Work Out Tax Credits Income Verkko 2 huhtik 2014 nbsp 0183 32 When you claim tax credits you ll need to give details of your total income You ll also need to work out your income when you renew your tax credits each year

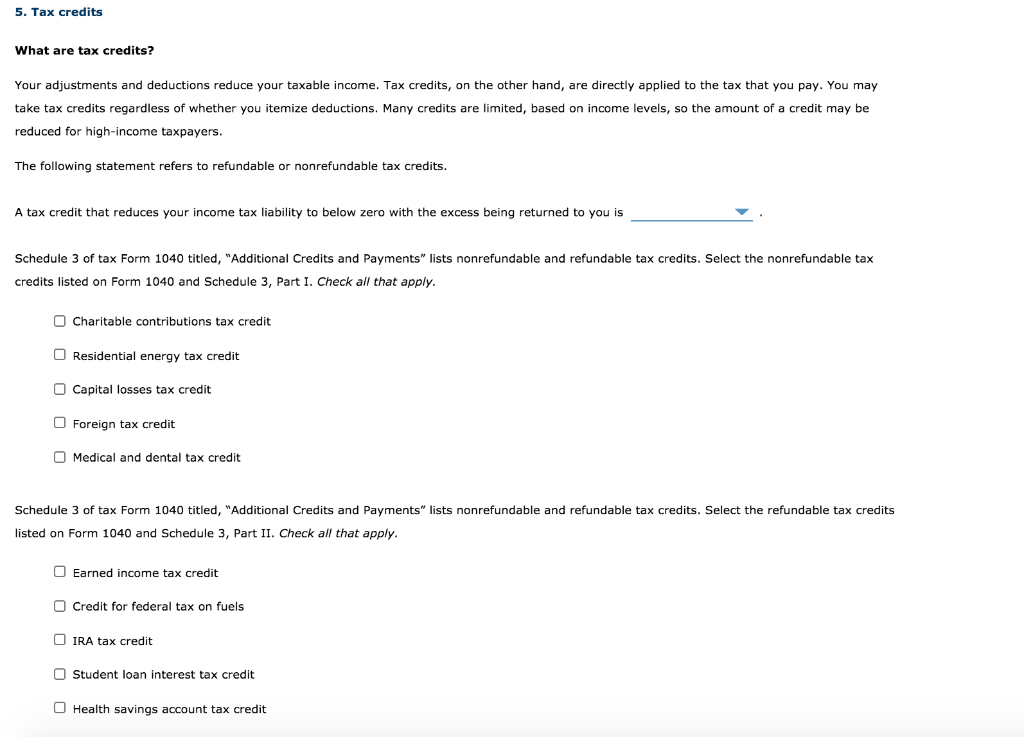

Verkko 2 huhtik 2020 nbsp 0183 32 In order to claim credits you must first fill out your tax return form to determine your taxable income and amount of taxes owed Beginning in 2018 all taxpayers must use Form 1040 2 Calculate your income The calculation of tax credit amount of your eligibility for tax credits will often depend on your income Verkko 12 helmik 2023 nbsp 0183 32 Tax Credit A tax credit is an amount of money that taxpayers are permitted to subtract from taxes owed to their government The value of a tax credit depends on the nature of the credit certain

Work Out Tax Credits Income

Work Out Tax Credits Income

https://blackdiamondfs.com/wp-content/uploads/2021/08/taxfilingstatus.jpeg

The Complete List Of Tax Credits For Individuals Tax Credits Federal

https://i.pinimg.com/originals/5b/16/4b/5b164bd7e067ddaa9caa8fdc87288ecb.png

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

Verkko 11 huhtik 2023 nbsp 0183 32 You can find out what counts as income for tax credits purposes on our income page Working tax credit only claims If you are only entitled to WTC because you are not responsible for a child or qualifying young person then there will be a reduction due to income if your income is above the 163 7 455 threshold Verkko 4 huhtik 2014 nbsp 0183 32 Use working sheet TC825 to help you work out your income for tax credits purposes From HM Revenue amp Customs Published 4 April 2014 Last updated 7 April 2022 See all updates

