California Ev Tax Credit Income Limit 2023 Verkko 7 syysk 2023 nbsp 0183 32 The income limits will be much more restrictive Californians who earn more than 300 of the federal poverty level will no longer qualify for a state subsidy when they purchase an electric car according to the California Air Resources Board

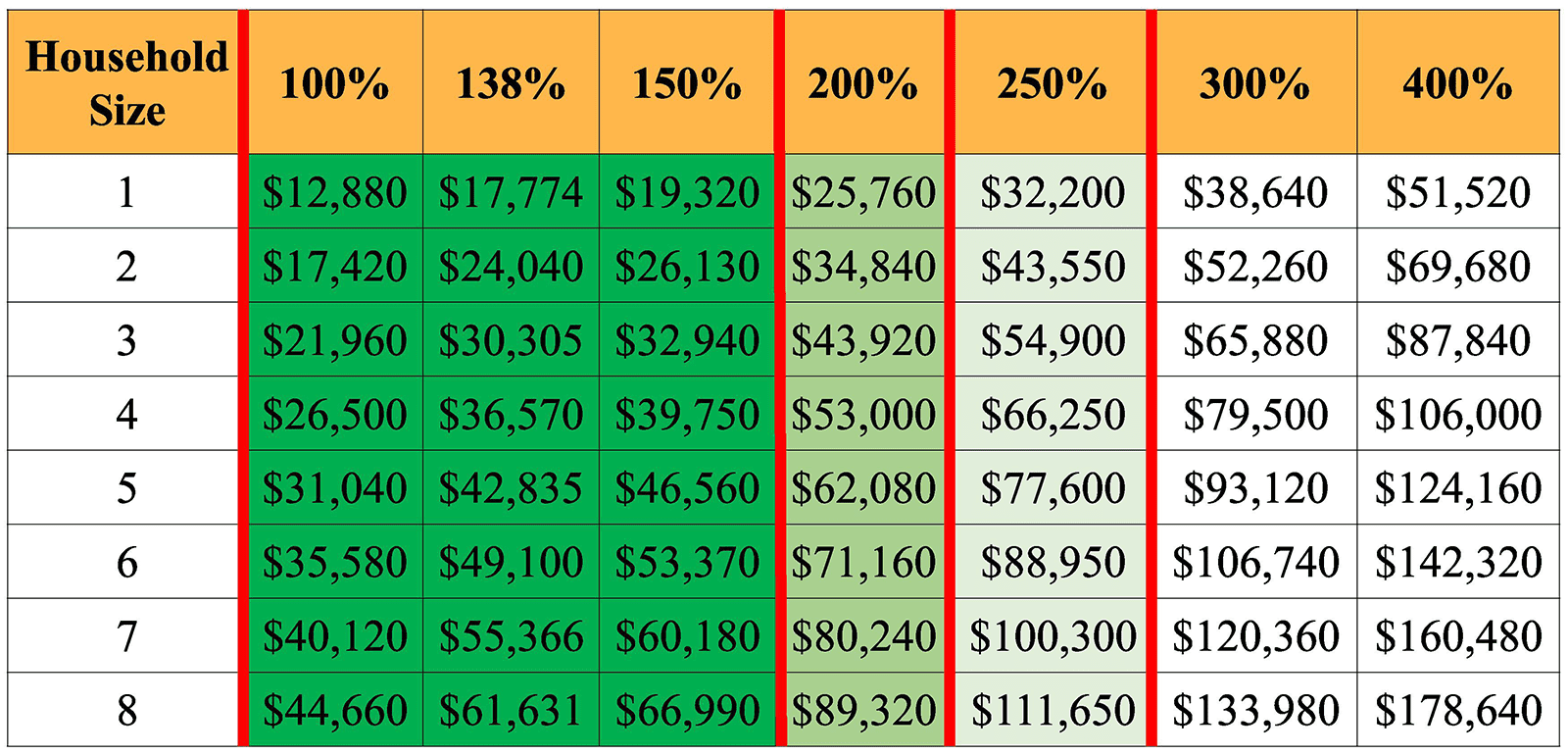

Verkko The table below lists the Increased Rebate Household Income Limits effective July 12 2023 These numbers are based on 400 of the 2023 Federal Poverty Level For example a family of 3 with a combined household income of less than 99 440 would qualify for the increased rebate Verkko 20 jouluk 2023 nbsp 0183 32 The tax benefit which was recently modified by the Inflation Reduction Act for years 2023 through 2032 allows for a maximum credit of 7 500 for new EVs and up to 4 000 limited to 30

California Ev Tax Credit Income Limit 2023

California Ev Tax Credit Income Limit 2023

https://vada.com/wp-content/uploads/2022/08/EV-Tax-Credits-Facebook-Post.png

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24015542/226268_CHEVY_EV_LINEUP_PHO_ahawkins_0006.jpg)

