Who Qualifies For Gst Credit In Bc Web 30 Juni 2023 nbsp 0183 32 You re eligible to receive the credit if you re a resident of B C and you Are 19 years of age or older or Have a spouse or common law partner or Are a parent who resides with your child Only one person can receive the credit on behalf of a family Expand All Collapse All If you have a spouse or common law partner

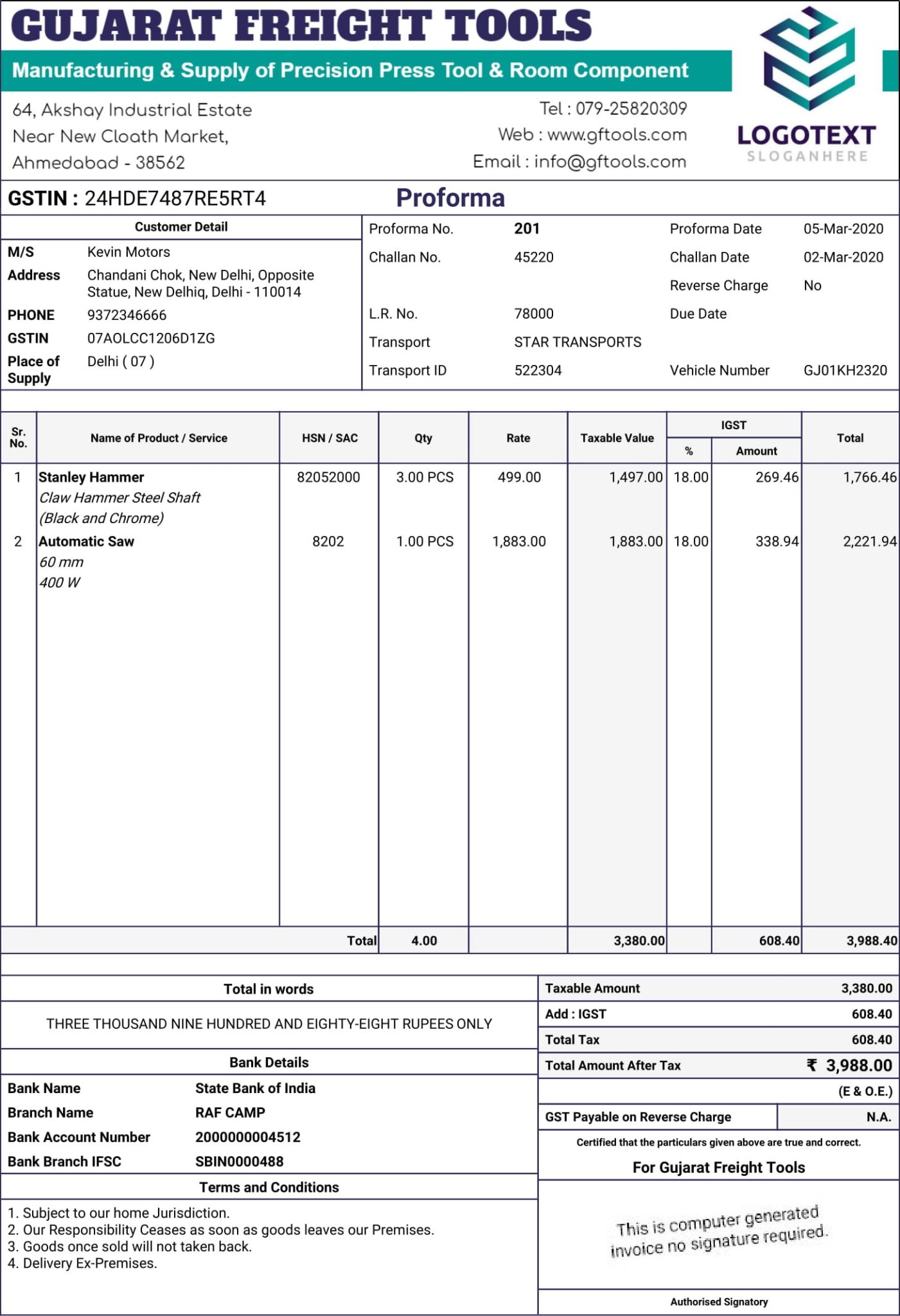

Web The GST credit in Canada is part of the Canadian FED deposit payments alongside the Canada Children and Canada Worker s benefits To fulfill the general eligibility requirement for the GST credit you must be considered a Canadian resident for income tax purposes at the beginning of the month during which the CRA makes the payment and the Web Definitions GST HST credit Eligibility criteria How to get the GST HST credit You need a social insurance number If you have a spouse or common law partner If you have children who are under 19 years of age If you turn 19 years of age before April 2024 How your GST HST credit is calculated Base year and payment period

Who Qualifies For Gst Credit In Bc

Who Qualifies For Gst Credit In Bc

https://www.insurdinary.ca/wp-content/uploads/2021/11/gst-hst-credit-application.jpg

Who Is Eligible For The GST Credit In Canada 2023 GST Payment Dates

https://reviewlution.ca/wp-content/uploads/2022/09/Who-is-Eligible-For-GST-Credit-.jpg

Who Qualifies For Business Credit Cards YouTube

https://i.ytimg.com/vi/PKi4fkIJtec/maxresdefault.jpg

Web the number of children under 19 years old that you have registered for the Canada child benefit and the GST HST credit For the 2022 base year payment period from July 2023 to June 2024 you could get up to 496 if you are single 650 if you are married or have a common law partner 171 for each child under the age of 19 Web 4 Nov 2022 nbsp 0183 32 Single Canadians qualify for a GST HST credit if you earn 60 000 and have 3 or 4 children 50 000 to 55 000 with one child or more Single Canadians who earn 45 000 or less qualify even

