Purchasing A House Tax Deductions To help you come next tax season here are tax credits and deductions you can get when you buy a house and additional tax breaks that come with homeownership

You can deduct some of the ongoing payments you make for owning your home including Real estate taxes actually paid to the taxing authority Qualifying home mortgage interest Mortgage insurance premiums You can t deduct these Tax Tip 2023 96 July 27 2023 The summer months are a popular time to buy or sell a house New homeowners should put reviewing the tax deductions programs and housing

Purchasing A House Tax Deductions

Purchasing A House Tax Deductions

https://img.etimg.com/thumb/msid-10529038,width-1070,height-580,overlay-etpanache/photo.jpg

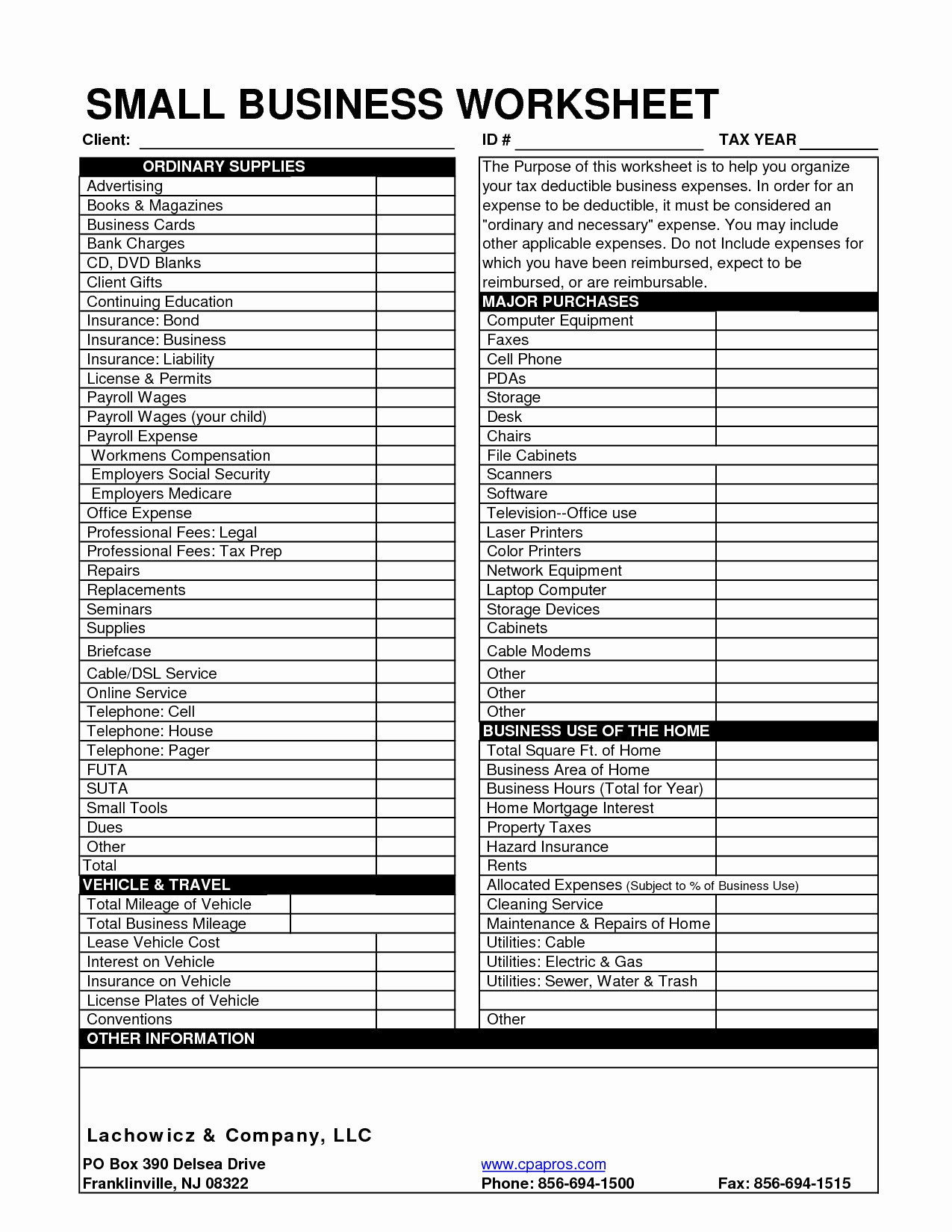

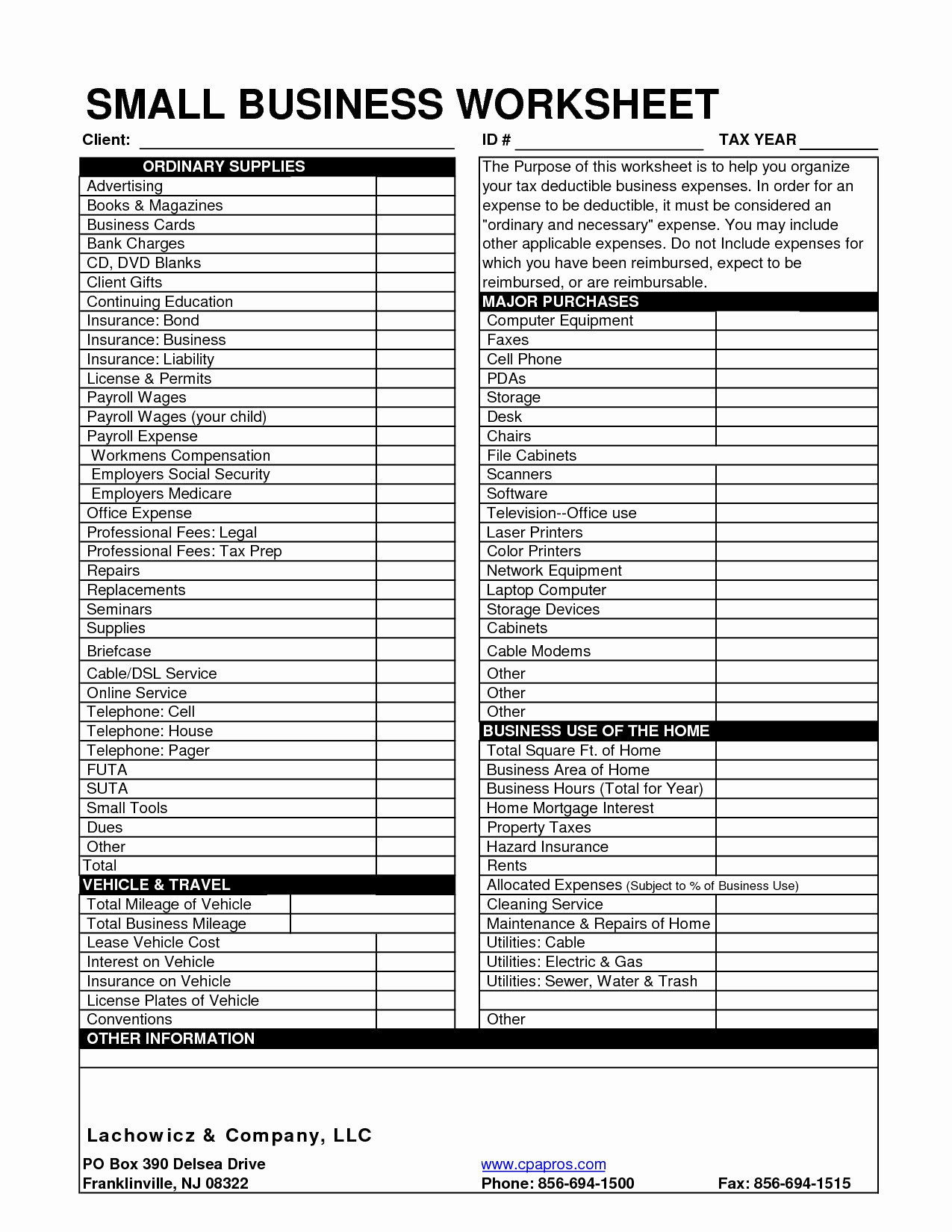

5 Tax Deductions Small Business Owners Need To Know

https://www.workinghomeguide.com/wp-content/uploads/2017/12/tax-deductions.jpeg

Home Buying Tax Deductions What s Tax Deductible Buying A House Tax

https://i.pinimg.com/originals/b7/5b/cf/b75bcf6496f9db065b57ba9cf5a3ca49.png

Buying your first home is a huge step but tax deductions available to you as a homeowner can reduce your tax bill TABLE OF CONTENTS Home ownership and taxes Tax breaks ease the cost of mortgage Mortgage interest Click to Tax Deductions for Homeowners You can deduct mortgage interest property taxes and other expenses up to specific limits if you itemize deductions on your tax return

