Who Qualifies For Gst Rebate In Alberta To qualify for the GST HST credit you must be a Canadian resident for income tax purposes in the month prior and at the start of the month in which the CRA makes a payment You also

This guide explains who is eligible for the GST HST credit how to apply for it how it is calculated and when the CRA payments 250 Working Canadians Rebate in Early 2025 In addition to the Winter GST Holiday the government will deliver a one time 250 tax free rebate to eligible Canadians in

Who Qualifies For Gst Rebate In Alberta

Who Qualifies For Gst Rebate In Alberta

https://b2148460.smushcdn.com/2148460/wp-content/uploads/2019/06/adultingmoney.jpg?size=417x270&lossy=1&strip=1&webp=1

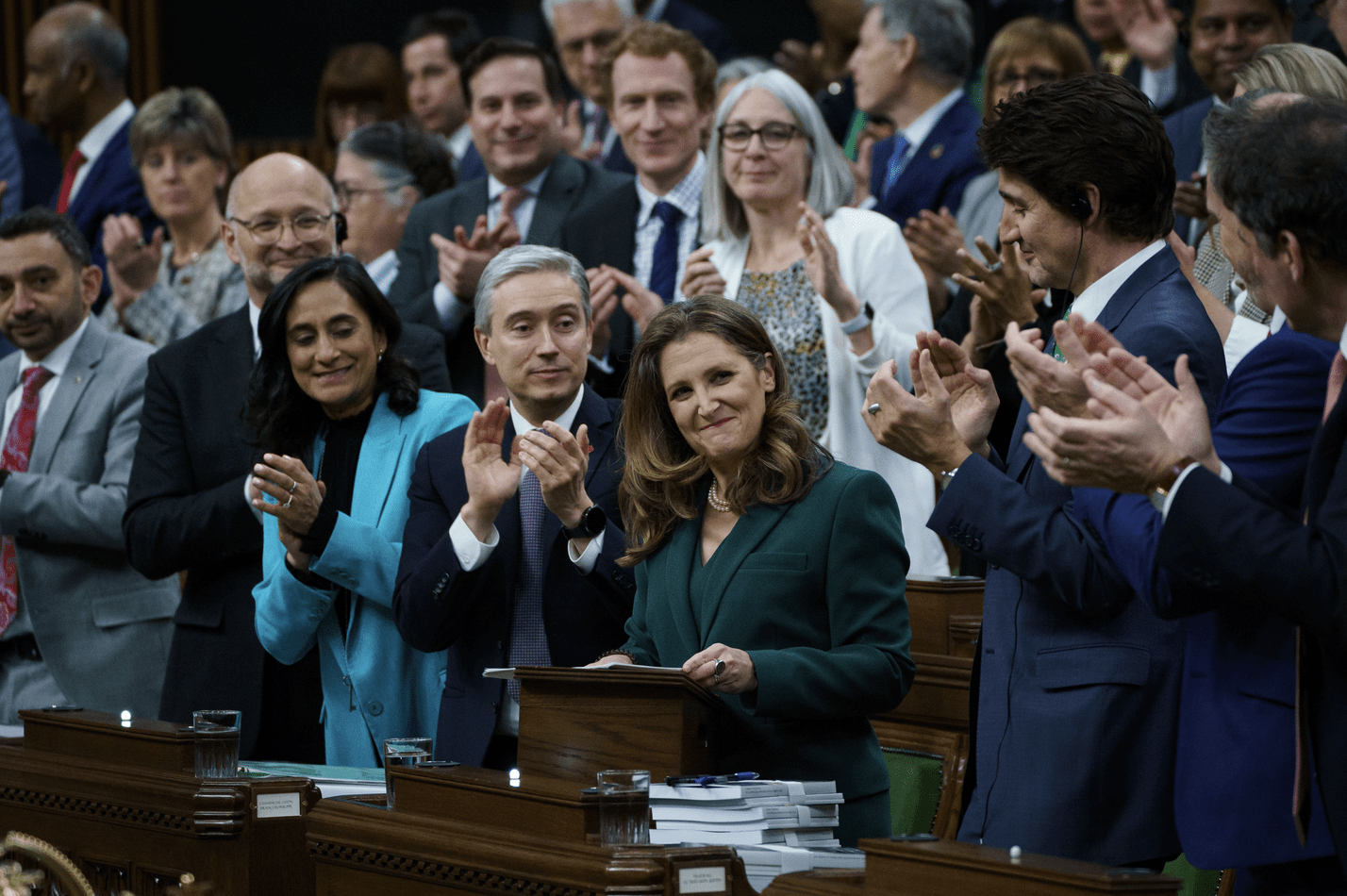

Canadians Begin To Receive Temporary Boost To GST Rebate Today

https://cdn.cheknews.ca/wp-content/uploads/2021/09/27134706/CRA-Canada-Revenue-Agency-Sign-Victoria-002-CHEK-scaled.jpg

Feds Temporary Boost To GST Rebate Will Help During High Inflation

https://www.nationalobserver.com/sites/nationalobserver.com/files/styles/article_header_xl/public/img/2022/09/14/e28716eec22252892070e8135bdaa05d7d100a22f1922e7264620b1091a4cdbb.jpg?itok=NK8tVZen