Web Who is eligible for the GST HST credit To qualify for the GST HST credit you must be a Canadian resident for income tax purposes in the month prior and at the start of the month in which the CRA makes a payment You also need to meet one of the following criteria You are 19 years of age or older You have or had a spouse or common law partner Web You re eligible to claim the sales tax credit for a tax year if you were a resident of B C on December 31 of the tax year and you Were 19 years of age or older or Had a spouse or common law partner or Were a parent For 2013 and later years you can claim up to 75 for yourself and 75 for your cohabiting spouse or common law partner

Download Who Qualifies For Gst Credit In Bc

More picture related to Who Qualifies For Gst Credit In Bc

GST Procedure For Audit Assessment Ruling Recovery

https://certicom.in/wp-content/uploads/2018/08/the-implementation-of-goods-and-service-tax-gst-malaysia-25-638.jpg

When Am I Eligible For Medicare Insurance

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/medicare-eligibility.png

Who Qualifies For A Business Credit Card Flipboard

https://thepointsguy.global.ssl.fastly.net/us/originals/2022/02/shutterstock_1886916463-scaled.jpg

Web 14 Nov 2022 nbsp 0183 32 You are eligible for the GST HST credit if you are considered a Canadian resident for income tax purposes the month before and at the beginning of the month in which the CRA makes a payment You also need to meet one of the following criteria You are at least 19 years old You have or had a spouse or common law partner Web Eligibility for the GST credit depends on your net income marital status and how many children you have There is no separate application necessary as eligibility is based on your 2021 tax

Web 14 Dez 2023 nbsp 0183 32 To qualify for the GST HST credit your adjusted net family income must be below a certain threshold which for the 2022 tax year ranges from 52 255 to 69 105 depending on your marital Web 5 Juli 2023 nbsp 0183 32 Eligibility criteria You and your spouse or common law partner if applicable must meet the eligibility criteria for the 2021 base year to qualify for this rebate Payment details The Grocery Rebate will be double the amount of your GST HST credit payment from January 2023