You can get a tax break for buying a house through tax deductions and credits for a few expenses you pay every month but rules and limits apply and you must itemize If you just bought a house you may be able to deduct Mortgage interest including points Property real estate tax Mortgage insurance PMI or MIP Unless it s a

Download Purchasing A House Tax Deductions

More picture related to Purchasing A House Tax Deductions

Tax Credit When You Buy A House TAXW

https://i.pinimg.com/originals/31/44/38/3144387a3d9e14c627ba7f058bcc4e79.jpg

10 Best Images Of Business Tax Deductions Worksheet Tax Itemized

http://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

No Itemizing Needed To Claim These 23 Tax Deductions Don t Mess With

https://dontmesswithtaxes.typepad.com/.a/6a00d8345157c669e2026bdecfbbd4200c-600wi

Homeowners can generally deduct home mortgage interest home equity loan or home equity line of credit HELOC interest mortgage points and state and local tax SALT deductions The IRS offers many tax breaks that can help offset the substantial costs of buying and owning a home Most states offer tax breaks similar or identical to the federal ones Here

The short answer is that owning a home can yield some tax breaks if you re able to deduct mortgage points mortgage interest property taxes and other expenses How much What kind of tax breaks for buying a house do you get these days We found 13 deductions credits and other potential savings opportunities for homebuyers

