Work From Home Rebate 2023 From the current tax year 2022 23 onwards employees who are eligible can still make a claim for tax relief for working from home The claim can be made in self

Updated October 19 2023 Important information Tax treatment depends on your individual circumstances and may be subject to future change Were you told by your employer to The CRA discontinued the flat rate method of claiming work from home expenses for the 2023 tax year Introduced in 2020 the temporary flat rate method

Work From Home Rebate 2023

Work From Home Rebate 2023

https://www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-iowa-energy-rebates-printable-rebate-form-from-bayer-rebates-2023-post.png

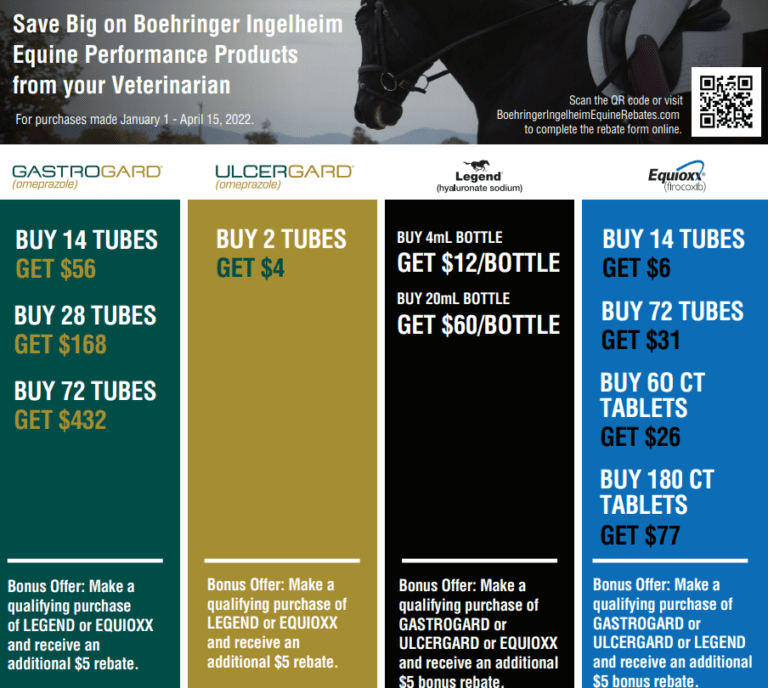

2023 Elanco Rebates Maximize Your Savings With Animal Health Products

https://www.elancorebates.net/wp-content/uploads/2023/04/2023-Elanco-Rebates-768x434.png

Alconchoice Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/01/Alconchoice.com-Rebate-2023-768x727.png

Can I claim working from home tax relief 2023 24 tax year Short answer Yes but beware that the eligibility criteria has changed Even if you were able to claim This page describes the recent changes to claiming work space in the home expenses Eligible employees who worked from home in 2023 will be required to use

Danielle Richardson Millions of workers were able to claim tax relief on expenses they incurred from working from home during the Covid 19 pandemic but Filing a 2023 tax year return or 2019 or prior year tax return Form T777S for 2020 2021 and 2022 only Use Option 2 Detailed method on Form T777S to claim