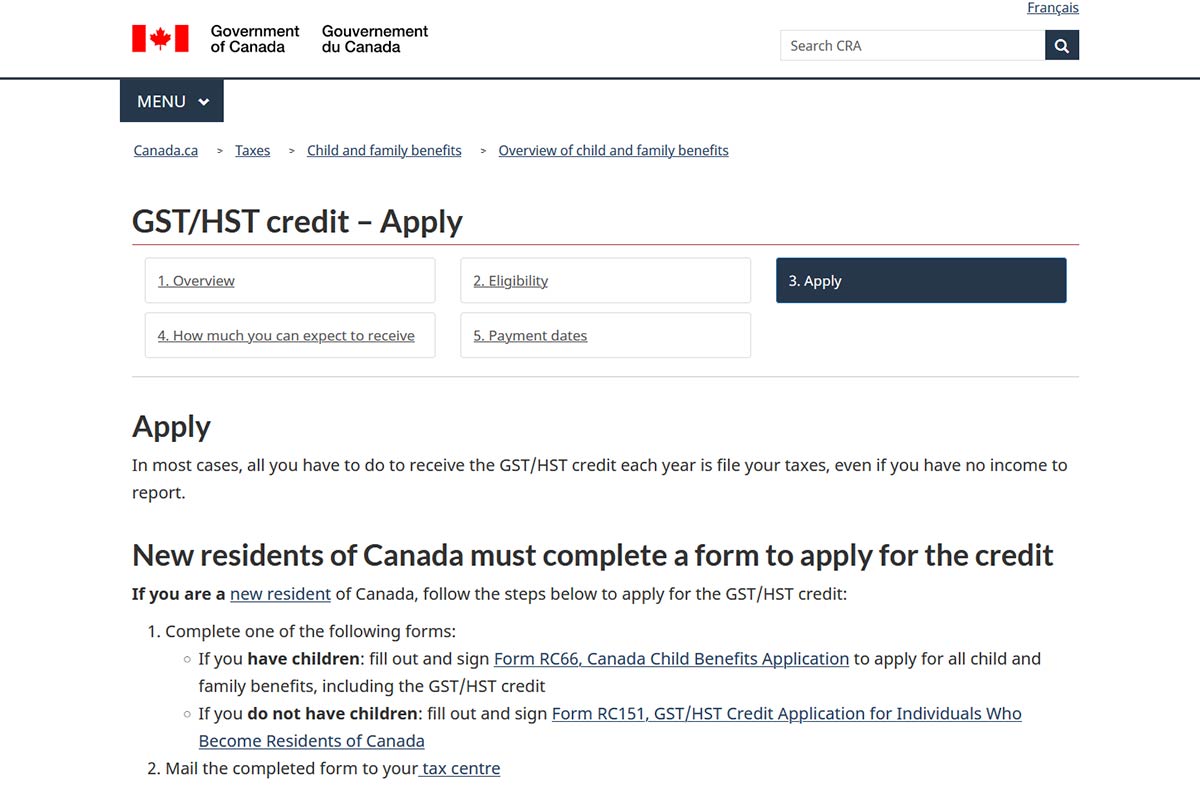

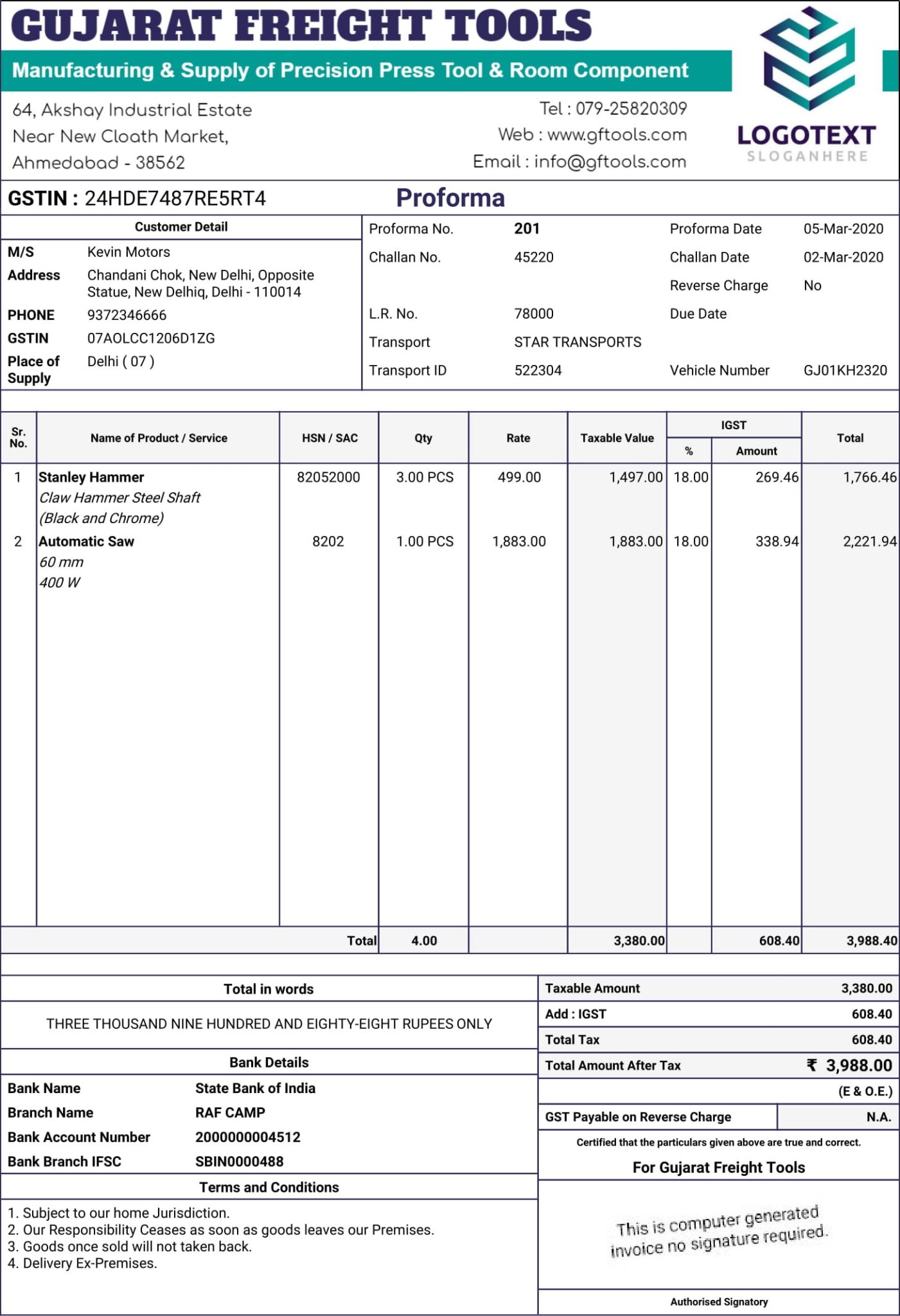

Proforma Nota Voorbeeld

https://gogstbill.com/wp-content/uploads/2020/03/Proforma_201-1-1401x2048.jpg

GST Timely Credit Can Enable Small Businesses To Go Oversea

https://certicom.in/wp-content/uploads/2019/06/Impact-Of-GST-On-Small-And-Medium-Businesses.jpg

https://www2.gov.bc.ca/gov/content/taxes/income-taxes/personal/credits/...

Web 30 Juni 2023 nbsp 0183 32 You re eligible to receive the credit if you re a resident of B C and you Are 19 years of age or older or Have a spouse or common law partner or Are a parent who resides with your child Only one person can receive the credit on behalf of a family Expand All Collapse All If you have a spouse or common law partner

https://reviewlution.ca/resources/who-is-eligible-for-gst-credit

Web The GST credit in Canada is part of the Canadian FED deposit payments alongside the Canada Children and Canada Worker s benefits To fulfill the general eligibility requirement for the GST credit you must be considered a Canadian resident for income tax purposes at the beginning of the month during which the CRA makes the payment and the

