Can Fixed Deposit Be Shown For Tax Exemption A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor can claim a

All NREs who make an investment in a Fixed Deposit will not be taxed for any interest earned on them and the NRE account will be exempt from taxes under section 10 4 ii as per the Foreign Exchange Management Act 1999 Should we pay tax on fixed deposits each year or only on maturity What does the law say What are the options for the investor Can we pay on maturity even if there is a tax

Can Fixed Deposit Be Shown For Tax Exemption

Can Fixed Deposit Be Shown For Tax Exemption

https://www.signnow.com/preview/497/332/497332566/large.png

Certificate Of Exemption Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/50/825/50825271/large.png

US Lawmakers New Legislation Seeking Tax Exemption On Small Crypto

https://www.thecoinrepublic.com/wp-content/uploads/2022/07/US-Senators-Introduce-Bill-to-Make-Crypto-Purchases-Less-Than-50-Tax-Free-1536x864.jpg

Individuals with a total taxable income of less than Rs 2 5 lakh are completely exempted from TDS on their FDs This exemption is a relief for individuals with lower incomes ensuring that The interest earned on FD is taxable however you can claim a fixed deposit income tax exemption as a shareholder Each investment decision is primarily influenced by the rate of return and the level of risk Those who

Interest that is earned on fixed deposits is taxable in the hands of the depositor as per the income slab so a person who earns income above 10 lakh pays 30 tax And An investor can claim income tax exemption on investments up to Rs 1 5 lakh when investing in Fixed Deposits As part of a Tax Saving Fixed Deposit interest earned is taxable which is

Download Can Fixed Deposit Be Shown For Tax Exemption

More picture related to Can Fixed Deposit Be Shown For Tax Exemption

Filing Exempt On Taxes For 6 Months How To Do This

https://mgtblog.com/wp-content/uploads/2021/05/download-2-801x1024.png

Evaluating A Tax Preparer Understanding Reasonable Tax Positions

https://certifiedtaxcoach.org/wp-content/uploads/2022/04/Ethics-Reasonable-B2C.jpg

