Average Property Tax In New Mexico 880 00 Avg 0 55 of home value Tax amount varies by county The median property tax in New Mexico is 880 00 per year for a home worth the median value of 160 900 00 Counties in New Mexico collect an average of 0 55 of a property s

The property tax rate in New Mexico varies by county but on average it is around 0 72 of the assessed property value This means that for a property valued at 200 000 the property tax would be approximately 1 440 per year If you need to find your property s most recent tax assessment or the actual property tax due on your property contact your county or city s property tax assessor The median property tax on a 160 900 00 house is 884 95 in New Mexico

Average Property Tax In New Mexico

Average Property Tax In New Mexico

https://alaskapolicyforum.org/wp-content/uploads/Property-taxes_22.jpg

The Rise Of Residential Property Tax In Arizona Klauer Law

http://klauerlaw.com/wp-content/uploads/2015/10/tax-increase.jpg

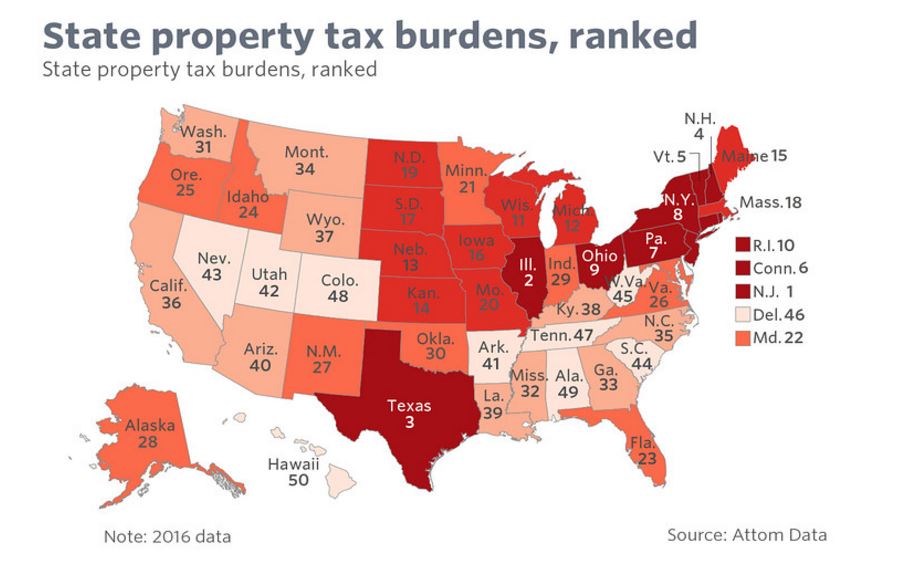

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

Overall New Mexico has a relative low average effective property tax rate and median payment The national averages for the USA are 0 99 and 4950 respectively In comparison the average rate for New Mexico is 0 87 and the median property tax bill is 3650 New Mexico Median property tax is 880 00 This interactive table ranks New Mexico s counties by median property tax in dollars percentage of home value and percentage of median income The list is sorted by median property tax in dollars by default

The state s median annual property tax that s paid is about 1 000 less than the national median at 1 232 Its average effective property tax rate is 0 76 That makes New Mexico the 13th lowest state in terms of property taxes in the country Nationally the average tax rate is assessed at 1 12 In New Mexico its only 0 72 The average property tax rate in New Mexico is 0 78 percent New Mexico s average property tax of less than one percent places it amongst the states with the lowest property taxes in the US New Mexico s property taxes

Download Average Property Tax In New Mexico

More picture related to Average Property Tax In New Mexico

KY State Legislature Makes Changes To Property Tax In House Bill 6

https://deandorton.com/wp-content/uploads/2022/05/Property-Tax-1.jpg

This Is How Much Property Taxes Value In All 50 States Clever Finance

https://cleverfinance.net/wp-content/uploads/2017/12/taxes-25.jpg

How Do Pa s Property Taxes Stack Up Nationally This Map Will Tell You

https://www.pennlive.com/resizer/p2gqH-9Cu-RsbFMDLy18ntSRMUc=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.pennlive.com/home/penn-media/width2048/img/capitol-notebook/photo/18540316-large.png

If you want to live in New Mexico with low property taxes Santa Fe County could be an excellent option The county s average effective property tax rate being 0 64 the tenth highest in the state At that rate a 282 600 home would have annual taxes of 1 808 Santa Fe s total 2022 millage rate stood at 23 717 mills Sandoval County The Property Tax Division helps local governments in the administration and collection of ad valorem taxes in the State of New Mexico Property taxes contribute a large portion of revenue to New Mexico s local governments and schools annually Residential and non residential property taxes are assessed by County Assessors and collected by

