Who Qualifies For Residential Energy Credit You can be entitled to a tax credit if electricity expenses are high in your permanent home The credit is a temporary measure in response to increased prices Only the expenses for January February March and April 2023 will qualify How much is the credit If the total 4 month cost exceeds 2 000 you are entitled to the tax credit

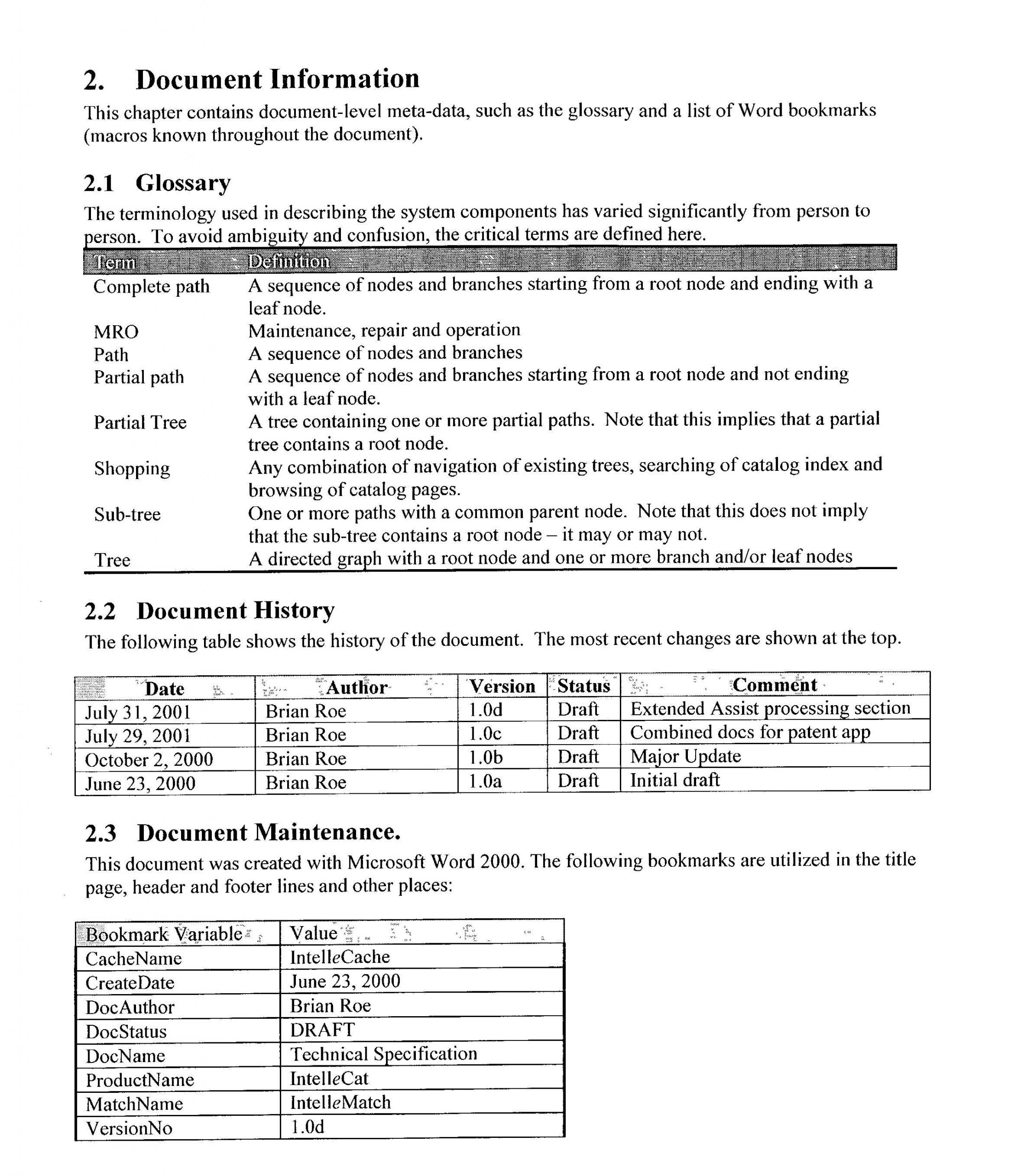

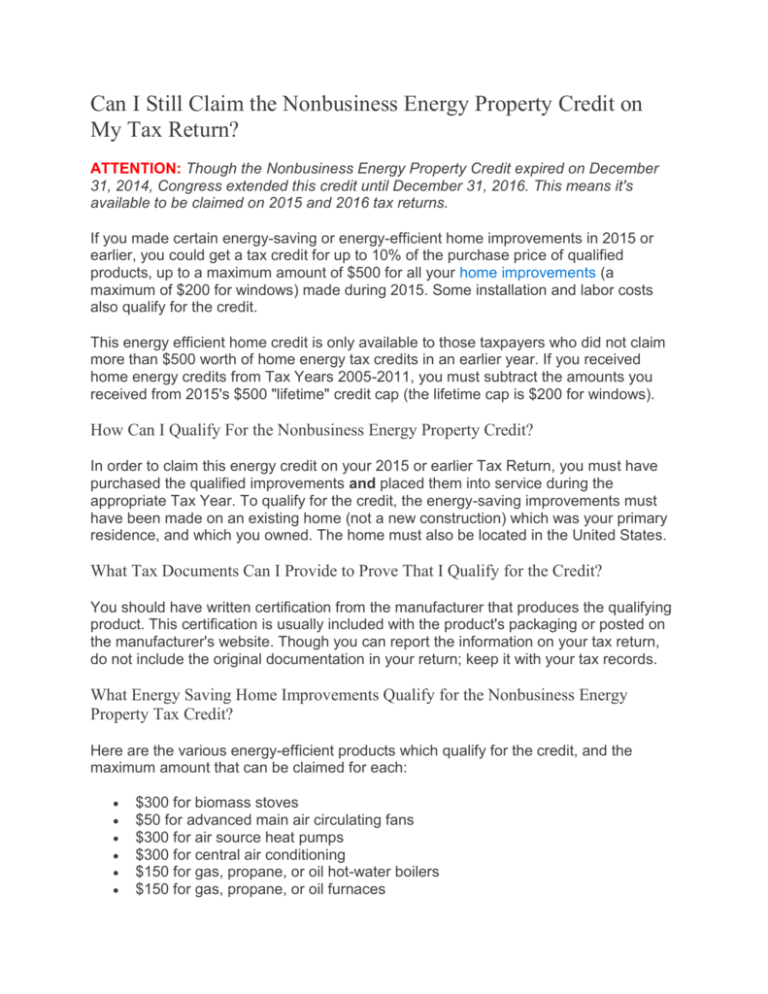

In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500 The residential clean energy property credit is a 30 percent credit for certain qualified expenditures made by a taxpayer for residential energy efficient property The IRA extended the residential clean energy property credit through 2034 modified the applicable credit percentage rates and added battery storage technology as an eligible

Who Qualifies For Residential Energy Credit

Who Qualifies For Residential Energy Credit

https://s3media.angieslist.com/s3fs-public/HOUSE-~1.jpeg

What You Need To Know About Energy Efficient Property Credits

https://tax.thomsonreuters.com/blog/wp-content/uploads/sites/17/2022/11/AdobeStock_440097569-scaled.jpeg

Coming Soon New Residential Energy Credit On The Mark Tax Service

https://otmtax.com/wp-content/uploads/2023/01/gamechanger-1024x576.jpg

Introducing a fixed term tax credit for electricity Temporary assistance with electricity costs from Kela Lump sum reimbursement for electricity costs Lump sum reimbursement for housing companies electricity costs Extending the payment period for electricity bills In general the residential clean energy property credit is a 30 credit for certain qualified expenditures made by a taxpayer for residential energy efficient property during a year The credit rate of 30 now applies to property placed in service after Dec 31 2021 and before Jan 1 2033

Residential Clean Energy Credit The Residential Clean Energy RCE Credit is a renewable energy tax credit extended and expanded by the 2022 Inflation Reduction Act The credit is worth 30 of certain qualified expenses for residential clean energy property The Residential Energy Credit also referred to as the Residential Clean Energy Credit RCE is an IRS tax credit offered to eligible taxpayers who install qualifying clean energy property into their homes between 2022 and 2023 The RCE credit is worth 30 of the qualified expenses involved in the qualified property installation

