Wisconsin Child Tax Credit 2022 The measure signed by Evers will allow Wisconsinites to claim up to 100 percent of the federal tax credit for child and dependent care on their state taxes starting in the 2024 tax year

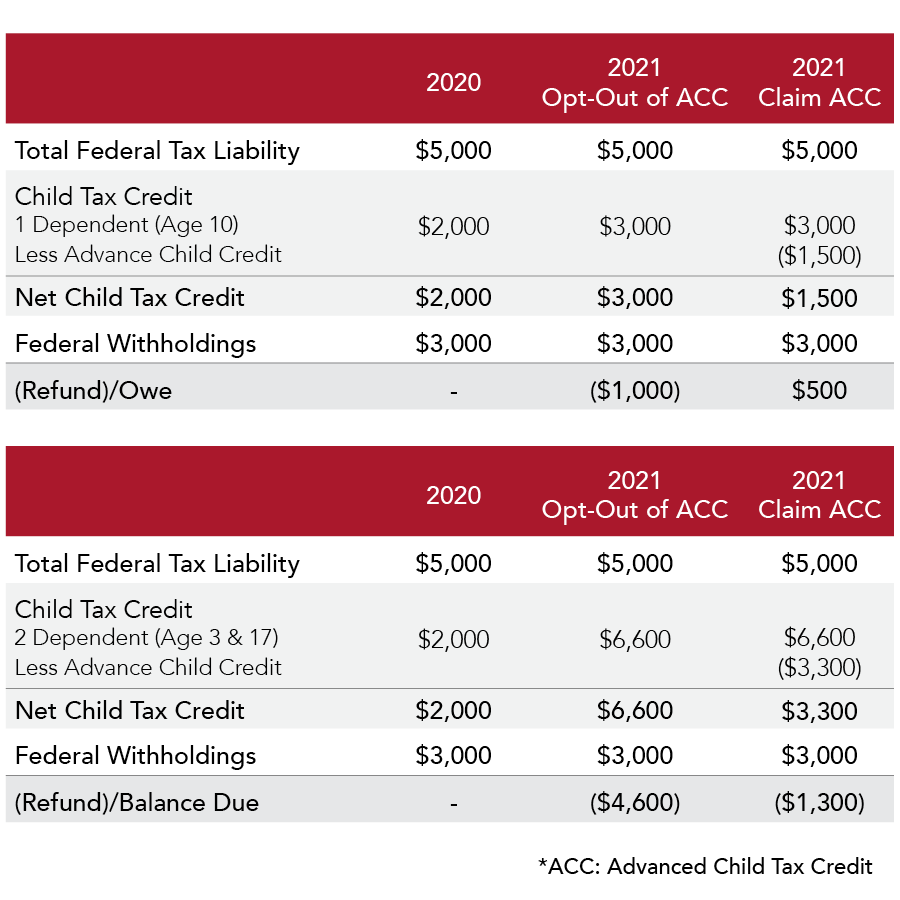

You may be eligible to receive up to 3 000 per dependent child aged 6 17 and 3 600 per child younger than 6 This tax credit directly reduces the amount of income tax you owe and was A qualifying child is your child step child grandchild niece nephew sibling or authorized foster child For the EiTC children must be under 19 at the end of 2022 or under 24 if fulltime

