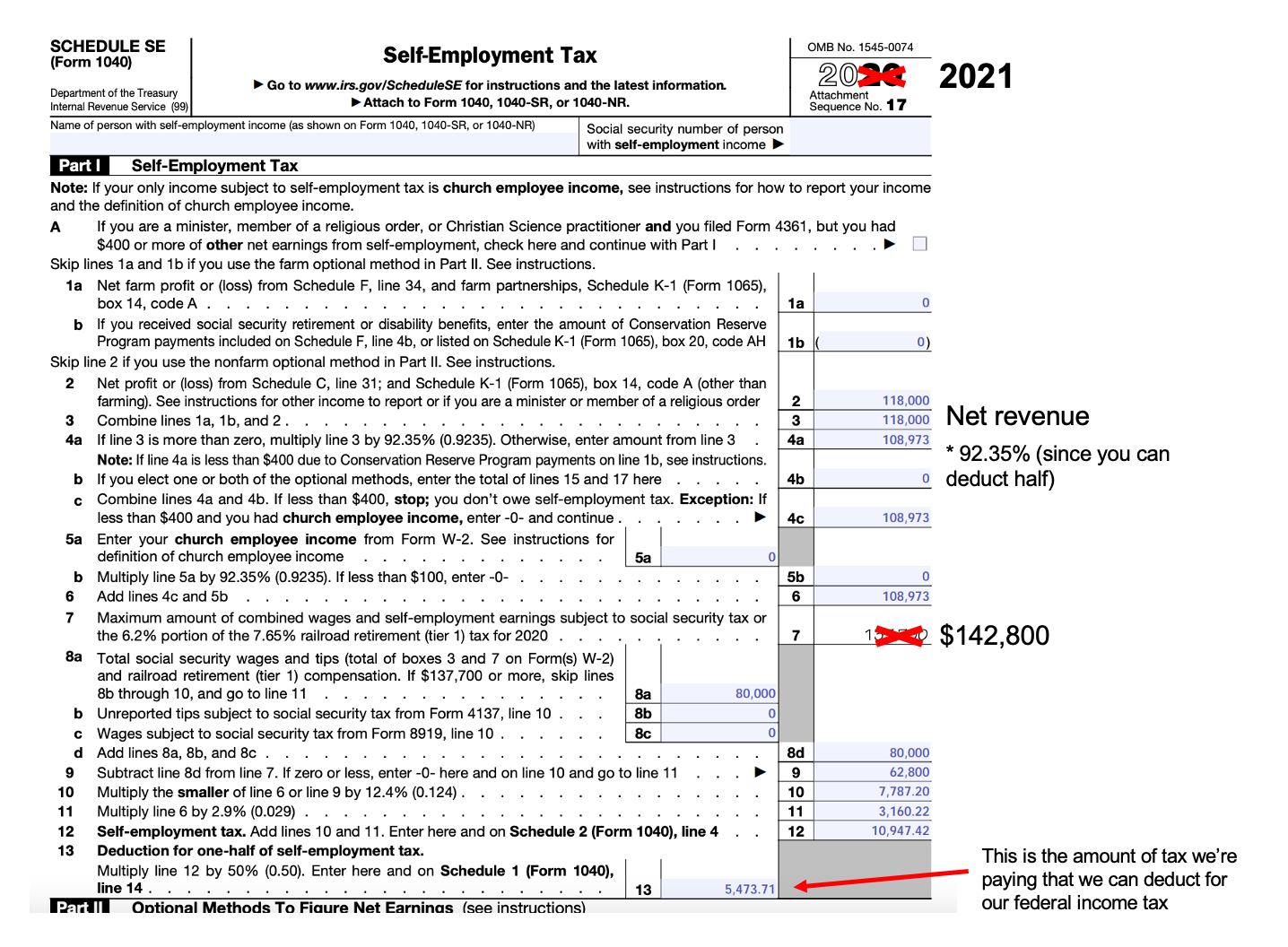

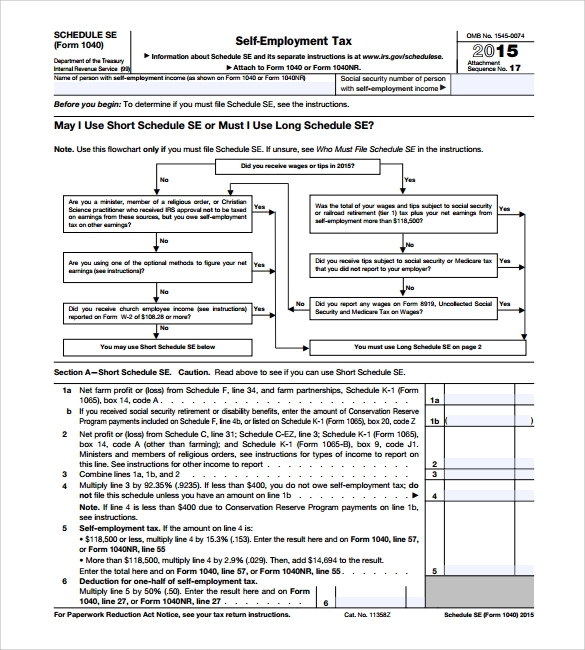

Average Tax Return For Self Employed Here s how you d calculate your self employment taxes Determine your self employment tax base Multiply your net earnings by 92 35 0 9235 to get your tax

The self employed must submit an income tax return Because you are self employed you must complete a business tax return Form 5 on which you inform the Finnish authorities of your trade or business operations You can either fill in the paper tax return Form 5 or log in to MyTax to submit your return Go to MyTax Read more tax The self employment tax is calculated as a percentage of the individual s net earnings from self employment while income tax is a percentage tax on a person s taxable income

Average Tax Return For Self Employed

