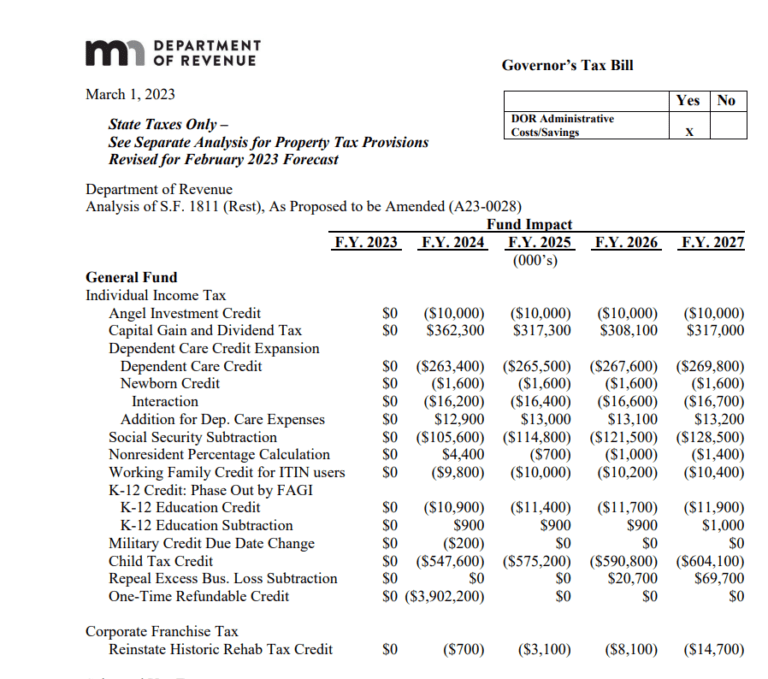

2023 Homeowners Tax Rebate The fiscal year 2023 property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most recipients of the School Tax Relief STAR exemption or credit were automatically qualified and have already received their rebates Afficher plus

Web 1 janv 2023 nbsp 0183 32 The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per Web You must reduce the basis of your home by the 426 122 247 365 215 1 275 the seller paid for you You can deduct your 426 share of real estate taxes on your return for the year

