four that makes less than 89 270

Web The Greenhouse Carbon Tax Relief Grant has been available to qualified commercial greenhouses covering a portion of the carbon tax paid on natural gas and propane Web 5 Okt 2023 nbsp 0183 32 A family of four can now receive as much as 893 50 390 more than last year The increased thresholds mean it s expected that more than two million families

Download Who Is Eligible For Carbon Tax Rebate In Bc

More picture related to Who Is Eligible For Carbon Tax Rebate In Bc

Who Is Eligible For The 450 Cost of living Payment In South Australia

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA11kQ7o.img?w=1920&h=1080&m=4&q=91

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

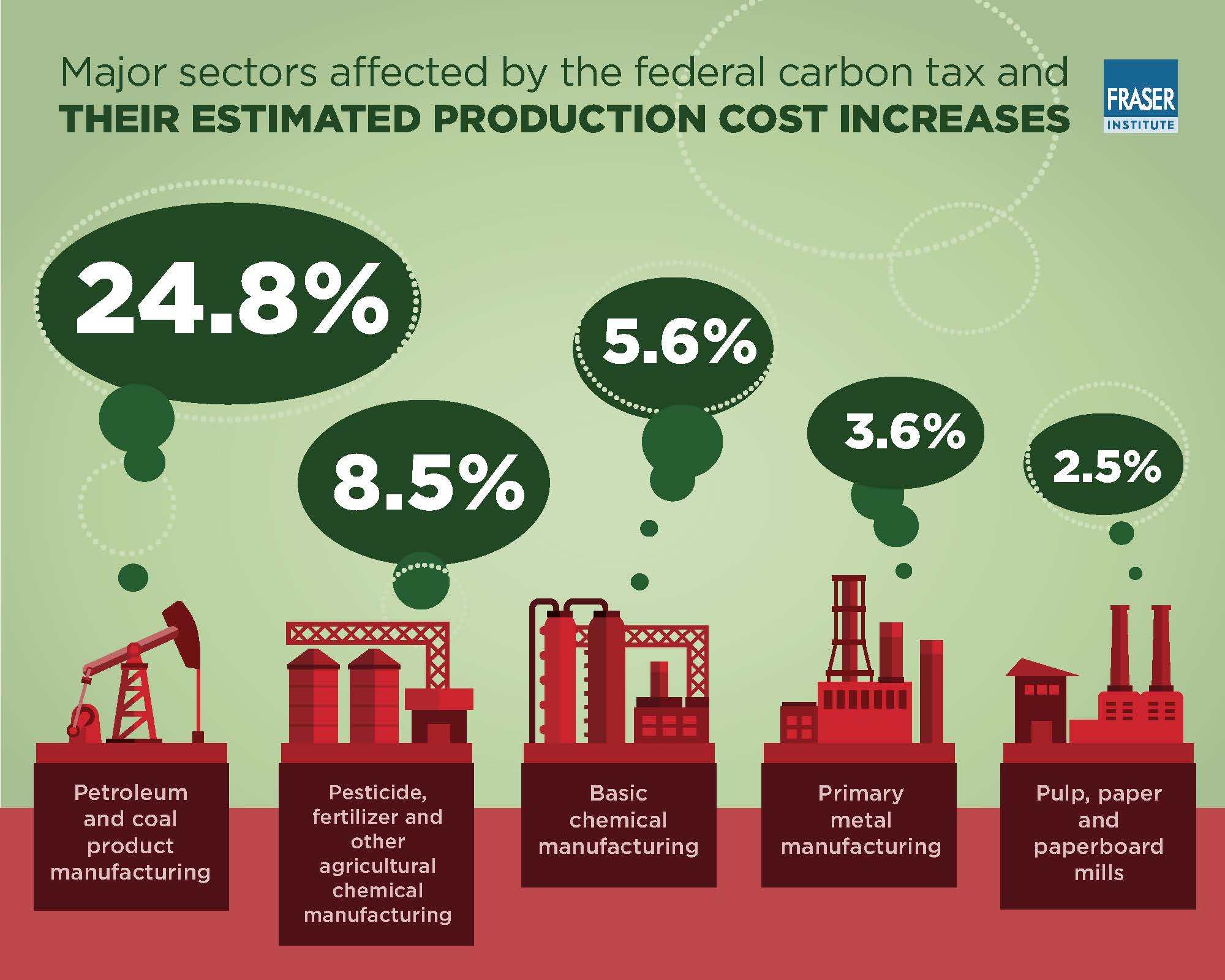

Impact of federal carbon tax on competitiveness infographic jpg

https://www.fraserinstitute.org/sites/default/files/impact-of-federal-carbon-tax-on-competitiveness-infographic.jpg

Web 1 Apr 2023 nbsp 0183 32 Eligible applicants To qualify to receive a January to March 2023 GCTRG an Applicant must have met all of the following criteria at the time of the application Web 2 Juli 2020 nbsp 0183 32 British Columbians will receive the climate action tax credit along with their federal GST HST credit payments Those who are eligible for the enhanced benefit will

Web 18 Dez 2023 nbsp 0183 32 Starting in July 2022 the rebate changed from a tax credit to an automatic payment sent on a quarterly basis to qualified residents of Alberta Manitoba Ontario Web 18 Dez 2020 nbsp 0183 32 The BC Climate Action Tax Credit BCCATC is a tax free payment made to low income individuals and families to help offset the carbon taxes they pay It is part of

