Agriculture Rebate Calculation A complete tax rebate is possible if The total agricultural income is Rs 5 000 The income from agricultural land is your only source of income no other income You have both agricultural income and other income The

Understand the concept of agricultural income in income tax including its definition exemptions and calculation methods Learn how to determine your eligibility Evaluate the tax on the sum of your agricultural and non agricultural income and the tax on the sum of your agricultural income and basic minimum exemption limit Finally

Agriculture Rebate Calculation

Agriculture Rebate Calculation

https://s3.studylib.net/store/data/007155201_1-df64c3e5d3307cf3cac4c14604b2d96b-768x994.png

Agriculture Energy Efficiency Rebate Program EMAP

http://askemap.org/wp-content/uploads/2022/01/613880283520149683-farming.full_.jpg

22 Average Due Date Calculation Of No Of Days Interest Calculation

https://i.ytimg.com/vi/eJvohpR2MRg/maxresdefault.jpg

HOW TO CALCULATE AGRICULTURAL INCOME AY 2019 20 EXAMPLE 1 AGRICULTURAL INCOME 300000 BUSINESS INCOME 500000 Total income excluding net agricultural income is more than the basic exempt slab limit If the above two conditions are satisfied then tax is computed as under Step 1 Compute

Agricultural income up to Rs 5000 is tax exempt Know about agricultural activities land exemption tax calculation with Scripbox Calculation of Agricultural Income Tax When the aforementioned criteria are met by an individual his her tax on agricultural income is computed using a three step calculation

Download Agriculture Rebate Calculation

More picture related to Agriculture Rebate Calculation

Rebate Calculation Example For An Employer YouTube

https://i.ytimg.com/vi/ZG_gk74-IpM/maxresdefault.jpg

Arbitrage Calculation Rebate Services Bond Compliance

https://cdn-fmlao.nitrocdn.com/ZkrGQDpJfzVmDWnYeeWiOMvmXQPEtzif/assets/static/optimized/rev-b1df775/rebatebyacs.com/wp-content/uploads/2019/03/6291a6d38da5b2d31a07ed582a2b817a.Video-image.jpg

Six Easy Tips For A Smooth Arbitrage Rebate Calculation Bingham

https://bingham-ars.com/wp-content/uploads/2019/09/Cover-Photo10.jpg

How to calculate income tax on Agricultural income for FY 2023 24 What are the tax implications on sale of agriculture land in AY 2024 25 How to save capital gain taxes on sale of Agricultural land Agricultural Income Tax All about Tax on Agricultural Income in India Check Sources to Considered and Examples on Agricultural Non agricultural Income

Calculation of Agricultural Income In case Agriculture income exceeds INR 5 000 and there are other sources of income too then the tax liability for that year Understand the agricultural income tax Learn free income tax under section 10 1 and what constitutes agricultural income tax exemptions calculation