2023 Homeowners Tax Rebate

2023 Homeowners Tax Rebate

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

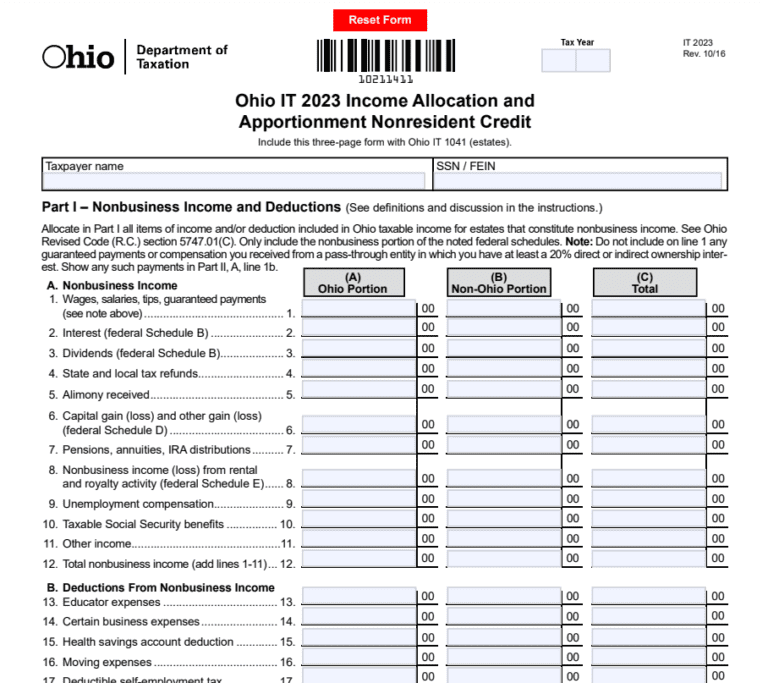

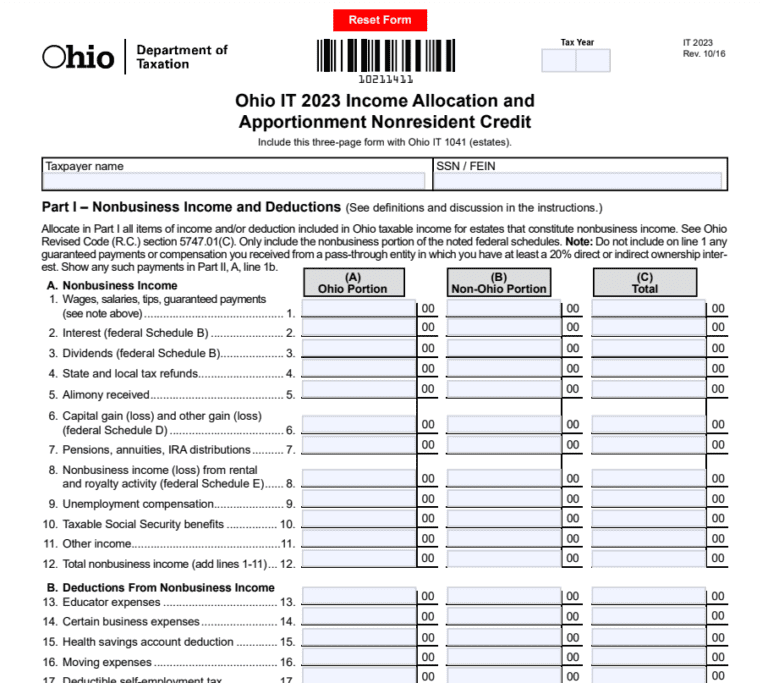

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Ohio-Tax-Rebate-2023-768x683.png

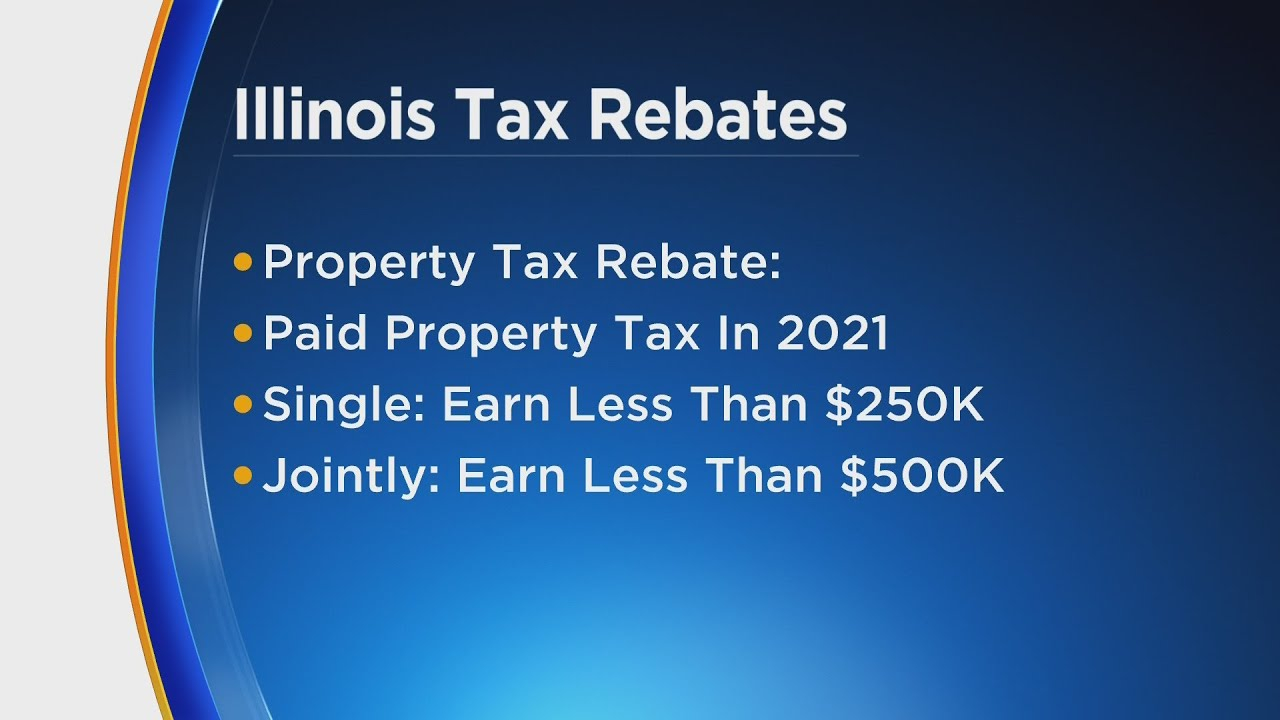

Illinois Property Tax Rebate Form 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Illinois-Property-Tax-Rebate-Form-2023-768x668.jpg