Download Work From Home Rebate 2023

More picture related to Work From Home Rebate 2023

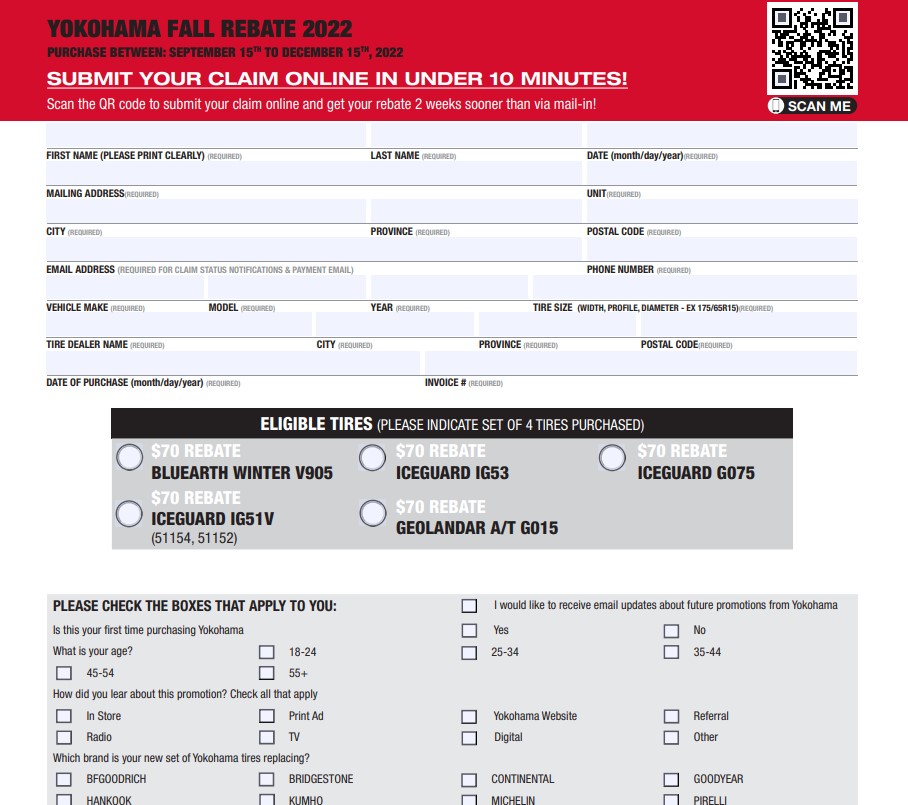

Yokohama Tire Rebate 2023 How To Qualify And Claim Your Rebate

https://www.tirerebate.org/wp-content/uploads/2023/03/Yokohama-Tire-Rebate-2023.jpg