Average Tax Return For Self Employed

https://valuewalkpremium.com/wp-content/uploads/2019/02/Tax-Refund.jpg

2022 Self Employed Tax Form Employment Form

https://www.employementform.com/wp-content/uploads/2022/10/2022-self-employed-tax-form.jpg

Self Employed Tax Refund Calculator JaceDillan

https://images.squarespace-cdn.com/content/v1/5e94adbc25a0ae61d843b475/1631660328281-6URFQ1JKAFLIJEBCHYDD/Schedule_SE_Example_2021

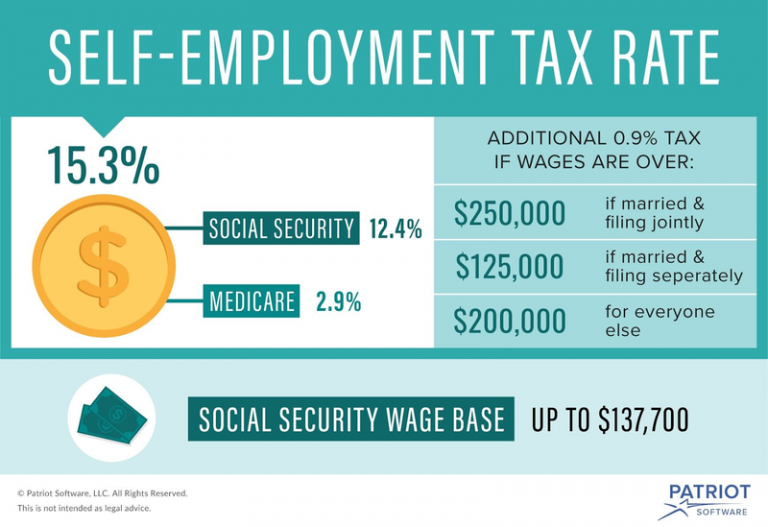

The self employment tax rate is 15 3 That rate is the sum of 12 4 for Social Security and 2 9 for Medicare Self employment tax applies to net earnings what many call profit If you earned 400 or more tax year 2023 as a business you are required to pay self employment taxes which include Social Security and Medicare taxes If you expect to owe 1 000 or more taxes