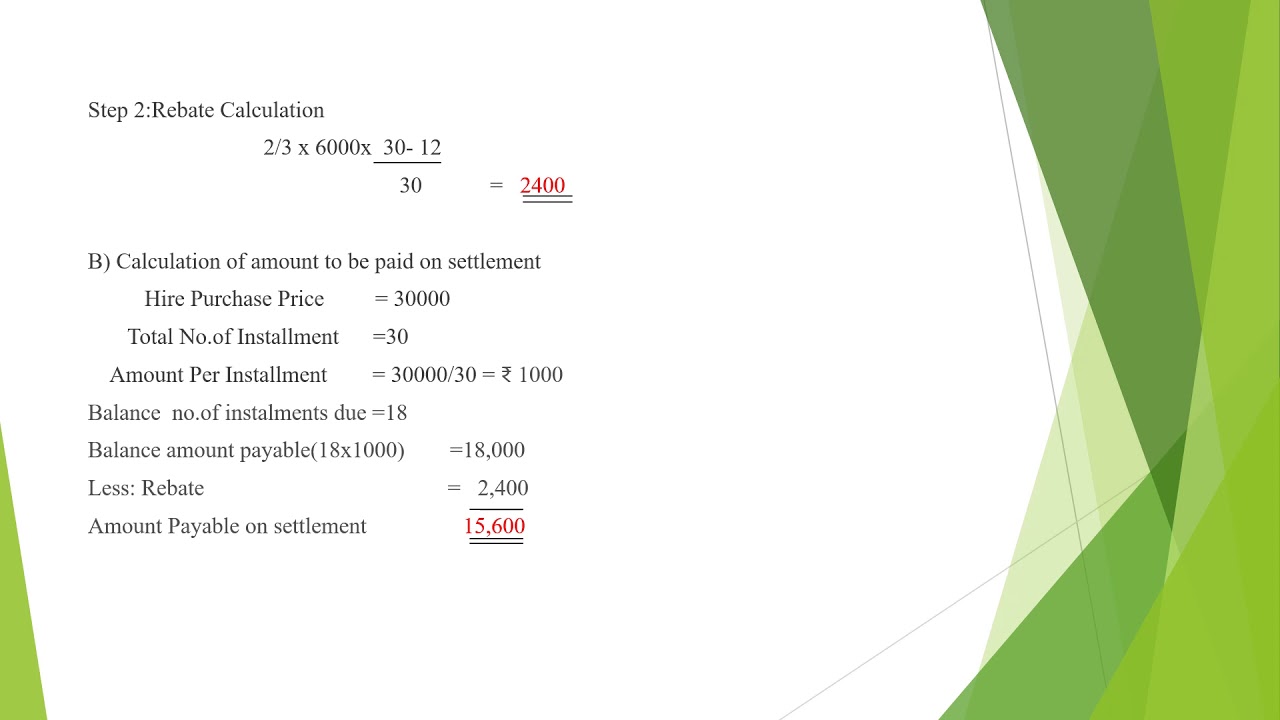

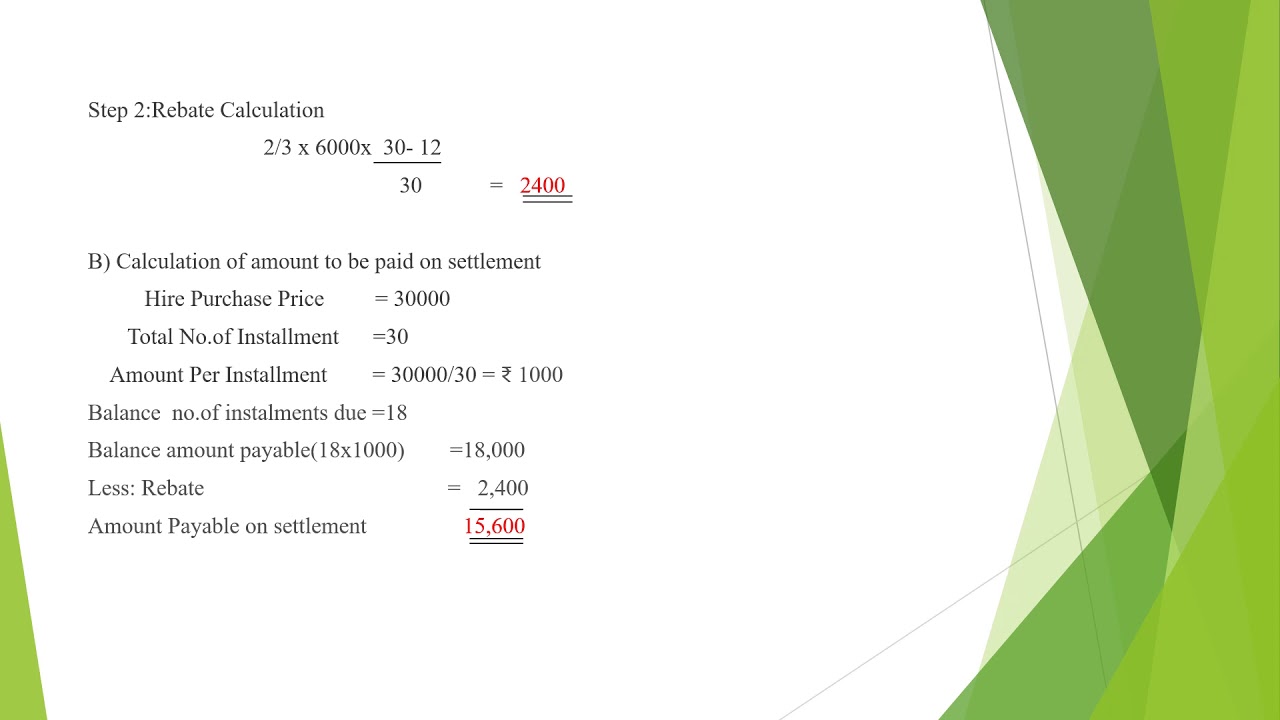

Rebate Calculation Aneesha K Shaji Assistant Professor Dept of Commerce

https://i.ytimg.com/vi/HxMHn189bv0/maxresdefault.jpg

GST New Home Rebate Calculation And Examples YouTube

https://i.ytimg.com/vi/2-0zuKt4bBk/maxresdefault.jpg

https://saral.pro/blogs/agricultural-income

A complete tax rebate is possible if The total agricultural income is Rs 5 000 The income from agricultural land is your only source of income no other income You have both agricultural income and other income The

https://tax2win.in/guide/income-tax-agricultural-income

Understand the concept of agricultural income in income tax including its definition exemptions and calculation methods Learn how to determine your eligibility

