Are Donations To Nonprofits Tax Deductible Charitable contribution tax information search exempt organizations eligible for tax deductible contributions learn what records to keep and how to report contributions

For giving money goods or property to certain types of organizations the IRS allows you to take a tax deduction Only donations to groups defined by section 501 c 3 of the Internal Revenue Code You must make contributions to a qualified tax exempt organization You must have documentation for cash donations of more than 250 You must have written appraisals for noncash donations of

Are Donations To Nonprofits Tax Deductible

Are Donations To Nonprofits Tax Deductible

https://peregianspringsss.eq.edu.au/SiteCollectionImages/Tax dedcuctale donations.jpg

Non Profit Letter For Donations Database Letter Template Collection

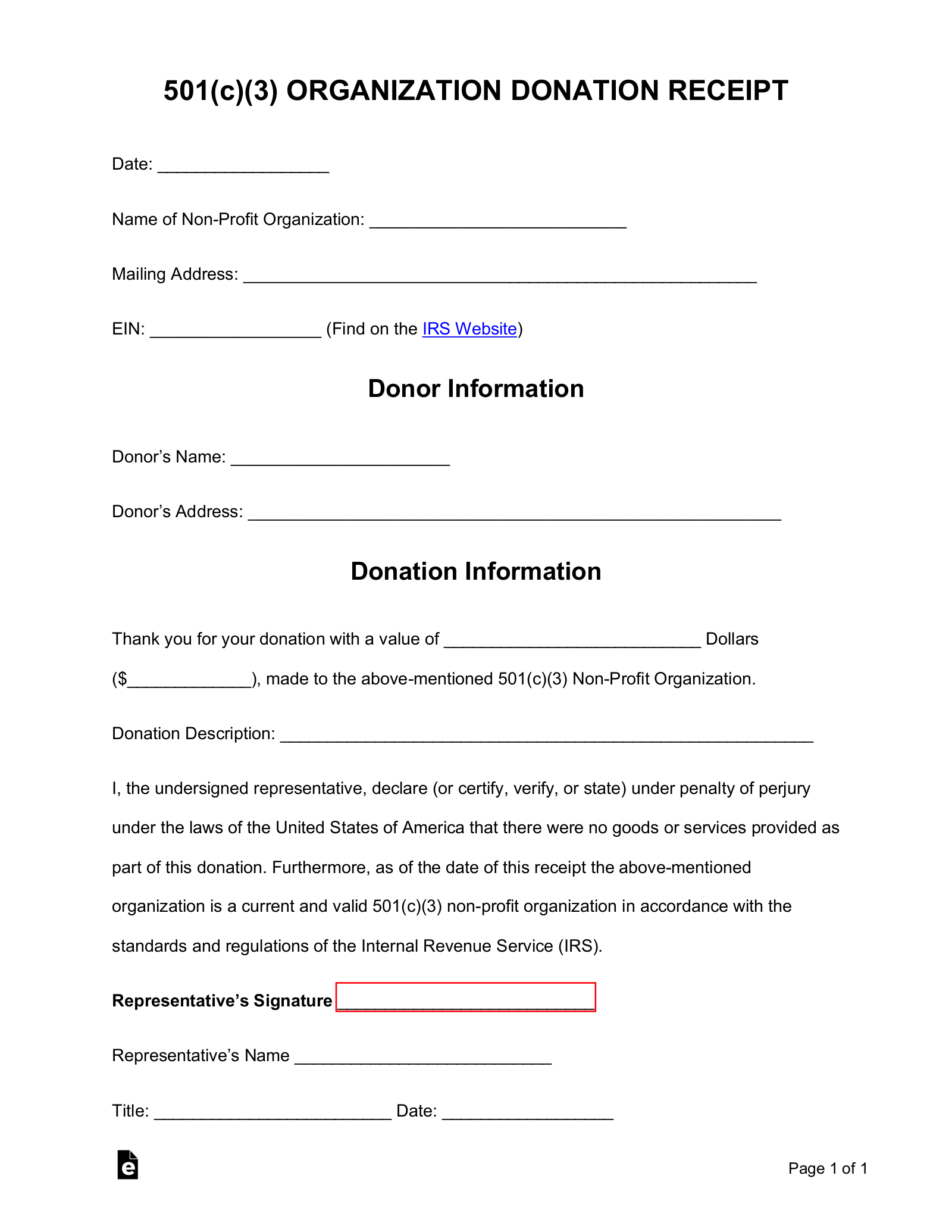

https://eforms.com/images/2018/04/501c3-Donation-Receipt-Template.png

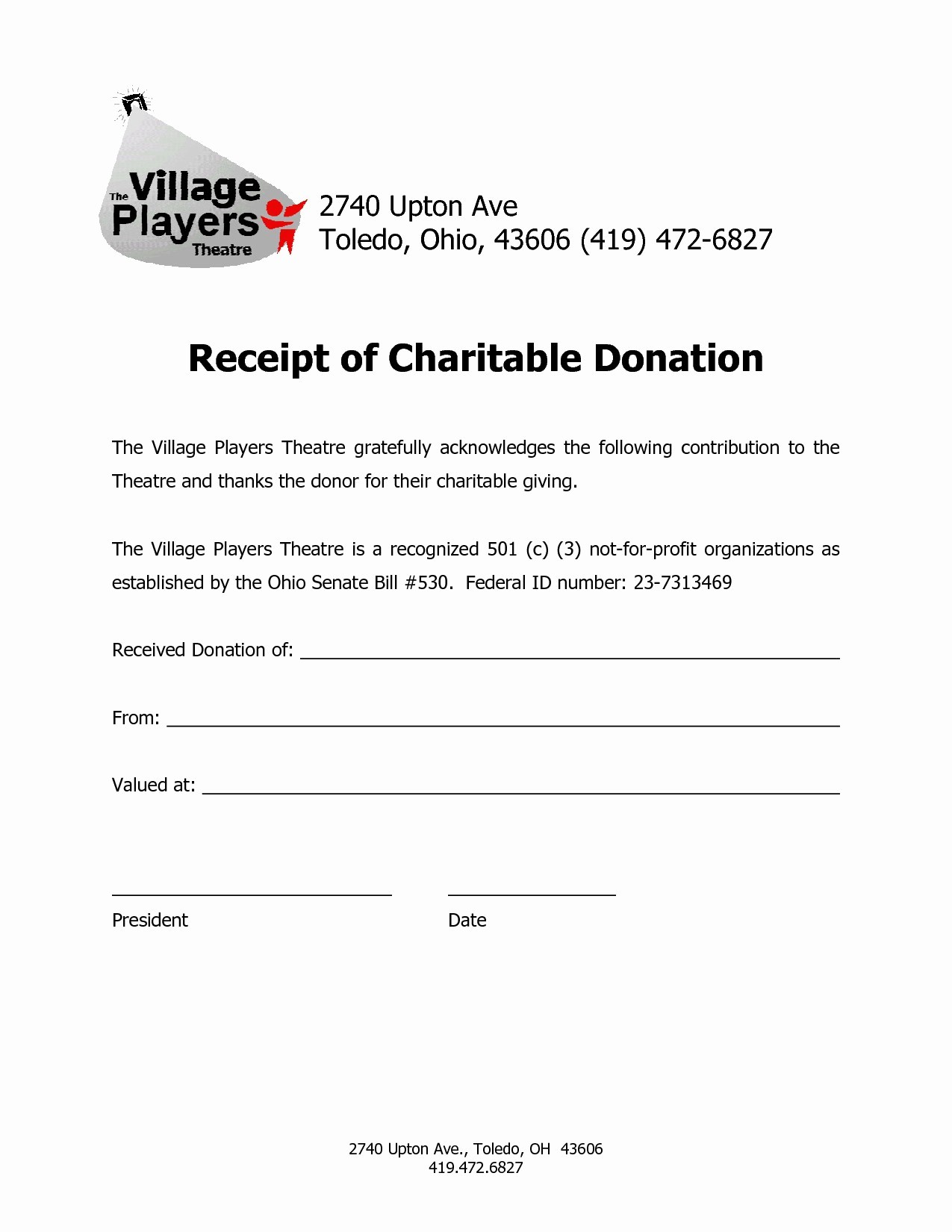

40 Donation Receipt Templates Letters Goodwill Non Profit Non Profit

https://i.pinimg.com/originals/23/40/13/2340137caff47005aa311dd2ba8ca1a5.jpg

Donations to a qualified charity are deductible for taxpayers who itemize their deductions using Schedule A of IRS Form 1040 Cash donations for 2022 and later It discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct It also discusses how much you can deduct what records you must keep

