Are Contributions To 529 Plans Tax Deductible In North Carolina However contributions made to the plan are not deductible from your income for state tax purposes Through this plan family members and friends can contribute to a child s college fund

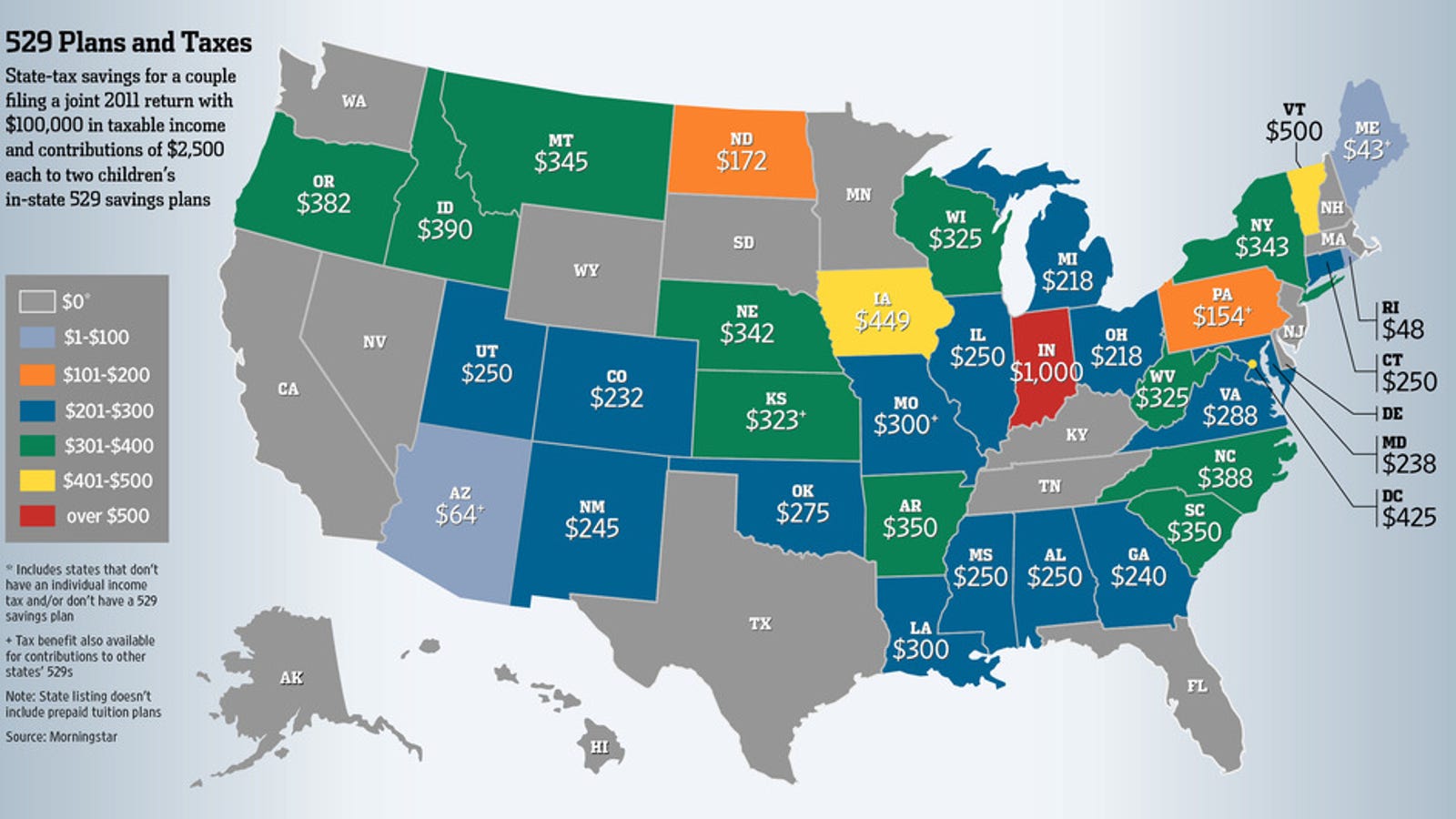

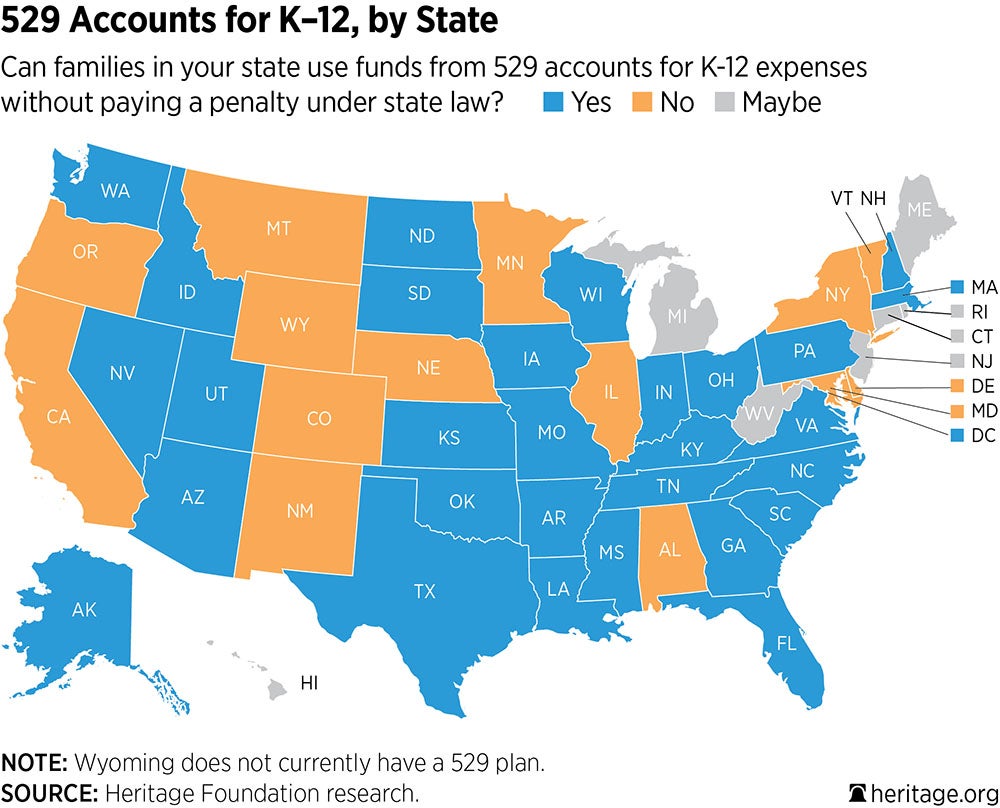

While most states tax deduction rules allow families to subtract 529 contributions from their gross income the rules vary from state to state The chart below provides an overview of the rules in each Perhaps the biggest advantage of saving in a 529 program is the tax free earnings The money you invest may grow over time and any earnings are free from federal and state income tax when they are withdrawn and

Are Contributions To 529 Plans Tax Deductible In North Carolina

Are Contributions To 529 Plans Tax Deductible In North Carolina

https://static.twentyoverten.com/5dd43b58fe95cc60688ef1e8/ZSL2kRyDUT/Financial-Planning-1.jpg

Is The NC 529 Plan Tax Deductible CFNC

https://www.cfnc.org/media/sjshnqm0/fafsa-tax-forms.jpg

Are Contributions To A 529 Plan Tax Deductible Sootchy

https://global-uploads.webflow.com/5e7af514190cb858e85adbbe/5f9c2480d8e12e5446ae4d45_shutterstock_1109910923-min.jpg

529 plan contributions grow tax free Withdrawals are tax free when used to pay for qualified higher education expenses You can contribute as much as you want as often North Carolina doesn t offer any tax deductions for contributions to a 529 plan Minimum 25 Maximum Accepts contributions until all account balances for the same

In North Carolina NC 529 Account earnings are also free from state taxes when used for qualified education expenses and the list of qualified expenses is pretty Is a 529 plan tax deductible in North Carolina No North Carolina does not offer tax deductions for 529 plans What happens to a North Carolina 529 Plan if not used There is no time in which the funds

Download Are Contributions To 529 Plans Tax Deductible In North Carolina

More picture related to Are Contributions To 529 Plans Tax Deductible In North Carolina

529 Plans Tax Time

https://cdn.zephyrcms.com/e112549c-a559-40fd-93fb-638041043470/-/progressive/yes/-/format/jpeg/-/stretch/off/-/resize/1200x/529-plans-tax-time-gennext-sm.jpg

