Can Education Loan Be Used For Tax Exemption Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E

You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a qualified student loan Your filing status To encourage borrowers to take an education loan there is a tax benefit on repayment of the education loan Once you avail of an education loan the interest paid which is a component of your EMI on

Can Education Loan Be Used For Tax Exemption

Can Education Loan Be Used For Tax Exemption

https://www.exemptform.com/wp-content/uploads/2022/08/free-10-sample-tax-exemption-forms-in-pdf-22.jpg

National Pension Scheme Check Types Of Accounts And Withdrawal Rules

https://images.news18.com/ibnlive/uploads/2023/07/harshit-pandey-2023-07-06t160601.299-168863977216x9.png

The Start Of The Financial Year Is The Best Time To Organise Your

https://pbs.twimg.com/media/Fs4H9FfWIAcsFsQ.png

You may exclude certain educational assistance benefits from your income That means that you won t have to pay any tax on them However it also means that you can t use Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on

The student loan isn t tax free educational assistance so the qualified expenses don t need to be reduced by any part of the loan proceeds Joan is treated as having paid You can save up to 10 times more tax if you take up an education loan to fund your education than using your own funds An education loan income tax exemption can be

Download Can Education Loan Be Used For Tax Exemption

More picture related to Can Education Loan Be Used For Tax Exemption

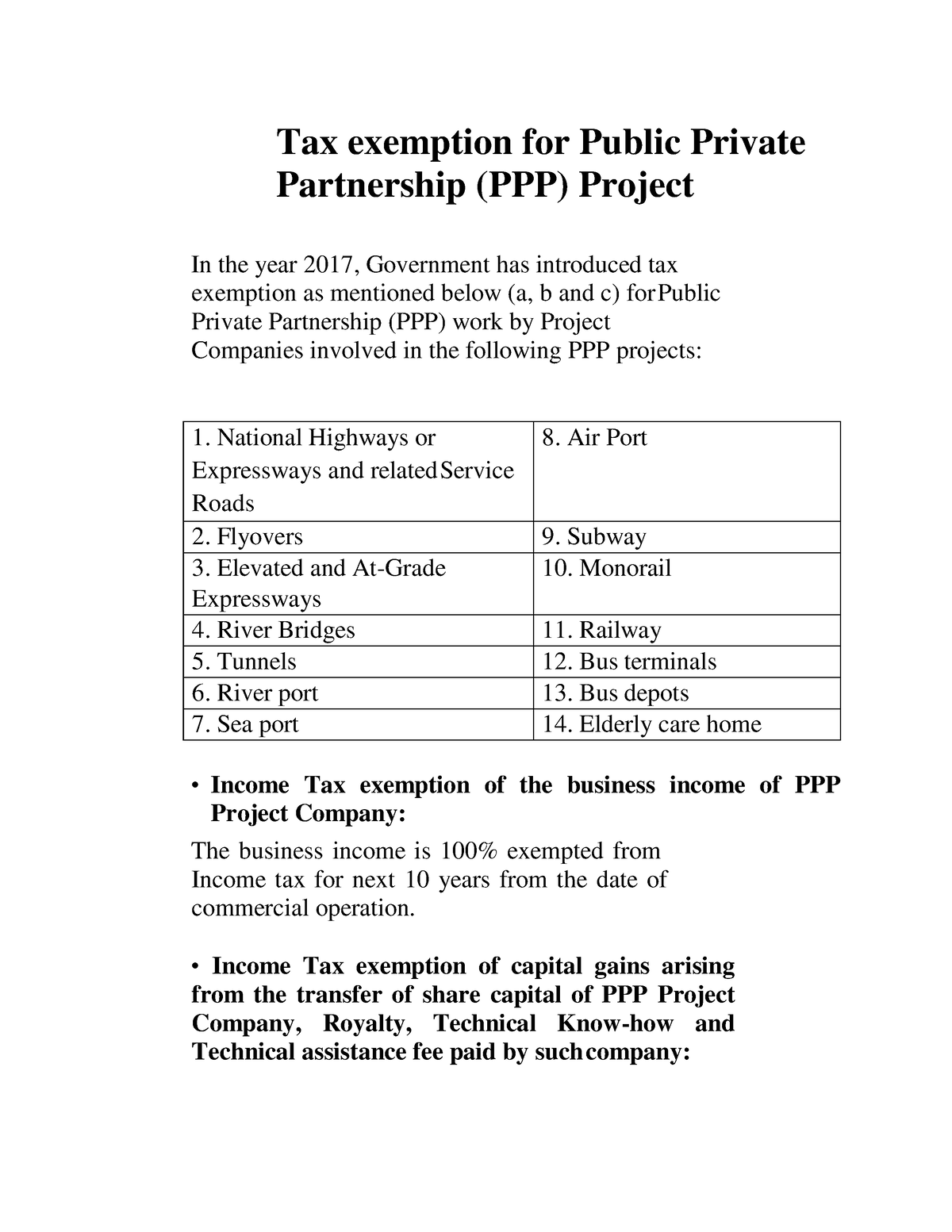

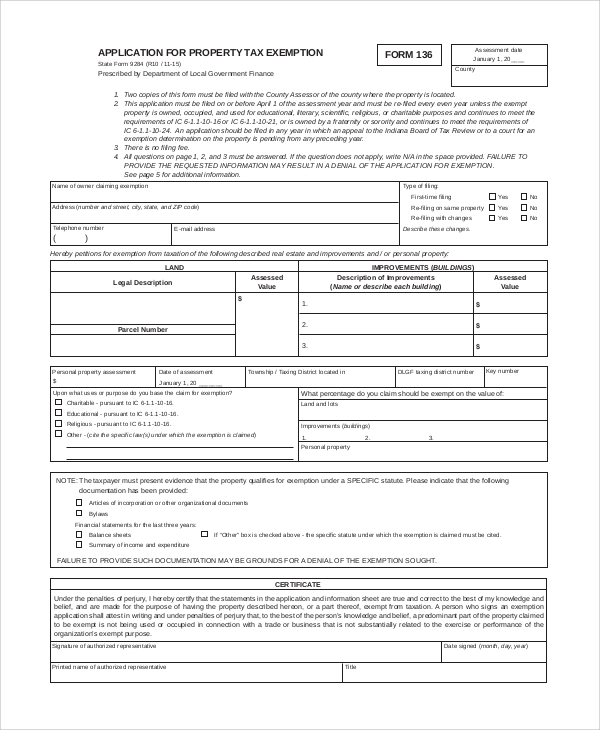

Tax Exemption For Public Private Partnership PPP Project Subway

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/0aa06532bc4576fca33552daa888a72a/thumb_1200_1553.png

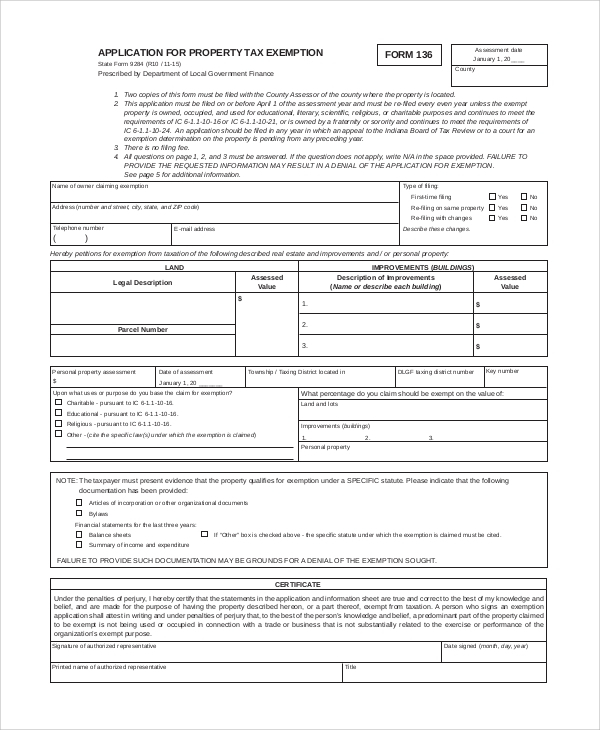

Fillable Online Claim For Tax Exemption Fax Email Print PdfFiller

https://www.pdffiller.com/preview/489/206/489206067/large.png

Fillable Online Edenny APPLICATION FOR TAX EXEMPTION OF Fax Email Print

https://www.pdffiller.com/preview/48/695/48695524/large.png

When you use student loan funds to finance your education if you are eligible the IRS allows you to claim qualifying expenses that you pay with those funds towards educational tax credits An individual who has availed a loan for higher education can enjoy various tax benefits as per the provisions of the Income Tax Act Suppose a taxpayer has already claimed the

The interest you ve paid for any student loan public or private is tax deductible as long as the loan qualifies it doesn t only have to be federal student aid You can claim a deduction of Interest paid on a loan taken for pursuing higher education from taxable income under Section 80E of the Income Tax Act 1961 According to