Download Who Qualifies For Residential Energy Credit

More picture related to Who Qualifies For Residential Energy Credit

E Leclerc Livraison Nouveau Maitre D Resume Hello Master Salon Jardin

https://www.1redpaperclip.com/wp-content/uploads/2020/01/e-leclerc-livraison-nouveau-maitre-d-resume-hello-master-de-e-leclerc-livraison-scaled.jpg

Commercial Solar In Georgia Commercial Solar Installation

https://www.altenergyse.com/images/Gallery/Roof-Mount-Commercial/REI.2001291943193.jpg

Who Qualifies For Business Credit Cards YouTube

https://i.ytimg.com/vi/PKi4fkIJtec/maxresdefault.jpg

Who Qualifies Homeowners investing in energy efficiency and clean energy can benefit from these credits Specifically the enhancements must be made to a residence in the United States and used as a primary or secondary home by the taxpayer The maximum credit for residential energy property costs is 50 for any advanced main air circulating fan 150 for any qualified natural gas propane or oil furnace or hot water boiler and 300 for any item of ener gy eficient building property

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings Jackson Hewitt IRS Forms Form 5695 IRS FORMS FORM 5695 Claiming Residential Energy Credits with Form 5695 Jo Willetts EA Director Tax Resources Published on February 26 2021 Share on social What is IRS Form 5695 Learn about claiming residential energy credits using Form 5695 here What is Form

Beneficiary Designation Vs Will Huizenga Law Firm P C

https://huizengalaw.com/wp-content/uploads/91710136-scaled.jpg

Who Qualifies For A Business Credit Card The Points Guy

https://thepointsguy.global.ssl.fastly.net/us/originals/2019/02/GettyImages-968890648.jpg?width=3840

https://www.vero.fi/.../tax-credit-for-electricity

You can be entitled to a tax credit if electricity expenses are high in your permanent home The credit is a temporary measure in response to increased prices Only the expenses for January February March and April 2023 will qualify How much is the credit If the total 4 month cost exceeds 2 000 you are entitled to the tax credit

https://www.irs.gov/newsroom/energy-incentives-for...

