Are Gst Rebates Considered Income Eligible Expenses You must have paid the GST or HST on your expenses and included them on your tax return before you can claim the rebate For example

The credit is designed to assist Canadians with low to moderate incomes Single individuals making 52 255 or more before tax are not entitled to the credit A married couple with The amount Canadians will get from the GST rebate annually depends on the level of family income and make up of the family The federal government has published

Are Gst Rebates Considered Income

Are Gst Rebates Considered Income

https://udyamregistrationform.com/wp-content/uploads/2021/09/is-gst-mandatory-for-udyam-registration.jpg

Rebates For Seniors Mark Coure MP

https://markcoure.com.au/images/news/seniors-rebates-photo.png

Are 2022 Tax Rebates Considered taxable Income YouTube

https://i.ytimg.com/vi/Kqpil_lM9jY/maxresdefault.jpg

Nov 4 2022 1 min read This one time payment will essentially double the GST credit amount for the 11 million eligible Canadians for a six month period By Ivy Mak Toronto You are eligible for the GST HST credit if you are considered a Canadian resident for income tax purposes the month before and at the beginning of the month in

Known as Bill C 30 and aimed to help Canadians cope with high inflation once the legislation officially becomes law those eligible for the GST rebate in Canada will GST rebate payment is either by cheque or direct deposit The GST credits are issued to offset the GST paid by certain residents of Canada When you file

Download Are Gst Rebates Considered Income

More picture related to Are Gst Rebates Considered Income

Tax Reductions Rebates And Credits

https://sb.studylib.net/store/data/008702919_1-5fc3b4877f75d05a02ea5cfa273ba161-768x994.png

10 Days GST Return Service Accounts Details Rs 1000 month RCS GST

https://5.imimg.com/data5/SELLER/Default/2022/11/PD/QI/GO/31985580/gst-return-service-1000x1000.jpg

Savings Rebates Application BWFL

https://images.typeform.com/images/yvr5P8zAEHiW

To qualify for the GST HST credit your adjusted net family income must be below a certain threshold which for the 2022 tax year ranges from 52 255 to 69 105 To obtain the GST HST credit you must file your tax return in 2021 even if you haven t received any income during the year Here s how to get your credit depending on your

Canada Spain Vietnam Nigeria Australia Brazil Singapore South Korea The UnitedKingdom India The majority of these countries use what is called a unified GST A GST rebate refers to a refund of GST you pay in error or GST you incur in other situations And your local authorities don t require you to register the GST to get

Gst Registration Service At Rs 499 session Gst Registration Services

https://5.imimg.com/data5/SELLER/Default/2023/8/331122797/EX/PX/ZH/27348931/gst-1000x1000.jpg

Singapore Company GST Registration Procedure Importance And

https://www.wzwu.com.sg/wp-content/uploads/2021/11/gst-registration-min.jpg

https://turbotax.intuit.ca/tips/did-you-know-you...

Eligible Expenses You must have paid the GST or HST on your expenses and included them on your tax return before you can claim the rebate For example

https://www.springfinancial.ca/blog/boost-your...

The credit is designed to assist Canadians with low to moderate incomes Single individuals making 52 255 or more before tax are not entitled to the credit A married couple with

GST Council Tweaks Rates Complete List Of Items That Will Get Cheaper

Gst Registration Service At Rs 499 session Gst Registration Services

Prepaid GST Rebates Starting 2016 Prepaid Reload Pricing Back To Normal

States And Rebates

Annalee Sides

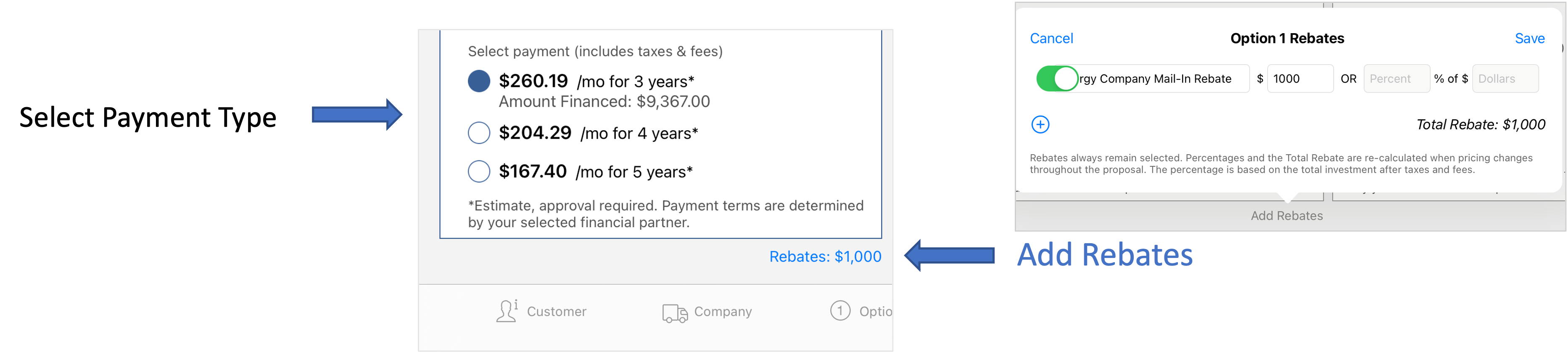

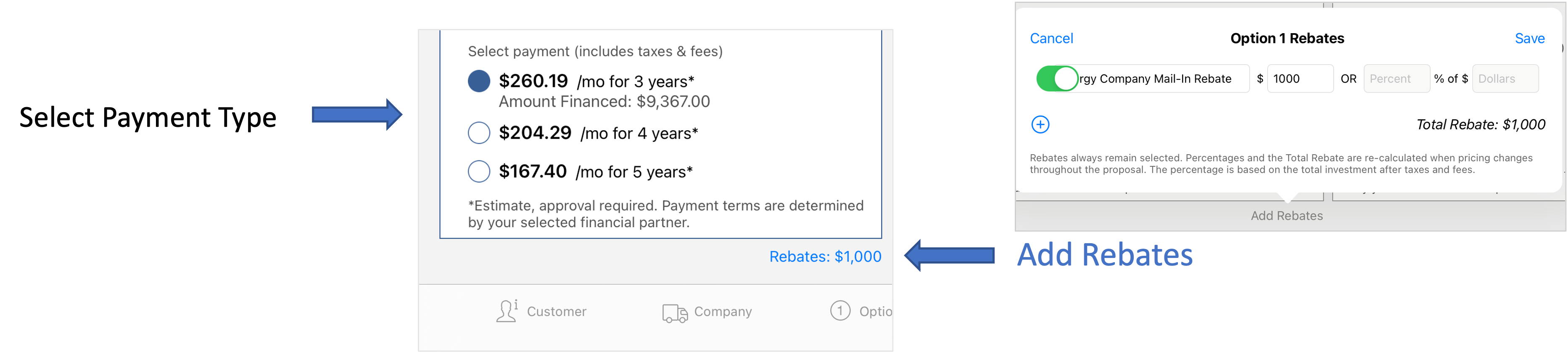

Signature Tab Intelligent Mobile Support

Signature Tab Intelligent Mobile Support

Land Transfer Tax Rebates ELLY NAJMABADI

Rebates And Refund Checks Checkeeper Can Handle Them For Your Business

Certificate Course On GST Return Filing

Are Gst Rebates Considered Income - Nov 4 2022 1 min read This one time payment will essentially double the GST credit amount for the 11 million eligible Canadians for a six month period By Ivy Mak Toronto