Web 9 avr 2022 nbsp 0183 32 Governor Kathy Hochul today announced multiple tax relief investments in the historic FY 2023 Budget The Enacted Budget includes tax relief for the middle class small businesses and homeowners to Web To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for

Web Il y a 1 jour nbsp 0183 32 The department will process claims as they are received and distribute rebates by December 31 2023 Additionally Montana homeowners will be eligible for a second Web 21 mai 2023 nbsp 0183 32 The NYS 2023 Homeowner Tax Rebate presents an exciting opportunity for New York State homeowners to secure significant financial relief By meeting the

Download 2023 Homeowners Tax Rebate

More picture related to 2023 Homeowners Tax Rebate

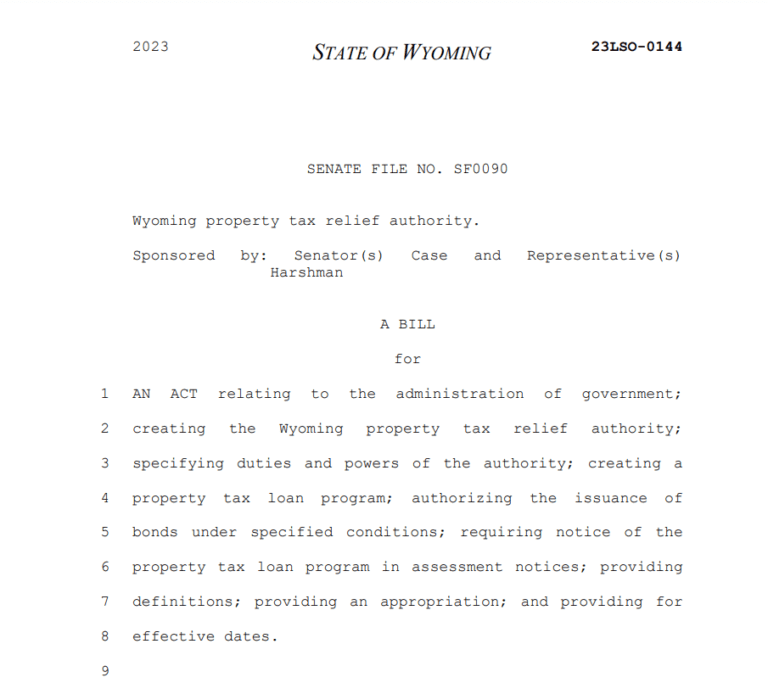

Wyoming Tax Rebate 2023 Complete Guide Tax Rebate Wyoming

https://printablerebateform.net/wp-content/uploads/2023/05/Wyoming-Tax-Rebate-2023-768x683.png

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

Tax Rebate 2023 California Tax Rebate

https://www.tax-rebate.net/wp-content/uploads/2023/05/Tax-Rebate-2023-California.jpg

Web 5 sept 2023 nbsp 0183 32 NEW For the 2023 tax year the IRS has announced that most state rebate payments won t be taxable on your federal return However there could be some exceptions in some state payments and Web Starting in January 2023 and each year through 2032 eligible households can claim a tax credit of 30 percent of the cost of qualified energy efficiency projects up to 1 200 per year These

Web Dans le m 234 me sillage que l ECO PTZ la d 233 fiscalisation des travaux de votre r 233 sidence principale peut 233 galement 234 tre r 233 alis 233 e via le CITE En effet ces travaux de r 233 novation Web 1 mai 2023 nbsp 0183 32 May 1 2023 by tamble Nys Property Tax Rebate Checks 2023 If you re a homeowner in New York State you may be eligible for a property tax rebate check in

Delaware Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Delaware-Tax-Rebate-2023-768x679.png

