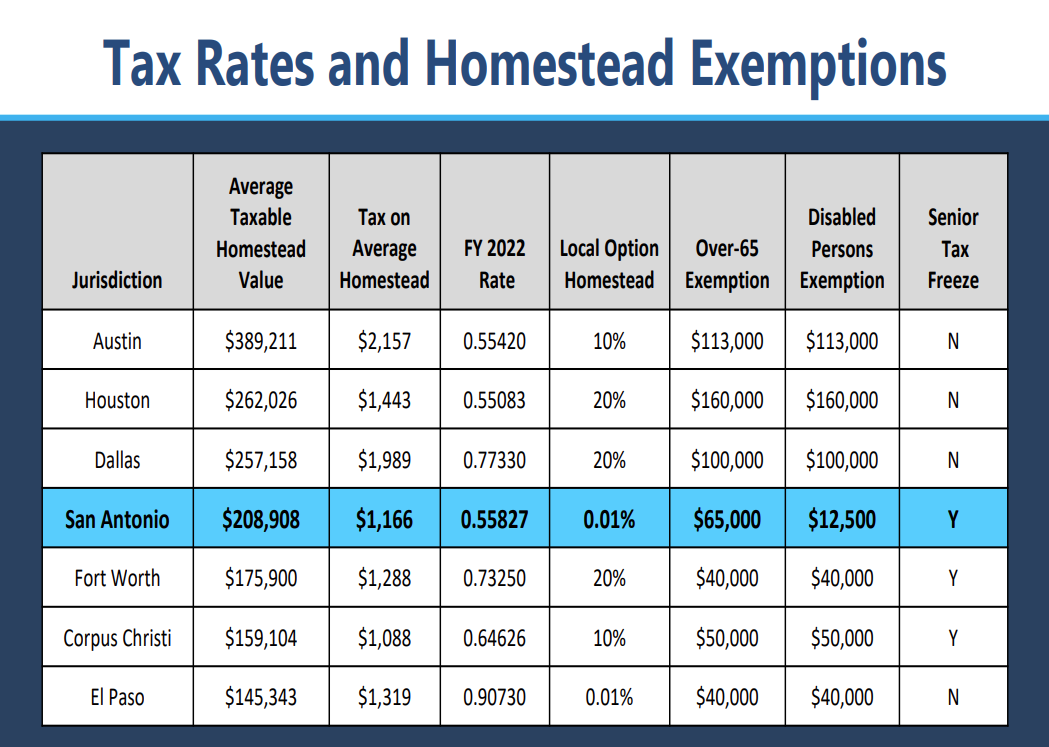

Who Qualifies For Property Tax Exemption In Texas You are eligible for a home stead exemption if you 1 own your home partial ownership counts 2 the home is your principal residence and 3 you have a Texas driver s

Texas residents are eligible for a standard 100 000 homestead exemption from public school districts as of November 2023 which can be applied for via an Application for Residential Homestead Exemption and once State law provides for a variety of exemptions from property tax for property and property owners that qualify for the exemption Texas offers a variety of partial or total absolute exemp tions

Who Qualifies For Property Tax Exemption In Texas

Who Qualifies For Property Tax Exemption In Texas

https://cloudfront-us-east-1.images.arcpublishing.com/gmg/K2SURLOHCFDULMLOC5YGR3LQHA.PNG