In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500

2023 Residential Clean Energy Credit Guide ReVision Energy

Beneficiary Designation Vs Will Huizenga Law Firm P C

Who Qualifies For A Business Credit Card The Points Guy

Residential Energy Credits

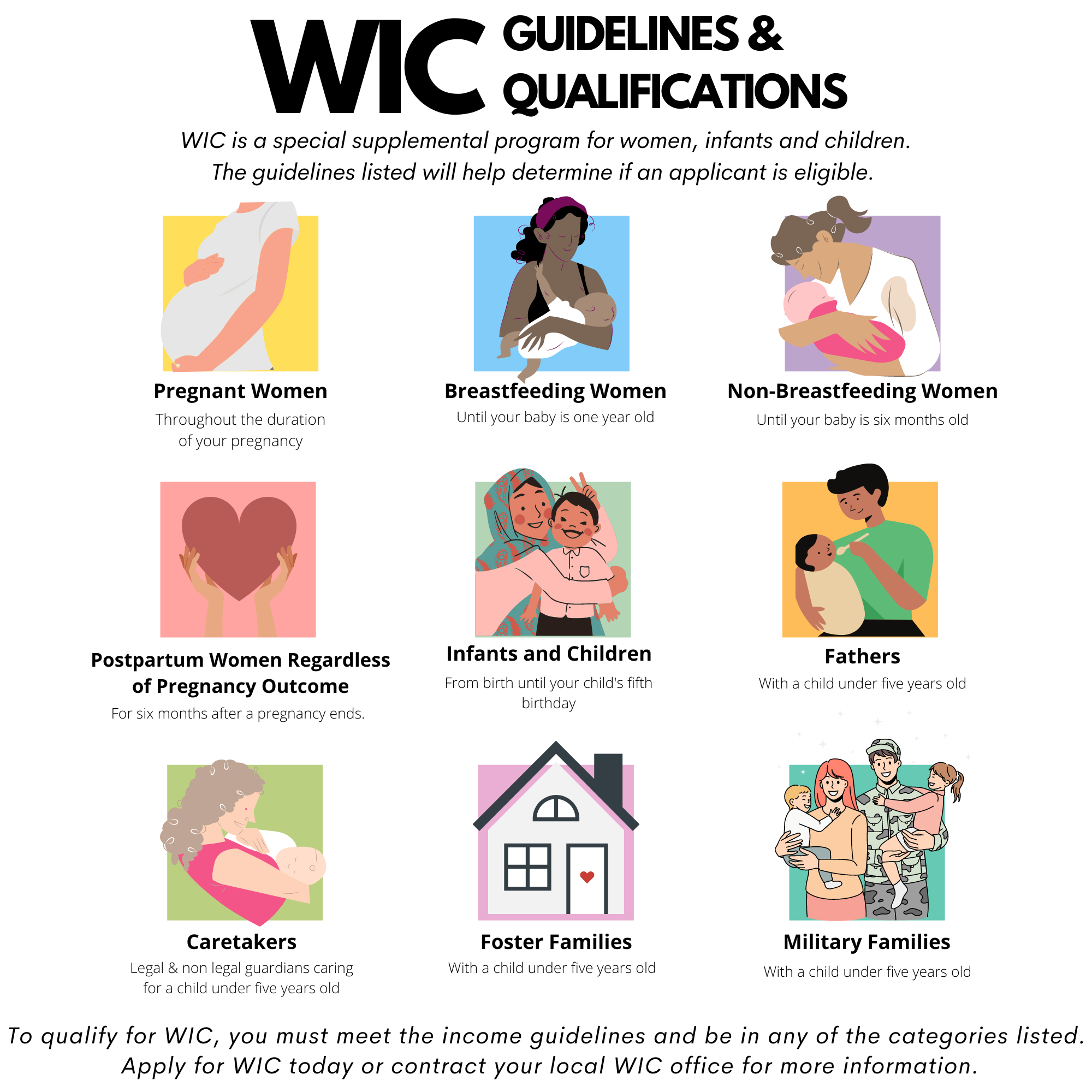

Who Qualifies For WIC Riverside University Health System

Residential Energy Credit Application 2024 ElectricRate

Residential Energy Credit Application 2024 ElectricRate

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

IRS Form 5695 Instructions Residential Energy Credits

TaxprepSmart How To Claim Residential Energy Credits

Who Qualifies For Residential Energy Credit - The Residential Energy Credit also referred to as the Residential Clean Energy Credit RCE is an IRS tax credit offered to eligible taxpayers who install qualifying clean energy property into their homes between 2022 and 2023 The RCE credit is worth 30 of the qualified expenses involved in the qualified property installation