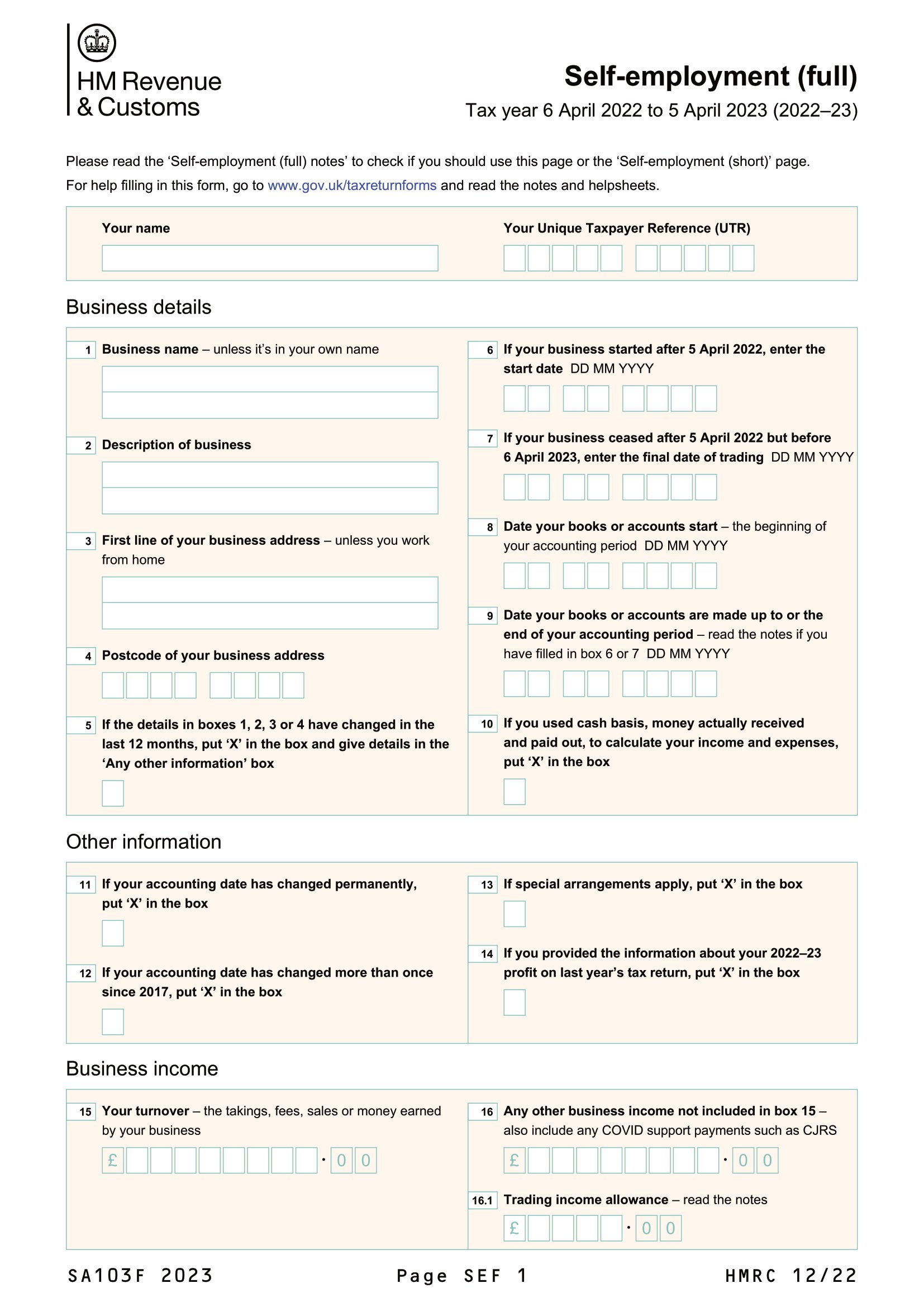

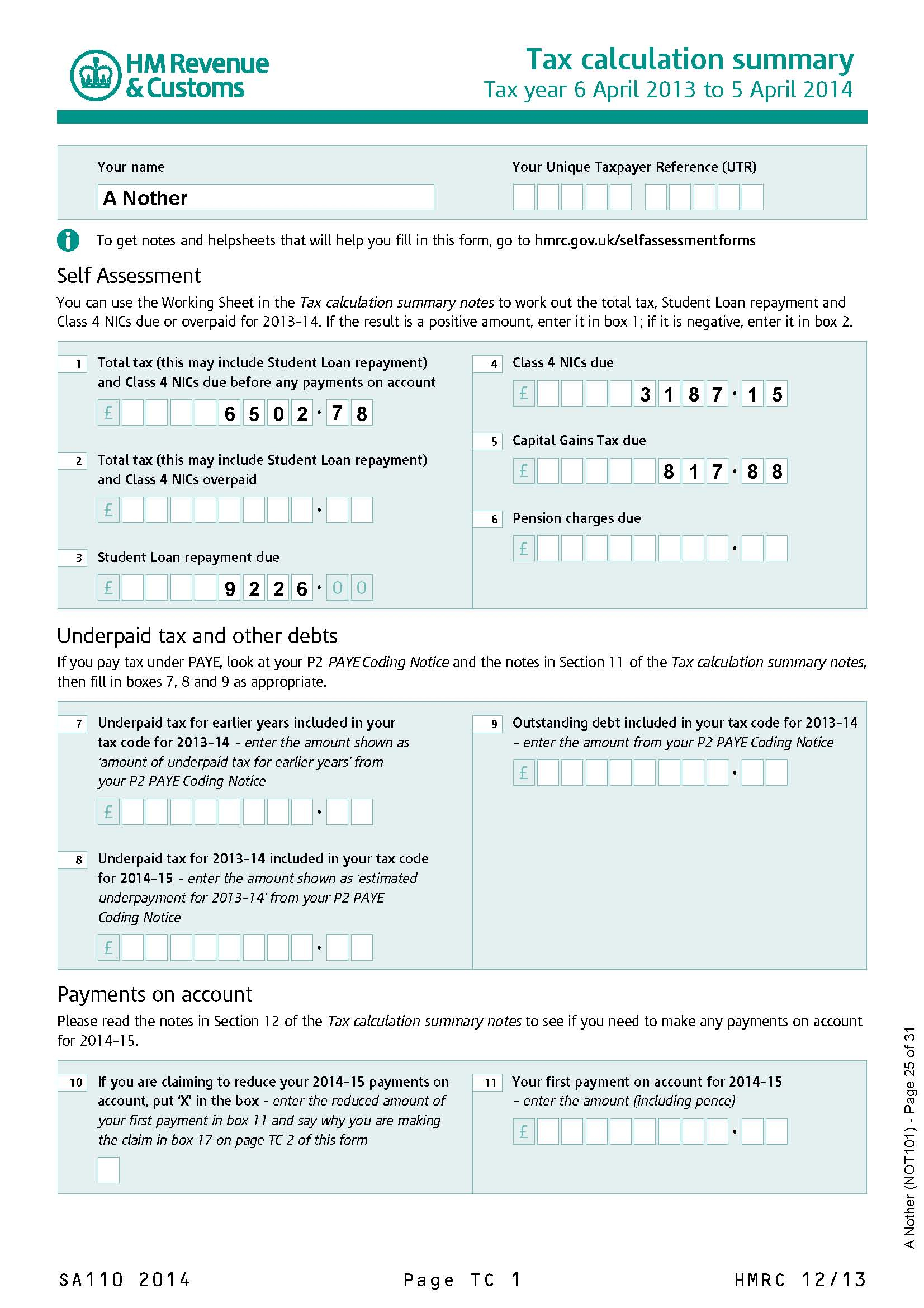

Self Assessment Use supplementary pages SA103S to record self employment income on your SA100 tax return if your annual business turnover was below the VAT threshold for the tax year Estimate your Self Assessment tax bill if you re self employed Use the self employed tax calculator to estimate your Self Assessment tax bill for the 2024 to 2025 tax year Enter

Download Average Tax Return For Self Employed

More picture related to Average Tax Return For Self Employed

USA 1040 Self Employed Form Template ALL PSD TEMPLATES

https://allpsdtemplates.net/wp-content/uploads/2020/12/3.jpg

How To Calculate Self Employment Tax YouTube

https://i.ytimg.com/vi/dmxwb20vSLo/maxresdefault.jpg

Help You Save Now This Specific No Cost Editable Self Employed Expense

https://i.pinimg.com/originals/51/dc/16/51dc16af007a47e9f8ce05c1511b2ed3.jpg

Use our Self Employed Tax Calculator and Expense Estimator to find common self employment tax deductions write offs and business expenses for 1099 filers Still need to file An expert can help or do The current self employment tax rate is 15 3 which includes 12 4 for Social Security and 2 9 for Medicare So if you make 10 000 you ll need to pay 1 530 in self employment taxes However

Let me take you through it step by step and show you what you need to know about self employed tax how it s calculated as well as how when you ll pay your tax bill when you work for yourself This You won t need to pay tax on anything you earn up to that amount Here s a breakdown of all the Income Tax rates for 2023 24 0 on the first 12 570 20 tax on income between 12 571 and 50 270

Calculate Self Employment Tax Deduction ShannonTroy

https://images.squarespace-cdn.com/content/v1/5e94adbc25a0ae61d843b475/1631660630025-G3GPPIMYRC8BMWX8LPIM/how_to_calculate_federal_tax_liability_self_employed_example

Guide To Self Employed Tax Returns Checkatrade

https://www.checkatrade.com/blog/wp-content/uploads/2022/02/self-employed-tax-return-1.jpg

https://www.forbes.com/advisor/taxes/self-employment-tax-calculator

Here s how you d calculate your self employment taxes Determine your self employment tax base Multiply your net earnings by 92 35 0 9235 to get your tax

https://www.vero.fi/en/individuals/tax-cards-and...