Deduction Police Form Edit Share AirSlate SignNow

https://www.signnow.com/preview/82/664/82664161/large.png

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

https://i.etsystatic.com/24598192/r/il/e3c7c0/3985544266/il_570xN.3985544266_82sm.jpg

https://realestate.usnews.com/real-estat…

To help you come next tax season here are tax credits and deductions you can get when you buy a house and additional tax breaks that come with homeownership

https://www.hrblock.com/tax-center/fili…

You can deduct some of the ongoing payments you make for owning your home including Real estate taxes actually paid to the taxing authority Qualifying home mortgage interest Mortgage insurance premiums You can t deduct these

Realtor Tax Deductions Worksheet

Deduction Police Form Edit Share AirSlate SignNow

10 Hair Stylist Tax Deduction Worksheet Worksheets Decoomo

Self Employed Tax Deductions Worksheet Worksheet Resume Examples

Itemized Tax Deduction Worksheet Oaklandeffect Deductions Db excel

Tax Deduction Spreadsheet Then Small Business Tax Deductions Db excel

Tax Deduction Spreadsheet Then Small Business Tax Deductions Db excel

5 Tax Deductions When Selling A Home Selling House Tax Deductions

Small Business Tax Small Business Tax Deductions Business Tax Deductions

What Are Tax Deductions Napkin Finance

Purchasing A House Tax Deductions - You can get a tax break for buying a house through tax deductions and credits for a few expenses you pay every month but rules and limits apply and you must itemize