Why Does California Have High Income Tax If you live in California you likely pay plenty of state taxes particularly state income tax to the California Franchise Tax Board The top California income tax rate has been

Income taxes account for three quarters of California s general fund revenues and the top 1 of California taxpayers generate nearly half of those taxes That s just 150 000 taxpayers in a state of 40 million so even a For many in the middle class and below California may let you keep more of your hard earned income than many other states according to a new study Who Pays from the Institute on Taxation

Why Does California Have High Income Tax

Why Does California Have High Income Tax

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

Tax Payment Which States Have No Income Tax Marca

https://phantom-marca.unidadeditorial.es/7f630bcfa3cc4f2b33db1ffa28dd66ab/resize/1200/f/jpg/assets/multimedia/imagenes/2023/02/05/16756118713316.jpg

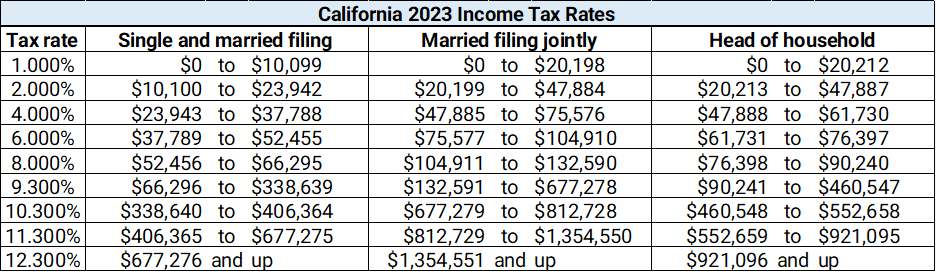

California has nine state income tax rates ranging from 1 to 12 3 Your tax rate and bracket depend on your income and filing status California s top tier income tax rate is the highest in the nation at 13 3 percent according to the Tax Foundation and California Taxpayers Association It s the rate paid by Californians

California has some of the nation s highest income tax rates on top earners but the state exempts a large share of the population from the income tax and its property and sales California s income tax adds a millionaire s tax a 1 surcharge to incomes of 1 million The state s sales tax was the highest in the nation in 2021 at 7 25 California s property taxes are less harsh with an effective

Download Why Does California Have High Income Tax

More picture related to Why Does California Have High Income Tax

/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)