Verkko 18 jouluk 2023 nbsp 0183 32 With the Earned Income Tax Credit the 2023 tax year the credit is worth up to 7 430 and you can qualify with up to 63 398 in income To get the credit your earned income and adjusted gross income can t be higher than that amount How you qualify and how much you qualify for will depend on your income and how many Verkko 2 toukok 2023 nbsp 0183 32 The table is based on 2022 23 rates Tax credits require the person to declare the taxable income less 100 of any pension contributions Person 2 will have a P60 that will show 163 16 800 which is 163 18000 minus 163 100 x 12 pension contributions and so they need make no adjustments for their pension contributions

Download Work Out Tax Credits Income

More picture related to Work Out Tax Credits Income

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

https://media.cheggcdn.com/media/4db/4db8bd1d-6102-4a72-a48f-72d1533edb22/phpsxAAGW

The Complete List Of Tax Credits MAJORITY

https://www.datocms-assets.com/20859/1587974477-screen-shot-2020-04-27-at-10-00-47.png?fit=crop&auto=format%2Ccompress&lossless=true&fm=png&w=900

Income Charts OregonHealthCare us

http://www.oregonhealthcare.us/uploads/2/9/6/1/29613079/2017-2018fplgraphic_1_orig.png

Verkko 13 hein 228 k 2023 nbsp 0183 32 So if your salary is 163 8 000 a year you ll be earning 163 545 over this threshold For each pound your working tax credit will be reduced by 41p which can be worked out as 545 x 0 41 223 45 This means that the maximum amount of working tax credit would be reduced by 163 223 45 over the year Verkko 13 huhtik 2023 nbsp 0183 32 One refundable tax credit for moderate and low income taxpayers is the Earned Income Tax Credit The IRS estimates four out of five workers claim the EITC which means millions of taxpayers are putting EITC dollars to work for them

Verkko Find out the amount of working tax credits you can get and how it s based on your income hours you work and if you re in a couple Verkko If you are working for the full year your tax credits will be divided into 52 equal weekly amounts if you are paid weekly 26 equal fortnightly amounts if you are paid fortnightly 12 equal monthly amounts if you are paid monthly 13 equal amounts if you are paid every four weeks If you have a second job or multiple employments you can

