Welcome to Our blog, an area where inquisitiveness meets information, and where day-to-day topics end up being engaging conversations. Whether you're seeking insights on lifestyle, modern technology, or a bit of everything in between, you have actually landed in the best place. Join us on this expedition as we study the realms of the average and amazing, making sense of the world one article at a time. Your journey into the fascinating and varied landscape of our Can I Deduct Work From Home Expenses begins below. Discover the captivating material that waits for in our Can I Deduct Work From Home Expenses, where we untangle the complexities of different topics.

Can I Deduct Work From Home Expenses

Can I Deduct Work From Home Expenses

Can I Deduct Work From Home Expenses On Taxes Bad IRS News

Can I Deduct Work From Home Expenses On Taxes Bad IRS News

Can You Deduct Remodeling Expenses For Your Rental Property

Can You Deduct Remodeling Expenses For Your Rental Property

Gallery Image for Can I Deduct Work From Home Expenses

Can I Deduct Coaching As A Job Search Expense Official Site Dan Miller

Business Expenses You Can t Deduct MileIQ

2021 Taxes Can You Deduct Work From Home Expenses Verify Wusa9

Can I Deduct Home Office Expenses LesemannCPA

Solved How Much Can She Deduct Were You Being A Tax Professional

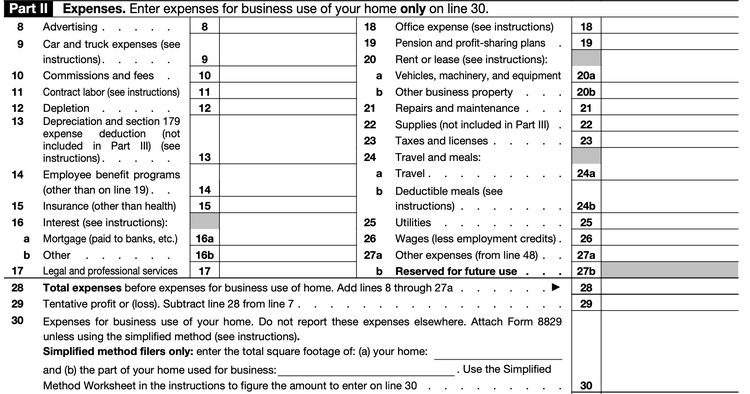

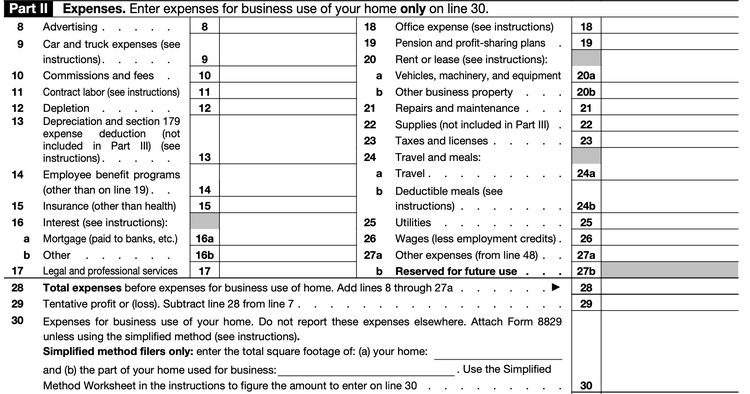

A Guide To Filling Out and Filing Schedule C For Form 1040

A Guide To Filling Out and Filing Schedule C For Form 1040

How To Deduct And Write off Almost Anything From Your Taxes

Thank you for picking to discover our website. We all the best hope your experience surpasses your assumptions, which you uncover all the info and sources about Can I Deduct Work From Home Expenses that you are looking for. Our dedication is to supply an user-friendly and helpful platform, so do not hesitate to browse through our pages effortlessly.