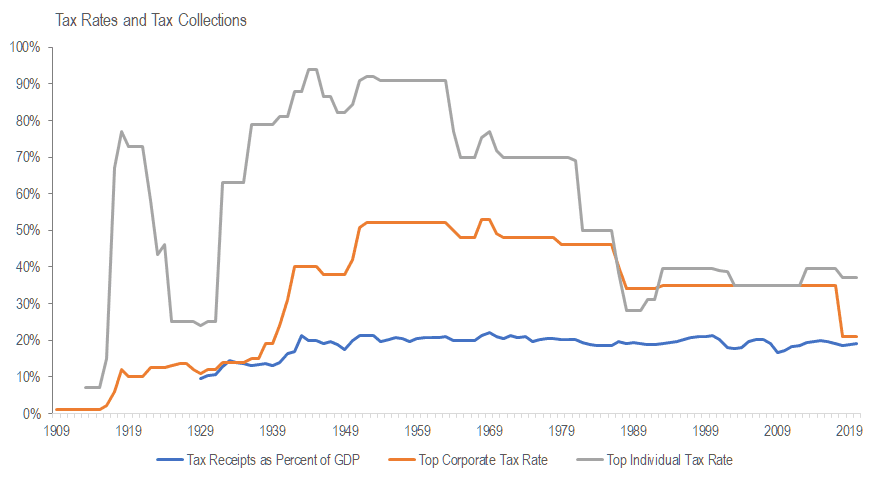

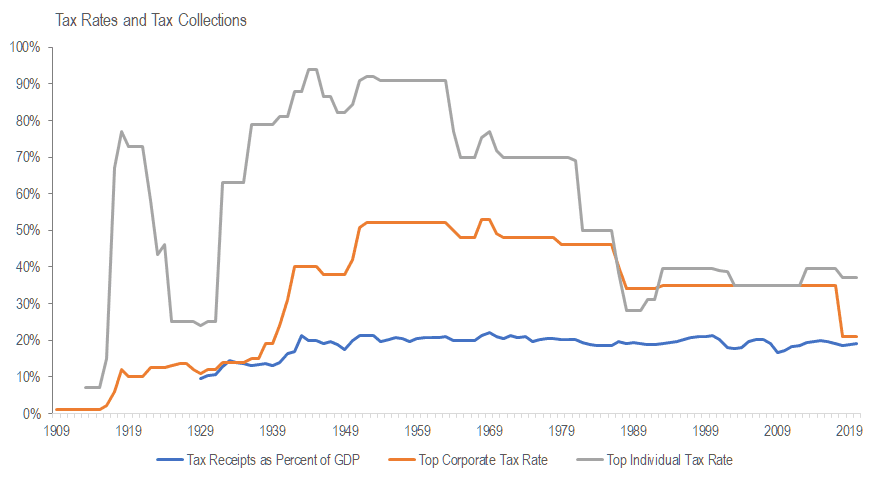

A Brief History Of Taxes In The U S

https://www.investopedia.com/thmb/cHigOcnY9JPQ4CjU4oshzsrEVm4=/2152x1393/filters:fill(auto,1)/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg

Get To Know California Income Tax Brackets Turbo Tax

https://www.bookstime.com/wp-content/uploads/2022/07/shutterstock_1150614920.webp

