Arkansas Sales And Use Tax Rebate Web Sales and Use Tax Administers the interpretation collection and enforcement of the Arkansas Sales and Use tax laws This includes Sales Use Aviation Sales and Use

Web Act 1277 of 2005 as amended by Act 795 of 2009 allows incentives in the form of state and local sales and use tax refunds and payroll rebates to eligible nonprofit organizations Web 22 f 233 vr 2020 nbsp 0183 32 1 A purchaser that pays any municipal sales or use tax in excess of the tax qualifying purchase of tangible personal property or a taxable service in a

Arkansas Sales And Use Tax Rebate

Arkansas Sales And Use Tax Rebate

https://grassrootstaxes.com/wp-content/uploads/2021/12/Should-my-Business-be-charging-Sales-Tax-FB-e1638503996346.png

Arkansas Sales Tax Sales Tax Arkansas AR Sales Tax Rate

https://1stopvat.com/wp-content/uploads/2022/06/14-768x768.png

Arkansas Sales Use Tax School

https://static.wixstatic.com/media/f2ce3e_11c5f9d441c846c9836b3c745007b22a~mv2.jpg/v1/fill/w_1920,h_754,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/f2ce3e_11c5f9d441c846c9836b3c745007b22a~mv2.jpg

Web The state of Arkansas has historically capped local sales tax paid to suppliers on business purchases with invoices exceeding 2 500 In recent years the state reduced the statute Web Sales and Use Tax Forms The Arkansas Sales and Use Tax Section does not send blank Arkansas Excise Tax Return ET 1 forms to taxpayers Contact 501 682 7104 to

Web sales use tax paid to more than one vendor you must attach a separate Section 2 and a separate Section 3 for each vendor and summarize your total refund claim in Section 1 Web Act 1404 of 2013 as codified in 167 167 26 52 447 26 53 149 and 15 4 3501 establishes two options by which certain state sales and use taxes relating to the partial replacement

Download Arkansas Sales And Use Tax Rebate

More picture related to Arkansas Sales And Use Tax Rebate

Arkansas Sales Use Tax School

https://static.wixstatic.com/media/f2ce3e_16a8eaf4ca1242c39c948ce9f67fd286~mv2.jpg/v1/crop/x_445,y_1,w_601,h_875/fill/w_538,h_783,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/ATS-PresenterArt.jpg

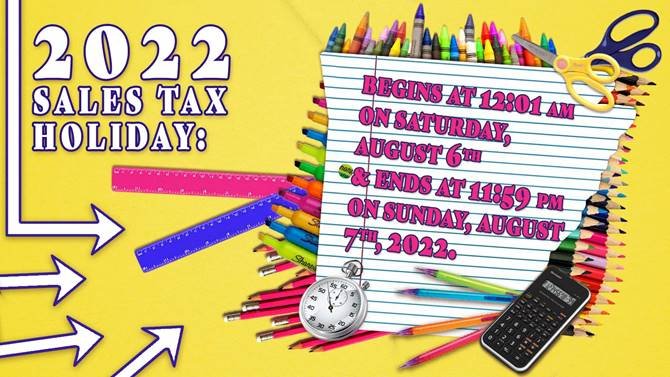

2022 Sales Tax Holiday Fran Cavenaugh Arkansas State Representative

https://francavenaugh.com/wp-content/uploads/2022/07/2022-Sales-Tax-Holiday.jpg

Checking In On Arkansas Taxes Yep Still High The Arkansas Project

https://www.thearkansasproject.com/wp-content/uploads/2012/01/sales_tax_suckers.jpg

Web The local sales and use tax is collected by the state and not the cities or counties It s then distributed back to the cities and counties every month Businesses report the cities or Web 28 janv 2020 nbsp 0183 32 Arkansas Code Annotated 167 26 52 307 addresses sales to construction contractors and provides Sales of services and tangible personal property including

Web The Local Distribution by NAICS Report reflecting monthly tax collection statistical information local tax rebates issued and audit adjustments is available for each Web Reduced sales amp use tax rate of 5 5 for the periods July 1 2014 through June 30 2018 Reduced sales amp use tax rate of 4 5 for the periods July 1 2018 through June 30

Arkansas Sales Use Tax School

https://static.wixstatic.com/media/f2ce3e_22bf0004d8e74cdb9c74048d04f38aae~mv2.gif

Arkansas Sales Tax On Used Vehicles Trailers And Semitrailers Priced

https://wehco.media.clients.ellingtoncms.com/img/photos/2022/01/01/AP710799883847_t800.jpg?90232451fbcadccc64a17de7521d859a8f88077d

https://www.dfa.arkansas.gov/excise-tax/sales-and-use-tax

Web Sales and Use Tax Administers the interpretation collection and enforcement of the Arkansas Sales and Use tax laws This includes Sales Use Aviation Sales and Use

https://www.dfa.arkansas.gov/excise-tax/tax-credits-special-refunds/...

Web Act 1277 of 2005 as amended by Act 795 of 2009 allows incentives in the form of state and local sales and use tax refunds and payroll rebates to eligible nonprofit organizations

Arkansas Sales Tax Holiday Archives Tax Free Weekend 2021 Sales Tax

Arkansas Sales Use Tax School

Report Arkansas 6th In Nation For State Local Sales Tax Rates The

Arkansas State Sales Tax Beautiful Flowers Images Flower Images Flowers

Arkansas Holds Back To School Sales Tax Holiday 2021 Vertex Inc

Arkansas To Require Remote Sellers To Collect Sales Tax Sales Tax

Arkansas To Require Remote Sellers To Collect Sales Tax Sales Tax

How To File Sales Tax In Arkansas Taxify

COVID 19 Toolkit Russellville Chamber Economic Development

Arkansas Online Sales Tax Goes Into Effect Covering Most Out of state

Arkansas Sales And Use Tax Rebate - Web Sales and Use Tax Forms The Arkansas Sales and Use Tax Section does not send blank Arkansas Excise Tax Return ET 1 forms to taxpayers Contact 501 682 7104 to