You will be notified one way or another by the CRA if you are eligible for the GST rebate and how much you will receive in Alberta There is no penalty for applying for the GST rebate in Alberta even if the CRA determines But who is eligible for the GST credit in Canada Follow for more details on the application process eligibility criteria and the 2022 payment dates The GST credit in Canada is part of the Canadian FED deposit payments alongside the

To be eligible for the GST HST credit payments a person should be at least 19 years old and must reside in Canada for income tax purposes the month prior to and To qualify for the GST HST credit your adjusted net family income must be below a certain threshold which for the 2023 tax year ranges from 54 704 to 72 244 depending on your marital

Download Who Qualifies For Gst Rebate In Alberta

More picture related to Who Qualifies For Gst Rebate In Alberta

880 000 HDB Households To Receive GST U Save Rebate Vouchers Of Up To

https://static1.straitstimes.com.sg/s3fs-public/styles/large30x20/public/articles/2017/04/03/gst.jpg?VersionId=lis9Lf3uHMfrRdqSE9GAYltzIbOIyCIR

Temporary Boost To GST Rebate Appropriate Amid High Inflation

https://www.talentcanada.ca/wp-content/uploads/2020/11/Ottawa-AdobeStock_299790306-2048x1279.jpeg

Temporary Boost To GST Rebate Would Cost 2 6 Billion PBO Brandon Sun

https://www.brandonsun.com/wp-content/uploads/sites/3/2022/09/20220929110932-6335baff2b5000acf6fcc3dajpeg.jpg?w=1000

Provides a tax free quarterly payment to help individuals and families with low and modest incomes offset the GST or HST they pay Am I eligible for the Canada GST HST refund You are eligible for the GST HST credit if you are considered a Canadian resident for income tax purposes the month before

Canadian Revenue Agency has released the family income limit and maximum payments eligible Canadians will receive as GST HST credit for the benefit year 2023 2024 In Alberta you only pay GST It is not harmonized GST in Alberta is 5 So if you went to a grocery store and bought a bag of chips for 1 you would pay 1 05 at checkout to

Budget 2023 An Ironic GST Rebate And A Happy NDP Policy Magazine

https://www.policymagazine.ca/wp-content/uploads/2023/03/Screen-Shot-2023-03-28-at-5.43.45-PM.png

Who Qualifies For The GST HST NEW HOUSING REBATE Program In Canada

https://static.shareasale.com/image/44487/DemoCreator_160x600.png

https://www.springfinancial.ca › blog › boost-your...

To qualify for the GST HST credit you must be a Canadian resident for income tax purposes in the month prior and at the start of the month in which the CRA makes a payment You also

https://www.canada.ca › ... › gst-hst-credit.html

This guide explains who is eligible for the GST HST credit how to apply for it how it is calculated and when the CRA payments