Charitable contributions are generally tax deductible though there can be limitations and exceptions Eligible itemized charitable donations made in cash for instance are eligible for 501 c 3 nonprofits are a specific class of nonprofit organizations recognized by the IRS including most charitable organizations and churches Donations to 501 c 3 nonprofit

Download Are Donations To Nonprofits Tax Deductible

More picture related to Are Donations To Nonprofits Tax Deductible

Addictionary

https://www.addictionary.org/g/006-impressive-tax-exempt-donation-receipt-template-concept-1920_2486.jpg

501c3 Tax Deductible Donation Letter Template Business

https://nationalgriefawarenessday.com/wp-content/uploads/2018/01/501c3-tax-deductible-donation-letter-donation-tax-receipt-letter.jpg

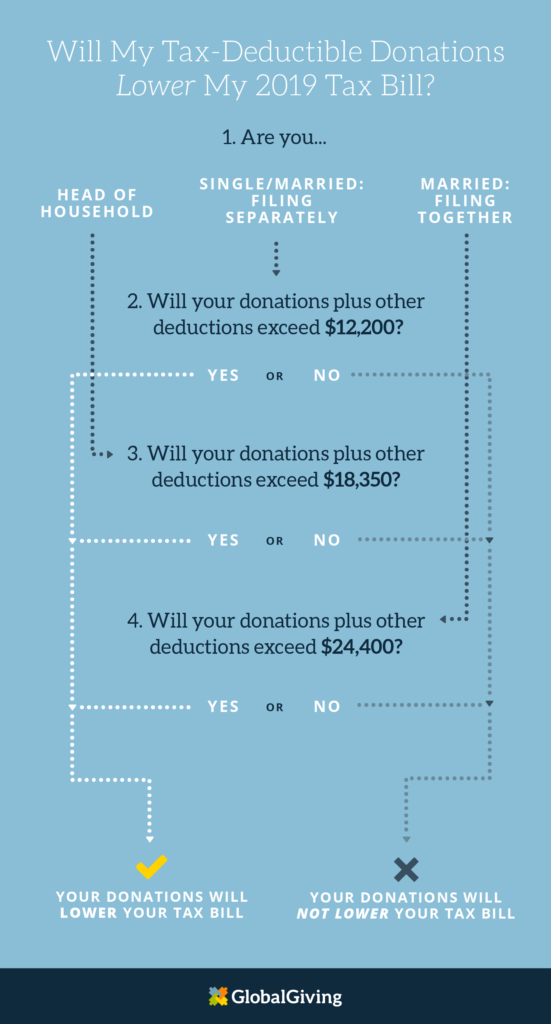

Everything You Need To Know About Your Tax Deductible Donation Learn

https://www.globalgiving.org/learn/wp-content/uploads/2019/07/Flow-Chart-2-Lower-My-2019-Tax-Bill-1-551x1024.png

In the United States ever changing tax laws can make it difficult for donors to know which gifts are tax deductible and to what extent We recommend checking how any changes to the tax code or your situation may impact In the United States ever changing tax laws can make it difficult for donors to know which gifts are tax deductible and how charitable giving can benefit your tax situation We recommend checking how any changes to

Donations to churches and other religious institutions are generally tax deductible provided that these organizations have obtained 501 c 3 status Are Donations Tax Deductible The Tax Cuts and Jobs Act which went into full effect on January 1 2018 retains the longstanding personal tax deduction for charitable

Bunching Up Charitable Donations Could Help Tax Savings

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/01/02/USATODAY/usatsports/donate-charity-coin-cash-tax-give-deduction-getty_large.jpg?width=3200&height=1680&fit=crop