2023 Equinox Rebates Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/01/Equioxx-Rebate-Form-2023-768x688.png

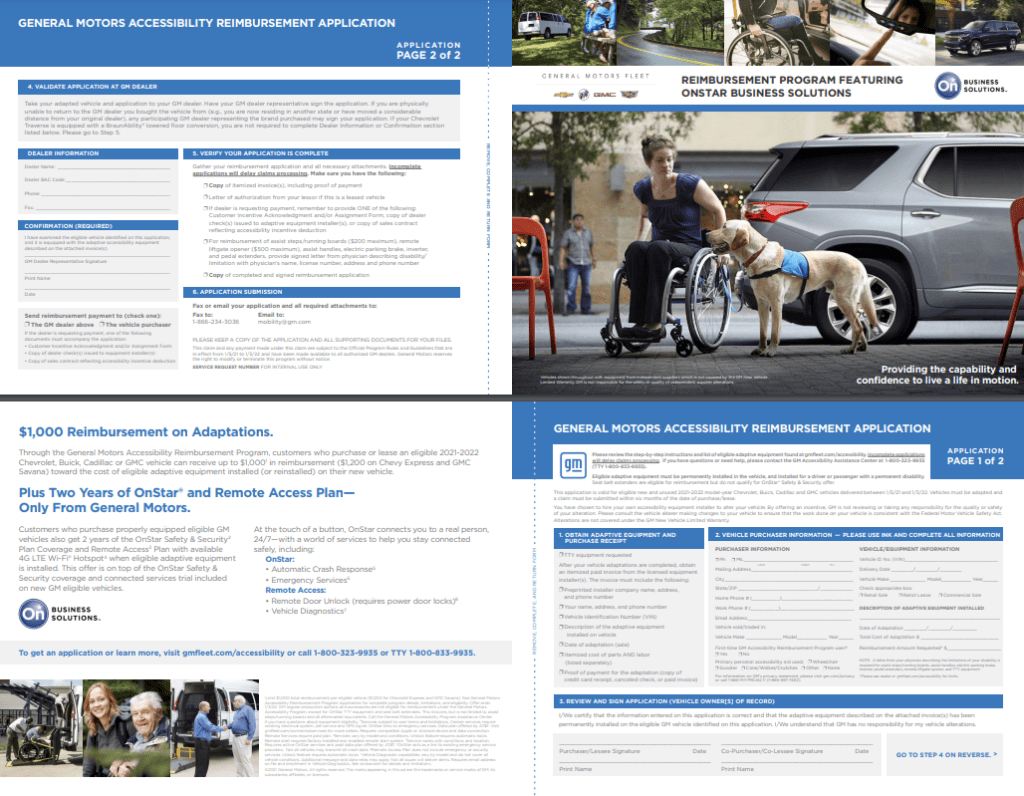

Save Money With GM Rebates 2023 General Motors Discounts Printable

https://printablerebateform.net/wp-content/uploads/2023/04/GM-Rebate-2023-1024x796.png

Published 13 May 2021 HM Revenue and Customs HMRC is accepting tax relief claims for working from home due to coronavirus during 2021 to 2022 More than 550 000 Home Office Tax Deduction Work from Home Write Offs for 2023 Can you claim the home office tax deduction this year

Written by Riley Adams CPA Reviewed by a TurboTax CPA Updated for Tax Year 2023 April 11 2024 5 00 PM OVERVIEW Since the 2018 tax reform at home expense However for the 2022 2023 tax year the working from home tax relief eligibility rules have changed The new rules state you can t claim tax relief if you choose to work from home

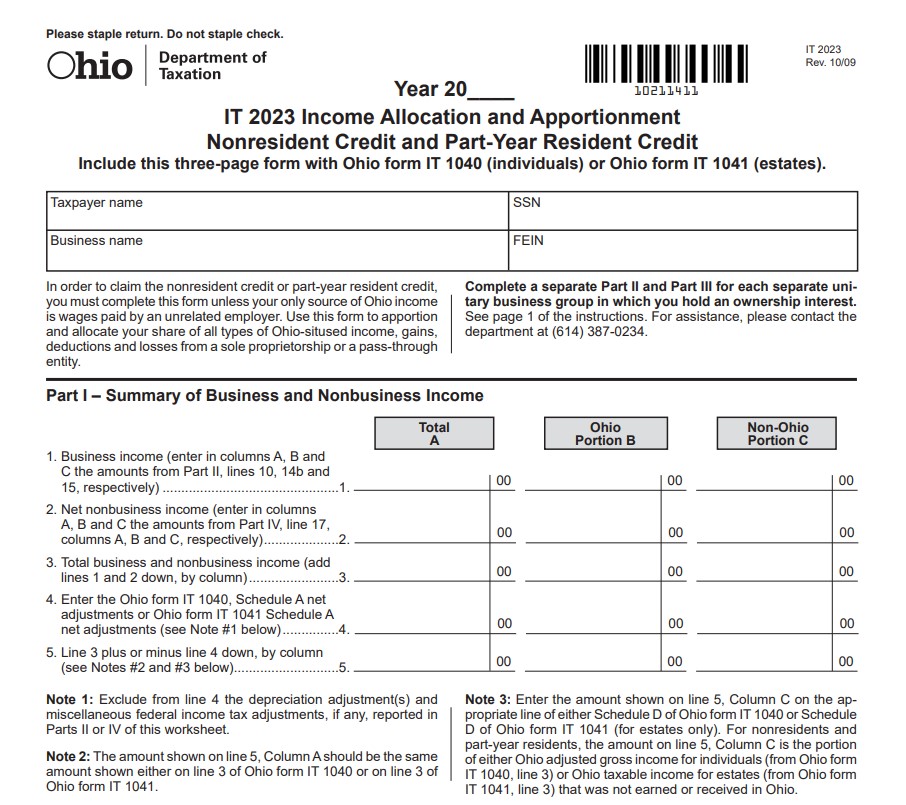

Aep Ohio Rebates 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Ohio-Renters-Rebate-2023.jpg

Winchester Spring Rebate 2023

https://cdn.bulkammo.com/media/promos/WIN_TARGET_RIFLE_MAY_2023.jpg

https://www.icaew.com/insights/tax-news/2023/jan...