Saving For Education 529 Plans Wheeler Accountants

https://wheelercpa.com/wp-content/uploads/529-plans-2120x1060.jpeg

The Tax Benefits Of College 529 Savings Plans Compared By State

https://i.kinja-img.com/gawker-media/image/upload/s--1ZmmFPnG--/c_fill,fl_progressive,g_center,h_900,q_80,w_1600/1005722794300725574.jpg

Most states limit the amount of annual 529 plan contributions eligible for a state income tax benefit but annual 529 plan contributions are fully deductible in When you take funds out of your 529 Plan you won t need to pay federal or state taxes on the distribution as long as you use the withdrawal for qualified education expenses In addition you don t incur a tax penalty if

Tax Benefits Good news for North Carolina residents by investing in a NC 529 plan you can deduct up to 2 500 on your state income taxes for single filer and 5 000 for In Colorado New Mexico South Carolina and West Virginia 529 plan contributions are fully deductible from state taxable income However most states

529 Maximum Contribution Limits In 2023 The Education Plan

http://theeducationplan.com/sites/default/files/styles/extra_large_landscape_1680x1120_/public/2022-12/Header Image - Max Contributions.png?itok=rIC2zKiH

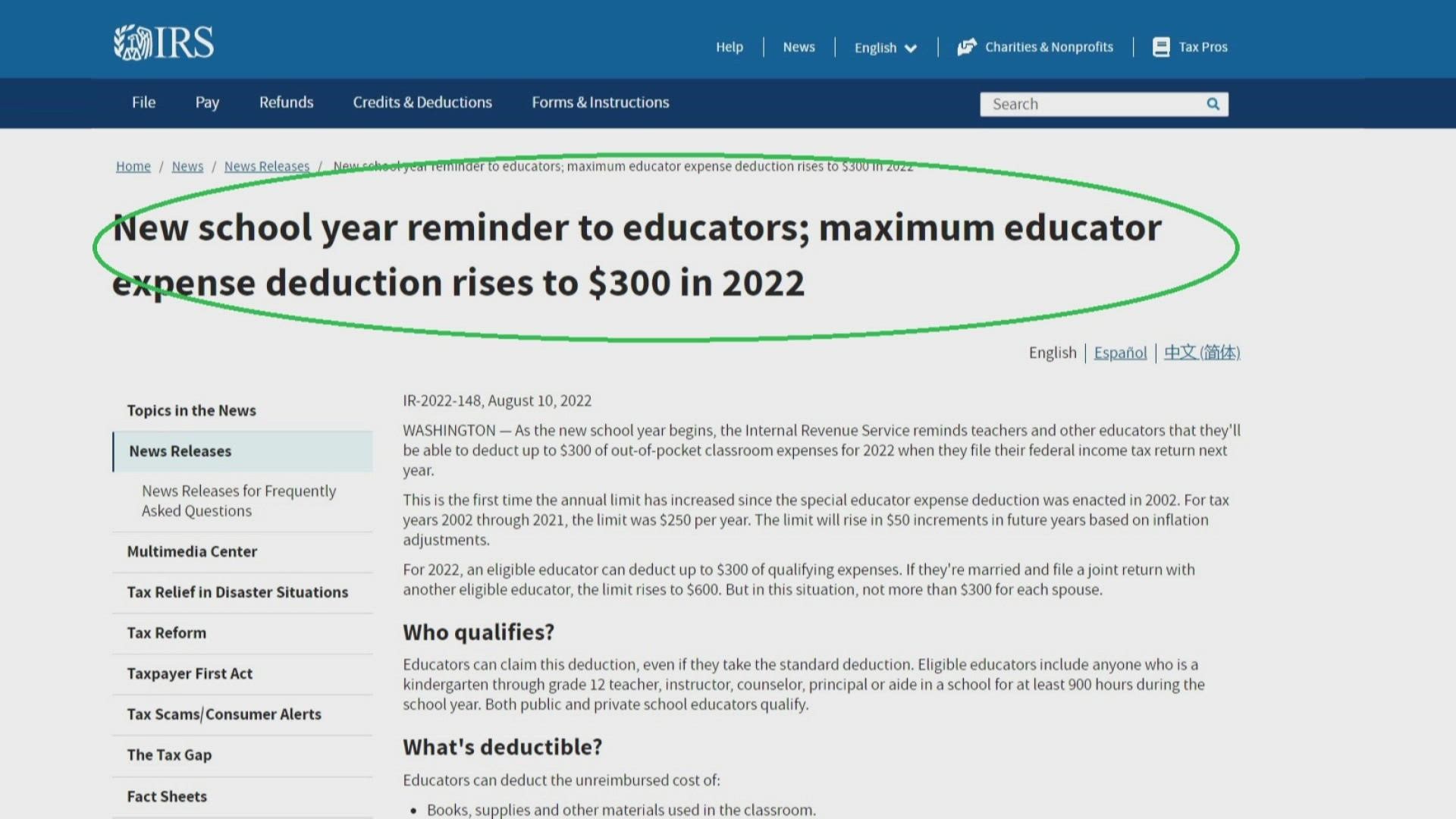

School Supplies Are Tax Deductible Wfmynews2

https://media.wfmynews2.com/assets/WFMY/images/181276e9-96af-4e3f-b43a-1cdd1d198fdc/181276e9-96af-4e3f-b43a-1cdd1d198fdc_1920x1080.jpg

https://www.thebalancemoney.com/north-c…

However contributions made to the plan are not deductible from your income for state tax purposes Through this plan family members and friends can contribute to a child s college fund

https://collegefinance.com/saving-for-colleg…

While most states tax deduction rules allow families to subtract 529 contributions from their gross income the rules vary from state to state The chart below provides an overview of the rules in each

/close-up-of-diploma-and-banknotes--studio-shot-150973797-b97794ab5e8f4535b64517d016b1220e.jpg)