Nebraska Commercial Rebates Black Hills Energy

Rebate Calculation Aneesha K Shaji Assistant Professor Dept of Commerce

Rebate Calculation

Rebates Calculation Rebate Marketing Debits And Credits

Income Tax Rebate Calculation And

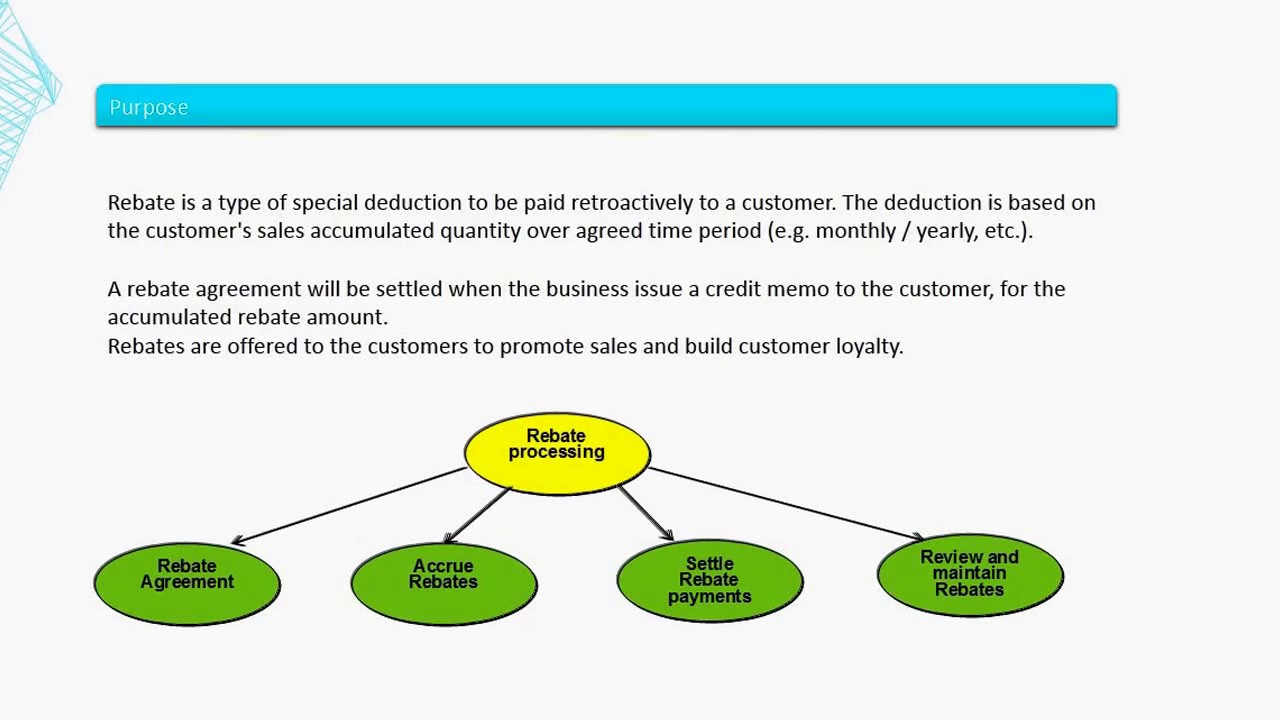

Rebate Agreement Process In SAP SD YouTube

Rebate Agreement Process In SAP SD YouTube