From the current tax year 2022 23 onwards employees who are eligible can still make a claim for tax relief for working from home The claim can be made in self

https://www.thetimes.co.uk/money-mentor/income...

Updated October 19 2023 Important information Tax treatment depends on your individual circumstances and may be subject to future change Were you told by your employer to

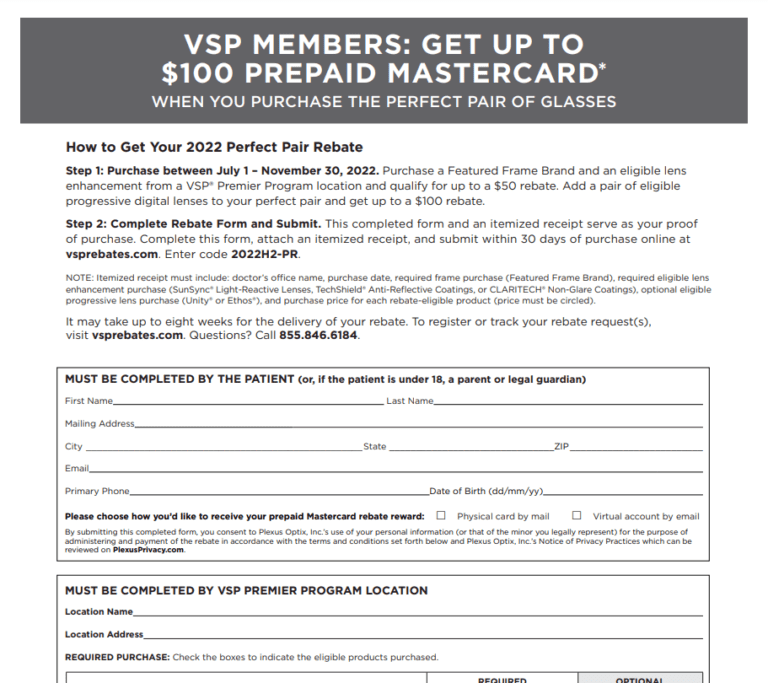

Vsp Rebate 2023 Printable Rebate Form

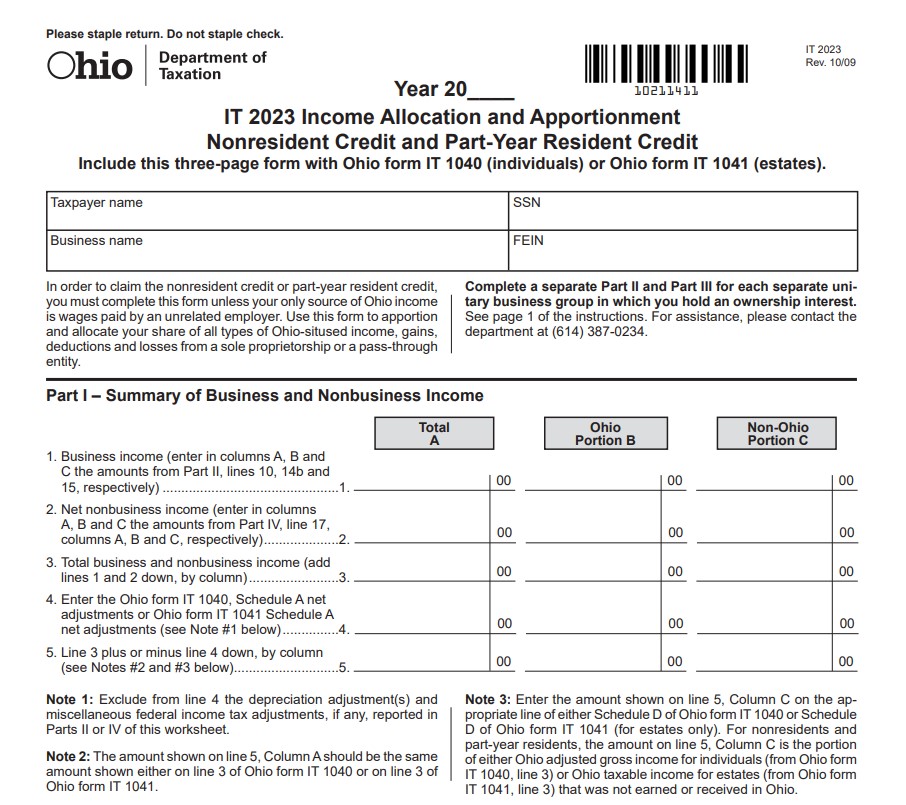

Aep Ohio Rebates 2023 Printable Rebate Form

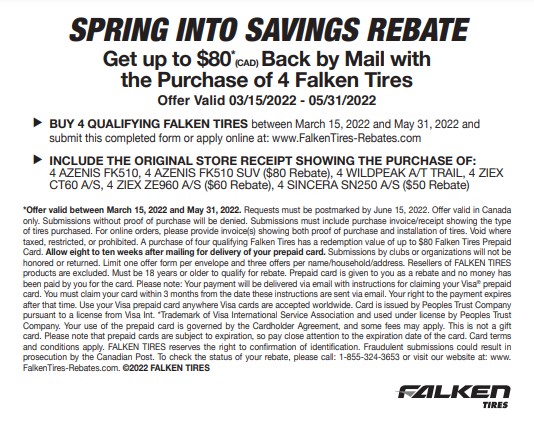