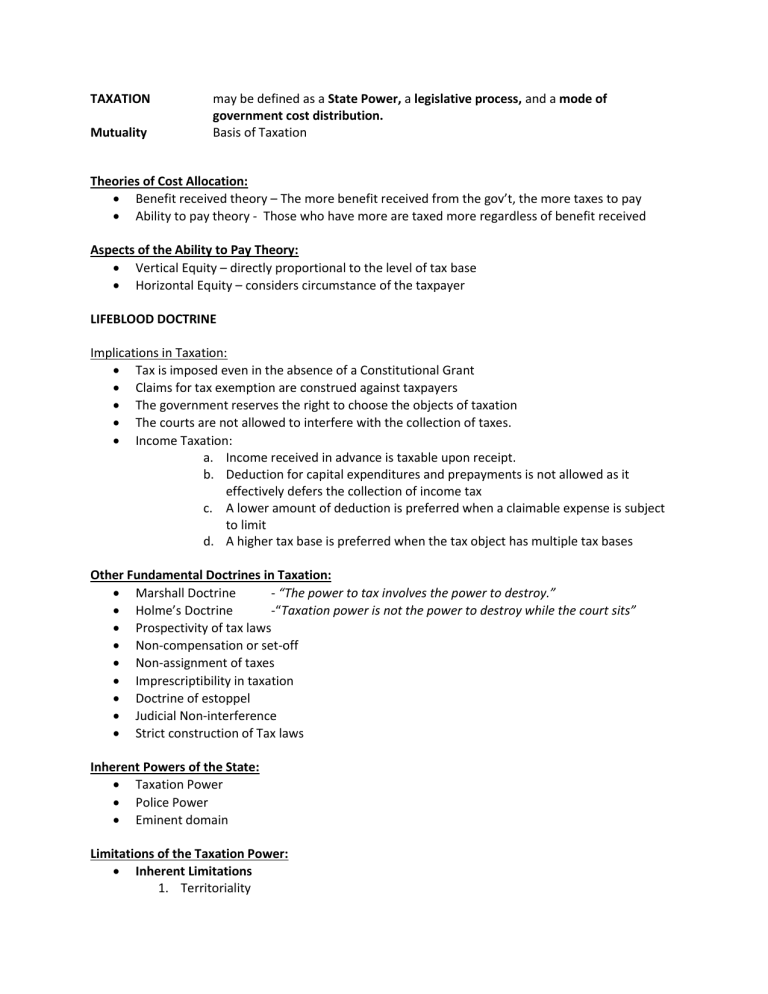

TAX Summary Notes 1

https://s2.studylib.net/store/data/025963115_1-fdd367a29c37c3655891dbac839ea1ba-768x994.png

According to Section 80C of the Income Tax Act 1961 fixed deposits that are booked by individuals or by Hindu Undivided Family for 5 years and up to Rs 1 Lakh are exempt from Tax deducted at source Not only can you claim Fixed Deposit tax exemption under Section 80C of the Income Tax Act you can also take a loan against your Fixed Deposit when in need In order to

Tax is not applicable when the income from the interest of a fixed deposit is less than Rs 40 000 in a year When the income from the interest of a fixed deposit exceeds Rs 40 000 The benefit of tax saving fixed deposit is that the principal invested is exempt from tax i e it can be claimed as a deduction under Section 80C and the benefit of tax free bonds is that the

![]()

Samsung Tax Exemption Program Samsung Business

https://image-us.samsung.com/SamsungUS/samsungbusiness/shop/tax-exemption/Tax-free-icon_6-1_THREE-COLUMN.jpg?$bu-three-column-ar3:2-desktop-jpg$

Sales Use Tax Exempt Form 2023 North Carolina ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/how-to-get-a-sales-tax-certificate-of-exemption-in-north-carolina-3.png

https://cleartax.in › tax-saving-fd-fixed-deposits

A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor can claim a

https://www.bankbazaar.com › fixed-deposit › tax...

All NREs who make an investment in a Fixed Deposit will not be taxed for any interest earned on them and the NRE account will be exempt from taxes under section 10 4 ii as per the Foreign Exchange Management Act 1999

