Who Qualifies For The Home Accessibility Tax Credit A qualifying individual is one of the following an individual who is eligible for the disability tax credit DTC at any time in the year an individual who is 65 years of age or older at

Who is eligible for the Home Accessibility Tax Credit To be eligible for the Home Accessibility Tax Credit HATC one must either be a qualifying individual or an A qualifying individual is an individual who is eligible to claim the disability tax credit at any time in a tax year or an individual who is sixty five years of age or older at the end of a

Who Qualifies For The Home Accessibility Tax Credit

Who Qualifies For The Home Accessibility Tax Credit

https://fbc.ca/wp-content/uploads/2017/11/canstockphoto17260651.jpg

Home Accessibility Expense Tax Credit Explained By Canwest Accounting

https://canwestaccounting.ca/wp-content/uploads/2021/07/Home-Accessibility-Expense-Tax-Credit-Explained-1799x899.jpg

How To Benefit From Home Accessibility Tax Credit YouTube

https://i.ytimg.com/vi/TtNpIzySPoY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYZSBWKEcwDw==&rs=AOn4CLAboZTvtUFdDQM6saKbFtmsjlnA8Q

To see if your home qualifies for the Home Accessibility Tax Credit here are a few simple guidelines Location The home must be in Canada and include dwellings such as a If you re renovating your home to make it more accessible for someone who is elderly or has disabilities you could qualify for a tax credit Learn more

The Home Accessibility Tax Credit HATC is a federal nonrefundable credit that currently allows qualifying 65 or older or those who qualify for the Disability Tax Credit Who Qualifies For The HATC Seniors aged 65 years or older as well as taxpayers who hold a valid DTC are considered qualified Qualified individuals may

Download Who Qualifies For The Home Accessibility Tax Credit

More picture related to Who Qualifies For The Home Accessibility Tax Credit

.jpg?format=1500w)

Physiotherapy Through Health Insurance The Physio Rooms

http://static1.squarespace.com/static/58b99323db29d62626985f16/59bf9f8fe5a68b0dd95e4f03/5bd3126eec212da02107accd/1554893822346/1+(30).jpg?format=1500w

VA Caregiver Program Application Eligibility Benefits Offered CCK Law

https://cck-law.com/wp-content/uploads/2021/05/Applying-for-VAs-Caregiver-Program-and-Requirements.jpg

ADU Grant Program CCS Inc Construction Consulting Services

https://www.laconstructioncompliance.com/wp-content/uploads/2022/09/ADU-Grant-Program.jpg

The Home Accessibility Tax Credit is a non refundable tax credit introduced in the Federal 2015 Budget The credit is for qualifying expenses incurred in 2016 or later for The Home Accessibility Tax Credit helps seniors and persons with disabilities finance home renovations for improved safety and accessibility Eligibility for

The Home Accessibility Tax Credit HATC is a non refundable federal tax credit for renovations and alterations that make a dwelling more accessible Who is eligible A The Home Accessibility Tax Credit is for eligible individuals with disabilities qualified for the canadian disability tax credit and people who are 65 years of age or