Are Contributions To 529 Plans Tax Deductible In Virginia Tax Walls

529 Maximum Contribution Limits In 2023 The Education Plan

If 529 Plans Get Taxed Here s Another Tax free Option

The Complete Guide To Virginia 529 Plans For 2024

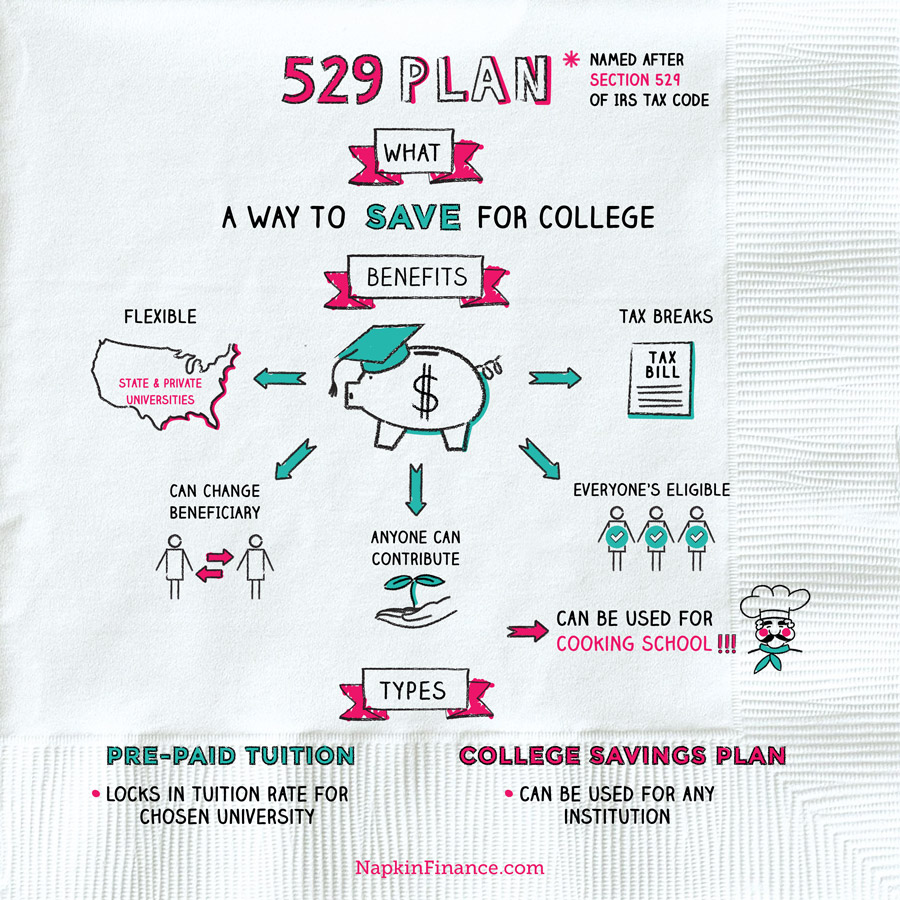

529 Plan Napkin Finance

Nj 529 Plan Tax Benefits Tiffaney Bernal

Nj 529 Plan Tax Benefits Tiffaney Bernal

529 Plan Tax Deductible College Savings Plans

