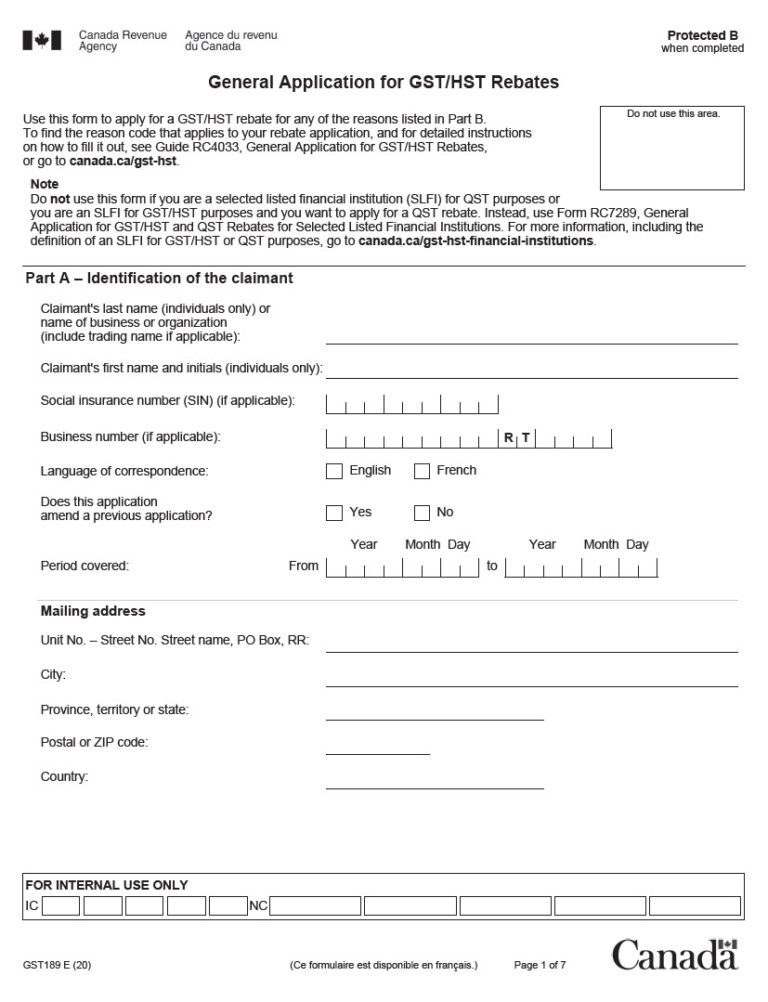

Is Gst Rebate Taxable Income How much you can expect to receive Your GST HST credit payments are based on the following your adjusted family net income If you re single the amount from line 23600 of your income tax return or the amount that it would be if you completed one

As an employee you may qualify for a GST HST rebate if all of the following conditions apply You paid GST or HST on certain employment related expenses and deducted those expenses on your income tax and benefit return Your employer is a GST HST registrant You do not qualify for a GST HST rebate in either of the following situations Are GST rebates taxable The rebate form has to be submitted electronically in Form RFD 01 within 2 years from the respective date The applicant should provide the return application certified by a Cost Accountant or Chartered Accountant if the amount of refund exceeds Rs 2 lakhs

Is Gst Rebate Taxable Income

Is Gst Rebate Taxable Income

https://www.victoriabuzz.com/wp-content/uploads/2019/06/adultingmoney-e1561581594509.jpg