Your Cheat Sheet To Carbon Pricing In Canada Delphi

https://delphi.ca/wp-content/uploads/2018/10/carbon-pricing-canada-map.png

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/585/571/585571881/large.png

https://www.cbc.ca/.../bc-quarterly-carbon-tax-rebates-1.6987717

Web 5 Okt 2023 nbsp 0183 32 Quarterly carbon tax rebates start going out to eligible British Columbians About 2 million families and individuals will receive the credit this year according to the

https://www2.gov.bc.ca/.../climate-change/clean-economy/carbon-tax

Web Approach to carbon pricing On April 1 2023 B C s carbon tax rate rose from 50 to 65 per tCO2e To protect affordability revenues generated by the new carbon tax

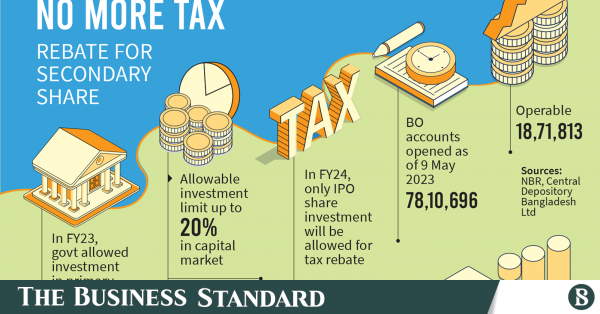

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

Your Cheat Sheet To Carbon Pricing In Canada Delphi

The Carbon Tax Rebate In New Brunswick This Is New Brunswick

Who Is Eligible For Rebate PrintableRebateForm

Tax Credits Save You More Than Deductions Here Are The Best Ones

Attitude On Carbon Tax Rebate Defined By Politics Not Facts Survey

Attitude On Carbon Tax Rebate Defined By Politics Not Facts Survey

/cdn.vox-cdn.com/uploads/chorus_image/image/60431081/shutterstock_586114652.0.jpg)

Carbon Tax Debate The Top 5 Things Everyone Needs To Know Vox

LIVE Carbon Tax What It Means For You

What You Need To Know About The Carbon Tax Rebate In N S And N B

Who Is Eligible For Carbon Tax Rebate In Bc - Web 1 M 228 rz 2023 nbsp 0183 32 The B C climate action tax credit is a quarterly payment from the province to residents to help offset carbon taxes paid by individuals and families 4 2 billion deficit