Key Takeaways New Mexico boasts some of the nation s lowest property taxes making homeownership more attainable in the state Understanding the assessment process is crucial as it directly influences property tax rates and payments Homeowners can take advantage of various payment options provided by state and local tax authorities Budget Finance Bureau Property Taxes Certificates of Property Tax Rates by County 2023 Certificates of Property Tax Rates range from the last 5 years For older property tax data please call 505 827 4975

New Mexico Lowest Property Taxes In The Nation Alamogordo Alamo

https://files.taxfoundation.org/20181024132920/SBTCI-Property.png

How Much Are You Paying In Property Taxes Real Estate Investing Today

https://i0.wp.com/realestateinvestingtoday.com/wp-content/uploads/2017/04/property-tax-rates-in-every-state.jpeg

https://www.tax-rates.org/new_mexico/property-tax

880 00 Avg 0 55 of home value Tax amount varies by county The median property tax in New Mexico is 880 00 per year for a home worth the median value of 160 900 00 Counties in New Mexico collect an average of 0 55 of a property s

https://www.payrent.com/articles/how-to-calculate...

The property tax rate in New Mexico varies by county but on average it is around 0 72 of the assessed property value This means that for a property valued at 200 000 the property tax would be approximately 1 440 per year

OUCH Alabama Has 4th Highest Combined Sales Tax Rate In The Country

New Mexico Lowest Property Taxes In The Nation Alamogordo Alamo

What Are The Average Property Taxes In Austin Buy Home

To What Extent Does Your State Rely On Property Taxes Tax Foundation

Property And Income Tax Theft

Property Taxes By State 2023 Wisevoter

Property Taxes By State 2023 Wisevoter

PRORFETY What Is The Average Annual Property Tax

The 15 States With The Highest Property Tax Rates In The U S A Bob Vila

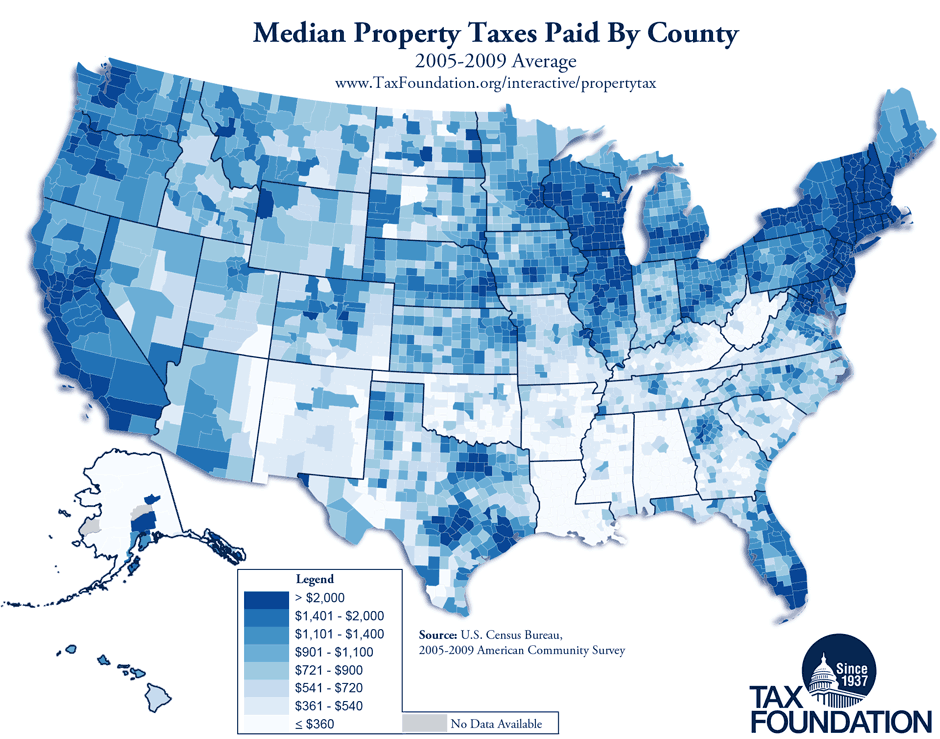

Monday Map Property Taxes By County 2005 2009 Average Tax Foundation

Average Property Tax In New Mexico - New Mexico Median property tax is 880 00 This interactive table ranks New Mexico s counties by median property tax in dollars percentage of home value and percentage of median income The list is sorted by median property tax in dollars by default