Who Qualifies For The Recovery Rebate Credit Most eligible people already received their stimulus payments and won t be eligible to claim a Recovery Rebate Credit People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return

People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim a Recovery Rebate Credit even if they don t usually file Economic Impact Payments were based on 2018 or 2019 tax year information Must be a U S citizen or U S resident alien in 2020 Cannot have been a dependent of another taxpayer in 2020 Must have a Social Security number that is valid for employment before the 2020 tax return due date Did not receive the full amount of the credit through an Economic Impact Payment

Who Qualifies For The Recovery Rebate Credit

Who Qualifies For The Recovery Rebate Credit

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/de418507-0277-4b17-89a7-765557117ca4.default.png

2021 Recovery Rebate Credit DC Accounting

https://dcaccountingpa.com/wp-content/uploads/2022/01/Rebate.jpg

Recovery Rebate Credit How To Apply And Who Qualifies YouTube

https://i.ytimg.com/vi/AeQXuigtZmw/maxresdefault.jpg

To be eligible for the credit you must have Been a U S citizen or U S resident alien in 2020 and or 2021 Not have been a dependent of another taxpayer for tax years 2020 and or 2021 Had a 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax Return or Form 1040

Banking Investing Insurance Credit Cards Loans Mortgages Money Smarts If you did not receive all the COVID 19 pandemic economic stimulus payments in 2020 or 2021 you may still be able to file for payments through the Recovery Rebate Credit The qualifying child was age 17 or older on January 1 2020 Math errors relating to calculating adjusted gross income and any EIPs already received IRS gov has a special section Correcting Recovery Rebate Credit issues after the 2020 tax return is filed that provides additional information explaining what errors may have occurred

Download Who Qualifies For The Recovery Rebate Credit

More picture related to Who Qualifies For The Recovery Rebate Credit

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

Bravecto Online Rebate 2022 Rebate2022 Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2022/11/bravecto-online-rebate-2022-rebate2022-2.png

You may qualify for the 2021 Recovery Rebate Credit if you never received the third stimulus payment last year or didn t receive the full amount Recovery Rebate Credit eligibility depends on the following requirements You can t be claimed as a dependent of another taxpayer If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Featured Partner Offers

The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim the RRC on your 2020 Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Tax Return for Seniors Eligibility for the Recovery Rebate Credit The eligibility rules for the recovery rebate credit are basically the same as they were for third round stimulus checks

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/the-recovery-rebate-credit-get-your-full-stimulus-check-payment-with-1.jpg

How To File Recovery Rebate Credit Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-1.png

https://www.irs.gov/newsroom/recovery-rebate-credit

Most eligible people already received their stimulus payments and won t be eligible to claim a Recovery Rebate Credit People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return

https://www.irs.gov/newsroom/check-your-recovery...

People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim a Recovery Rebate Credit even if they don t usually file Economic Impact Payments were based on 2018 or 2019 tax year information

What Is The Recovery Rebate Credit And Do You Qualify The

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

Recovery Rebate Credit Questions Answers

What You Need To Know About Filling Out Your Recovery Rebate Credit

Recovery Credit PrintableRebateForm

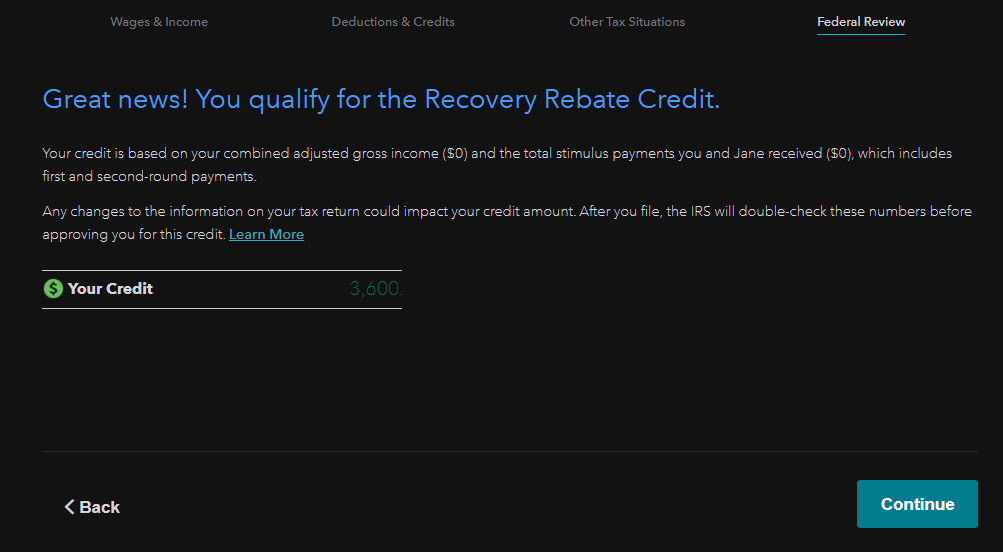

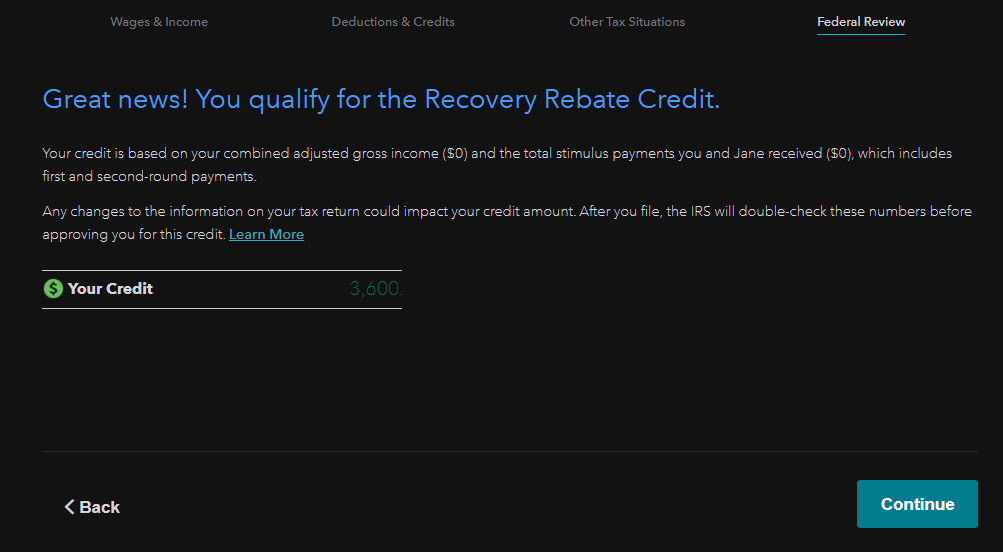

How To Claim Stimulus Recovery Rebate Credit On TurboTax

How To Claim Stimulus Recovery Rebate Credit On TurboTax

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax

IRS Ends Up Correcting Tax Return Mistakes For Recovery Rebate Credit

IRS Letters Explain Why Some 2020 Recovery Rebate Credits Are Different

Who Qualifies For The Recovery Rebate Credit - Who qualifies for the Recovery Rebate Credit Generally your clients are eligible for the credit if in 2021 they were a U S citizen or resident alien weren t a dependent of another taxpayer and have a valid social security number This includes taxpayers who died in