Solved Previous University Questions On Calculation Of Rebate On Bills

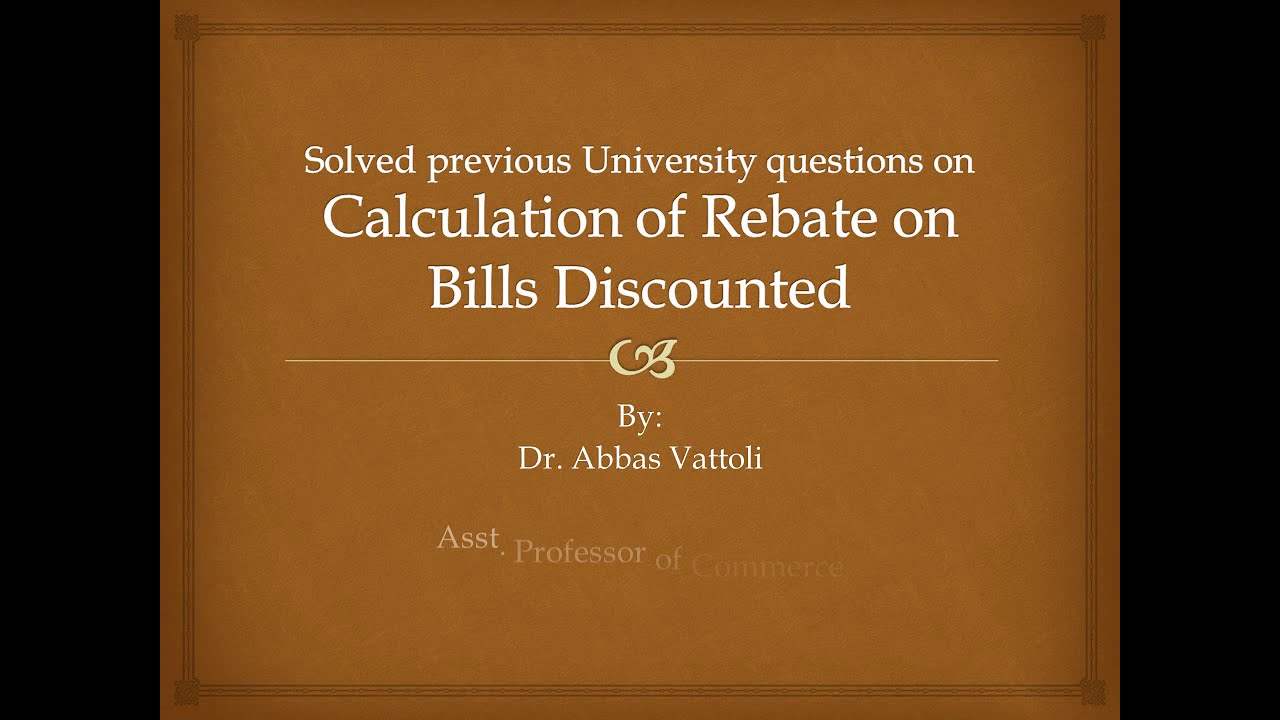

How To Pay ZERO Income Tax With Tax Rebate Income Tax Calculation

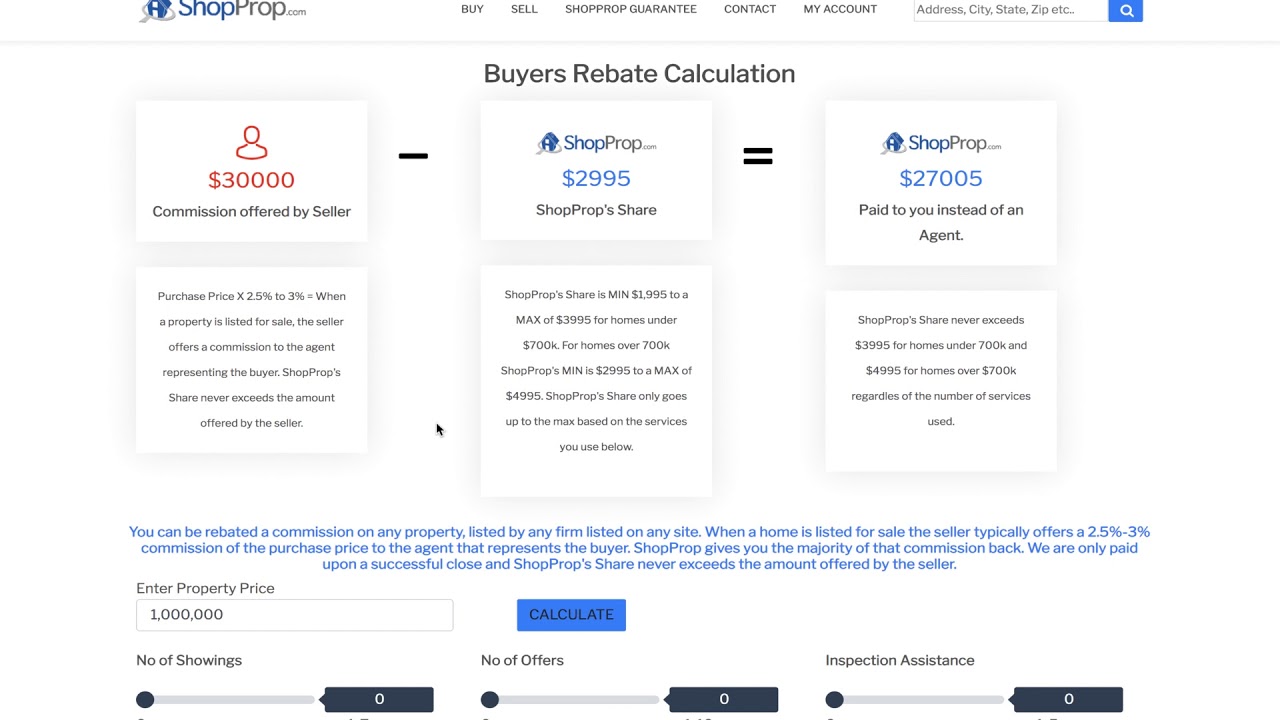

ShopProp Home Buyer s Rebate Calculation YouTube

Agriculture Rebate Calculation - HOW TO CALCULATE AGRICULTURAL INCOME AY 2019 20 EXAMPLE 1 AGRICULTURAL INCOME 300000 BUSINESS INCOME 500000