Only Six EVs Still Qualify For The 7 500 Federal Tax Credit After New

https://duet-cdn.vox-cdn.com/thumbor/0x0:2040x1360/2400x1600/filters:focal(1020x680:1021x681):format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24015542/226268_CHEVY_EV_LINEUP_PHO_ahawkins_0006.jpg

EV Tax Credit Rules Are Becoming More Complicated Local News Today

https://i2.wp.com/image.cnbcfm.com/api/v1/image/106916725-1627308432240-gettyimages-1330261567-bth_014_7-21-2021_chargingstationforelectricvehicleinpennsyl.jpeg

Verkko 25 jouluk 2023 nbsp 0183 32 As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 There are certain restrictions The used EV tax credit can Verkko 28 elok 2023 nbsp 0183 32 Your new electric vehicle could qualify for up to 7 500 If you bought it after April 18 2023 the vehicle needs to meet battery and mineral requirements to get the full incentive Those

Verkko Purchasing an electric car can give you a tax credit starting at 2500 Other tax credits are available if the battery size is 5kWh with a cap of 7500 credit if the battery exceeds Verkko 1 maalisk 2023 nbsp 0183 32 Income cut offs for the standard CVRP are 135 000 for single tax filers 175 000 for head of household and 200 000 for joint filers People with low to moderate incomes can get a bigger

Download California Ev Tax Credit Income Limit 2023

More picture related to California Ev Tax Credit Income Limit 2023

Why Getting A 7 500 EV Tax Credit Will Be Easier In 2024 WSJ

https://images.wsj.net/im-865215/social

New US EV Tax Credit Here s Everything You Need To Know

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAX9y19.img?w=1920&h=1080&m=4&q=50

Mary Rice The Truth About The Inflation Reduction Act s Electric

https://riceimpact.com/wp-content/uploads/2022/08/EV-Tax-Credit-Web-Post-1080x675.jpg

Verkko Note however that these California electric car rebate amounts are income dependent Specifically you re only eligible for the maximum CVRP rebates listed above if your household income is less Verkko 19 jouluk 2023 nbsp 0183 32 0 00 0 00 If you ve got your eyes on an electric vehicle there may be no better time to buy one than this Christmas That s because between now and Dec 31 buyers get an EV tax credit of

Verkko Overview of the Federal EV Tax Credit for New Car Buyers in California Until the end of 2023 credit is received when you file your taxes the following year Starting in 2024 There are strict income limits assuring credits go to single filers with a modified adjusted gross income of 150 000 or less or joint filers with a 300 000 limit Verkko 14 marrask 2022 nbsp 0183 32 The model year must be at least two years earlier than the calendar year it s purchased The credit is 30 of the price up to 4 000 whichever is less The buyer s adjusted gross income can

Income Limits For California Electric Vehicle Tax Credit Todrivein

https://todrivein.com/wp-content/uploads/2023/06/income-limits-for-california-electric-vehicle-tax-credit_featured_photo.jpeg

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

https://calmatters.org/environment/2023/09/california-electric-car-rebates

Verkko 7 syysk 2023 nbsp 0183 32 The income limits will be much more restrictive Californians who earn more than 300 of the federal poverty level will no longer qualify for a state subsidy when they purchase an electric car according to the California Air Resources Board

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24015542/226268_CHEVY_EV_LINEUP_PHO_ahawkins_0006.jpg?w=186)

https://cleanvehiclerebate.org/en/eligibility-guidelines

Verkko The table below lists the Increased Rebate Household Income Limits effective July 12 2023 These numbers are based on 400 of the 2023 Federal Poverty Level For example a family of 3 with a combined household income of less than 99 440 would qualify for the increased rebate