Star Rebate Checks 2023 Schedule RebateCheck

https://www.rebatecheck.net/wp-content/uploads/2023/04/when-will-ny-homeowners-get-new-star-rebate-checks-syracuse.jpg

https://www.nyc.gov/site/finance/taxes/property-tax-rebate.page

The fiscal year 2023 property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most recipients of the School Tax Relief STAR exemption or credit were automatically qualified and have already received their rebates Afficher plus

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per

Maine Tax Relief 2023 Printable Rebate Form

Delaware Tax Rebate 2023 Printable Rebate Form

SARS Tax Brackets Tax Tables For 2022 2023 QuickBooks South Africa

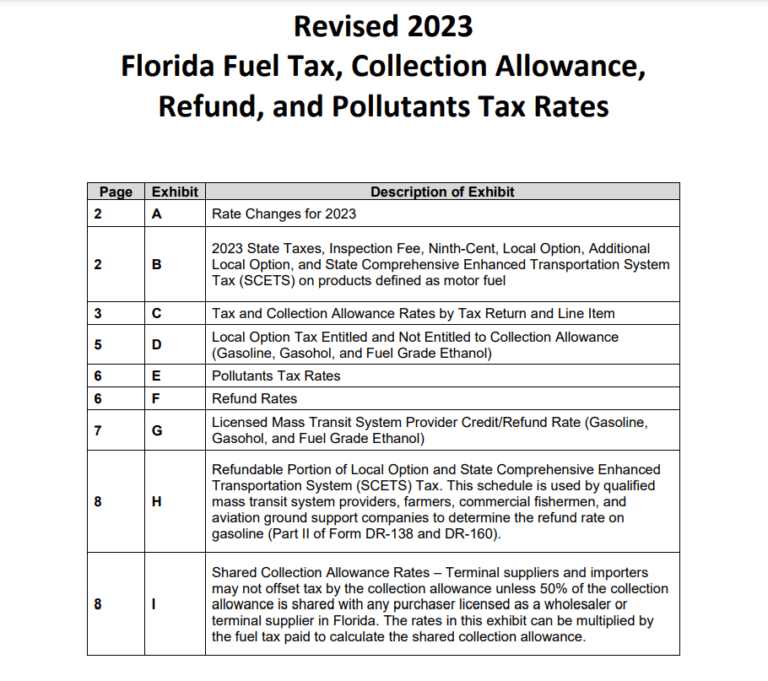

Florida Tax Rebate Printable Rebate Form

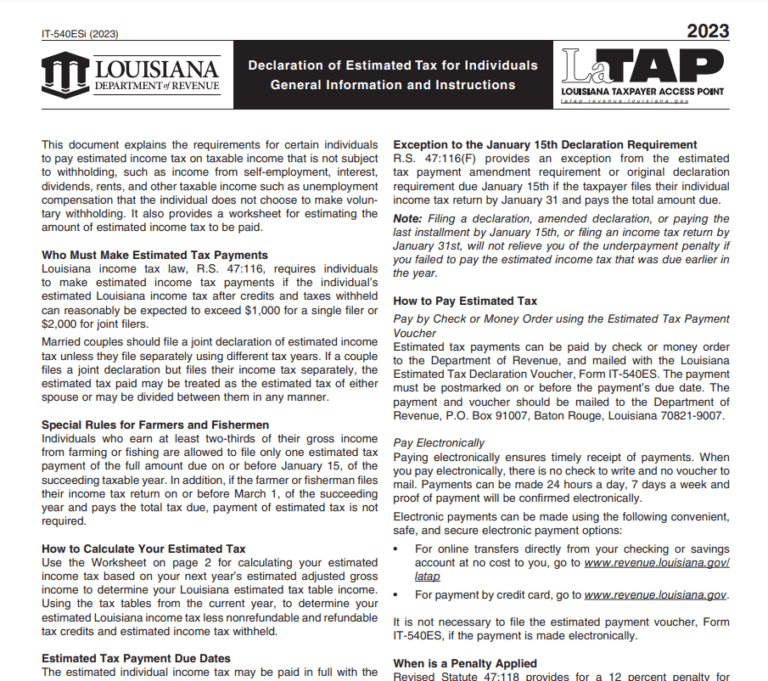

Louisiana Tax Credits 2023 Printable Rebate Form

Richmond Christian School Board deeply Disturbed By Sex Allegations

Richmond Christian School Board deeply Disturbed By Sex Allegations

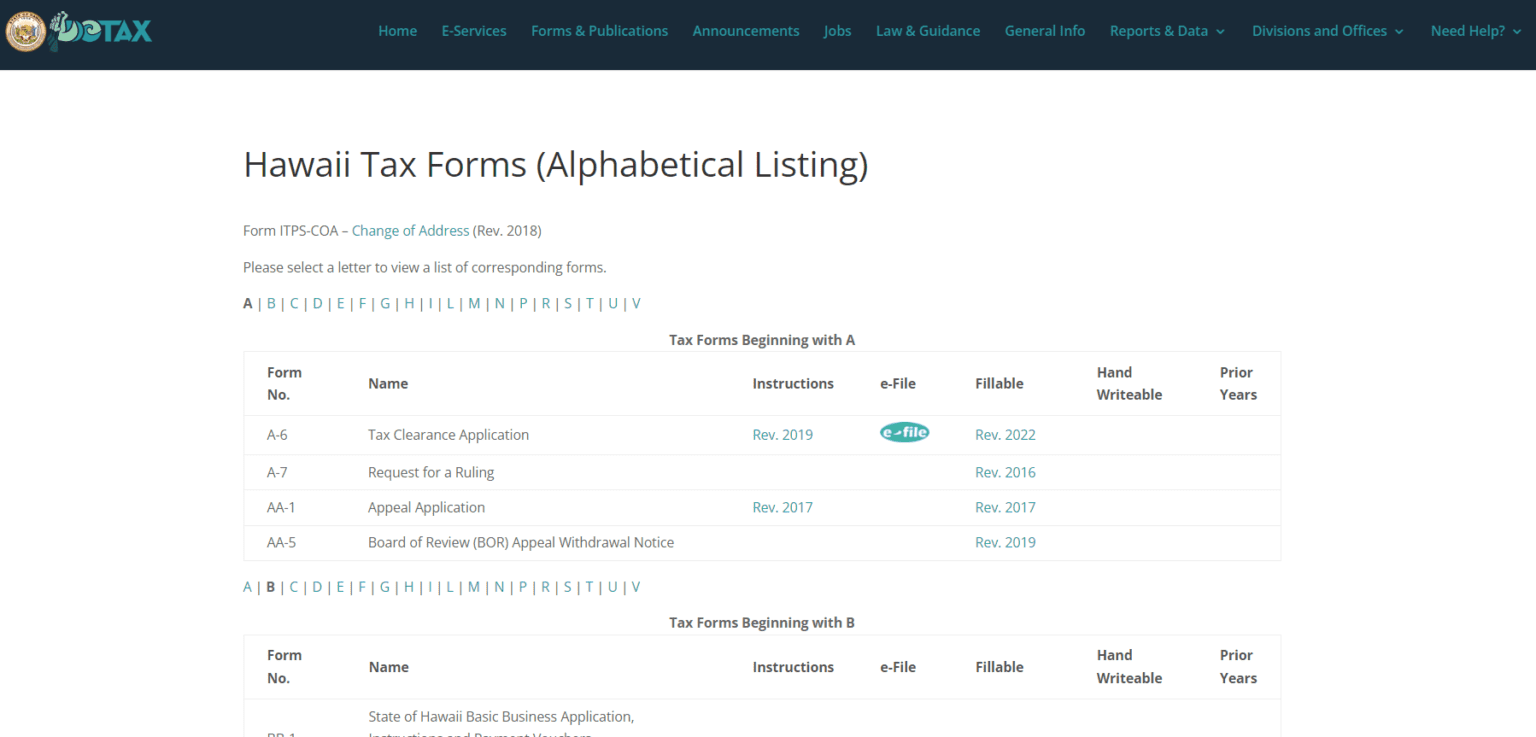

Hawaii Rebate 2023 Printable Rebate Form

Nj Property Tax Rebates 2023 PropertyRebate

Nebraska Tax Rebate 2023 Eligibility Application Deadline Status

2023 Homeowners Tax Rebate - Web 29 ao 251 t 2022 nbsp 0183 32 The Inflation Reduction Act of 2022 H R 5376 will lower health care prescription drug and energy costs invest in energy security and make our tax code