2020 Recovery Rebate Credit Qualifications People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return They were issued in 2020

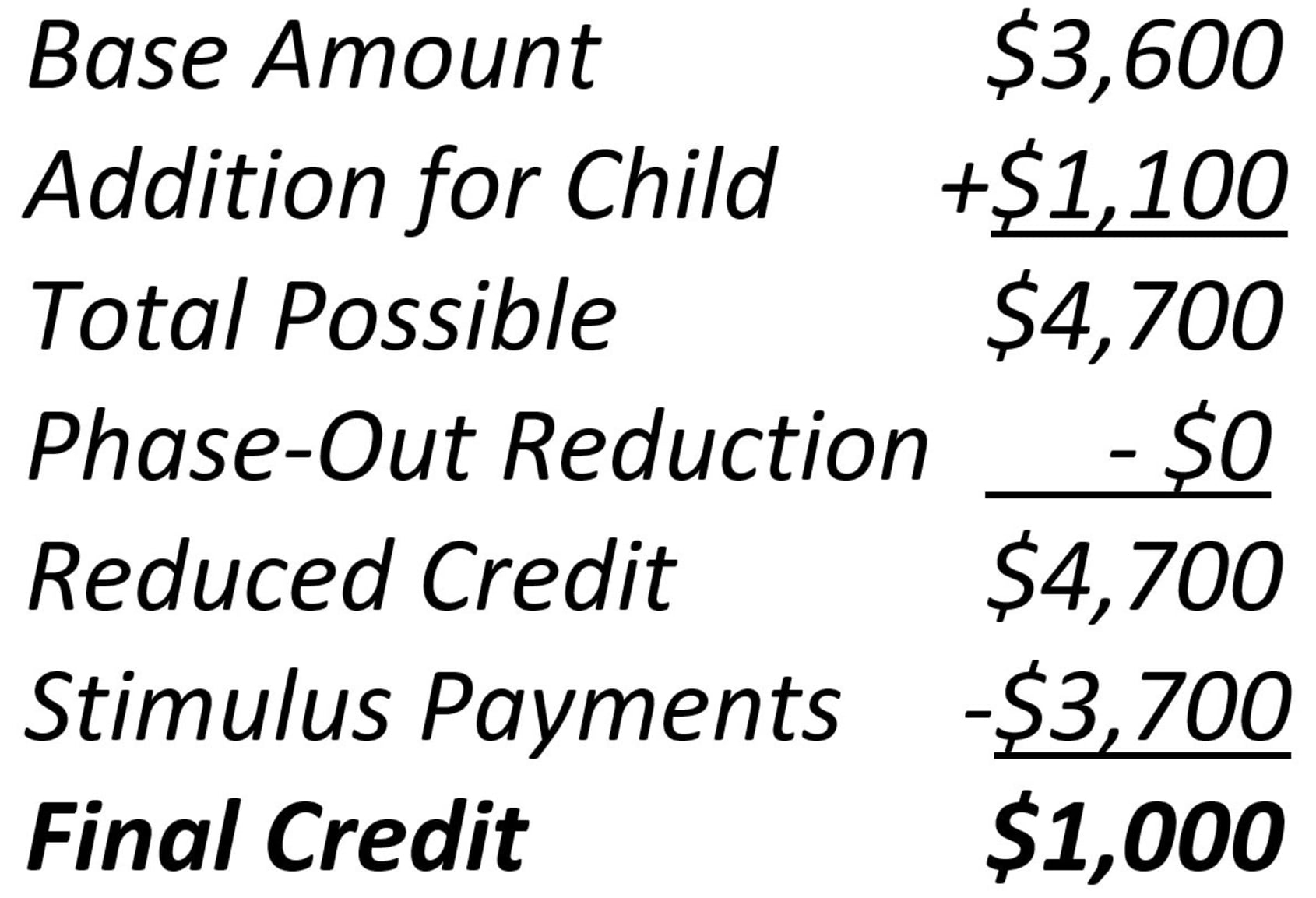

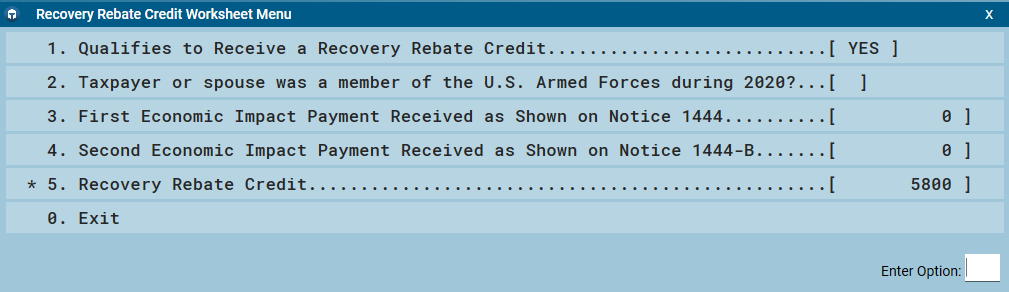

A1 You must file a 2020 tax return to claim a 2020 Recovery Rebate Credit even if you don t usually file a tax return See the 2020 Recovery Rebate Credit FAQs Topic A Claiming the Recovery Rebate Credit if you aren t required to file a tax return To figure the credit amount you will need to know the amount s of any first or The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial stimulus payment provided up to 1 200 per qualifying adult and up to 500 per qualifying dependent Most of these payments went out to recipients in mid 2020

2020 Recovery Rebate Credit Qualifications

2020 Recovery Rebate Credit Qualifications

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/de418507-0277-4b17-89a7-765557117ca4.default.png

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/the-recovery-rebate-credit-get-your-full-stimulus-check-payment-with-1.jpg

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

The law also provided for an advanced payment of the Recovery Rebate Credit RRC in calendar year 2020 These payments were referred to as Economic Impact Payments EIP1s IRC section 6428 f 3 provides that EIP1s cannot be made or allowed after Dec 31 2020 The IRS deadline for individuals to register for an EIP1 was Nov 21 2020 The May 17 2024 deadline is fast approaching for taxpayers who have not yet filed a 2020 tax return to claim a refund of withholdings estimated taxes or their 2020 Recovery Rebate Credit The IRS estimates that almost 940 000 of the nation s taxpayers have unclaimed refunds totaling more than 1 billion for tax year 2020 and encourages

The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be able to take this credit only if Your EIP 2 was less than 600 1 200 if married filing jointly plus 600 for each qualifying child you had in 2020 However you don t qualify for this credit if Key Takeaways The Recovery Rebate Credit allowed certain taxpayers to lower their taxes via a credit for the full Economic Impact Payment if it was not received for some reason in 2020 and or

Download 2020 Recovery Rebate Credit Qualifications

More picture related to 2020 Recovery Rebate Credit Qualifications

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-2.png

How To File Recovery Rebate Credit Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-1.png

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

The economic impact payments and rebate recovery credit were authorized by the Coronavirus Aid Relief and Economic Security CARES Act P L 116 136 All eligible individuals are entitled to a payment or credit of up to 1 200 for individuals or 2 400 for married couples filing jointly Eligible individuals also receive 500 for each Noncitizens who are ineligible for the 2020 recovery rebates include nonresident aliens and ITIN filers who by definition do not have a work authorized SSN defined for the child tax credit as well as aliens whose SSNs are associated with public benefits For married joint filers both spouses must have work authorized SSNs unless