Wisconsin Child Tax Credit 2022

Wisconsin Child Tax Credit 2022

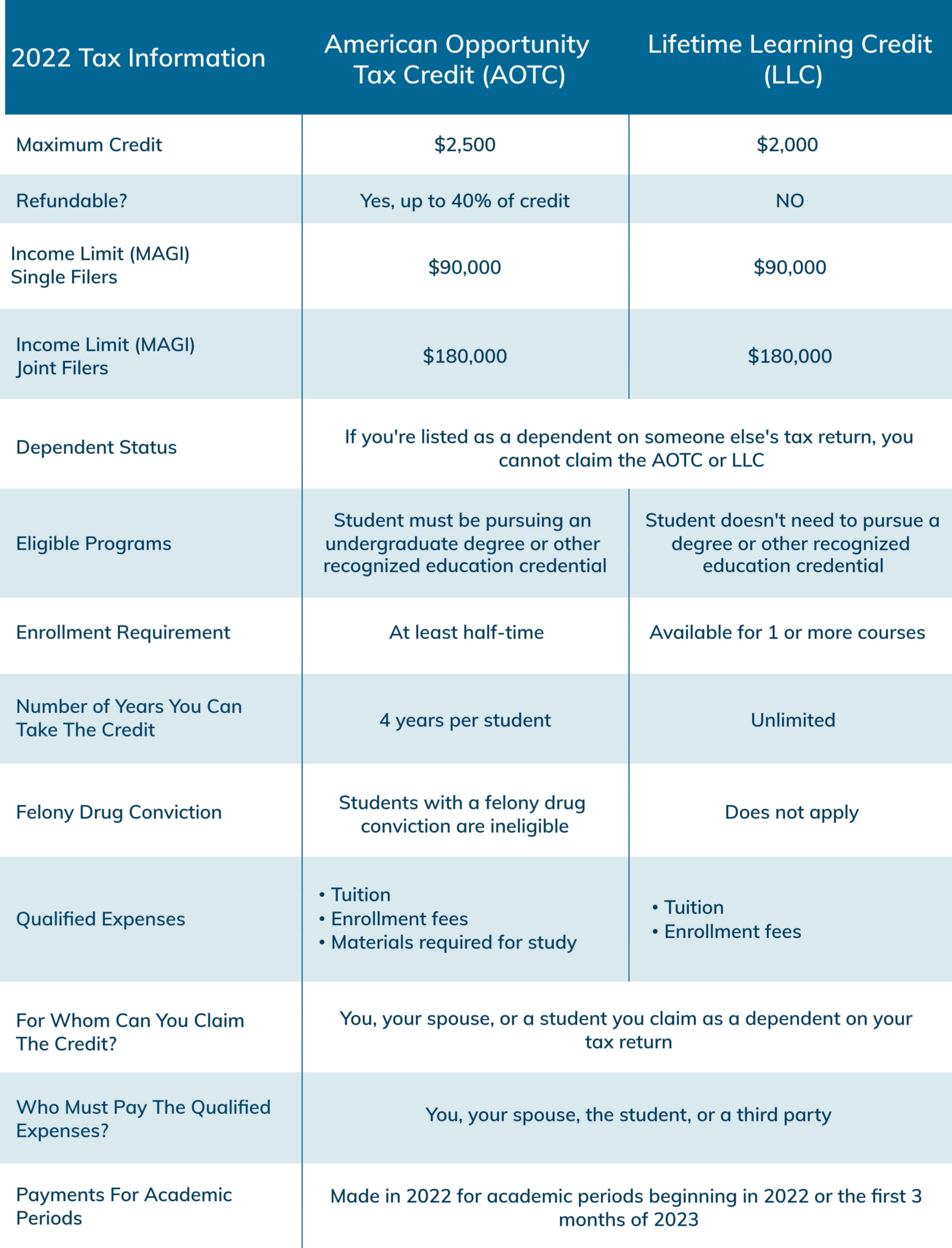

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

Child Tax Credit 2022 Schedule Payments

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

2022 Child Tax Credit Dates Latest News Update

https://i2.wp.com/images.sampleforms.com/wp-content/uploads/2016/10/Child-Tax-Credit-Form.jpg

There is a new Wisconsin child and dependent care tax credit in 2022 that is based on the federal child and dependent care tax credit reported on your federal tax return For the first time younger ages 19 24 and older 65 and over workers without dependent children in Wisconsin are eligible for the EITC The expanded Child and Dependent Care Tax

You may be eligible for both Wisconsin and federal earned income tax credits if you worked any time in 2022 You may be able to get a combined total of state and federal credits up to Federal child and dependent care tax credit means the tax credit under section 21 of the Internal Revenue Code The credit must be claimed within 4 years of the unextended due date of the

Download Wisconsin Child Tax Credit 2022

More picture related to Wisconsin Child Tax Credit 2022

Child Tax Credit Going Up In 2022 Latest News Update

https://i2.wp.com/www.the-sun.com/wp-content/uploads/sites/6/2022/02/JF-US-CHILD-TAX-CREDIT-LIVE-02.jpg?w=1125

2023 Child Tax Credits Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/fb/source_images/child-tax-credits-form-irs-d1.png

What Is The New Child Tax Credit For 2022 A2022c

https://i2.wp.com/templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-02.jpg

Roughly 19 million children will no longer be eligible for the full credit in 2022 according to the Tax Policy Center a collaboration of the Urban Institute and the Brookings CHILD TAX CREDIT CTC Wisconsin does not currently offer a state level CTC Latest Legislative Action In 2018 Wisconsin enacted a one time Child Tax Rebate worth 100 per

The tax credits part of President Joe Biden s 1 9 trillion coronavirus relief program increased payments to up to 3 600 annually for each child age 5 or younger and 3 000 for Beginning in tax year 2022 state law provides a nonrefundable credit for child and dependent care expenses equal to 50 of the corresponding federal credit The state credit acts as a

Who Is Eligible For The Child Tax Credit In 2022 Leia Aqui Can You

https://assets1.cbsnewsstatic.com/hub/i/r/2022/10/06/209eb318-0f3a-4dbf-9578-8eb2fd86623b/thumbnail/1200x630/9610f6b65ef37866a629887f9006d07b/child-tax-credit.jpg

What Is The Child Tax Credit And How Much Of It Is Refundable

https://i0.wp.com/www.brookings.edu/wp-content/uploads/2021/01/Who-gets-the-Child-Tax-Credit-in-2020_by-income.png?w=768&crop=0%2C0px%2C100%2C9999px&ssl=1

https://www.wpr.org › news › evers-signs-b…

The measure signed by Evers will allow Wisconsinites to claim up to 100 percent of the federal tax credit for child and dependent care on their state taxes starting in the 2024 tax year

https://www.dhs.wisconsin.gov › dms › memos › ops

You may be eligible to receive up to 3 000 per dependent child aged 6 17 and 3 600 per child younger than 6 This tax credit directly reduces the amount of income tax you owe and was

5 Ways Will There Be Child Tax Credit For 2022 Outbackvoices

Who Is Eligible For The Child Tax Credit In 2022 Leia Aqui Can You

What To Know About The New Monthly Child Tax Credit Payments

2021 Child Tax Credit What Should I Know Collins Consulting

2022 Child Tax Credit Chart Latest News Update

What You Need To Know About The 2021 Child Tax Credit Pittman Legal

What You Need To Know About The 2021 Child Tax Credit Pittman Legal

Child Tax Credit 2021 Chart Child Tax Credit 2020 2021 How To

CHILDCTC The Child Tax Credit The White House

Child Tax Credit 2022 Brackets Latest News Update

Wisconsin Child Tax Credit 2022 - The tax credits part of President Joe Biden s 1 9 trillion coronavirus relief program increased payments to up to 3 600 annually for each child age 5 or younger and 3 000 for