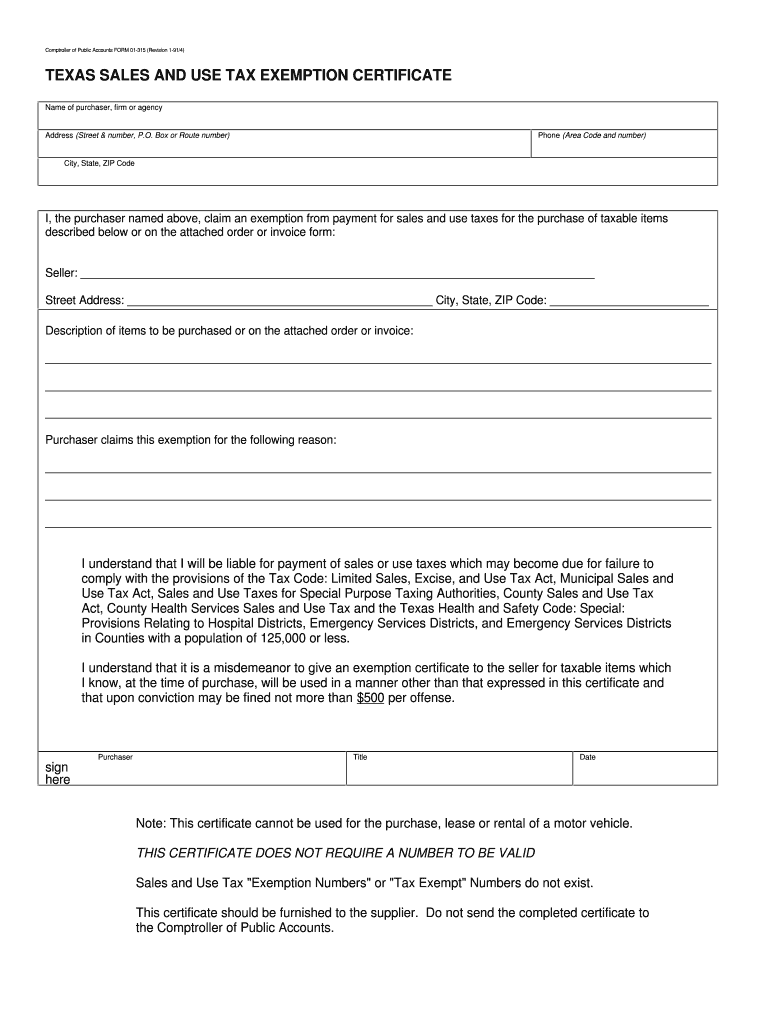

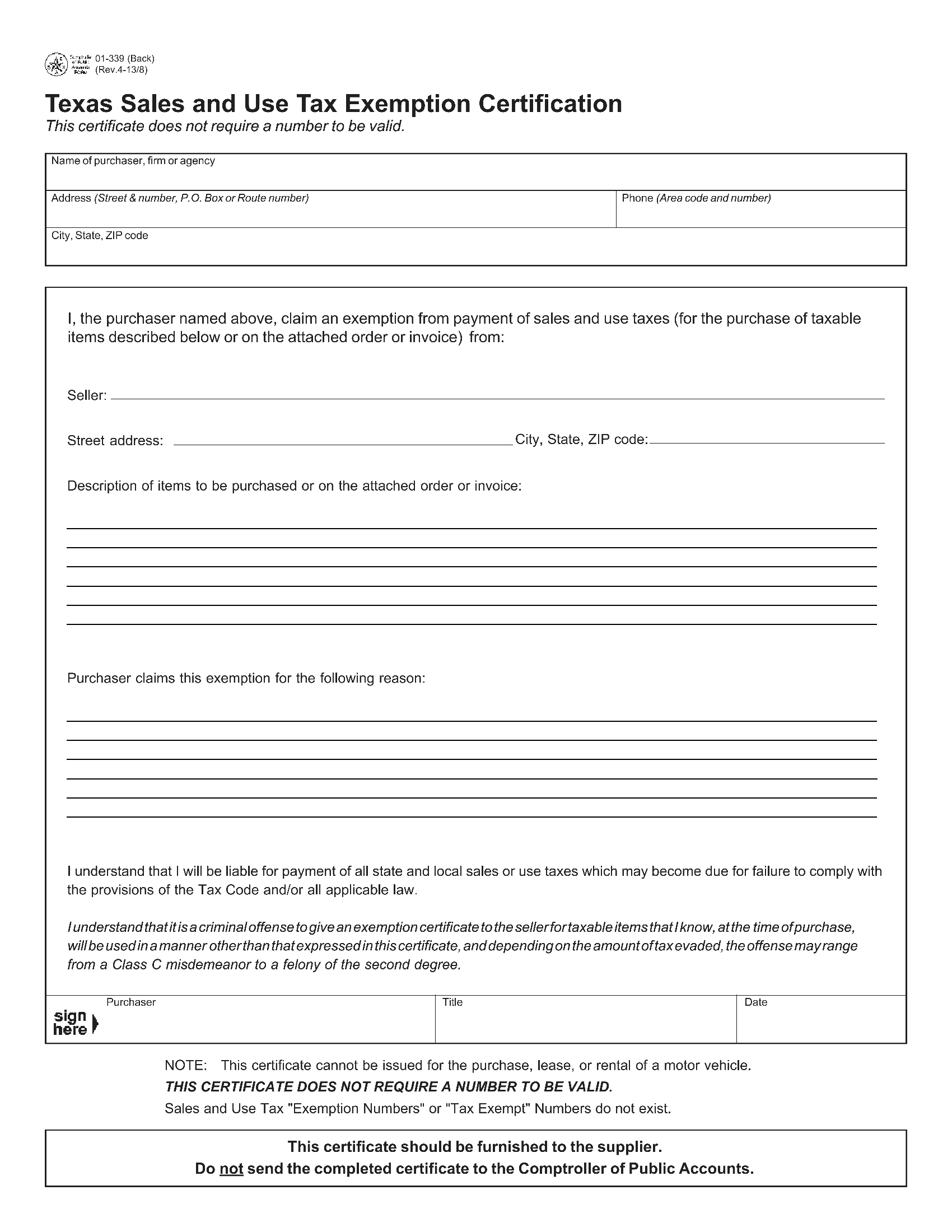

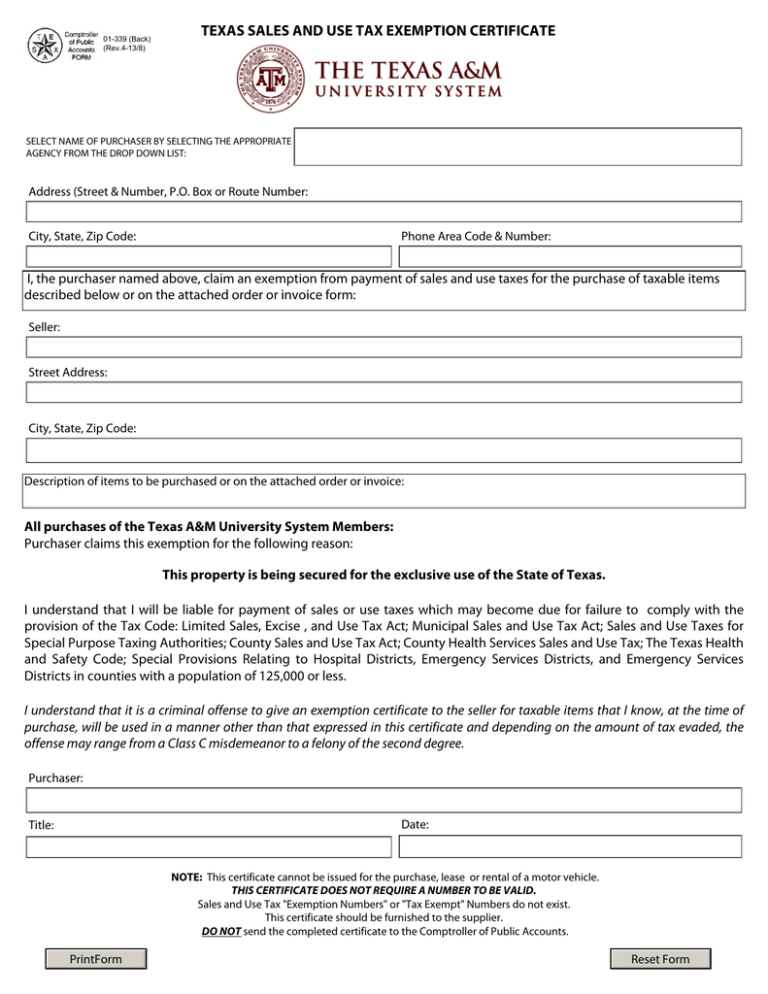

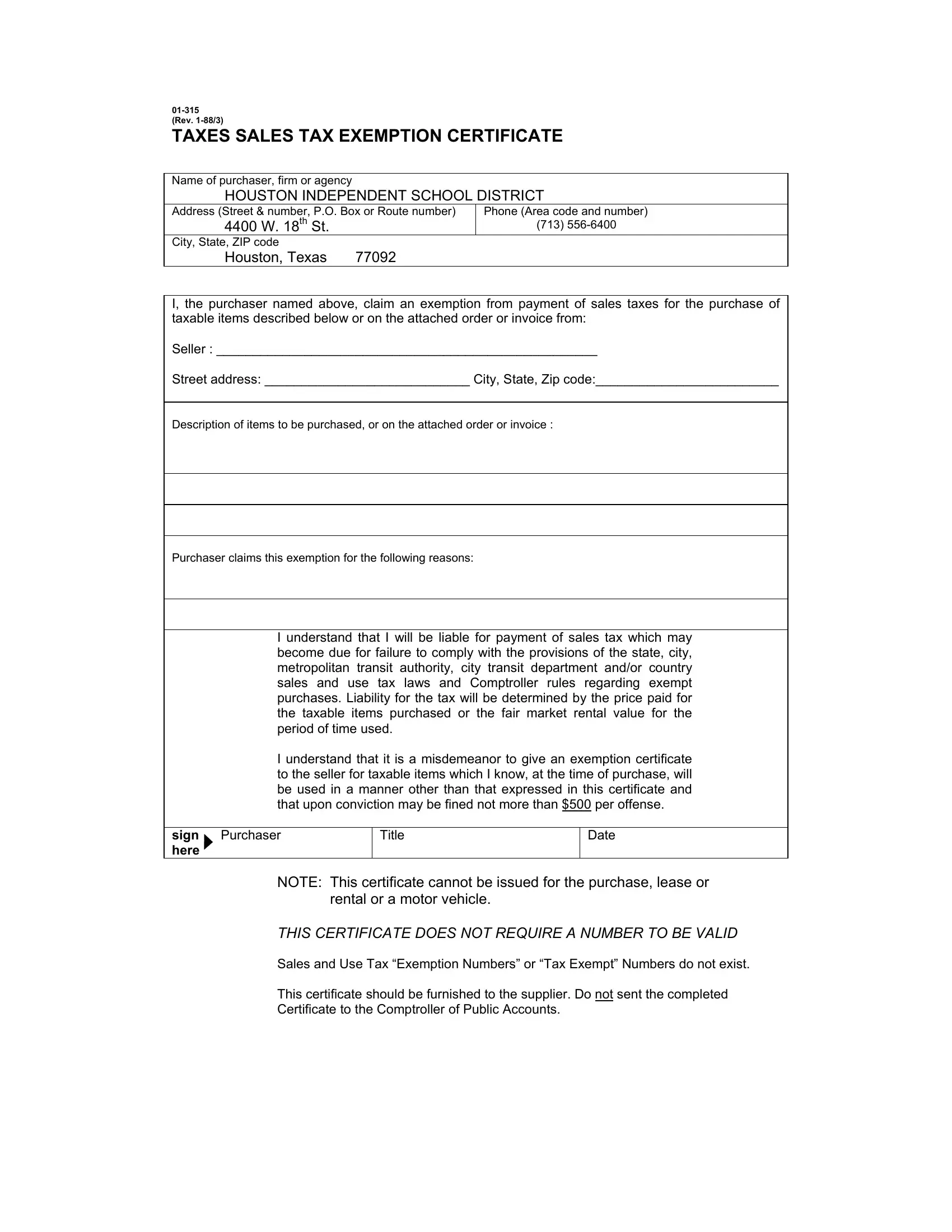

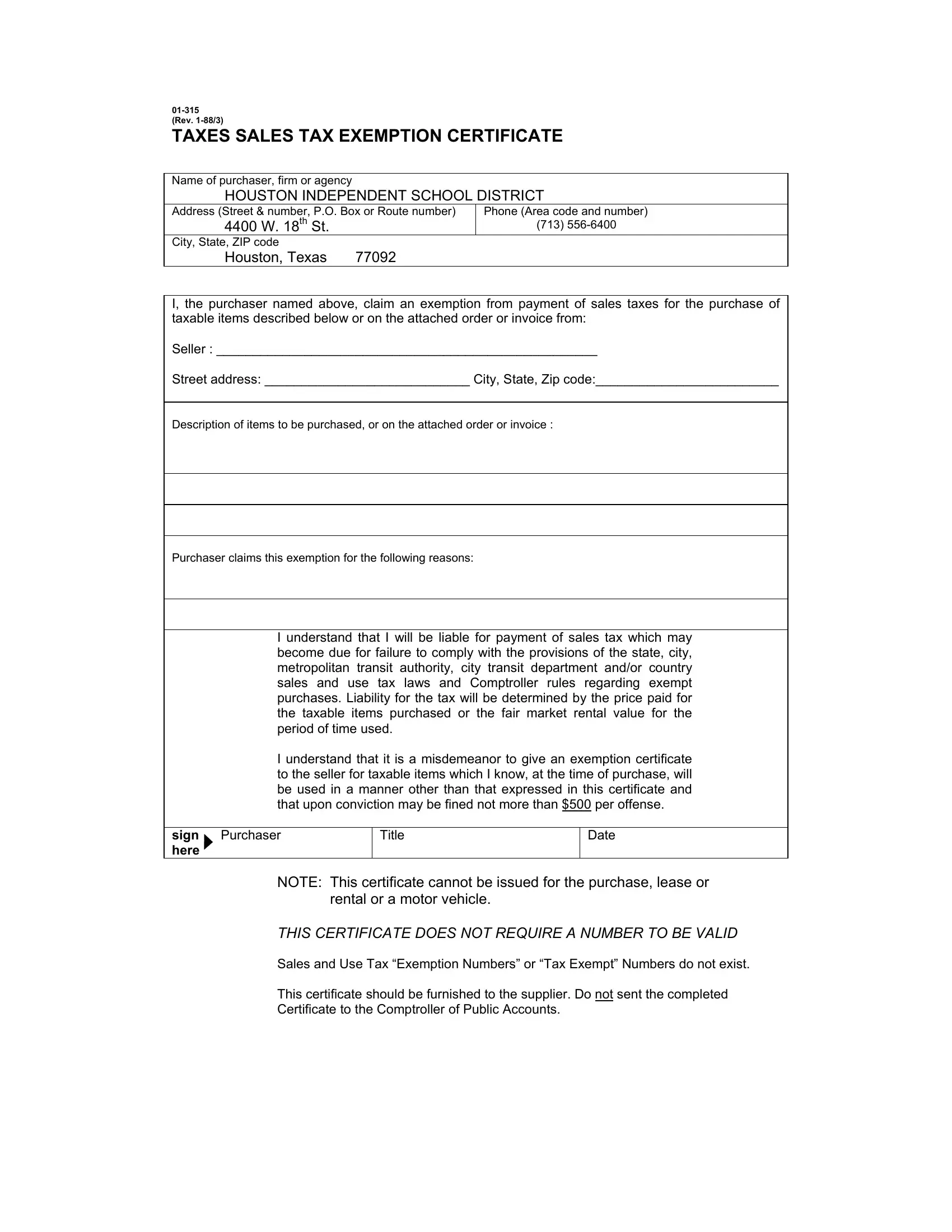

Texas Sales And Use Tax Exemption Certification Forms Docs 2023

https://blanker.org/files/images/01-339b.png

Uncategorized Mojgan JJ Panah

http://jjpanah.agent.jbgoodwin.biz/files/2018/12/Homestead-Exemption-Infographic.jpg

Residents are also entitled to a number of Texas property tax exemptions These exemptions can reduce your taxable property value resulting in a lower annual property tax The texas constitution article 8 taxation and revenue sec 1 equality and uniformity of taxation taxation of property in proportion to value occupation and income taxes exemption of certain

Learn how Texas homestead exemptions reduce your property taxes Find out if you qualify how to apply and calculate your savings under the new exemption