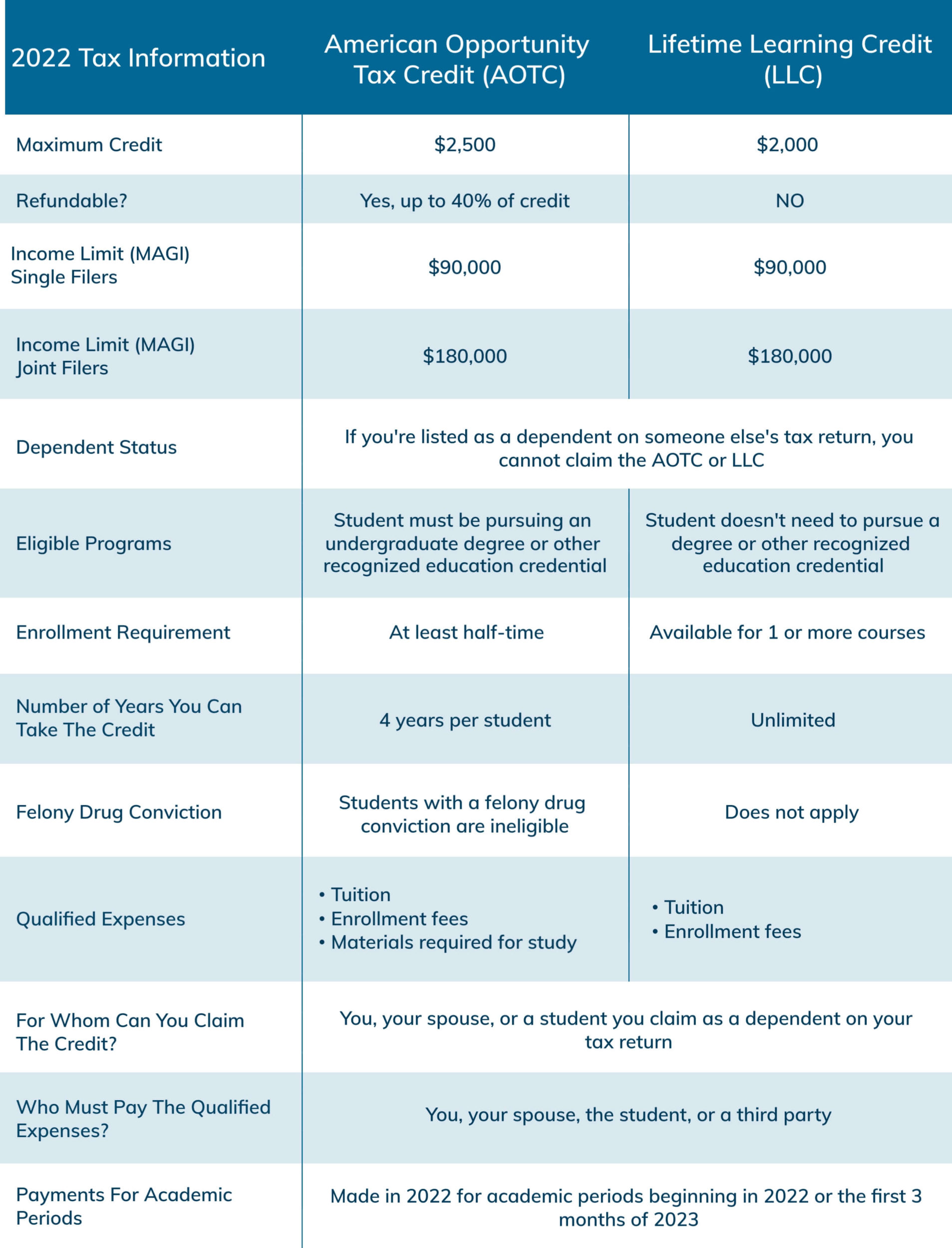

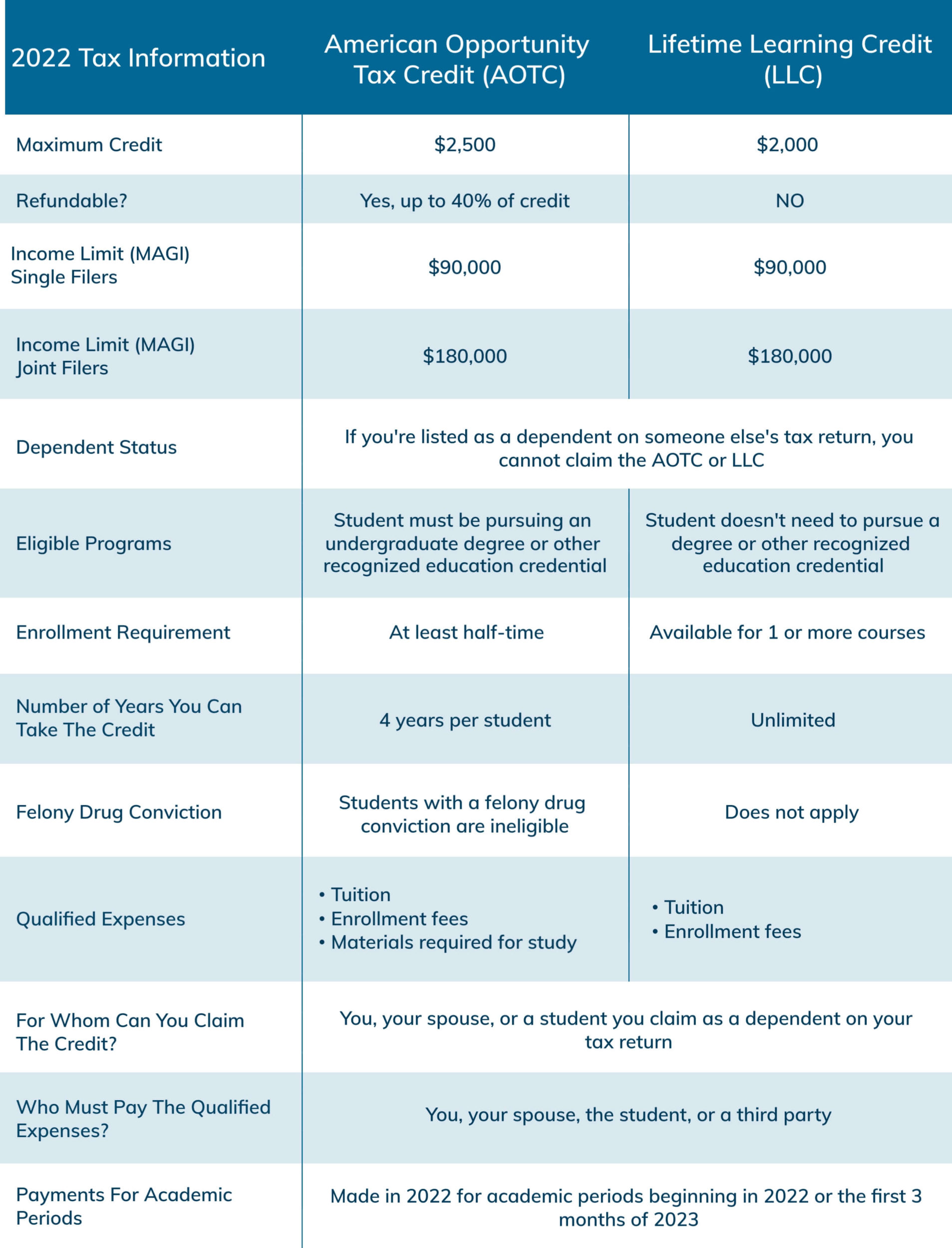

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-1907x2500.jpg

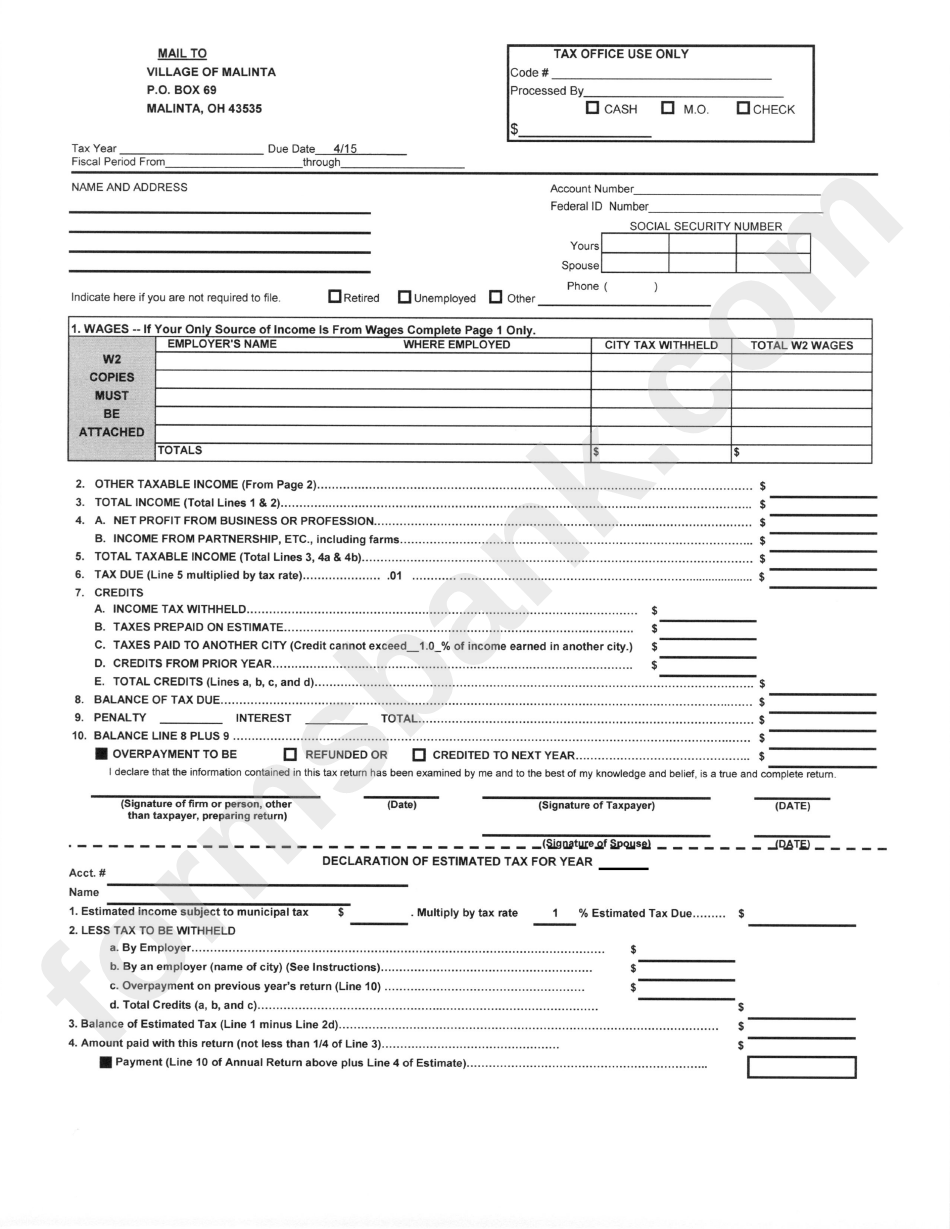

Printable Income Tax Forms Printable Forms Free Online

https://www.printableform.net/wp-content/uploads/2021/06/ohio-income-tax-form-printable-pdf-download.png

https://www.gov.uk/guidance/tax-credits-working-out-income

Verkko 2 huhtik 2014 nbsp 0183 32 When you claim tax credits you ll need to give details of your total income You ll also need to work out your income when you renew your tax credits each year

https://www.wikihow.com/Calculate-Tax-Credits

Verkko 2 huhtik 2020 nbsp 0183 32 In order to claim credits you must first fill out your tax return form to determine your taxable income and amount of taxes owed Beginning in 2018 all taxpayers must use Form 1040 2 Calculate your income The calculation of tax credit amount of your eligibility for tax credits will often depend on your income

FAQ WA Tax Credit

2022 Education Tax Credits Are You Eligible

Make Filing Your Taxes Less Painful With These Tax Breaks Credit

62000 A Year Is How Much A Month After Taxes New Update Abettes

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)

Astounding Gallery Of Eic Tax Table Concept Turtaras

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)

Astounding Gallery Of Eic Tax Table Concept Turtaras

Tax Credits 2018 2019 Family Dependent Tax Credits AvaxHome

A COMPREHENSIVE GUIDE FOR INCOME TAX RETURN FILLING

Care Credit Printable Application Printable Word Searches

Work Out Tax Credits Income - Verkko 4 huhtik 2014 nbsp 0183 32 Use working sheet TC825 to help you work out your income for tax credits purposes From HM Revenue amp Customs Published 4 April 2014 Last updated 7 April 2022 See all updates