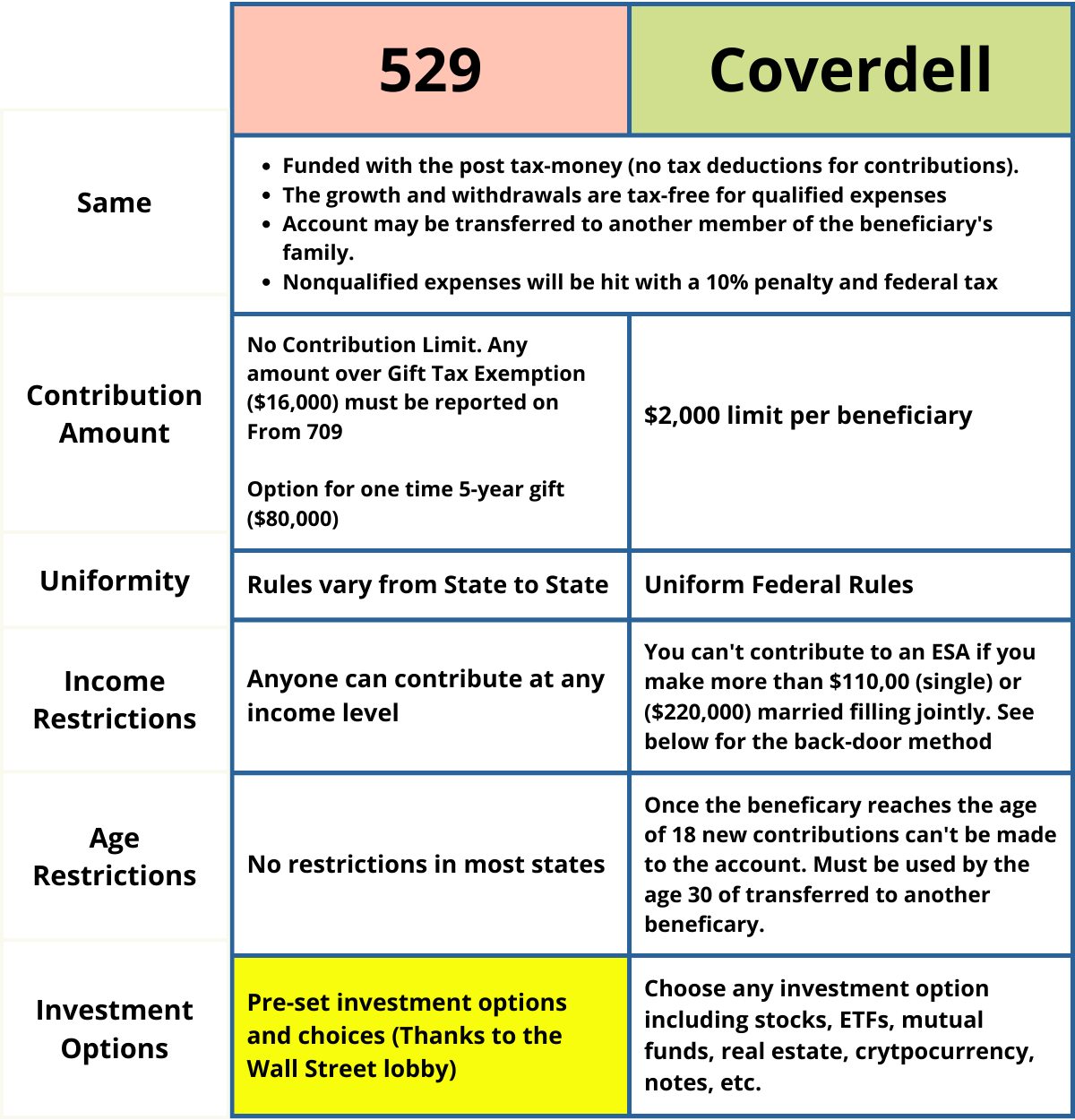

529 Versus ESA The Best For College Savings Mark J Kohler

Are Oklahoma 529 Contributions Tax Deductible Diamond Carranza

Are Contributions To 529 Plans Tax Deductible In North Carolina - 529 plan contributions grow tax free Withdrawals are tax free when used to pay for qualified higher education expenses You can contribute as much as you want as often