The self employed must submit an income tax return Because you are self employed you must complete a business tax return Form 5 on which you inform the Finnish authorities of your trade or business operations You can either fill in the paper tax return Form 5 or log in to MyTax to submit your return Go to MyTax Read more tax

Self Employment Tax Forms FACS Coding Quest

Calculate Self Employment Tax Deduction ShannonTroy

How To Calculate Tax Liability For Your Business

Self Employed Tax Return In The UK A Step by Step Guide Health

Amazon Flex Take Out Taxes Augustine Register

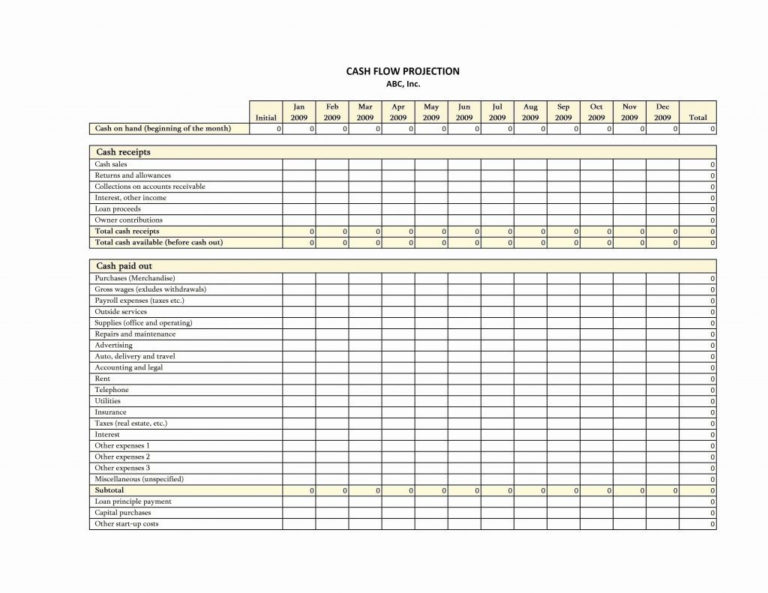

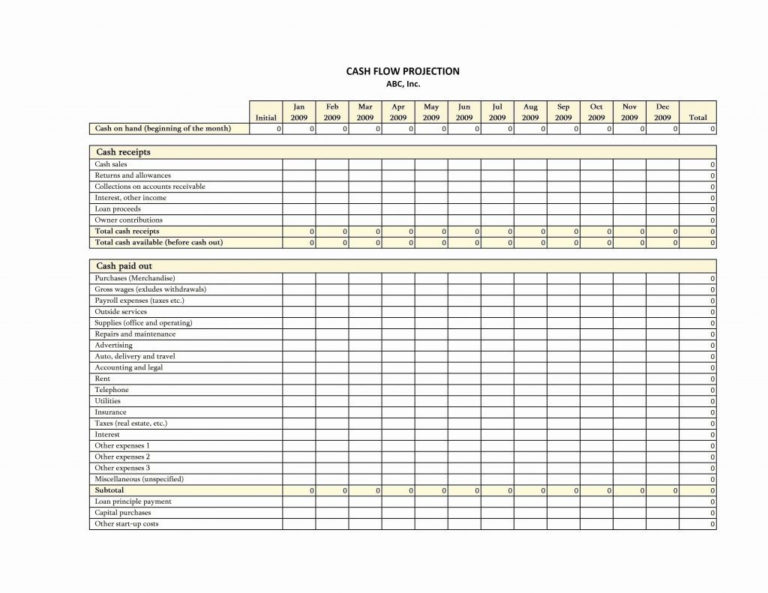

Self Employed Tax Spreadsheet Pertaining To Self Employed Expense Sheet

Self Employed Tax Spreadsheet Pertaining To Self Employed Expense Sheet

Hmrc Self Assessment Form Employment Employment Form

Self Employed Tax Spreadsheet For Self Employed Expense Sheet

Tax Form Self Employed Employment Form

Average Tax Return For Self Employed - Estimate your Self Assessment tax bill if you re self employed Use the self employed tax calculator to estimate your Self Assessment tax bill for the 2024 to 2025 tax year Enter