Buying A House Tax Break You can get a tax break for buying a house through tax deductions and credits for a few expenses you pay every month but rules and limits apply and you must itemize

The IRS offers many tax breaks that can help offset the substantial costs of buying and owning a home Most states offer tax breaks similar or identical to the federal ones There are tax benefits that can help taxpayers save money and offset some of the costs that come with homeownership Homeowners should review the tax deductions

Buying A House Tax Break

Buying A House Tax Break

https://www.governmentprotalk.com/wp-content/uploads/looking-to-buy-a-home-with-your-tax-refund-this-year-tax-refund.png

Renting Versus Buying A Home

https://u.realgeeks.media/nichols-realty/pexels-photo-186077.jpeg

Tax Implications Of Buying A House

https://optimataxrelief.com/wp-content/uploads/2023/05/23-optima-tax-implications-buying-1024x512.png

Taxpayers must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize their deductions to deduct home Ten Tax Breaks for Homeowners and Homebuyers Owning or buying a home is expensive But there are some tax breaks for homeowners that can help you recoup some of those costs

Tax credits and breaks for first time home buyers can be an attractive incentive that makes purchasing a home more affordable These credits are designed to support new buyers and stimulate the housing market Buying a home can help lower your tax bill in certain circumstances In fact tax breaks for homeownership are a primary motivation for many people to buy their own homes To get the maximum tax benefit from your home

Download Buying A House Tax Break

More picture related to Buying A House Tax Break

File With Confidence Homeowner Tips For 2015 Taxes Home Buying

https://i.pinimg.com/originals/e4/cf/9f/e4cf9f17ddb40a953343cc106ce988fe.png

Use Your Tax Refund To Grow Your Down Payment Homeownership Center

https://i.pinimg.com/originals/7e/3b/ec/7e3bec4d662cf2d155bbb2a1183d3b6d.jpg

Freddie Kitchens Annual Salary Jogosgratiscelularsimulador

https://i.pinimg.com/originals/0e/8a/2c/0e8a2c13f83aa5cd4c3f3de00c0f477e.jpg

Key Takeaways The Internal Revenue Service IRS provides several tax breaks to make homeownership more affordable Common home related tax deductions include those for mortgage interest What kind of tax breaks for buying a house do you get these days We found 13 deductions credits and other potential savings opportunities for homebuyers

For most people the biggest tax break from owning a home comes from deducting mortgage interest For tax years prior to 2018 you can deduct interest on up to 1 million of debt used to Here s a description of tax breaks that encourage homeownership including tax deductions tax credits the capital gains exclusion and other tax incentives

What Are The Tax Implications Of Buying Or Selling A House

https://jdgrouptaxes.com/wp-content/uploads/2022/07/JD-Group-taxes.png

Should I Talk To A CPA When Buying A House Tax Knowledge

https://harocpa.com/images/2022/05/13/talk-to-cpa-buying-a-house-chris-haro-cpa.jpg

https://www.thebalancemoney.com

You can get a tax break for buying a house through tax deductions and credits for a few expenses you pay every month but rules and limits apply and you must itemize

https://www.forbes.com › advisor › mort…

The IRS offers many tax breaks that can help offset the substantial costs of buying and owning a home Most states offer tax breaks similar or identical to the federal ones

Tax Benefits Of Opportunity Zone Investment MoneyTips

What Are The Tax Implications Of Buying Or Selling A House

The Operation Process Of Tax Refund For Buying A House In 2021 Under

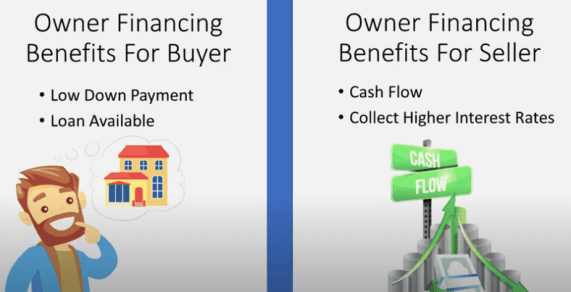

What Is Owner Financing When Buying A House

Tips And Guide On Buying A House BuyingaHouse Real Estate Home

Closing Costs During The House Buying Process Rene Burchell 2022

Closing Costs During The House Buying Process Rene Burchell 2022

What Are Closing Costs And How Much Will You Pay LowerMyBills

Tax Breaks For Homebuyers The E4 Realty Group Of Pearson Smith Realty

:max_bytes(150000):strip_icc()/GettyImages-680315897-10a201dfb5a64c3aa9134bd1a6d29f1e.jpg)

Do You Get A Tax Break For Buying A House

Buying A House Tax Break - Taxpayers must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize their deductions to deduct home