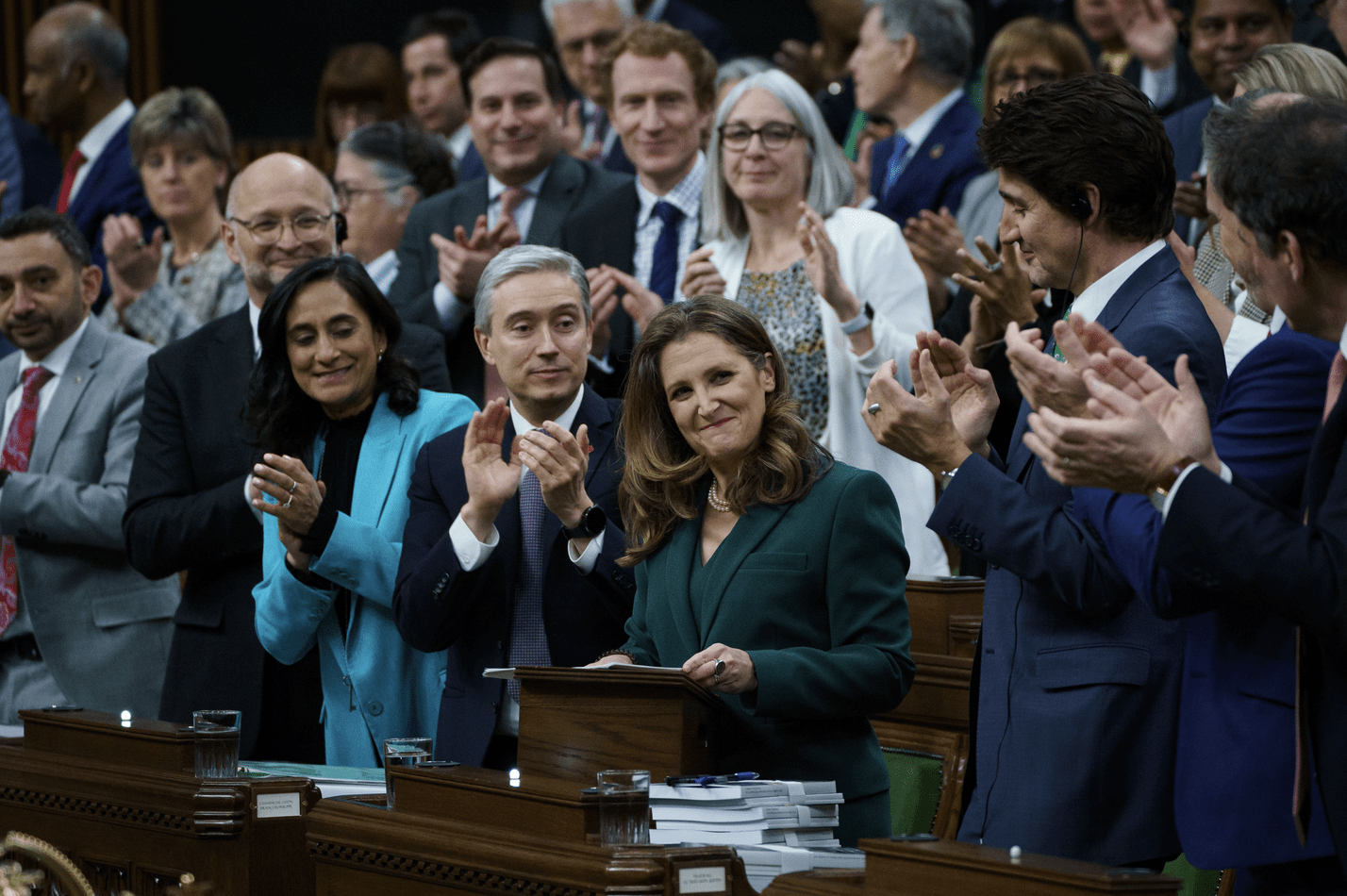

Feds Temporary Boost To GST Rebate Will Help During High Inflation

https://www.nationalobserver.com/sites/nationalobserver.com/files/styles/article_header_xl/public/img/2022/09/14/e28716eec22252892070e8135bdaa05d7d100a22f1922e7264620b1091a4cdbb.jpg?itok=NK8tVZen

Temporary Boost To GST Rebate Appropriate Amid High Inflation

https://www.talentcanada.ca/wp-content/uploads/2020/11/Ottawa-AdobeStock_299790306-2048x1279.jpeg