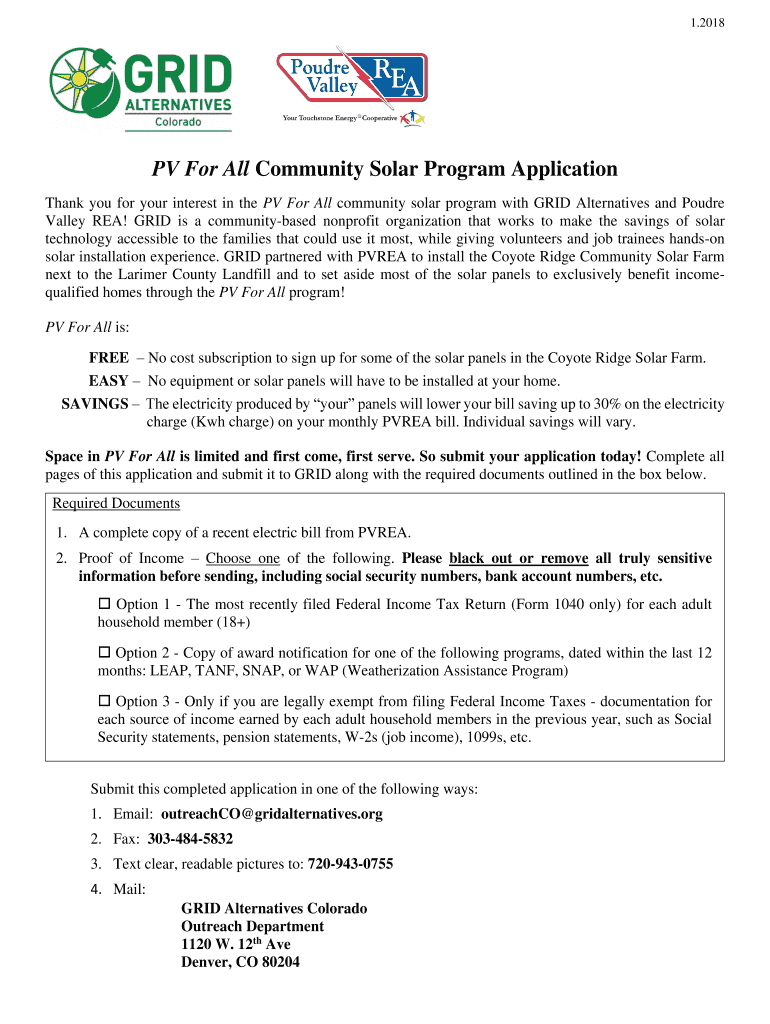

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

CBDT Notifies And Amends Rules Regarding Accumulation Of Unspent Income

https://capindia.in/wp-content/uploads/2022/08/Income-Tax-Rules-768x697.jpg

https://tax2win.in › guide

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E

https://www.irs.gov › taxtopics

You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a qualified student loan Your filing status

Why You Shouldn t Co sign On A College Loan CBS News

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

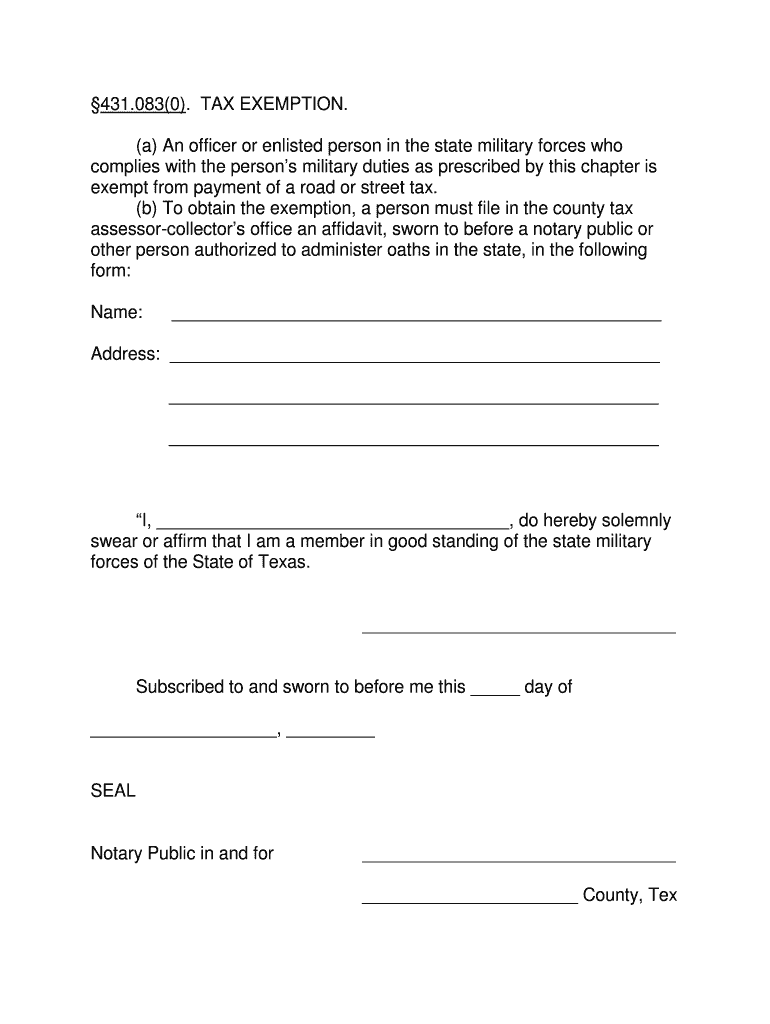

PDF Review Of Tax Exemption In The Kory Dynasty

Tax Treatment Of Educational Institutions

Fillable Online Tax Exemption Formdoc Fax Email Print PdfFiller

Fillable Online Exempt Organization TypesInternal Revenue

Fillable Online Exempt Organization TypesInternal Revenue

Tax Exemption Form For Veterans ExemptForm

Global Finance SAVE TAX BY TAKING HOME LOAN

GST Registration Exemption Unlimited Guide

Can Education Loan Be Used For Tax Exemption - But can parents claim a tax deduction on their child s education loan Parents who have taken an education loan for their child s higher education in India or abroad can claim this