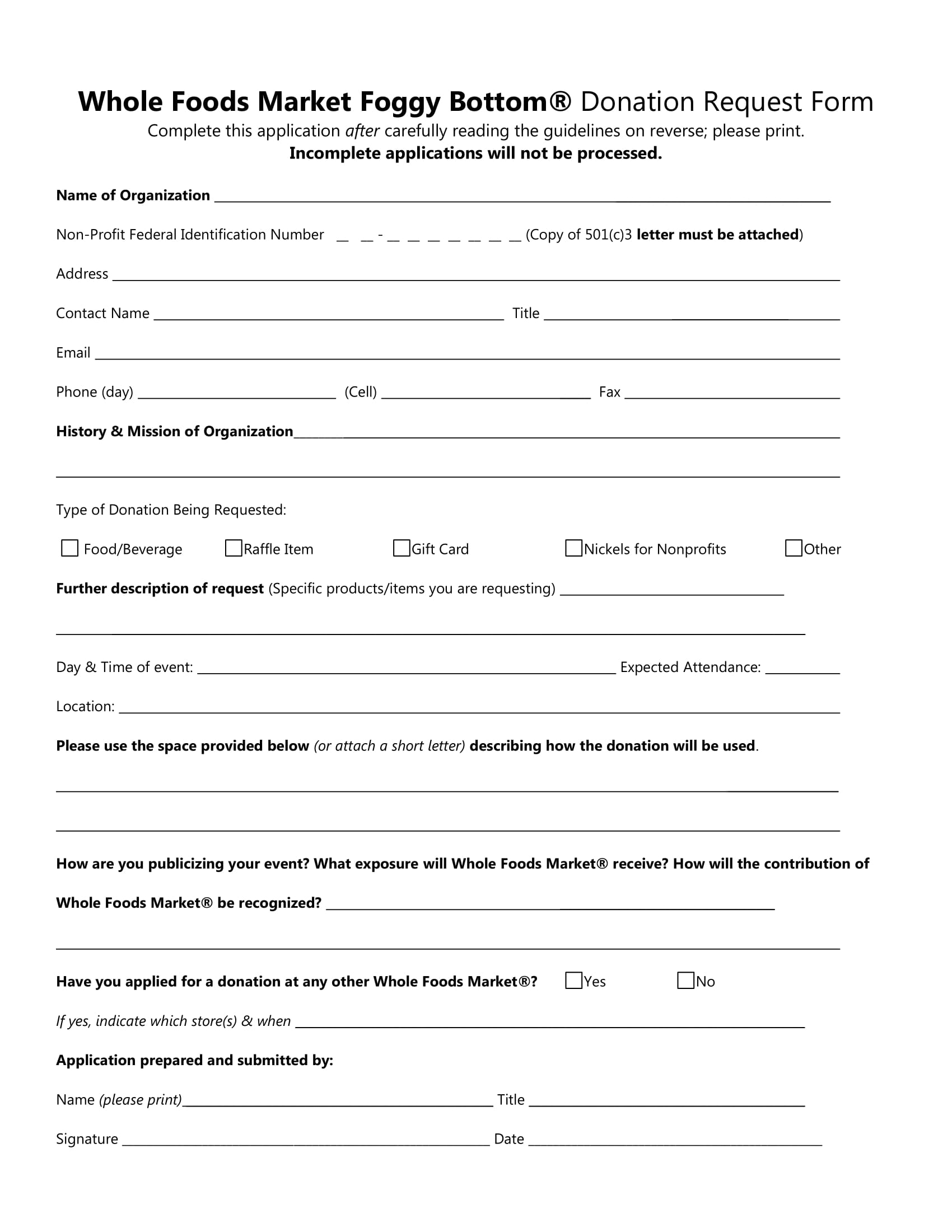

Best Buy Donation Request Form 2023 Printable Forms Free Online

https://www.typecalendar.com/wp-content/uploads/2023/05/Donation-Request-Letter-1.jpg

https://www.irs.gov/charities-non-profits/charitable-contributions

Charitable contribution tax information search exempt organizations eligible for tax deductible contributions learn what records to keep and how to report contributions

https://turbotax.intuit.com/tax-tips/char…

For giving money goods or property to certain types of organizations the IRS allows you to take a tax deduction Only donations to groups defined by section 501 c 3 of the Internal Revenue Code

