Buying A House Tax Deductions How Home Tax Deductions Work First a quick lesson or refresher on income tax deductions A deduction reduces how much tax you owe but only if you itemize

To help you come next tax season here are tax credits and deductions you can get when you buy a house and additional tax breaks that come with homeownership Homeowners can use several credits and deductions including the mortgage interest deduction and the SALT deduction to reduce their federal income tax bills

Buying A House Tax Deductions

Buying A House Tax Deductions

https://capextax.com/wp-content/uploads/2022/06/5624808f3b6e28b580c3b4a5ef6dcfb8d5a9e273-1921x748-1.jpg

Home Buying Tax Deductions What s Tax Deductible Buying A House Tax

https://i.pinimg.com/originals/7c/0c/10/7c0c10b07eb95303663bc0d1664923dc.jpg

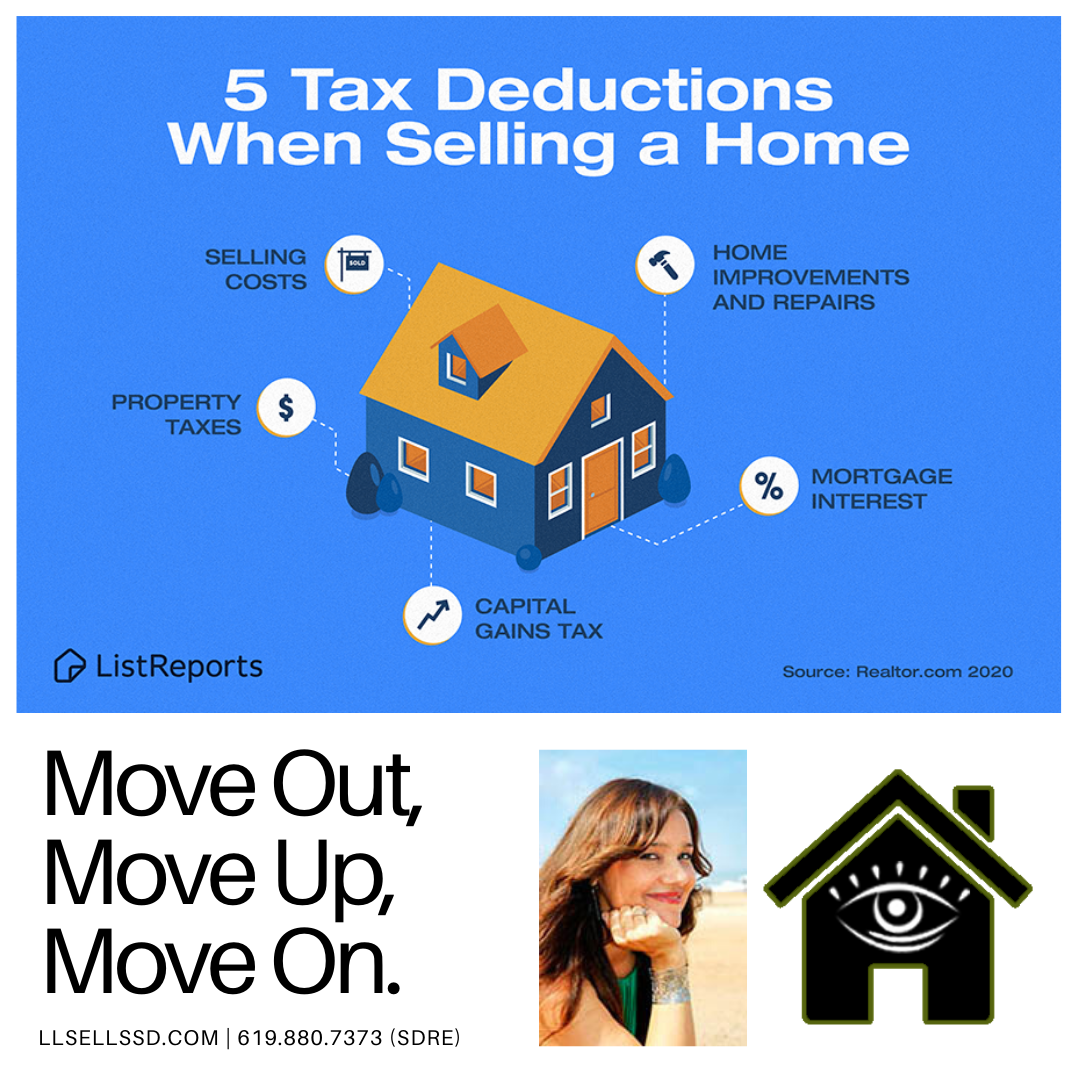

5 Tax Deductions When Selling A Home Selling House Tax Deductions

https://i.pinimg.com/originals/6e/04/47/6e04478e1452ed28bdedcae05ab5f3ab.png

You can get a tax break for buying a house through tax deductions and credits for a few expenses you pay every month but rules and limits apply and you must itemize Tax Deductions for Homeowners You can deduct mortgage interest property taxes and other expenses up to specific limits if you itemize deductions on your tax return

The only settlement or closing costs you can deduct are home mortgage interest and certain real estate taxes You deduct them in the year you buy your home if you itemize your deductions You can add certain other settlement or closing Deductible house related expenses Most home buyers take out a mortgage to buy their home and then make monthly payments to the mortgage holder This payment may

Download Buying A House Tax Deductions

More picture related to Buying A House Tax Deductions

Tips And Guide On Buying A House BuyingaHouse Real Estate Home

https://i.pinimg.com/originals/f4/ef/5a/f4ef5a24479daac8d9c8ce34db69fb31.png

The Deductions You Can Claim Hra Tax Vrogue

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

Small Business Tax Small Business Tax Deductions Business Tax Deductions