Child Tax Credit 2023 Income Limit Eligibility Calculator APSBB

Income Limits For California Electric Vehicle Tax Credit Todrivein

Understanding Electric Vehicle Tax Credits Inside New Orleans

Ask Your Questions About EV Tax Credit Cars News Informer

ACA Tax Credits To Help Pay Premiums White Insurance Agency

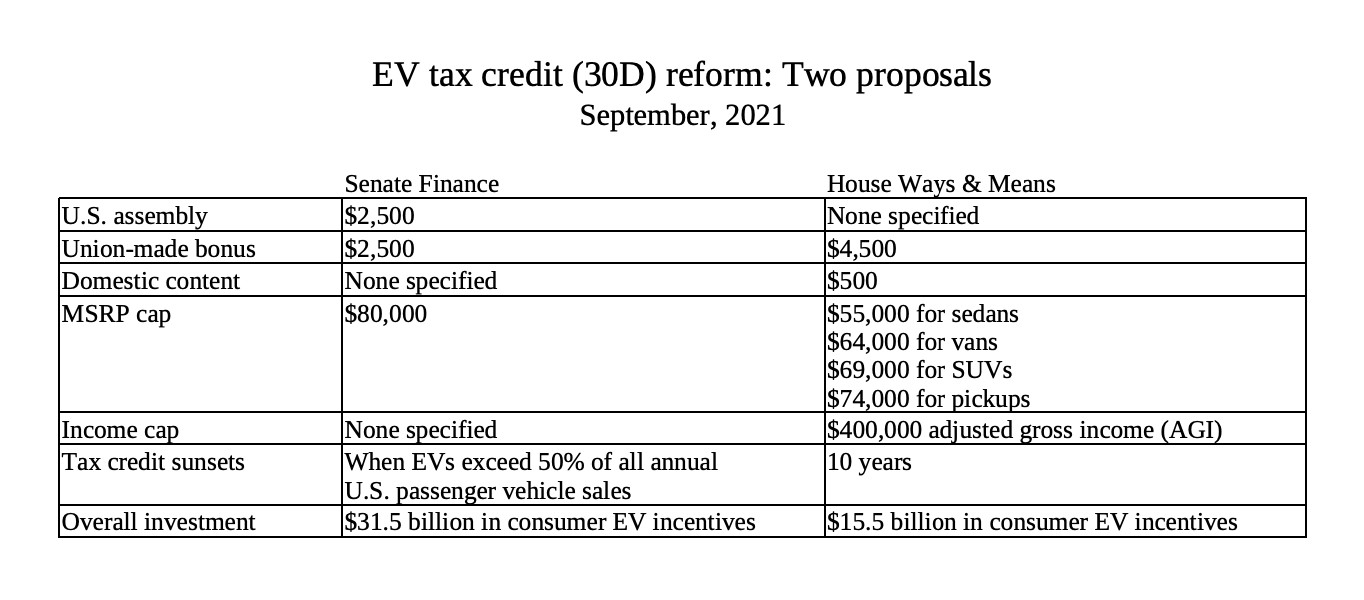

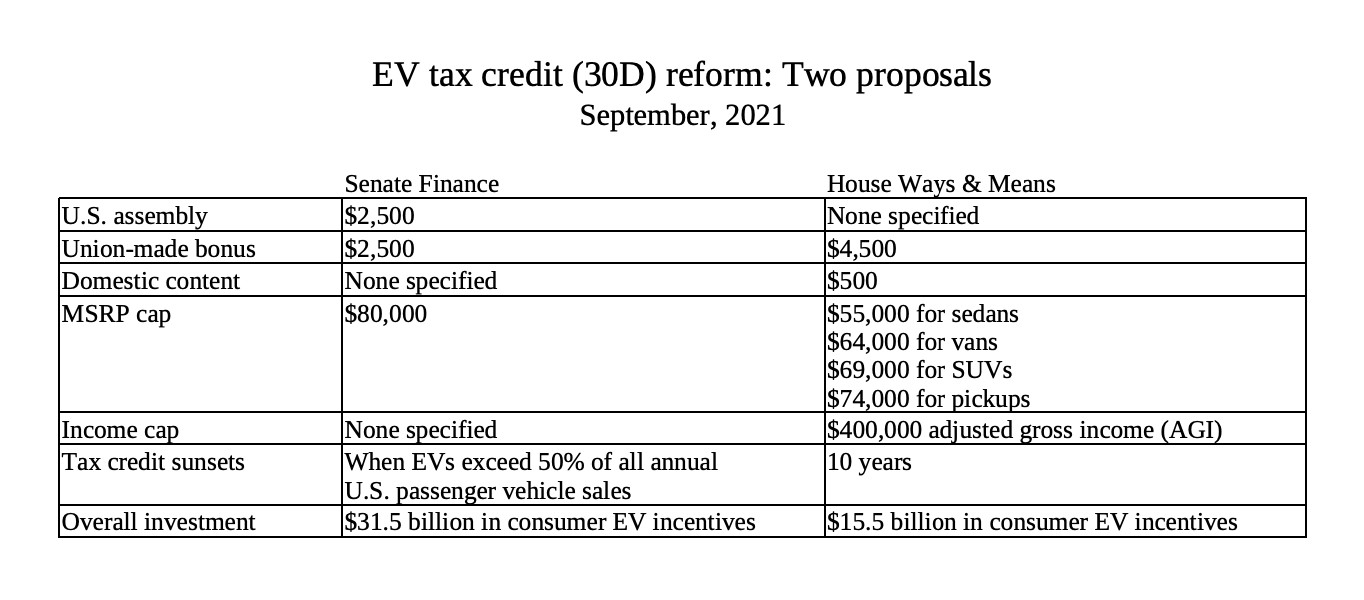

EV Tax Credit Boost At Up To 12 500 Here s How The Two Versions Compare

EV Tax Credit Boost At Up To 12 500 Here s How The Two Versions Compare

Revised Walz Budget Seeks Lead Pipe Fixes EV Tax Credit MPR News

New EV Tax Credits Taxed Right

Treasury Department Lays Out EV Tax Credit Foreign Sourcing Rules

California Ev Tax Credit Income Limit 2023 - Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 Well if they do consider used ones That s because if you buy a used electric vehicle for 2024 from model year 2022 or earlier there s a tax credit for you too It s worth 30 of the sales price up to 4 000 This tax credit has a much lower income cap 150 000 for a household 75 000 for a single person