The total GST HST rebate is claimed on line 45700 of your income tax return The calculation of the GST HST rebate consists of two parts rebate on expenses other than CCA and rebate on CCA expenses The rebate on expenses other than CCA will be considered income for the year you received it The employee and partner GST HST rebate is taxable income and must be included in income on line 10400 line 104 prior to 2019 of your tax return for the year it is received So if you ve claimed the rebate on your 2019 tax return and received it in 2020 you would include it in your 2020 taxable income

Thanks to the GST HST credit low earning taxpayers can get back a portion or all of the federal sales tax they pay Here s everything you need to know about the credit how it works who is eligible and how much you could be entitled to If you re registered for GST then GST will be payable on the rebate amount The two transactions are the purchase of the car and then if you re eligible a second transaction for the NSW government rebate The rebate will be assessable income This is because you ll be using the car to earn income

Download Is Gst Rebate Taxable Income

More picture related to Is Gst Rebate Taxable Income

AY 2022 2023 GST Vouchers Everything You Need To Know

https://res.cloudinary.com/valuechampion/image/upload/c_limit,dpr_1.0,f_auto,h_1600,q_auto,w_1600/v1/GST_Voucher_pic.png

Are GST Rebates Taxable Top 10 Reasons To Claim A GST Rebate

https://cdn-eohhj.nitrocdn.com/loWhbUxsgjGMjxRtFZxfytbzJRLaxRlZ/assets/images/optimized/rev-b7ea951/iiptr.com/wp-content/uploads/2023/01/Are-GST-Rebates-Taxable-Top-10-Reasons-To-Claim-A-GST-Rebate-540x501.jpg

Is Costco Rebate Taxable Income CostcoRebate

https://i0.wp.com/www.costcorebate.com/wp-content/uploads/2022/10/turbotax-costco-price-3-stocks-to-watch-next-week-costco-intuit-and.png

Understand what a rebate is and the way you apply GST to rebates Making an adjustment because of a rebate Information for purchasers and suppliers on making an adjustment The GST HST tax credit is a tax free quarterly payment that helps low or modest income Canadians offset the GST HST they pay on goods and services If you were employed by a company or you re a member of a partnership that is a GST HST registrant you might be able to claim a rebate for the GST HST you paid on any employment expenses you

Millions of Canadians will see GST credits double starting Friday Here s who qualifies The one time payment was announced by the federal government in September and is intended to help The quarterly non taxable payment on April 5 is meant to offset GST or HST costs for people with low and modest incomes and most Canadians are assessed for the credit when they file their