law Exemptions reduce the property tax burden on your home Property Taxes and Homestead Exemptions provides information on homestead and other property tax

Download Who Qualifies For Property Tax Exemption In Texas

More picture related to Who Qualifies For Property Tax Exemption In Texas

Texas Sales Tax Exemption Certificate From The Texas Human Rights

https://digital.library.unt.edu/ark:/67531/metadc967514/m1/1/high_res/

California Tax Exempt Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/442/869/442869902/large.png

Texas Application For Residence Homestead Exemption File Homestead

https://cdn.uslegal.com/uslegal-preview/TX/TX-HM-001/1.png

For fiscal 2025 aggregate exemptions for these revenue sources will total an estimated 98 14 billion Of this amount exemptions related to state taxes included in the Homeowners or prospective buyers in Texas probably have heard of the state s homestead exemptions which affect property taxes However as useful as the exemption can be it is important

Want to know who is exempt from paying property taxes in Texas There are several property tax exemptions in Texas for which taxpayers may be eligible Find out who qualifies in this article Do You Qualify for a Property Tax Exemption If you are a homeowner don t pay more than you should for your property taxes Contact NTPTS to see if you qualify for a

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

Texas Fillable Tax Exemption Form Fill Out And Sign Printable PDF

https://www.exemptform.com/wp-content/uploads/2022/08/tax-exempt-form-fill-out-and-sign-printable-pdf-template-signnow-5.png

https://texaslawhelp.org › article › property-taxes

You are eligible for a home stead exemption if you 1 own your home partial ownership counts 2 the home is your principal residence and 3 you have a Texas driver s

https://www.texasrealestatesource.com › bl…

Texas residents are eligible for a standard 100 000 homestead exemption from public school districts as of November 2023 which can be applied for via an Application for Residential Homestead Exemption and once

2023 Sales Tax Exemption Form Texas ExemptForm

York County Sc Residential Tax Forms Homestead Exemption CountyForms

Homestead Exemption Form Fill Out Sign Online DocHub

Tax Letter Template Format Sample And Example In PDF Word

Illinois Tax Exemption Form

Texas Sales Tax Exemption Certificate PDF Form FormsPal

Texas Sales Tax Exemption Certificate PDF Form FormsPal

Jefferson County Property Tax Exemption Form ExemptForm

Who Qualifies For Tax Exemption Top 10 Best Answers

Texas Homestead Tax Exemption Form ExemptForm

Who Qualifies For Property Tax Exemption In Texas - Residents are also entitled to a number of Texas property tax exemptions These exemptions can reduce your taxable property value resulting in a lower annual property tax