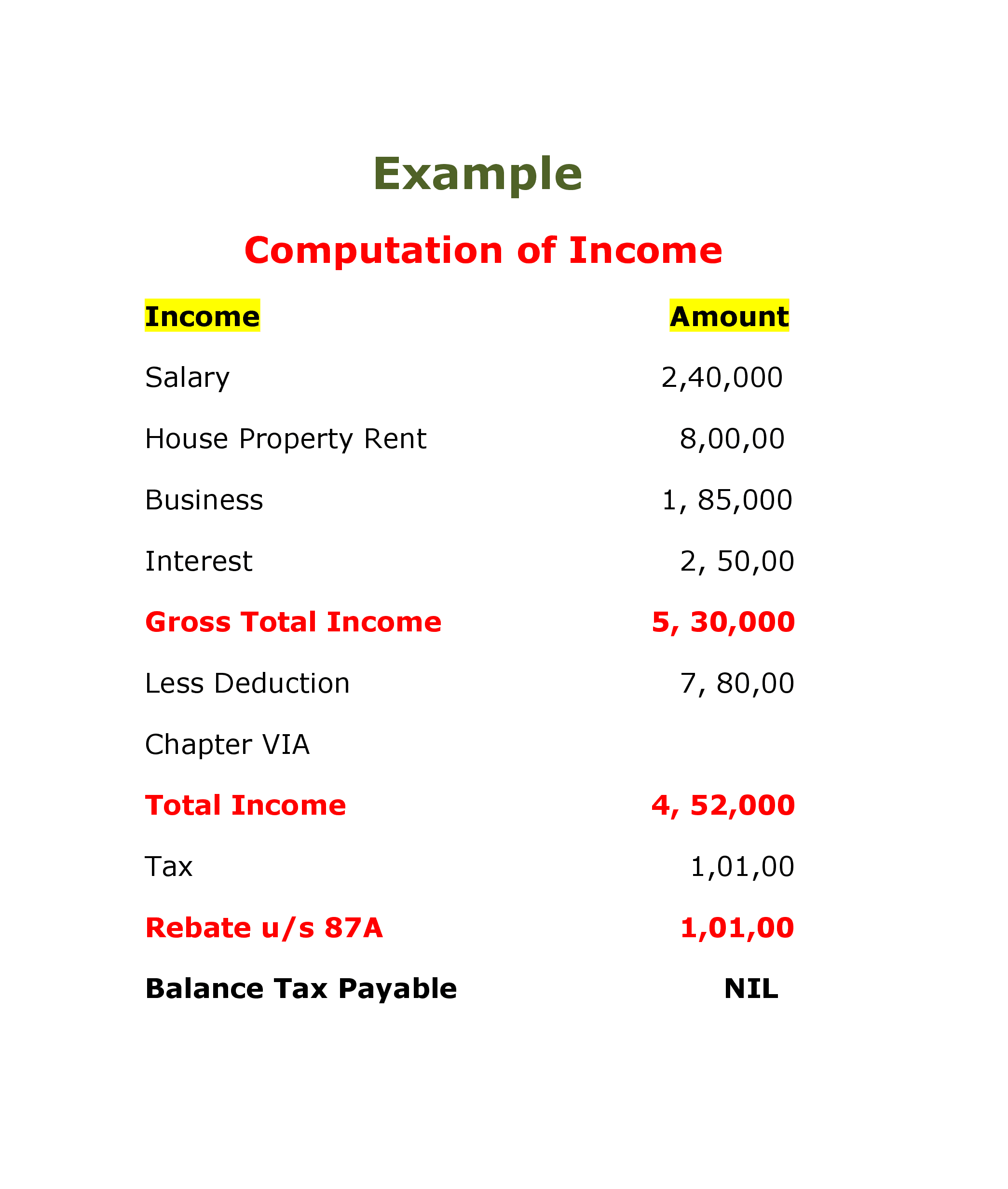

Who Is Not Eligible For Rebate U S 87a Under the new regime taxpayers with income less than Rs 7 lakh are eligible for a rebate of up to Rs 25 000 under Section 87A In case the income exceeds Rs 7 lakh Rebate under marginal scheme will be available