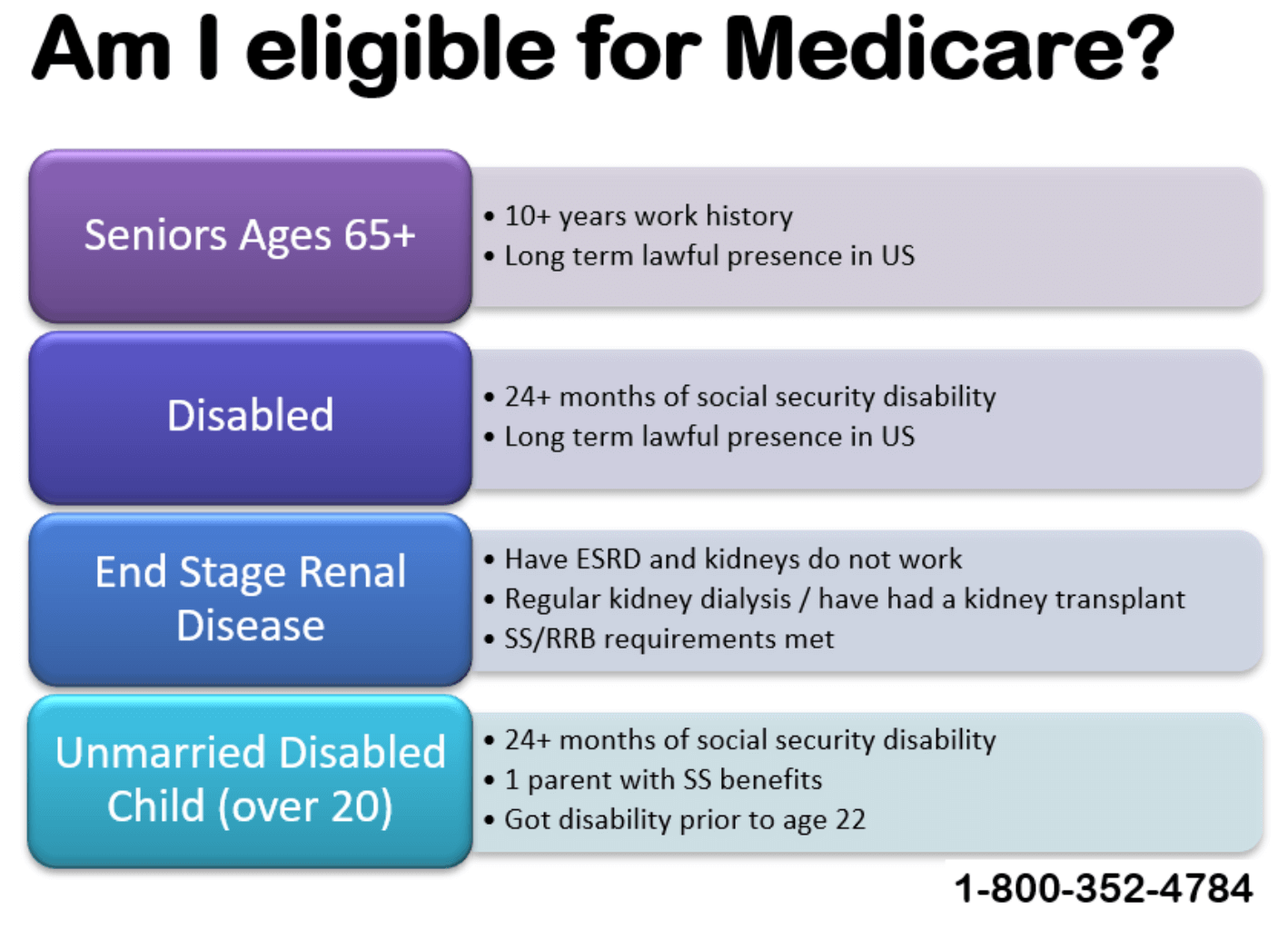

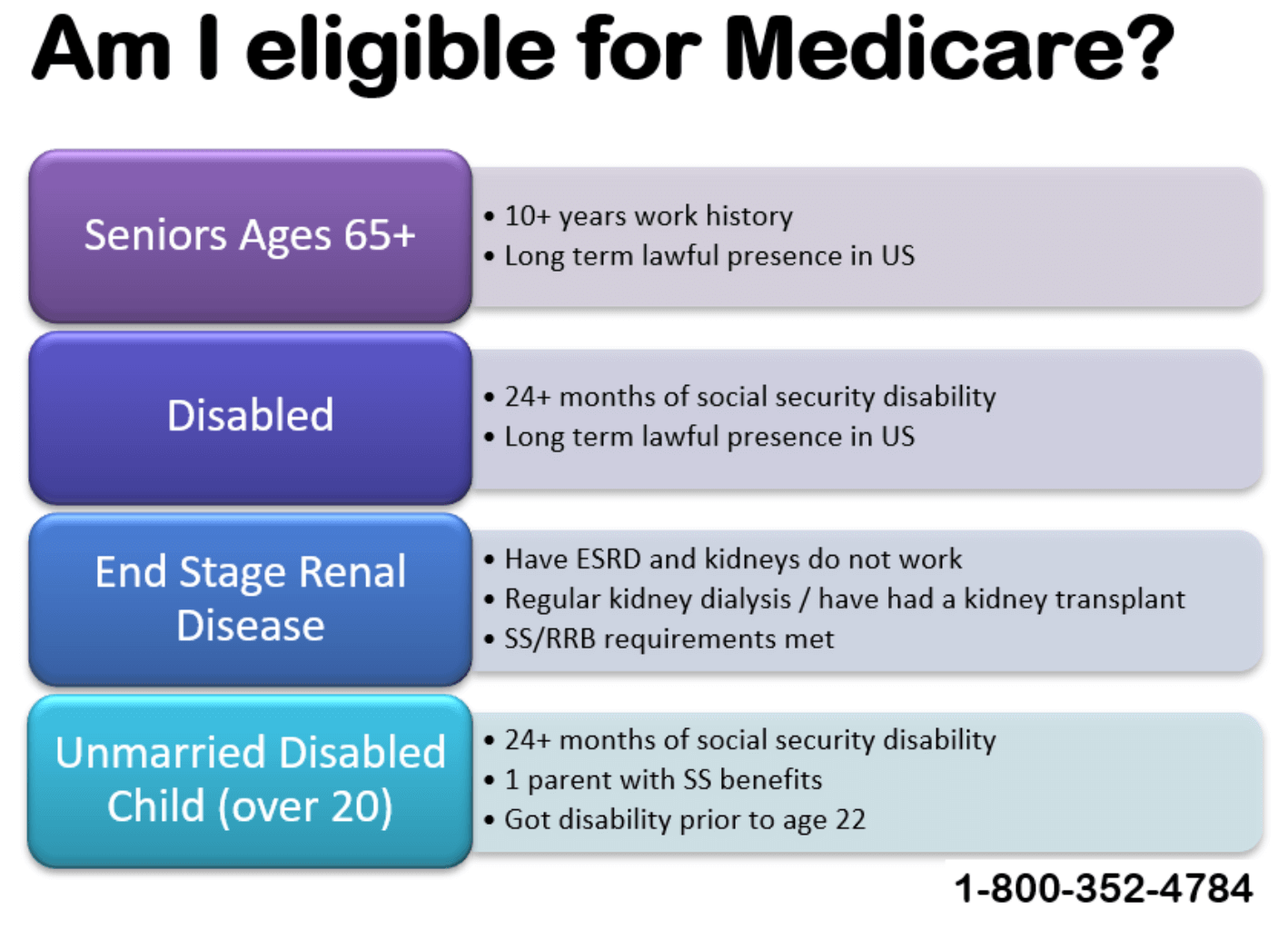

When Am I Eligible For Medicare Insurance

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/medicare-eligibility.png

Senior Home Accessibility Tax Credit A New Article By Still CPA

https://i0.wp.com/stillcpa.ca/wp-content/uploads/2021/10/senior-home-accessibility-tax-credit.jpg?w=795&ssl=1

https://www.canada.ca/en/revenue-agency/services/...

A qualifying individual is one of the following an individual who is eligible for the disability tax credit DTC at any time in the year an individual who is 65 years of age or older at

https://goodcaring.ca/explainers/home-accessibility-tax-credit-hatc

Who is eligible for the Home Accessibility Tax Credit To be eligible for the Home Accessibility Tax Credit HATC one must either be a qualifying individual or an

Income Tax Preparation Northern Rebates

When Am I Eligible For Medicare Insurance

Is It Worth It Medicare Savings Program Questions Answered SC Thrive

How Can You Claim Home Accessibility Tax Credit HATC In Canada

Who Qualifies For A Business Credit Card Flipboard

How Can You Claim Home Accessibility Tax Credit HATC In Canada

How Can You Claim Home Accessibility Tax Credit HATC In Canada

Earned Income Tax Credit EITC Who Qualifies

Primary Care Providers SCI Healthcare Resources American Spinal

Home Accessibility Tax Credit Throughout Canada Home Mortgage Home

Who Qualifies For The Home Accessibility Tax Credit - To qualify for the HATC individuals must meet one of the following conditions Be eligible for the disability tax credit Be 65 years of age or older Be an