Xcel Energy Tax Credit Explore the different rebate offers and Xcel Energy customer programs available for your home energy efficiency upgrades and improvements

BONUS REBATE There is a bonus rebate of 600 available to customers who install Xcel Energy rebate qualifying insulation and air sealing measures followed by installation of a Xcel Xcel Energy outlined how it intends to leverage new and extended tax credits and grant programs in the IRA to pass savings on to customers in a filing to the Minnesota Public Utilities

Xcel Energy Tax Credit

Xcel Energy Tax Credit

https://www.pv-tech.org/wp-content/uploads/2021/02/Xcel_brings_62MW_Minnesota_PV_project_online-2048x1367.jpg

Xcel Energy Scholarship Saint Mary s Today

https://today.smumn.edu/wp-content/uploads/2022/08/money.jpg

Xcel Energy Infrastructure Design Group

https://www.infrastructuredg.com/wp-content/uploads/2023/10/Xcel_Cadastral.jpg

Xcel Energy Inc is already seeing strong interest in the purchase of its renewable energy tax credits as the company awaits clarification on the transferability option from the Xcel Colorado s dominant utility and other utility companies are offering rebates as well and they are stackable too More utilities will add rebates as they are required to file their Clean Heat Plans under 2021 legislation so check with your local utility s link provided below Xcel s rebates now include

Following the approval of the new EV plan Xcel Energy and the Colorado Energy Office have since confirmed that residents can combine the income qualified utility rebate and the state tax Xcel Energy EV Rebates are available to all residential Xcel Energy electric service customers on a first come first serve basis who i have an active Xcel Energy service account that

Download Xcel Energy Tax Credit

More picture related to Xcel Energy Tax Credit

AKedOLTzSOkXU40zpMloxTkybObkARW1EeoFAI3VXY 7RQ s900 c k c0x00ffffff no rj

https://yt3.ggpht.com/ytc/AKedOLTzSOkXU40zpMloxTkybObkARW1EeoFAI3VXY_7RQ=s900-c-k-c0x00ffffff-no-rj

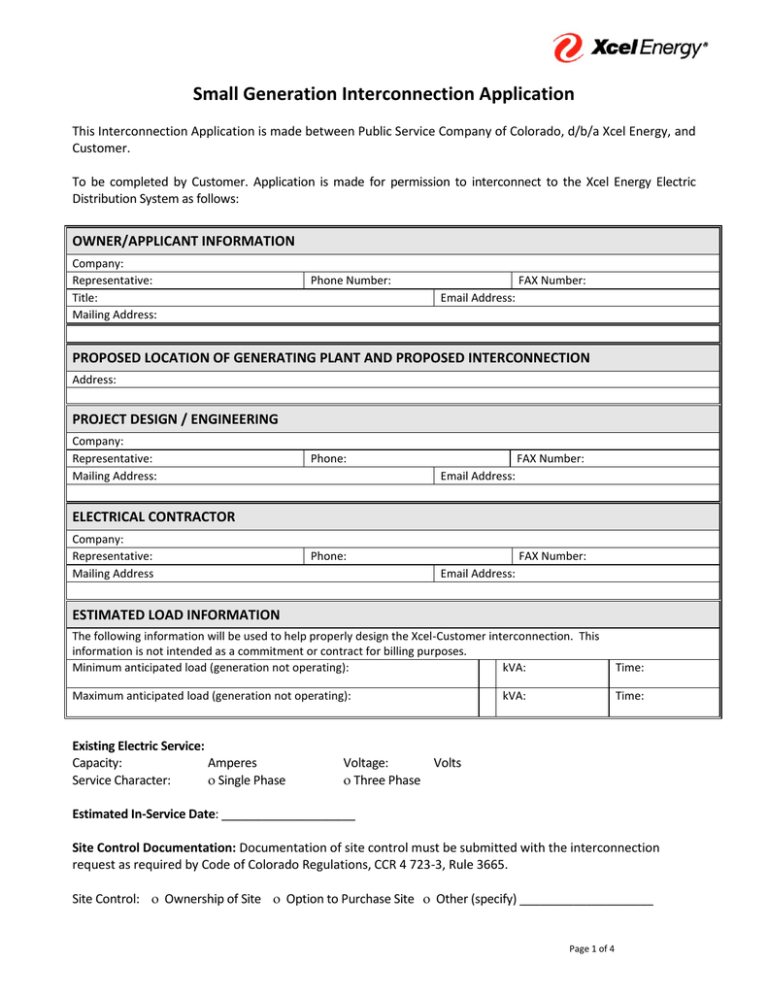

PDF Xcel Energy

https://s2.studylib.net/store/data/018102195_1-0231250c0045c792ae3fe03f288091af-768x994.png

Marie Xcel Florida

https://xcelflorida.com/wp-content/uploads/2023/12/xcel-logo.png

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through Focus on Energy incentive eligible customers will receive a bonus incentive check in the mail from Xcel Energy that is equal to 75 of the Focus on Energy incentive Combined incentives

Don t forget about federal tax credits Federal tax credits of up to 7 500 are still available for most EVs Learn more about electric vehicles incentives rebates and how we The plan will keep costs low for customers by unlocking 5 7 billion in estimated tax credit savings from the Inflation Reduction Act for renewable generation and energy

Xcel Perfect Wetsuit

https://www.datocms-assets.com/15606/1572973768-artem-verbo-uohgievhwiq-unsplash.jpg?auto=format&dpr=1&w=4032

Where On My Xcel Energy Bill Do I Find My Bill Credit How Much Money

https://support.us-solar.com/galleryDocuments/edbsn3281c1b94e58d71b21ab0f4fedac86d75e6897b52ceed1eed1cdf586b6eff91df2ee97fa49c39f21771f38c4eb286a36?inline=true

https://my.xcelenergy.com/s/residential/ho…

Explore the different rebate offers and Xcel Energy customer programs available for your home energy efficiency upgrades and improvements

https://www.xcelenergy.com/staticfiles/xe...

BONUS REBATE There is a bonus rebate of 600 available to customers who install Xcel Energy rebate qualifying insulation and air sealing measures followed by installation of a Xcel

Xcel

Xcel Perfect Wetsuit

Facts About Xcel Energy Employment Opportunities

Xcel Energy On LinkedIn xeproud pridemonth

Xcel Energy On LinkedIn mlkjrday

What s New In The Xcel Program In 2022 23 The Gymnastics Guide

What s New In The Xcel Program In 2022 23 The Gymnastics Guide

Xcel

Solar Tax Credit What You Need To Know NRG Clean Power

1000 Xcel Energy EPIC MN

Xcel Energy Tax Credit - Approximately 18 6 million in anticipated tax credits and rebates will make the projects more affordable to customers If Minnesota regulators approve the proposal Xcel