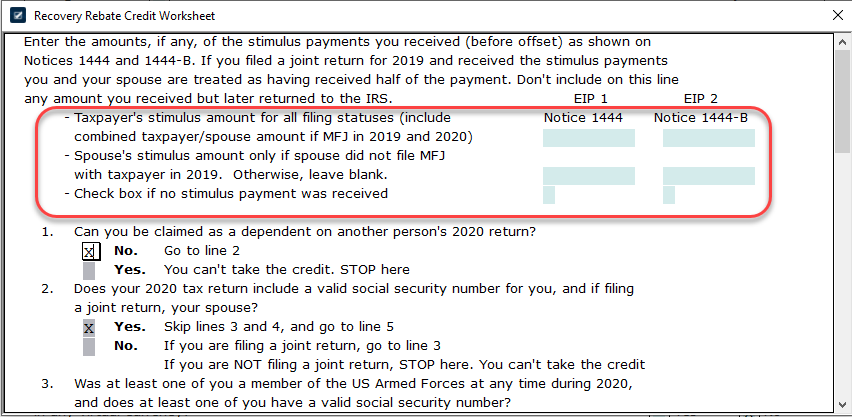

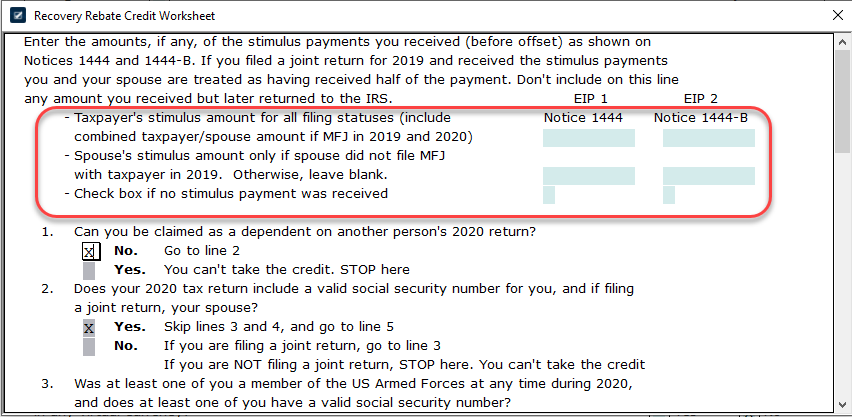

To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form 1040 and Form 1040 SR Instructions PDF Enter the computed amount from the worksheet onto line 30 Recovery Rebate Credit of your 2020 Form 1040 or 2020 Form 1040 SR As a result after subtracting the amount of their third stimulus payment the recovery rebate credit they report on Line 30 of their 2021 tax return is equal to 840 4 200 3 360 840

Menards Printable Rebate Form MenardsRebate Form

https://www.menardsrebate-form.com/wp-content/uploads/2022/09/menards-printable-rebate-form.png

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

https://www.irs.gov/newsroom/recovery-rebate-credit

People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return They were issued in 2020

https://www.irs.gov/newsroom/2020-recovery-rebate...

A1 You must file a 2020 tax return to claim a 2020 Recovery Rebate Credit even if you don t usually file a tax return See the 2020 Recovery Rebate Credit FAQs Topic A Claiming the Recovery Rebate Credit if you aren t required to file a tax return To figure the credit amount you will need to know the amount s of any first or

Desktop 2020 Recovery Rebate Credit Support

Menards Printable Rebate Form MenardsRebate Form

What Is The Recovery Rebate Credit And Do You Qualify The

How To Calculate Recovery Rebate Credit 2022 Rebate2022 Recovery Rebate

2020 Recovery Rebate Credit FAQs Updated Again Elmbrook Tax Accounting

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

20 2020 Recovery Rebate Credit Worksheet Worksheets Decoomo

Recovery Rebate Credit 2020 Calculator KwameDawson Recovery Rebate

Recovery Rebate Credit Questions Answers

2020 Recovery Rebate Credit Qualifications - In late December 2020 congress passed the COVID Relief Act authorizing a second stimulus payment based on 2019 returns The same rules apply for claiming a 2020 Recovery Rebate Credit for the second stimulus payment