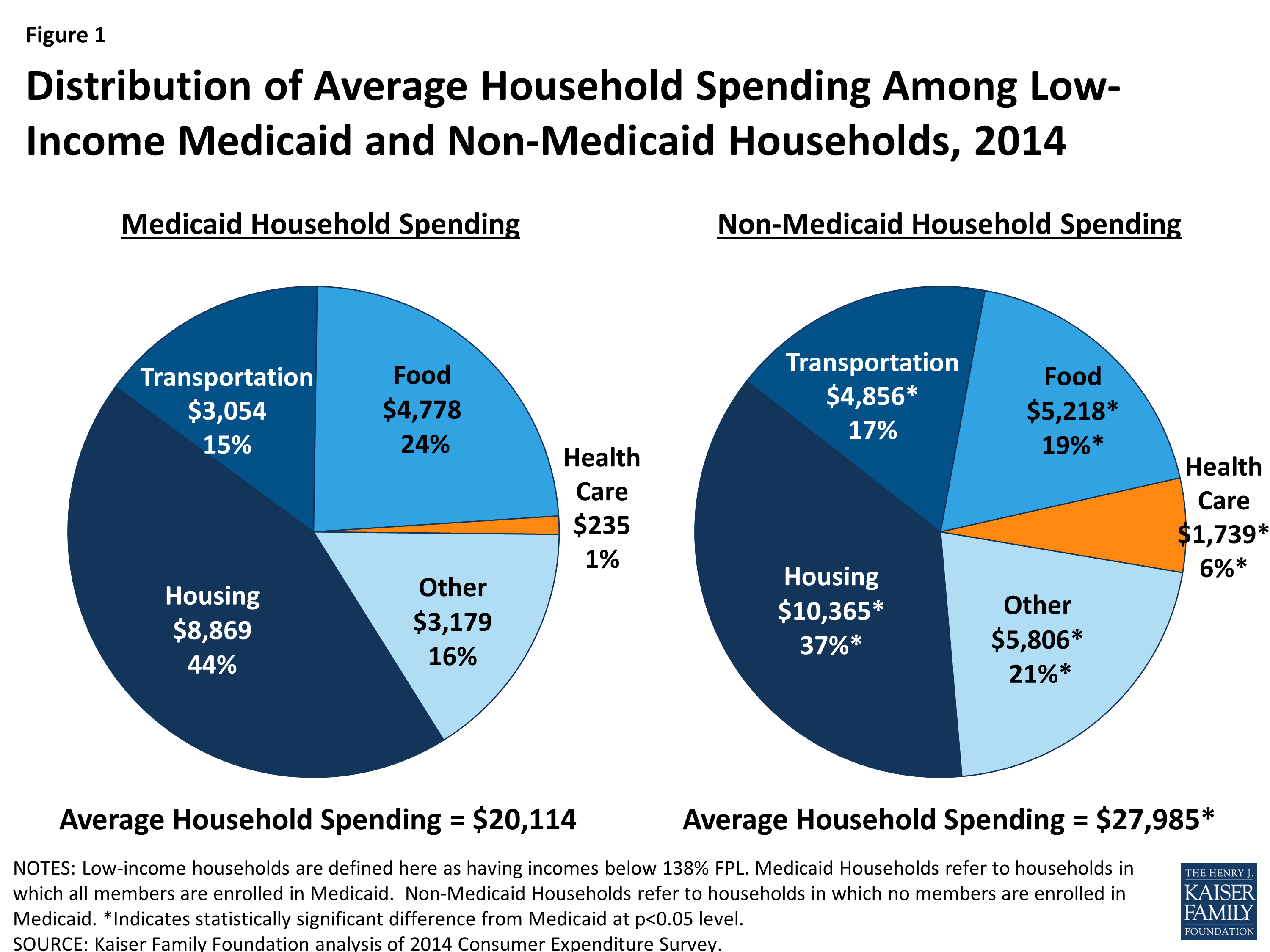

Health Care Spending Among Low Income Households With And Without

https://www.kff.org/wp-content/uploads/2016/02/8832-figure-1.png?resize=698

State policymakers can make the tax and revenue system more equitable by strengthening taxation of Californians with high incomes and wealth while providing more support to Californians with low incomes and Californians of Explore California tax increases including California Proposition 30 and a proposed windfall profits tax California is no stranger to high taxes and the state has enough going for it that its economy can withstand higher

The payroll tax expansion increases the state s top income tax bracket from 13 3 to 14 4 The new 14 4 tax rate applies to income over 1 million That exceeds other notoriously The 14 4 rate is a combination of the highest marginal tax bracket mental health tax and now uncapped state disability insurance which is a payroll tax

Income Tax Rates And Taxes Paid

https://www.wichitaliberty.org/wp-content/uploads/2021/06/Income-tax-rates-and-taxes-paid-2020.png

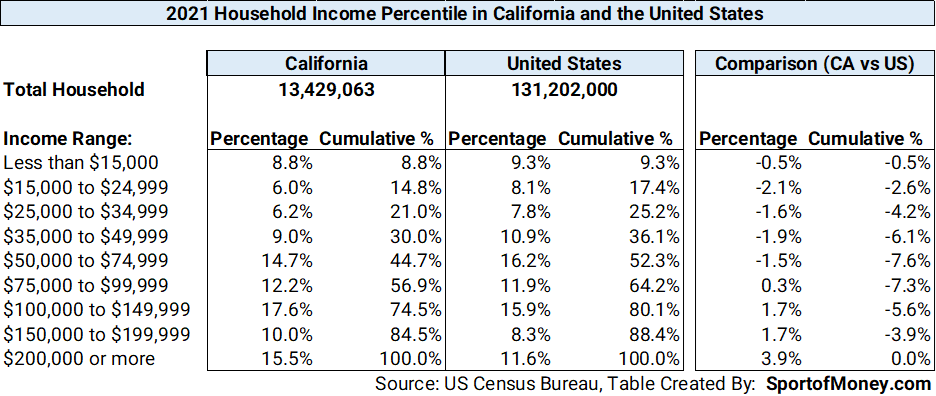

Average Income In California What Salary Puts You In The Top 50 Top

https://www.sportofmoney.com/wp-content/uploads/2022/12/California-2023-Income-Tax-Rates.png

https://www.forbes.com/sites/robertwood/2…

If you live in California you likely pay plenty of state taxes particularly state income tax to the California Franchise Tax Board The top California income tax rate has been

https://calmatters.org/commentary/2022/08/...