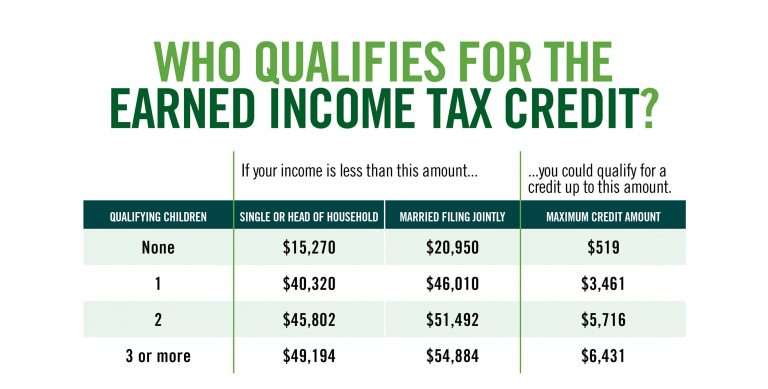

Earning Income Tax Credit Table

Proforma Nota Voorbeeld

Why Are Eligible Canadians Given A grocery Rebate And Who Qualifies

Guide To Maximizing The Utilization Of GST Input Tax Credit

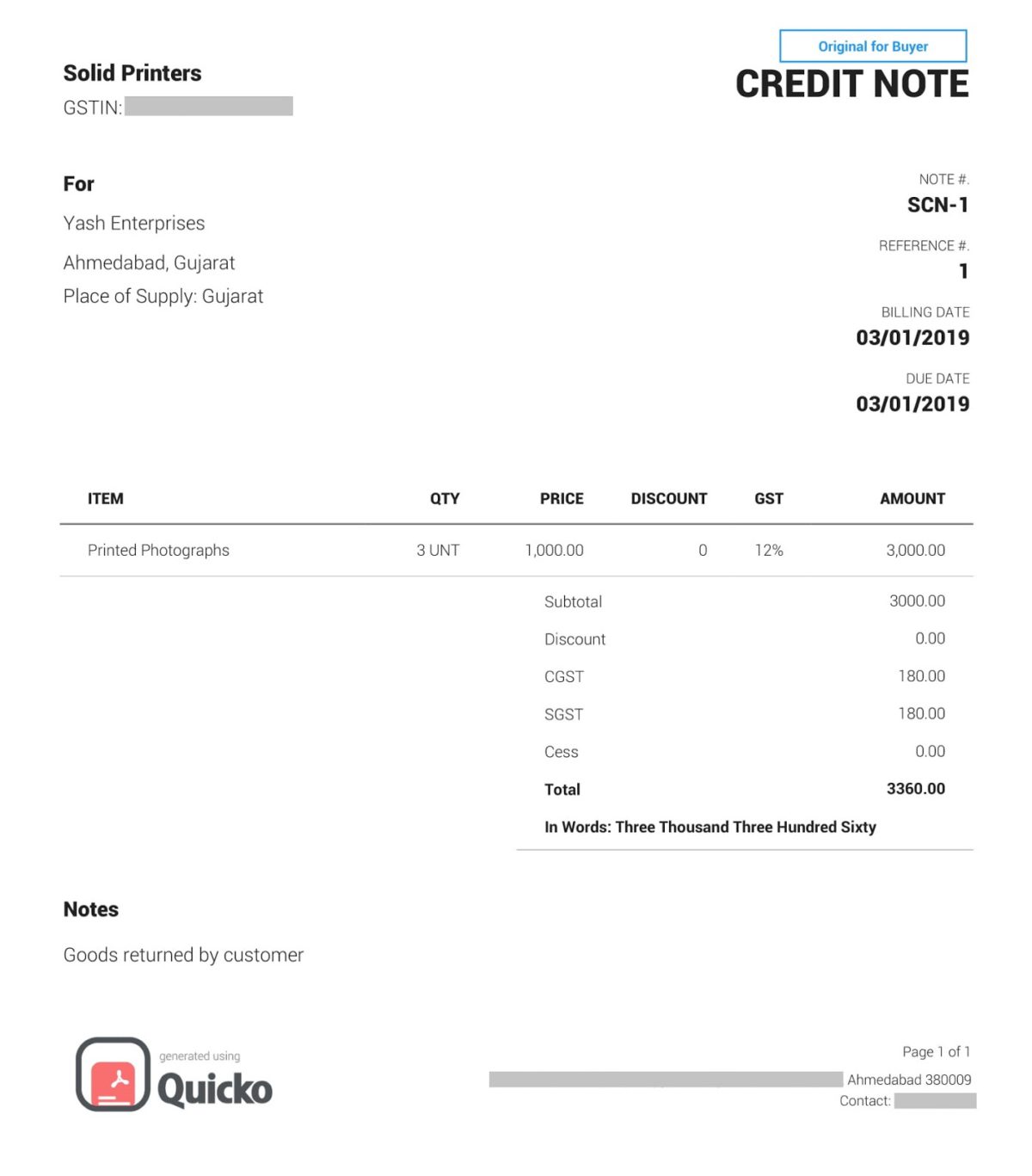

What Is A Credit Note Under GST Learn By Quicko

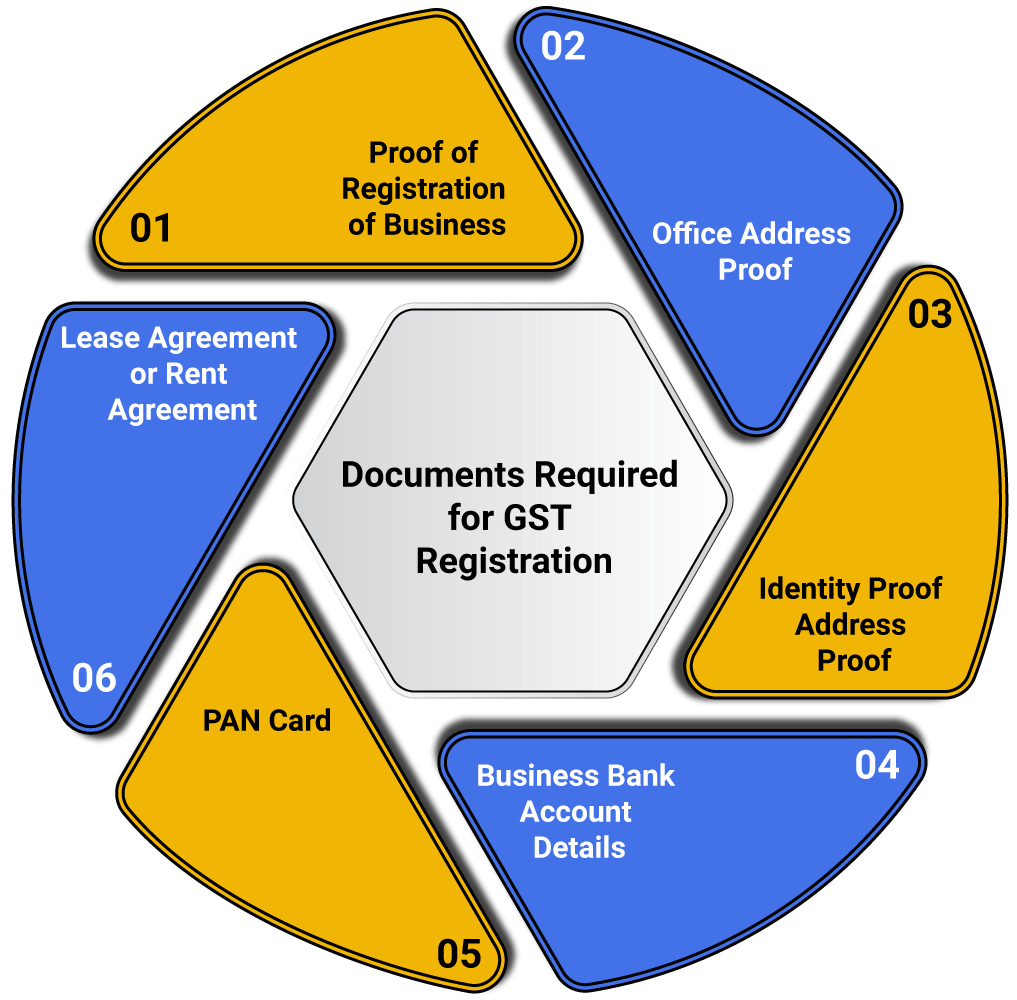