Winnings from gambling virtual digital assets VDA online gaming lotteries game shows or betting are not eligible for tax rebate under Section 87A This income will be There is no section 87 rebate for this income though total income of Rs 5 lakh is typically eligible for rebate under section 87A under the old tax regime Moreover special rate

Who Is Not Eligible For Rebate U S 87a

Who Is Not Eligible For Rebate U S 87a

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Rebate U s 87A

https://media.licdn.com/dms/image/C5112AQHGhIc7iVAbrg/article-cover_image-shrink_600_2000/0/1523954816383?e=2147483647&v=beta&t=BtH1y3BpTu4KevMTicf4-bfJurzHAXOcHYOEp8_GexA

Rebate U s 87A Tax Slab Format For Computing Tax Liability Session 23

https://i.ytimg.com/vi/pdHTAr-HPP0/maxresdefault.jpg

According to the Income tax Act the rebate under Section 87A is available to only resident individuals Taxpayers such as non resident individuals NRIs Hindu Undivided How much is the Rebate Allowed u s 87A If an individual s total taxable income is up to Rs 7 lakh and chooses the new tax regime they will be eligible for rebate of lower of the following an amount of income tax payable

The updated utility no longer provides rebate u s 87A for special rate incomes including STCG under Section 111A For Example If an individual income is Rs 7 lakh without any special rate income then they will be eligible Rebate granted under section 87A will depend upon your taxes payable for the FY 2023 24 AY 2024 25 under the new regime As under The benefit of rebate u s 87A is not

Download Who Is Not Eligible For Rebate U S 87a

More picture related to Who Is Not Eligible For Rebate U S 87a

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

Income Tax Rebate Under Section 87A

http://bemoneyaware.com/wp-content/uploads/2016/04/ITR-87a-rebate.png

1 No Rebate for LTCG Long term capital gains LTCG from the sale of listed equity shares or equity oriented mutual funds do not qualify for the 87A rebate even if total income is below Rs 7 lakh Individuals whose tax liability amounts to less than Rs 2 000 shall not be considered eligible for the rebate The provision of the rebate is only applicable for Indian residents and not NRI s HUF AOP BOI firm and other

To be eligible for claiming a tax rebate under Section 87A of the Income Tax Act for the financial year 2023 24 Assessment Year 2024 25 individuals must satisfy the following eligibility criteria The taxpayer must be Section 87A Income Tax Rebate Who Qualifies and Who Doesn t The Income Tax Act states that resident Indians qualify for a rebate under 87A Also Hindu United

Section 87A Tax Rebate Under Section 87A Rebates Financial

https://i.pinimg.com/736x/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Who Is Eligible For A Recovery Rebate Credit PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2022/10/Who-Is-Eligible-For-Rebate-768x738.png

https://taxguru.in › income-tax

Under the new regime taxpayers with income less than Rs 7 lakh are eligible for a rebate of up to Rs 25 000 under Section 87A In case the income exceeds Rs 7 lakh Rebate under marginal scheme will be available

https://economictimes.indiatimes.com › wealth › tax

Winnings from gambling virtual digital assets VDA online gaming lotteries game shows or betting are not eligible for tax rebate under Section 87A This income will be

Rebate U s 87A

Section 87A Tax Rebate Under Section 87A Rebates Financial

Decoding Rebate U s 87A Post Interim Budget For The F Y 2019 20

FAQs On Rebate U s 87A FinancePost

2023 Rent Rebate Form Printable Forms Free Online

Income Tax Rebate Meaning Types How To Calculate HDFC Life

Income Tax Rebate Meaning Types How To Calculate HDFC Life

What Is Rebate U s 87A For AY 2023 24

87A Rebate Rebate U s 87A How To

Rebate U s 87A Of I Tax Act Income Tax

Who Is Not Eligible For Rebate U S 87a - According to the Income tax Act the rebate under Section 87A is available to only resident individuals Taxpayers such as non resident individuals NRIs Hindu Undivided