Tax Rebate On Loan Web 26 juin 2023 nbsp 0183 32 What is a tax refund loan Tax refund loans are available to taxpayers who ve filed a federal income tax return and are eligible for a refund These loan

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From Web 28 mars 2017 nbsp 0183 32 The maximum amount that can be claimed is up to Rs 1 5 lakh But to claim this deduction the house property should not be sold within five years of possession

Tax Rebate On Loan

Tax Rebate On Loan

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

First Time Home Buyer Tax Questions

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Home Loan Tax Benefits In India Important Facts

https://propertyadviser.in/assets/front/images/real-estate-news/s1/income-tax-rebate-on-home-loan-819-s1.jpg

Web 11 janv 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit Web 3 mars 2023 nbsp 0183 32 How Much Tax Save on a Home Loan 5 Income Tax Benefits on Home Loan Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for Interest Paid on Loan During the Initial

Web 2 avr 2022 nbsp 0183 32 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the Web Tax saving on home loan increases the affordability of your home loan With the help of a home loan tax benefit calculator you can find out your exact tax exemption My Annual

Download Tax Rebate On Loan

More picture related to Tax Rebate On Loan

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Education Loan Tax Deduction Benefits Tax Benefits On Educational Loans

https://financegradeup.com/wp-content/uploads/2020/03/Education-Loan-Tax-Deduction.jpg

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

http://cachandanagarwal.com/wp-content/uploads/2021/04/Income-Tax-Rebate.jpeg

Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri Web 6 sept 2023 nbsp 0183 32 Section 87A Section 87A of the income tax act 1961 was launched to give relief to the taxpayers who fall under the 10 percent tax slab If a person whose total net income does not cross INR 5 lakh can

Web 8 sept 2022 nbsp 0183 32 The organization initially estimated that 13 states may tax student loan forgiveness and has revised projections with updates It now projects seven states Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

Realtors Seek Tax Rebate On House Loans

https://images.assettype.com/dtnext/import/Images/Article/201602090046480107_Realtors-seek-tax-rebate-on-house-loans_SECVPF.gif

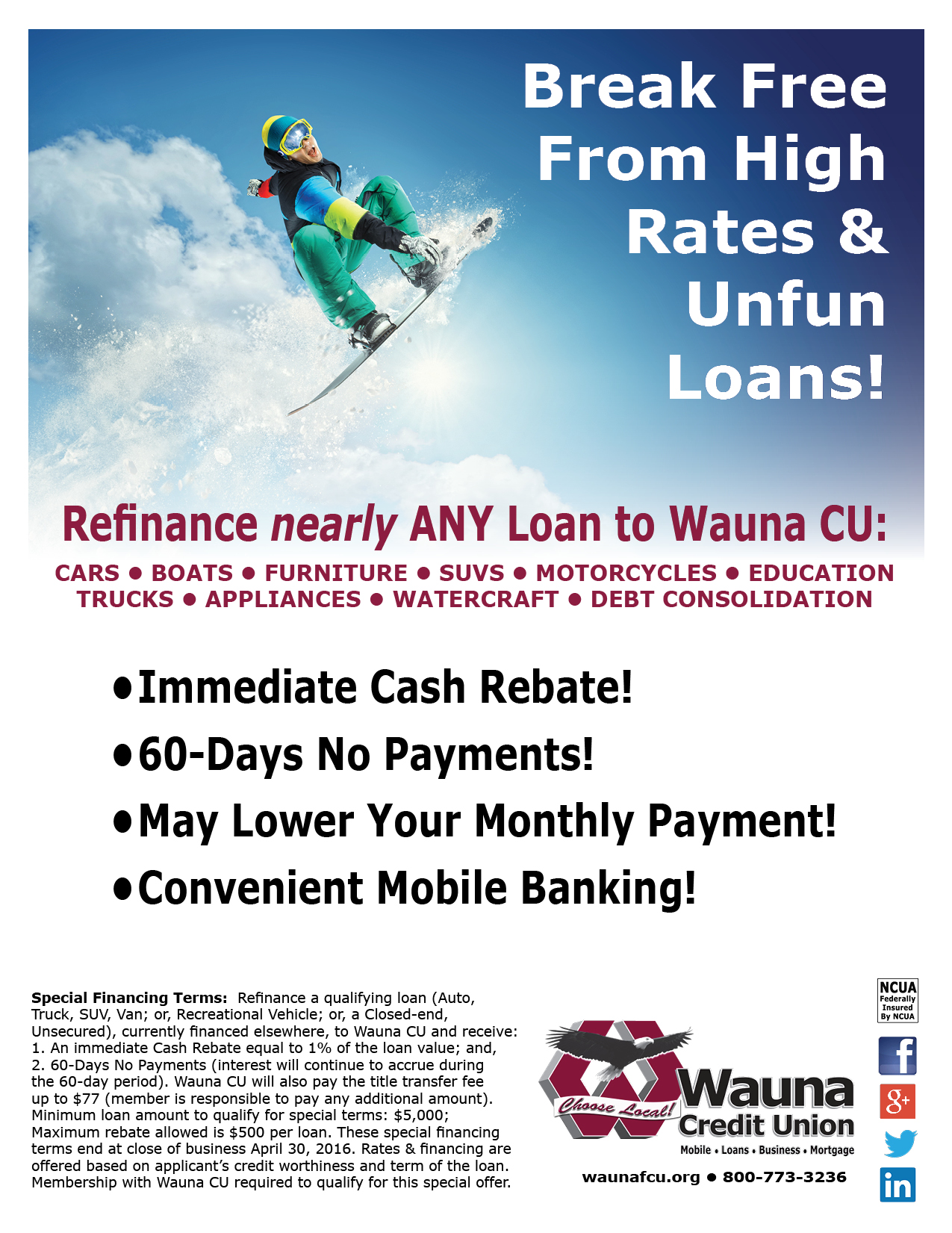

Refinance Special Move Your Loan To Us And Save The Wonderful

https://waunafcu.org/blog/wp-content/uploads/snowboard-rebate-version-3.jpg

https://www.bankrate.com/loans/personal-loans/what-to-know-about-tax...

Web 26 juin 2023 nbsp 0183 32 What is a tax refund loan Tax refund loans are available to taxpayers who ve filed a federal income tax return and are eligible for a refund These loan

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Microfinance Loan Application Form

Realtors Seek Tax Rebate On House Loans

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

How Can You Find Out If You Paid Taxes On Student Loans

Danpirellodesign Income Tax Rebate On Home Loan And Hra

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Ptr Tax Rebate Libracha

P55 Tax Rebate Form By State Printable Rebate Form

2007 Tax Rebate Tax Deduction Rebates

Tax Rebate On Loan - Web 3 mars 2023 nbsp 0183 32 How Much Tax Save on a Home Loan 5 Income Tax Benefits on Home Loan Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for Interest Paid on Loan During the Initial