https://i.pinimg.com/736x/80/f5/2d/80f52dac2182daa554539d9580ab22d3.jpg

If you just bought a house you may be able to deduct Mortgage interest including points Property real estate tax Mortgage insurance PMI or MIP Unless it s a For most people the biggest tax break from owning a home comes from deducting mortgage interest If you itemize you can deduct interest on up to 750 000 of debt

You can deduct some of the ongoing payments you make for owning your home including File with H R Block to get your max refund File online File with a tax pro Real estate taxes Answer The mortgage interest deduction allows homeowners to deduct interest paid on up to 750 000 of mortgage debt from their taxable income This deduction applies to

Home Buying Tax Deductions Home Buying Tax Deductions Tax Refund

https://i.pinimg.com/originals/29/23/63/292363de2ed341e54e7af560eb77a54d.jpg

5 Tax Benefits From Selling A Home San Diego Realtor Listing Agent

http://llsellssd.com/wp-content/uploads/2020/06/tax-deductions-branded.png

https://www.forbes.com › advisor › mort…

How Home Tax Deductions Work First a quick lesson or refresher on income tax deductions A deduction reduces how much tax you owe but only if you itemize

https://realestate.usnews.com › real-esta…

To help you come next tax season here are tax credits and deductions you can get when you buy a house and additional tax breaks that come with homeownership

The 6 Best Tax Deductions For 2020 The Motley Fool

Home Buying Tax Deductions Home Buying Tax Deductions Tax Refund

Home Buying Tax Deductions What s Tax Deductible Buying A House Home

Home Buying Tax Deductions What s Tax Deductible Buying A House

5 Tax Deductions Small Business Owners Need To Know

Tax Breaks For Homebuyers The E4 Realty Group Of Pearson Smith Realty

Tax Breaks For Homebuyers The E4 Realty Group Of Pearson Smith Realty

Tax Deductions For Home Buyers

Home Buying Tax Deductions What s Tax Deductible Buying A House Tax

What Are Tax Deductions Napkin Finance

Buying A House Tax Deductions - Key Takeaways You can deduct the mortgage interest on your primary and second residences but there are certain limits Your property taxes are deductible including