Falken Tire Rebate 2023 TireRebate

Elanco Trifexis Rebate 2023 How To Claim Your Discount ElancoRebates

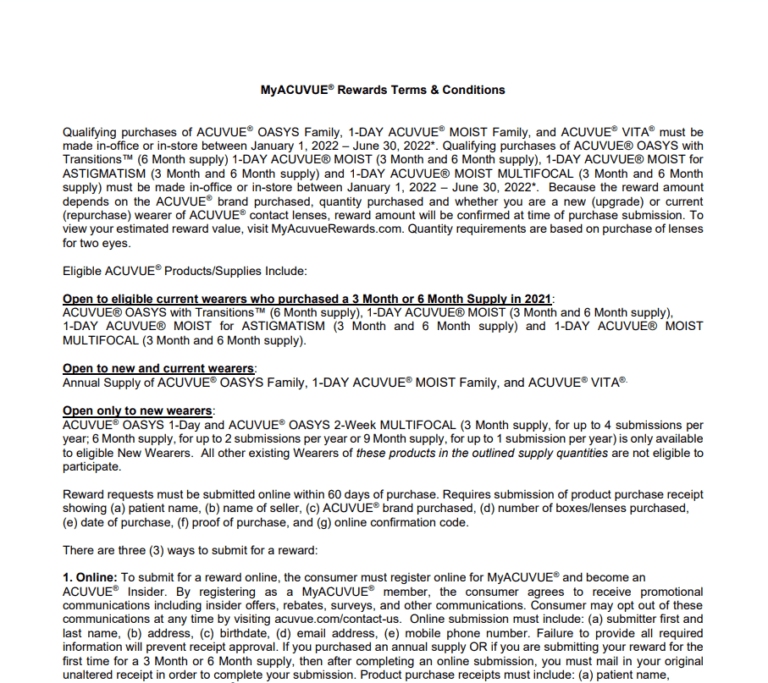

2023 Acuvue Rebates Printable Rebate Form

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

Elanco Rebates Seresto 2023 ElancoRebates

NJ Home Rebate 2023 Printable Rebate Form

Elanco Galliprant Rebate Code 2023 Save On Pet Pain Relief

Work From Home Rebate 2023 - Filing a 2023 tax year return or 2019 or prior year tax return Form T777S for 2020 2021 and 2022 only Use Option 2 Detailed method on Form T777S to claim