MPs Unanimously Vote To Temporarily Double GST Rebate For Lower income

Budget 2023 An Ironic GST Rebate And A Happy NDP Policy Magazine

New Home HST GST Rebate By Nadene Milnes Issuu

Food Items Cheaper In Hotels After GST Rebate GST

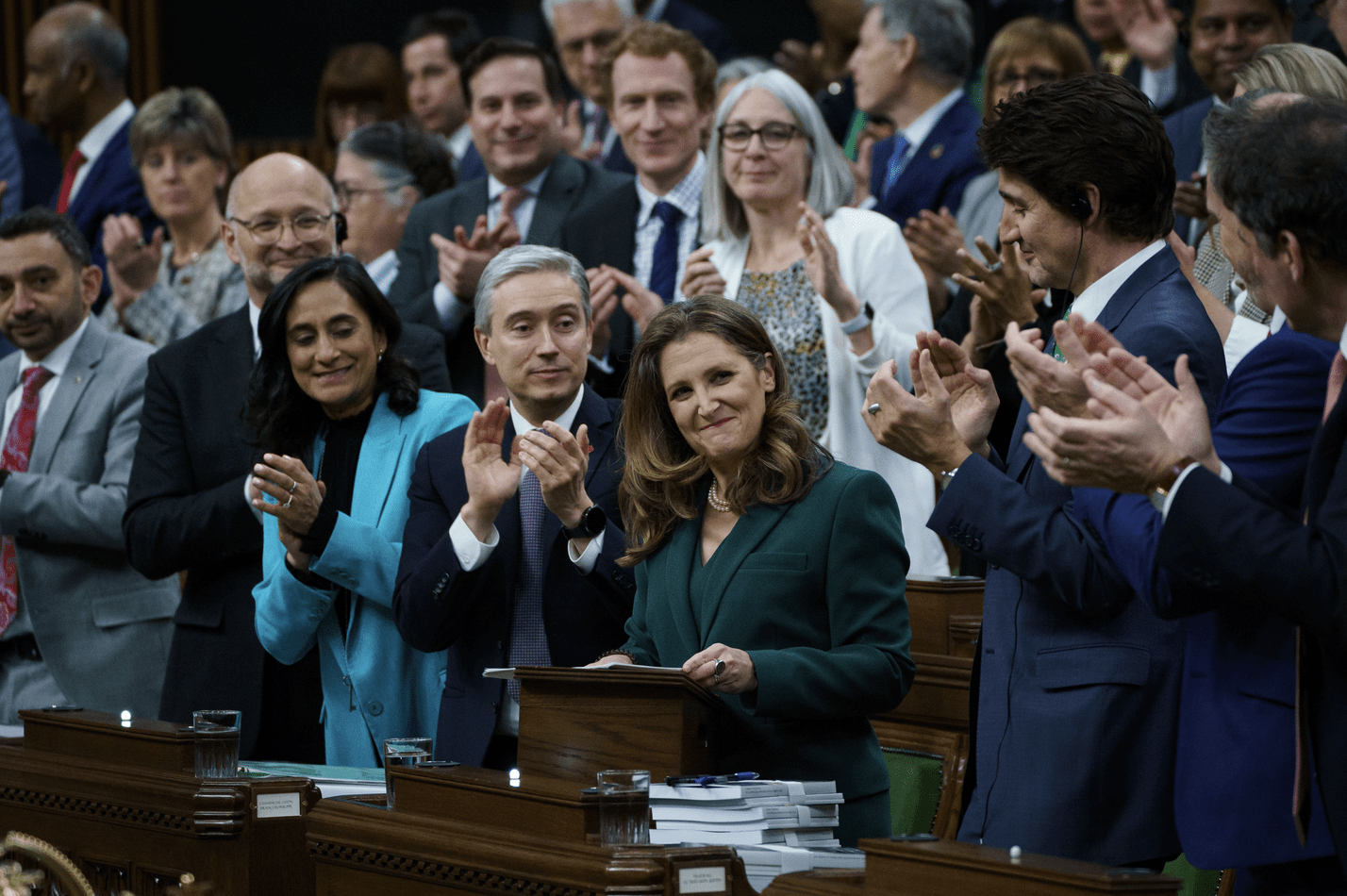

GST Refund Form Rfd 01 Printable Rebate Form

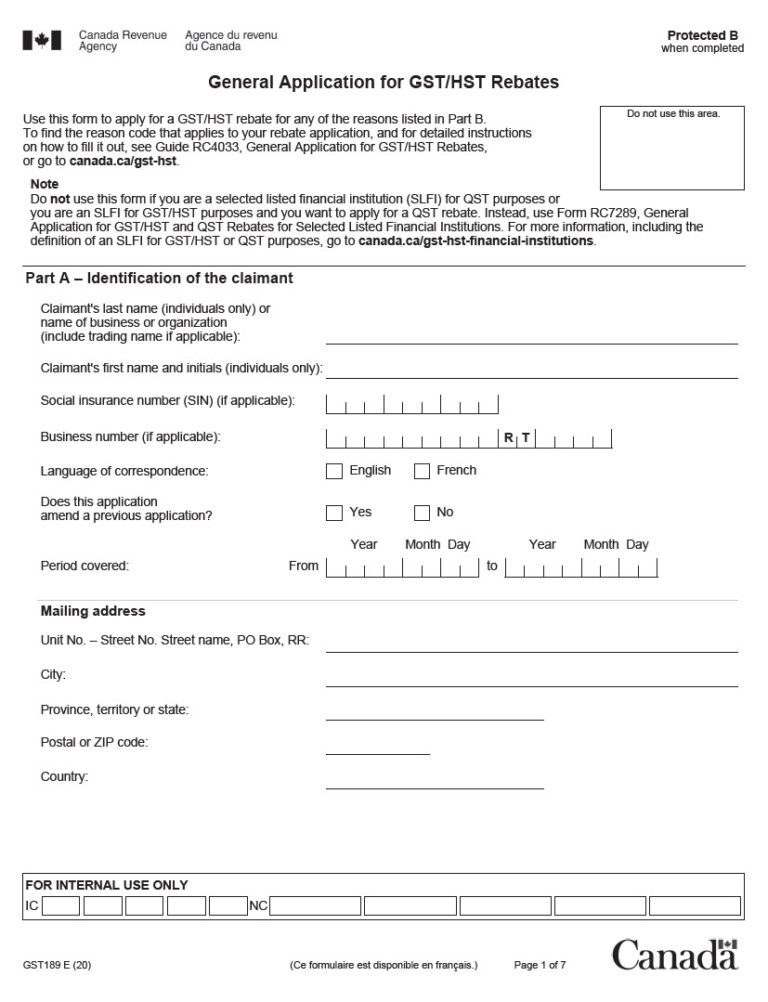

Replacement Windows Government Rebate Window Replacement

Replacement Windows Government Rebate Window Replacement

The HST GST Rebate And One s Primary Place Of Residence

One time GST Rebate Hike Approved By Parliament

Feds Temporarily Double GST Rebate Reveal Launch Of Dental Care Plan

Who Qualifies For Gst Rebate In Alberta - But who is eligible for the GST credit in Canada Follow for more details on the application process eligibility criteria and the 2022 payment dates The GST credit in Canada is part of the Canadian FED deposit payments alongside the