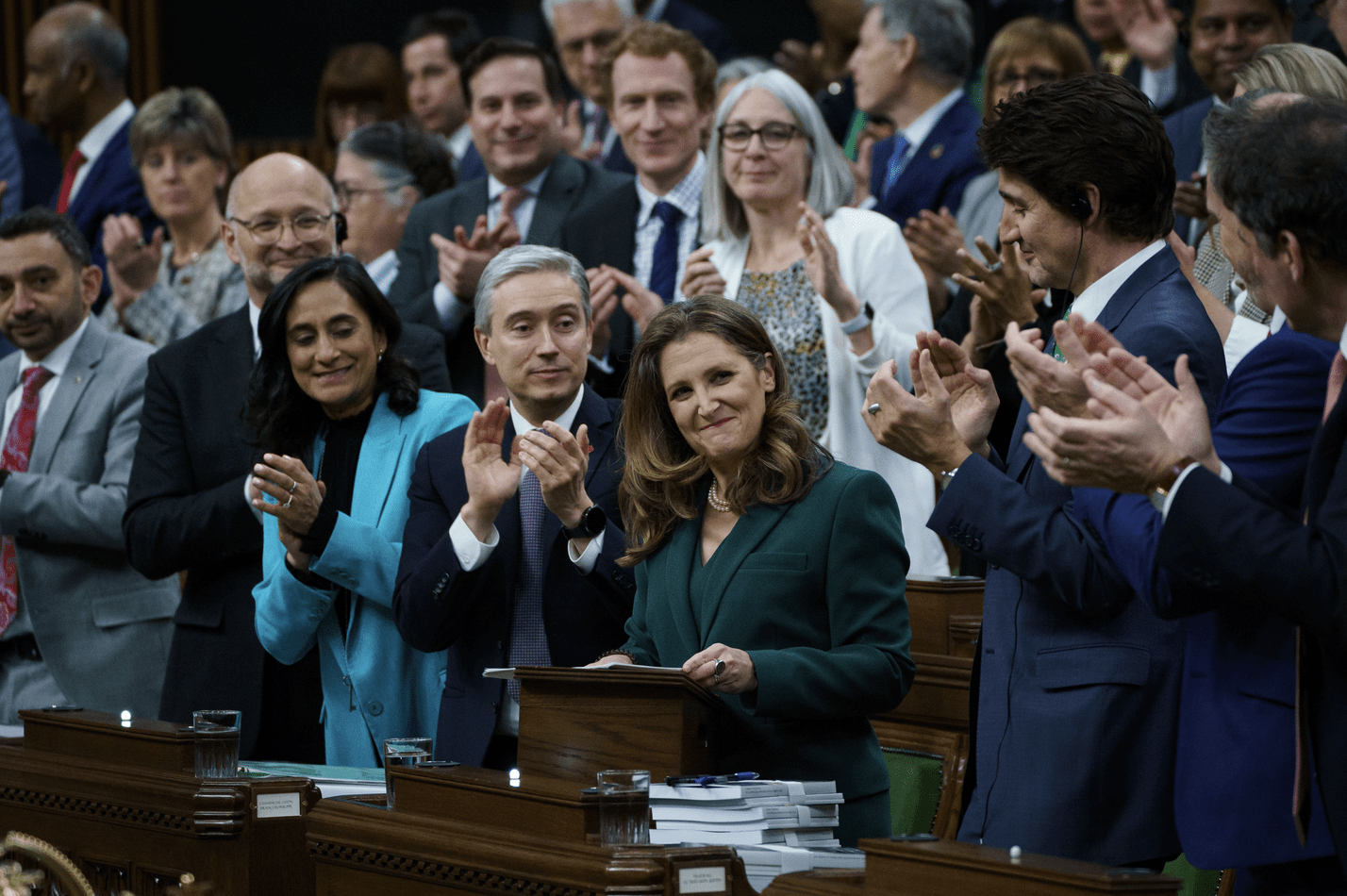

Budget 2023 An Ironic GST Rebate And A Happy NDP Policy Magazine

https://www.policymagazine.ca/wp-content/uploads/2023/03/Screen-Shot-2023-03-28-at-5.43.45-PM.png

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-13.jpg

https://www.canada.ca/en/revenue-agency/services/...

How much you can expect to receive Your GST HST credit payments are based on the following your adjusted family net income If you re single the amount from line 23600 of your income tax return or the amount that it would be if you completed one

https://www.canada.ca/.../employee-gst-hst-rebate.html

As an employee you may qualify for a GST HST rebate if all of the following conditions apply You paid GST or HST on certain employment related expenses and deducted those expenses on your income tax and benefit return Your employer is a GST HST registrant You do not qualify for a GST HST rebate in either of the following situations

MPs Unanimously Vote To Temporarily Double GST Rebate For Lower income

Budget 2023 An Ironic GST Rebate And A Happy NDP Policy Magazine

GST Refund Form Rfd 01 Printable Rebate Form

New Home HST GST Rebate By Nadene Milnes Issuu

Customers To Fully Understand GST Rebate Method On Prepaid Top ups

Are GST Rebates Taxable Top 10 Reasons To Claim A GST Rebate

Are GST Rebates Taxable Top 10 Reasons To Claim A GST Rebate

Income Property Tax Rebate Payments Going Out Chronicle Media

How To Reduce Your Taxable Income

Is CA EV Rebate Taxable

Is Gst Rebate Taxable Income - Thanks to the GST HST credit low earning taxpayers can get back a portion or all of the federal sales tax they pay Here s everything you need to know about the credit how it works who is eligible and how much you could be entitled to