50 Non Profit Donation Receipt Form

Bunching Up Charitable Donations Could Help Tax Savings

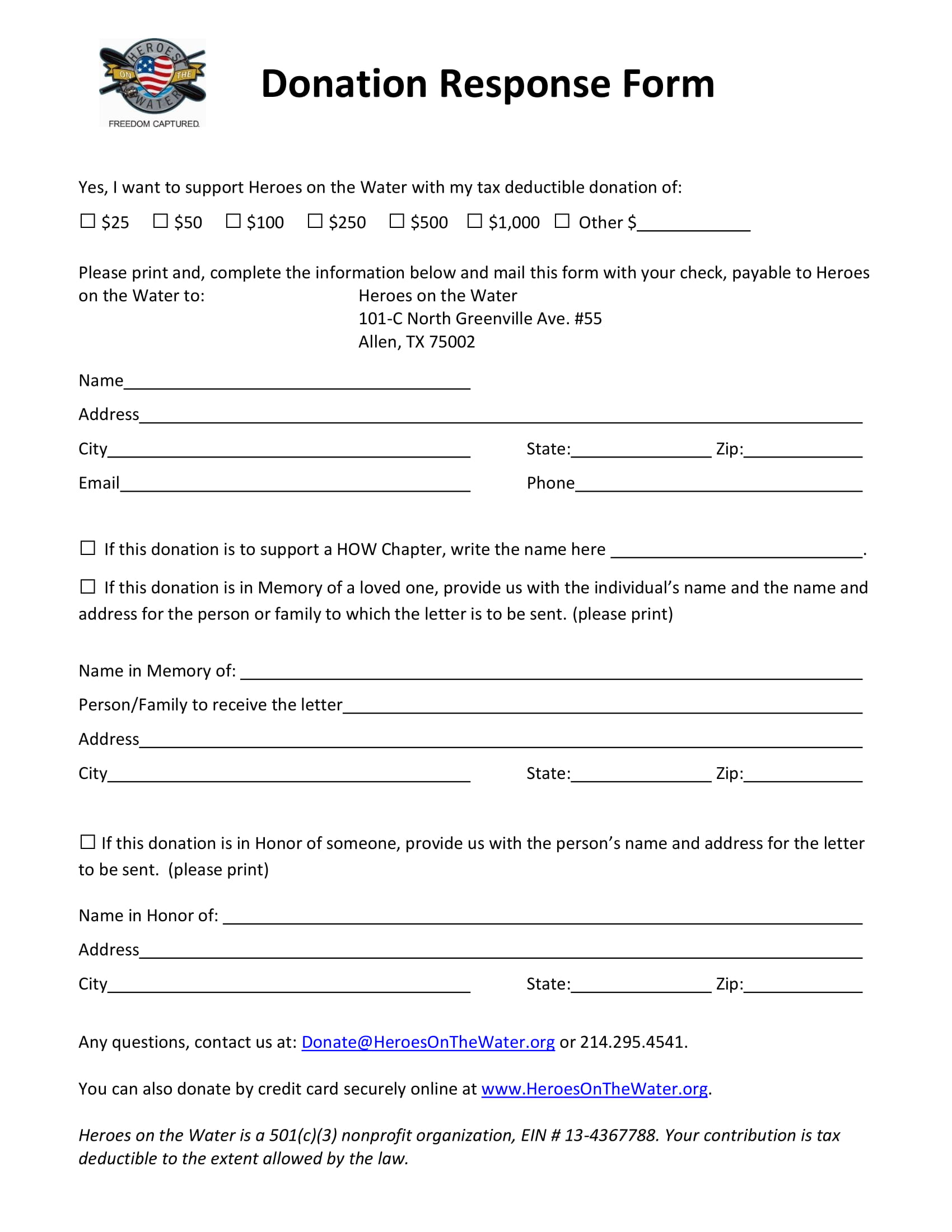

FREE 4 Nonprofit Donation Forms In PDF MS Word

Editable Nonprofit Donation Request Letter Template Donation

Tax Deductible Donation Letter Templates At Allbusinesstemplates

Tax Deductible Donation Receipt Printable Addictionary

Tax Deductible Donation Receipt Printable Addictionary

Explainer Why Are Donations To Some Charities Tax deductible

Vehicle Donation Receipt Template

FREE 4 Nonprofit Donation Forms In PDF MS Word

Are Donations To Nonprofits Tax Deductible - Gifts to a non qualified charity or nonprofit are not deductible To qualify a group must register with the IRS under section 501 c 3 or in some cases section