Work From Home Tax Credit 2023 Canada With the COVID pandemic largely behind us there has been a small change in the Canada Revenue Agency rules on how Canadians can claim their work from home expenses this tax season

Claiming other employment expenses on line 22900 for example motor vehicle expenses as well as home work space in the home office supplies and Learn how to claim home office expenses if you work primarily from home for your employer Find out the eligibility criteria eligible expenses and how to calculate your deduction for the 2023

Work From Home Tax Credit 2023 Canada

Work From Home Tax Credit 2023 Canada

https://media.blogto.com/articles/2023228-work-from-home-tax-credit.jpg?w=2048&cmd=resize_then_crop&height=1365&quality=70

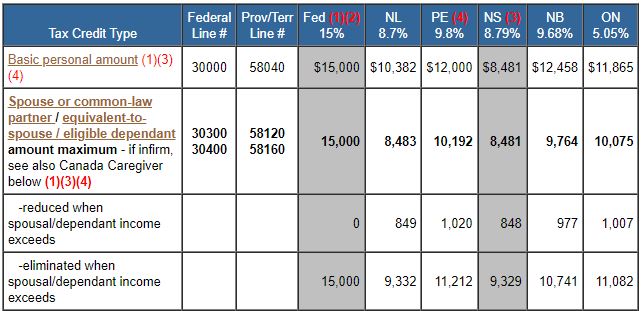

TaxTips ca 2023 Non Refundable Personal Tax Credits Tax Amounts

https://www.taxtips.ca/nrcredits/2023-personal-tax-credits.jpg

Does Canada Have A Work From Home Tax Credit In 2023 NerdWallet

https://www.nerdwallet.com/ca/wp-content/uploads/sites/2/2022/01/GettyImages-1219750966-e1643134355360-2048x854.jpg

The guidance indicates that for 2023 the CRA has adopted a broad interpretation of situations in which an employee is required to work from home which is one of the At least for 2023 the CRA has indicated that employees who voluntarily initiate work from home arrangements can potentially qualify to deduct eligible home

If you re one of the millions of Canadians who worked from home during 2023 either full time or on a hybrid work arrangement you ll need to take some extra time this tax filing season if you want to claim a In a news release dated 21 December 2023 the Canada Revenue Agency CRA provided an update on the process for claiming home office expenses for the

Download Work From Home Tax Credit 2023 Canada

More picture related to Work From Home Tax Credit 2023 Canada

Higher WORK FROM HOME Deduction In Your 2023 Australian Tax Return

https://i.ytimg.com/vi/xWtv0-9DLIE/maxresdefault.jpg

Working From Home Tax Deductions In 2022 Wattle Accountants

https://www.wattleaccountants.com.au/wp-content/uploads/2022/05/Social-Media-01-2-scaled.jpg

Pinterest

https://i.pinimg.com/originals/bd/c3/63/bdc363b1ddc3595d230e3287dcb12525.png

Learn how to claim the work from home tax deduction for 2023 and beyond which is different from the temporary flat rate method used for 2020 2022 Find The temporary flat rate method which allowed Canadians working from home due to Covid to claim up to 400 in employment expenses in 2020 and up to 500 in 2021 and 2022 is not available for

Business use of home expenses include a portion of costs related to heat electricity water home insurance mortgage interest property taxes and capital costs If you meet the eligibility criteria you can claim a portion of certain expenses related to the use of a work space in your home Commission employees who sell

Work From Home Illustration Sets

https://figmaui4free.com/wp-content/uploads/2022/10/Work-From-Home-Illustration-sets.jpg

Setc Tax Credit 2023 1099 Expert

http://1099.expert/wp-content/uploads/2023/12/image-title-Generate-high-resolution-50941.png

https://www.thestar.com/business/persona…

With the COVID pandemic largely behind us there has been a small change in the Canada Revenue Agency rules on how Canadians can claim their work from home expenses this tax season

https://www.canada.ca/en/revenue-agency/services...

Claiming other employment expenses on line 22900 for example motor vehicle expenses as well as home work space in the home office supplies and

2023 Canada Tax Checklist What Documents Do I Need To File My Taxes

Work From Home Illustration Sets

Federal Solar Tax Credit In 2023 A Comprehensive Guide OUPES

Work From Home Meme 2023 Caps N Lock

Working From Home Tax Deductions 2023

Work From Home Tax Deductions Unlocking Savings Opportunities For

Work From Home Tax Deductions Unlocking Savings Opportunities For

Free Printable Tax Worksheets

Android Paisa Wala Work From Home

Taxes 2023 Do You Qualify For A Home Office Deduction

Work From Home Tax Credit 2023 Canada - If you re one of the millions of Canadians who worked from home during 2023 either full time or on a hybrid work arrangement you ll need to take some extra time this tax filing season if you want to claim a