WooCommerce Tax Exempt Vat Exempt Customers Role Plugin Script News

Samsung Tax Exemption Program Samsung Business

PDF Corporate Income Taxation In Canada

Tax Exemption Certificate SACHET Pakistan

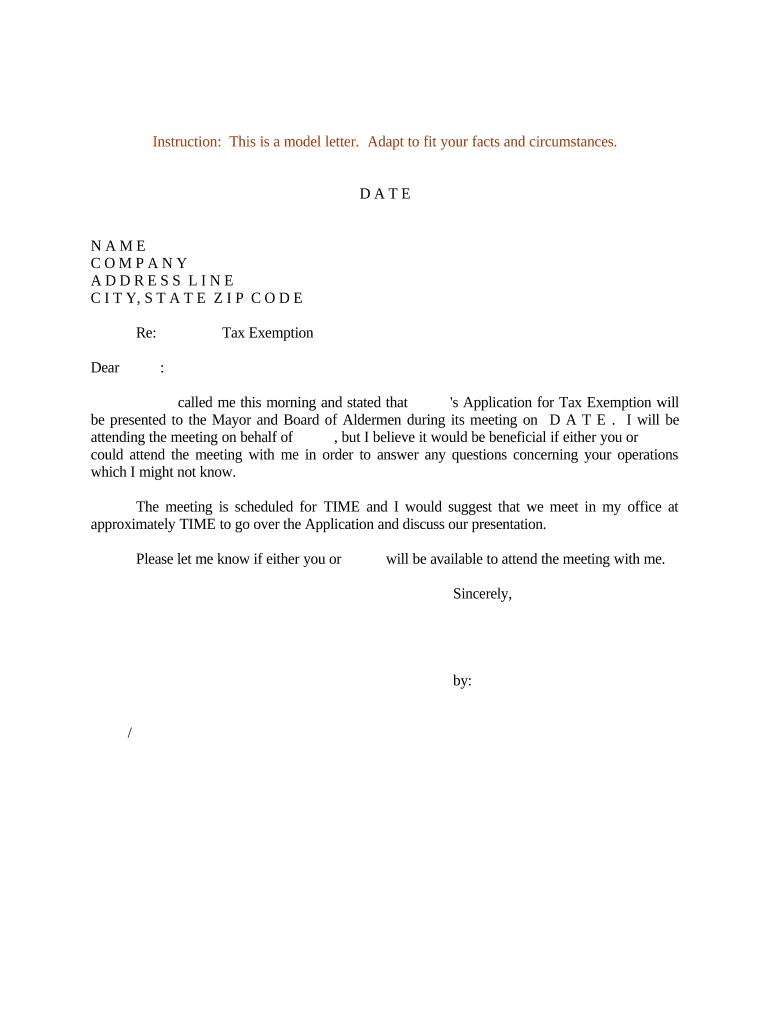

Cook County Amusement Tax Form Fill Out And Sign Printable PDF

Does EZ Texting Charge Sales Tax

Does EZ Texting Charge Sales Tax

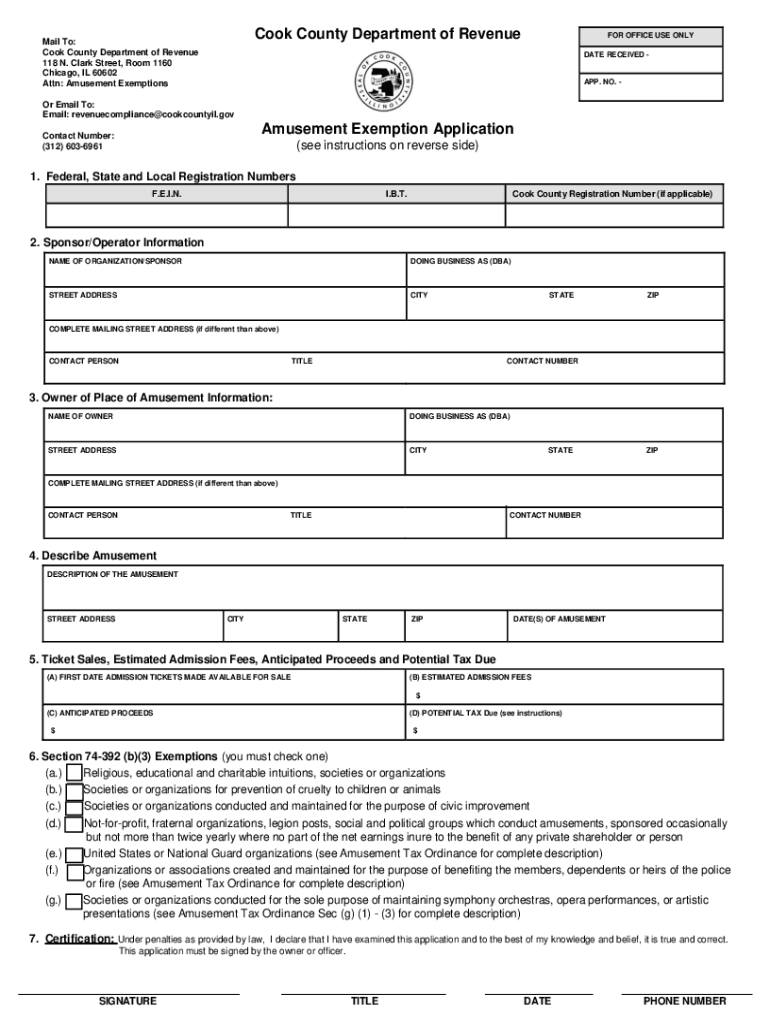

Proof Of No Income Letter For Tax Exemption Purposes How To Templates

Budget 2023 No Income Tax For Those Earning Up To Rs 7 Lakh Annually

CBDT Notifies And Amends Rules Regarding Accumulation Of Unspent Income

Can Fixed Deposit Be Shown For Tax Exemption - Interest earned on fixed deposits is taxable as per the Income Tax Act 1961 If you have FD in one or more bank accounts you should aggregate FD interest from all the banks