Income taxes account for three quarters of California s general fund revenues and the top 1 of California taxpayers generate nearly half of those taxes That s just 150 000 taxpayers in a state of 40 million so even a

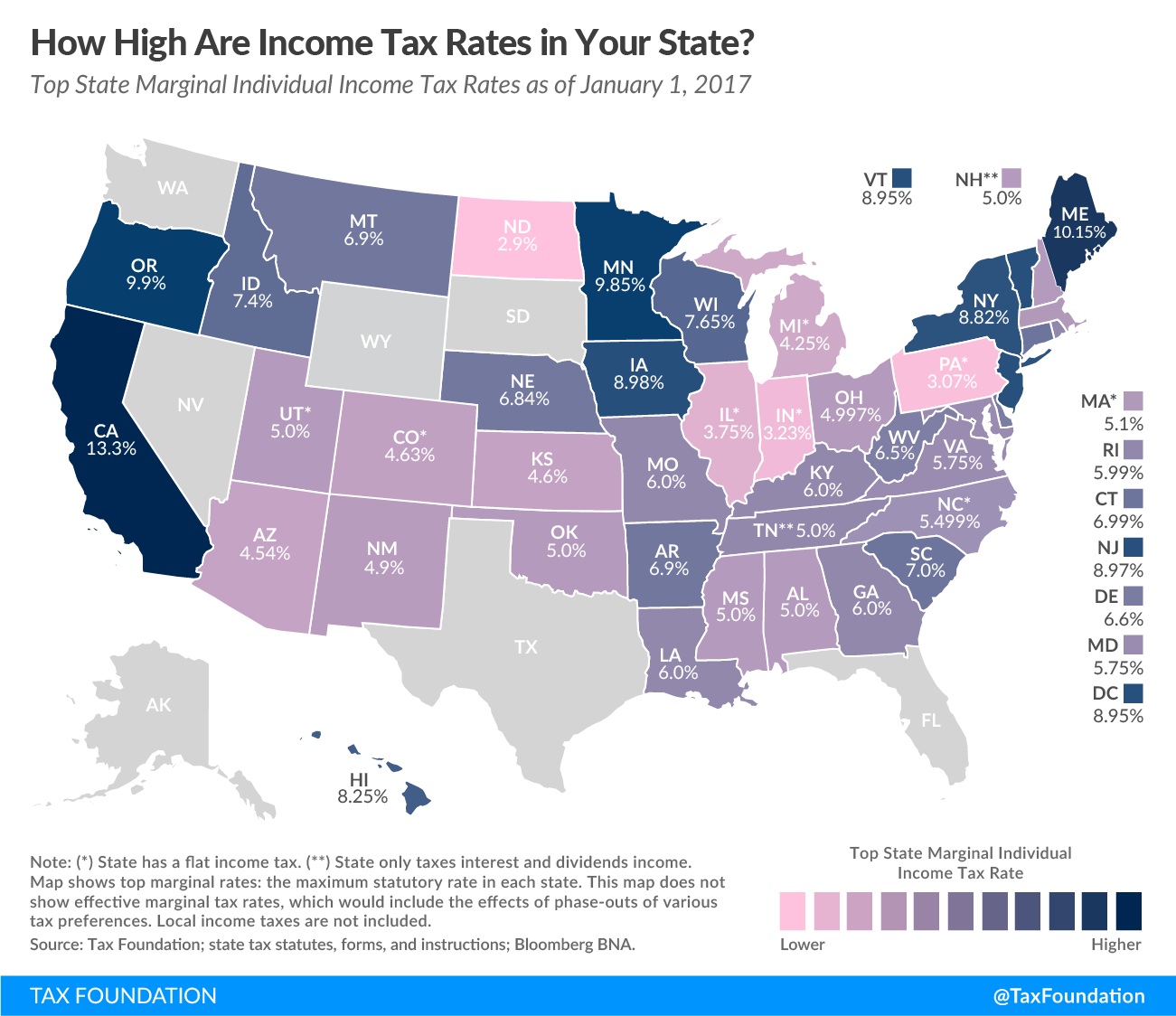

State Individual Income Tax Rates And Brackets 2017 Tax Foundation

Income Tax Rates And Taxes Paid

Comparing Texas And California Taxes One Side Seems Determined To Lose

Which States Have The Highest And Lowest Income Tax USAFacts

Five Most Serious Offences Under The Income Tax Act

Phineas Baxandall Mass Budget And Policy Center

Phineas Baxandall Mass Budget And Policy Center

Graph Of The Week World s Highest Tax Rates

Average Income In California What Salary Puts You In The Top 50 Top

Marxist Oder Auch Dilemma Overall Tax Burden Kosten Western Rostfrei

Why Does California Have High Income Tax - California has a progressive income tax where the state s top earners pay at a higher rate and provide a bulk of that tax revenue Over the years income taxes have