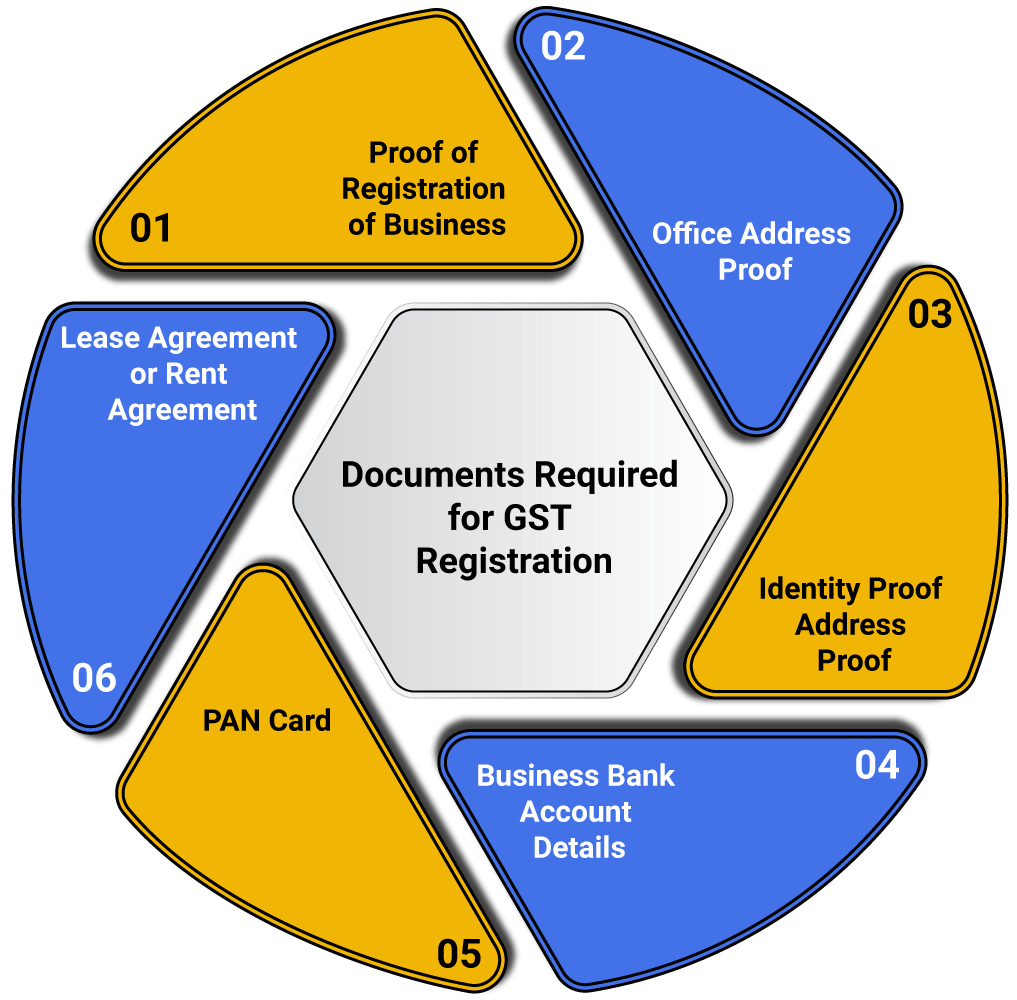

GST Registration Process Eligibility Fees Documents Swarit Advisors

GST Registration Process Eligibility Fees Documents Swarit Advisors

What Is GST Goods And Services Tax Presentation Video YouTube

Gst Return Working Form Fill Out And Sign Printable PDF Template

How To Check GST Number Online Verify GST No YouTube

Who Qualifies For Gst Credit In Bc - Web To qualify for a full exemption at the time the property is registered you must be a Canadian citizen or permanent resident have lived in B C for 12 consecutive months immediately before the date you register the property or filed at least 2 income tax returns as a B C resident in the last 6 years