Does Fixed Deposit Have Tax Exemption The interest earned on a Fixed Deposit FD is subject to tax based on the income tax slab you fall into There is TDS Tax Deducted at Source on FD interest along with any

Bank Fixed Deposits FDs are a safe and secure way of earning a fixed return on your capital Especially for senior citizens they provide higher returns without Tax saving deposits are a type of deposit scheme that allows you to enjoy a deduction of up to 1 5 lakh under Section 80C of the Income Tax Act They come with

Does Fixed Deposit Have Tax Exemption

Does Fixed Deposit Have Tax Exemption

https://www.businessleague.in/wp-content/uploads/2021/08/Income-Tax-Rules-for-Fixed-Deposit.jpg

Tax Credit Or Tax Deduction Which Is More Helpful For Tax Savings And

https://i.pinimg.com/originals/ff/c2/2c/ffc22c3cacdd92bd70a97183067c7a7a.jpg

How Does Your Fixed Deposit Work Paytm Blog

https://paytmblogcdn.paytm.com/wp-content/uploads/2021/09/12_fixed-deposit_-How-does-fixed-deposit-work-and-how-to-open-it-online-offline-800x500.jpg

A Tax Saving FD is one step better it is aimed at helping you claim a Fixed Deposit income tax exemption under Section 80C of the Income Tax Act for investments up to 1 5 lakh A Tax Saving Fixed Deposit What are tax saving FDs This instrument is a fixed deposit which allows tax deduction under Section 80C of the Income Tax Act Such fixed deposits have

Check out the eligibility criteria for Five Year Tax Saving Fixed Deposit Deposits at HDFC Bank Know more about terms conditions charges other requirements Fixed deposit income tax exemption refers to exemption from tax or deposits that are not subject to tax deductions by government or regular authorities

Download Does Fixed Deposit Have Tax Exemption

More picture related to Does Fixed Deposit Have Tax Exemption

Fixed Deposit Tips For Students And Working Professionals HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/07/documents-required-for-opening-fd-account.png

How To Claim Tax Exemptions Here s Your 101 Guide

https://okcredit-blog-images-prod.storage.googleapis.com/2021/02/taxexemption1.jpg

When How To Pay Income Tax On Fixed Deposit

https://askopinion.com/images/Files/UserFiles/posting/lrg/2017/8/taxes-euw.jpg

You can take advantage of the income tax deduction provision under Section 80C of the Income Tax Act by investing up to Rs 1 5 lakh in a tax saver fixed deposit Investing in tax saving FDs allows you to claim tax incentives under Section 80C of the Income Tax Act In this article learn about tax savings on FDs fixed deposit income tax exemption and tax benefits

In order to encourage more and more people to invest the government of India introduced tax exemptions on Fixed Deposits FDs for investments held for 5 to According to current income tax laws if an individual opts for old existing tax regime then under Section 80C of the Income tax Act you can claim deduction for

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/50/825/50825271/large.png

Know The Changed Fixed Deposit Rules By RBI And More

https://img.jagranjosh.com/images/2022/November/16112022/rule-changes-in-fd.jpg

https://www.icicibank.com/blogs/fixed-deposits/tax...

The interest earned on a Fixed Deposit FD is subject to tax based on the income tax slab you fall into There is TDS Tax Deducted at Source on FD interest along with any

https://freefincal.com/tax-on-fixed-deposits

Bank Fixed Deposits FDs are a safe and secure way of earning a fixed return on your capital Especially for senior citizens they provide higher returns without

Mismanaged Idle SSS Assets Justifies Tax Exemption Says BMP The

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

Savings

State Lodging Tax Exempt Forms ExemptForm

:max_bytes(150000):strip_icc()/Taxation_updated2-dfd2ae499d314d05972225d3f743f8aa.png)

Taxation Defined With Justifications And Types Of Taxes

:max_bytes(150000):strip_icc()/Taxation_updated2-dfd2ae499d314d05972225d3f743f8aa.png)

Taxation Defined With Justifications And Types Of Taxes

2022 Taxes Due Deadlines Refunds Extensions And Credits This Year

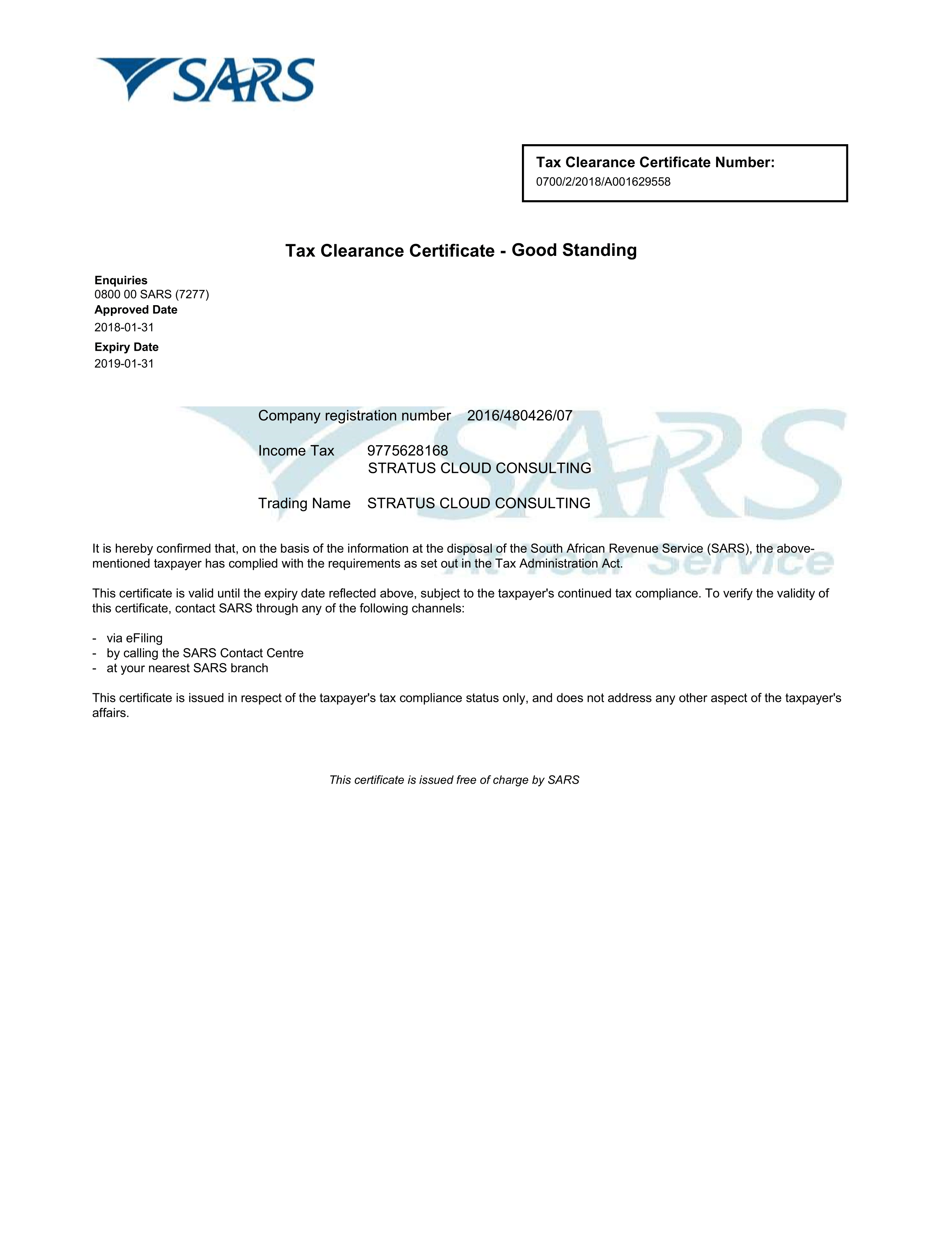

Tax Clearance Certificate Sample SexiezPix Web Porn

How Does Fixed Deposit Work In India Freo Save

Does Fixed Deposit Have Tax Exemption - Fixed deposit income tax exemption refers to exemption from tax or deposits that are not subject to tax deductions by government or regular authorities